Bill Ackman interview; ChatGPT imitates Buffett; Did Tesla just surrender its key competitive advantage?

1) On my long drive to New Hampshire on Friday, I finally had the chance to listen to the 67-minute interview my college buddy Bill Ackman did in March with venture capitalist Harry Stebbings for his Twenty Minute VC podcast.

You can stream on your favorite podcast app or watch it on YouTube here: Bill Ackman: SVB Collapse; Biden vs Trump; How I Lost $400M on Netflix; Bill's 10-Year Long.

It's an insightful and entertaining interview that covered a wide range of topics, including:

- How he lost $400 million on Netflix (NFLX) (10:26)

- Tips on position sizing (18:19)

- Tips for a happy marriage and raising great kids (45:58)

- The trend most investors are missing (51:50)

- His favorite stock for the next 10 years, Universal Music Group (UMG.AS) (an open recommendation in our flagship Empire Stock Investor newsletter – click here to subscribe and gain instant access to our entire archive) (53:50)

- Why his SPAC failed (55:08), and

- What scares him about the economy (1:03:35)

Speaking of kids, here's a picture of us in which I'm wearing my favorite shirt, which says, "You can't scare me: I have three daughters," and Bill is wearing a similar one I got him that says "four daughters":

2) I've been talking a lot about generative AI and OpenAI's incredible software, ChatGPT.

A lifetime subscriber, Ed C., whom I met last month (I included a picture of us in my May 12 e-mail), recently gave ChatGPT the following prompt:

Write an inspiring letter of encouragement from me, as a financial advisor, to a client explaining the value of being a long term investor vs. a short term trader as if I were Warren Buffett.

ChatGPT replied...

Dear valued client,

As someone who has dedicated my entire life to the study and practice of investing, I can confidently say that being a long-term investor is the best way to achieve your financial goals. While short-term trading may seem appealing in the moment, it ultimately leads to uncertainty and instability in your portfolio.

One of the keys to successful long-term investing is to focus on the fundamentals of the companies in which you are investing. This means looking beyond the day-to-day fluctuations of the market and instead focusing on the underlying business models, financial statements, and management teams of the companies you own. By taking a long-term perspective and investing in quality businesses, you can avoid the pitfalls of short-term trading and create sustainable wealth over time.

Another advantage of long-term investing is the power of compound interest. By reinvesting your dividends and letting your investments grow over time, you can reap the benefits of compounding and watch your portfolio grow exponentially. This is something that short-term traders simply cannot replicate, as they are constantly buying and selling positions and missing out on the long-term benefits of compound interest.

Of course, there will always be ups and downs in the market, and it can be tempting to make short-term trades in an attempt to capitalize on these fluctuations. However, I urge you to resist this temptation and instead stay focused on your long-term goals. By holding quality companies through market cycles, you can weather the storms and come out stronger on the other side.

In conclusion, I want to encourage you to embrace the power of long-term investing. By focusing on quality businesses, reinvesting dividends, and staying disciplined in the face of short-term market volatility, you can build a portfolio that will provide for you and your loved ones for years to come. Remember, investing is a marathon, not a sprint, and the most successful investors are those who stay the course and remain committed to their long-term goals.

Sincerely,

Warren Buffett

I'm impressed!

3) Tesla (TSLA) and its brilliant, mercurial CEO, Elon Musk, are endlessly fascinating.

Tesla just reached agreements with both Ford (F) and General Motors (GM) to open up its supercharging network to electric vehicles made by both of these competitors.

Is this a brilliant strategic move that cements Tesla's dominance in this area, or a terrible blunder in which Tesla has given away one of its major competitive advantages?

I'm still trying to figure this out and would welcome your feedback...

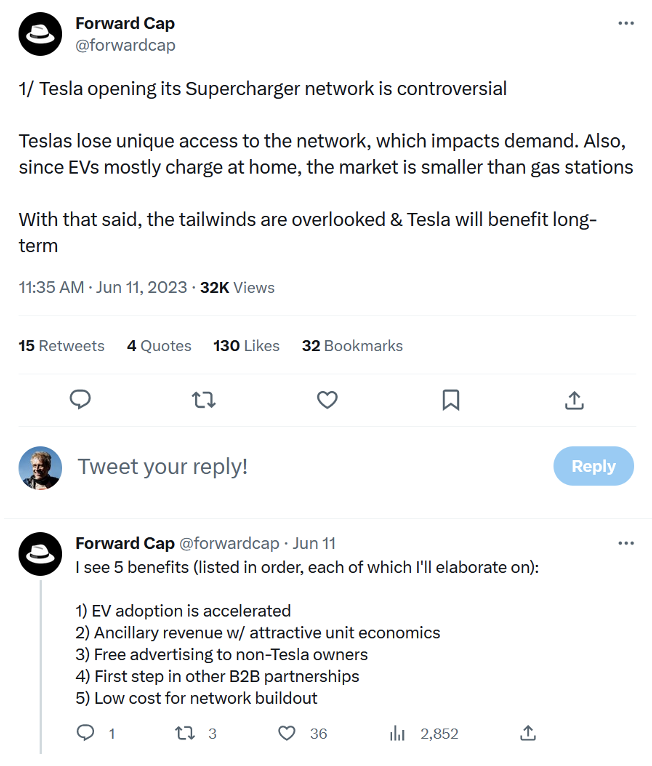

Here's the bull case, in a Twitter thread that begins:

And here's the bear case by Anton Wahlman: Tesla Has Surrendered Its Key Competitive Advantage. Excerpt:

- Tesla, Inc. has opened up its network and charging standards for other automakers to use, initially to Ford Motor Company and General Motors Company, but likely to all others in due course.

- Tesla's charging network had already been open to all other automakers in Europe for some time.

- Tesla's EV market share in Europe is also materially lower than in the U.S. Is the open network a material contributor to this? We can't say for sure.

- In the U.S., Tesla's network was widely perceived by the consumer to be its dominant advantage in the U.S. market. Now, that is gone.

- For the U.S. consumer of this persuasion, there is, therefore, no longer any reason to stick to Tesla despite any other misgivings with the brand (quality, service, etc.).

(I created an e-mail list focused solely on Tesla, Musk, and the electric and autonomous vehicle markets. You can sign up for it by sending a blank email to: tsla-subscribe@mailer.kasecapital.com.)

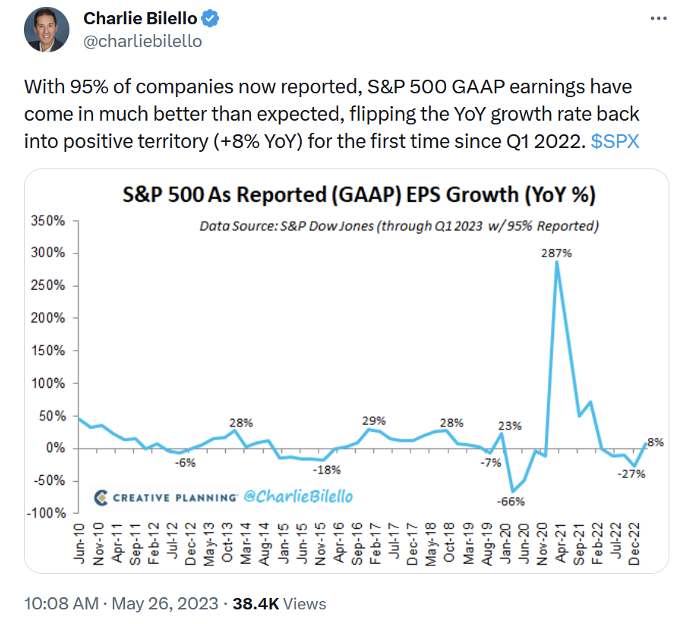

4) Charlie Bilello tweeted an interesting chart showing how strong corporate earnings were in the first quarter:

5) I recently finished listening to Dr. Peter Attia's excellent book, Outlive: The Science and Art of Longevity.

The main message is that you need to be much more proactive, at a much younger age, against "the diseases of aging that kill most people: heart disease, cancer, Alzheimer's disease, and type 2 diabetes."

The main ways to do this are diet, exercise, screening tests, getting enough sleep (8 hours per night is key... the chapter largely mirrors this TED talk, Sleep Is Your Superpower, which has more than 10 million views), and strong relationships.

Attia argues persuasively that our medical system mostly only engages when people are, say, in their 60s and one or more of these diseases are already manifesting themselves. However, their roots are taking shape decades earlier (just look at childhood obesity rates, for example).

One point Attia made caught my attention because it's something I tested four years ago. He said he always tests his patients' grip strength because it's an excellent indicator of current health and future problems. This research paper confirms this: Grip Strength: An Indispensable Biomarker For Older Adults. Here's the abstract:

Grip strength...is largely consistent as an explanator of concurrent overall strength, upper limb function, bone mineral density, fractures, falls, malnutrition, cognitive impairment, depression, sleep problems, diabetes, multimorbidity, and quality of life.

Evidence is also provided for a predictive link between grip strength and all-cause and disease-specific mortality, future function, bone mineral density, fractures, cognition and depression, and problems associated with hospitalization.

Consequently, the routine use of grip strength can be recommended as a stand-alone measurement or as a component of a small battery of measurements for identifying older adults at risk of poor health status.

In short, weak grip strength is highly correlated with all sorts of terrible outcomes as you age, so it's something every doctor should be measuring (but, to my knowledge, almost none do).

I took my first grip strength test in 2017 and my left and right hands were in the 99th and 90th percentiles, respectively. Those are excellent results, but odd because normally your dominant hand is stronger, but I think I had some right elbow tendonitis at that time...

In 2019, I bought this $23 device on Amazon that measures grip strength:

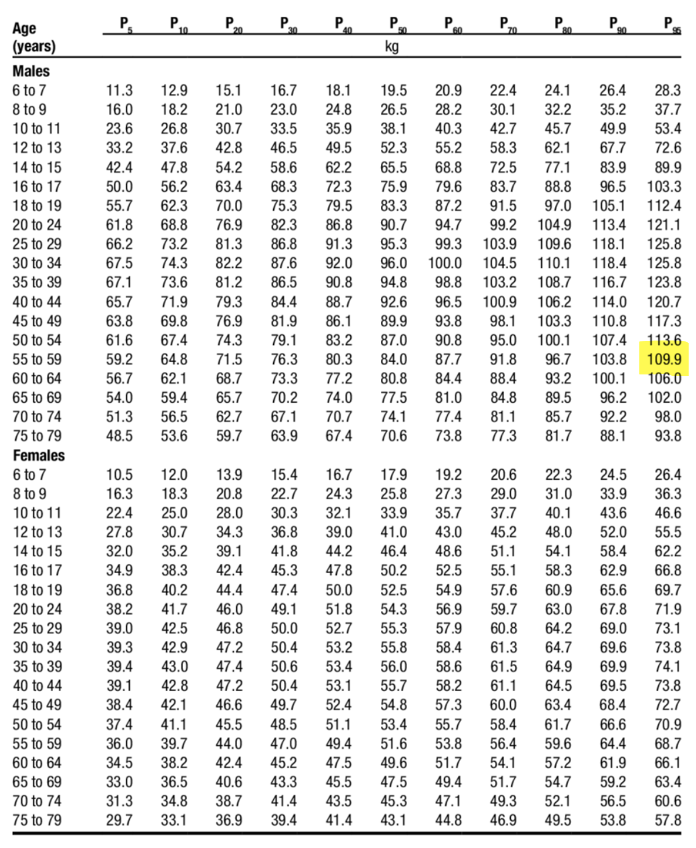

It's been sitting in my closet, unused, for years, but listening to Attia's book led me to find it and test myself again. My results: 67.2 kilograms with my right hand and 68.1 kilograms with my left (good to see they're back to being even), for a combined 135.3 kilograms.

To see what this means, I Googled "grip strength percentile" and found this chart from of a study of 5,188 Canadians. I highlighted the 95th percentile in my age cohort (I'm 56) in the far right column, which is a combined 109.9 kilograms, so my score of 135.3 kilograms easily puts me in the top 1% of my age group, which bodes well for my long-term health and lifespan!

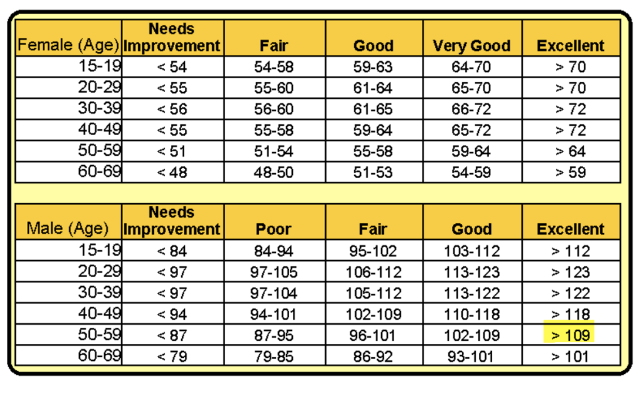

Here's another simpler chart, also showing 109 kilograms or better is the highest category of "excellent":

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.