David Einhorn interview; Lawsuit against 'meme stock king' Ryan Cohen; Mini meme-stock bubble bursting; The Deepest Breath

1) I enjoyed this 17-minute interview with my old friend, David Einhorn of Greenlight Capital, who thinks this is "a very exciting time."

I think he's right that traditional long-short value managers have been crushed since 2009 and most have exited the business permanently (including yours truly), which creates a better environment for the few remaining players.

I also agree with David's view that there are some incredible opportunities among boring, sub-$5 billion market cap stocks that are too small for the index funds and don't screen well for the quant funds – the two types of "investors" (I use that term loosely here) that are increasingly driving stock prices, at least in the short term. (in the long run, I continue to believe that what Benjamin Graham said nearly a century ago is still true: "In the short run, the market is a voting machine but in the long run it is a weighing machine.").

Here's an excerpt from the interview:

It's very exciting because you don't get these valuations except at the bottom of bear markets or in the middle of recessions. And when that happens, you have different alternatives that make you decide you don't want to buy these things at these prices anyway, because the stock might be down 80% because there's some collapse and you're wondering if the world is coming to an end.

And you look at the bonds and the bonds are trading at 55 cents, why buy the stock? You can just buy the bonds, and you'll make a nice teens return and all you have to get is solvency. You're probably not going to lose another.

If it's down 80%, it can go down 90%. You can lose 50% really quickly. Those bonds trading at 55, if you're remotely right, are going to be a good investment. So you have that alternative.

You don't really have that right now. These businesses are not collapsing. The economy is not collapsing. You do not have the distress cycle in corporate credit the way that you would normally do when you're looking at companies that are performing reasonably well at three, four, five, six times earnings. And so I find this to be a very exciting time.

2) I was pleased to read in Bloomberg columnist Matt Levine's July 31 column that "meme stock king" Ryan Cohen has been sued by Bed Bath and Beyond shareholders for securities fraud and insider trading.

I called him out nearly a year ago in my August 18, 2022 e-mail:

In yesterday's e-mail, I highlighted the absurd and unwarranted run-up in the stock of struggling retailer Bed Bath and Beyond (BBBY), which I think is in a death spiral because it likely doesn't have enough liquidity to build inventory for the holidays and will therefore have to file for bankruptcy.

I concluded by predicting that:

Today's spike in BBBY smells like a blow-off top to me, and I expect the stock will be back under $10 per share very soon.

Sure enough, the stock is crashing today on news that Ryan Cohen, the founder of Chewy (CHWY) and the chairman of GameStop (GME), whose 11.8% stake in BBBY excited the WallStreetBets speculators on Reddit, disclosed in an SEC filing yesterday that he may dump his entire stake (and may, I suspect, have done so yesterday): Bed Bath & Beyond shares fall after investor Ryan Cohen reveals intent to sell entire stake.

Cohen's trading patterns stink to high heaven, and may be a classic pump and dump. Here's why...

First, on Monday, Cohen filed a Form 3 showing that he had bought far-out-of-money call options that expire in January with strike prices of $60, $75, and $80 per share, multiples of the $10 to $15 share price at the time.

This highly aggressive, bullish-seeming bet caused the stock to soar on Tuesday: Bed Bath & Beyond soars as much as 70% as meme traders talk up Ryan Cohen's call options purchase.

Then, Cohen added fuel to the fire by filing an amended 13D showing that he owned 9.45 million shares of BBBY's stock. But this was unnecessary because it was unchanged from his previous 13D filing on March 25, so I think he filed it to cause a further run-up in the stock.

Having successfully pumped the stock up 100% to 200% in a couple of days, Cohen is dumping/has dumped it on the unsuspecting retail investors who foolishly got caught up in the hype he generated.

What a total disgrace!

This morning I did something I've never done before: I reported Cohen's actions to the SEC using its website to "Report Suspected Securities Fraud or Wrongdoing" and checked the boxes for "manipulation of a security" and "pump and dump scheme." I hope the SEC investigates...

In rejecting Cohen's motion to dismiss, the judge wrote of one of Cohen's tweets:

First, Bratya has plausibly alleged that the moon tweet relayed that Cohen was telling his hundreds of thousands of followers that Bed Bath's stock was going up and that they should buy or hold.

In the meme stock "subculture," moon emojis are associated with the phrase "to the moon," which investors use to indicate "that a stock will rise." So meme stock investors conceivably understood Cohen's tweet to mean that Cohen was confident in Bed Bath and that he was encouraging them to act.

For example, one investor replied to Cohen "buy $BBBY. Got it. Thanks." And Bratya plausibly alleges that Redditors gleaned the same message.

And regarding Cohen's 13-D filing, the judge opined:

Taking the Complaint as true, Cohen's amended 13D was materially misleading as well. Investors filing 13Ds have a duty to disclose any solid plans to sell their stock...

Bratya has plausibly alleged that Cohen had a definite plan to sell. For one, the timing of Cohen's sales suggests it. Cohen filed his 13D in the morning on August 16, 2022, and that very same day sold roughly $100 million in Bed Bath shares. See Compl. ¶ 165. It is no stretch to infer that Cohen likely hatched that plan some time before that morning. More, Bratya has plausibly alleged that Cohen filed the 13D as part of a broader plan to pump Bed Bath's price so that he could dump his shares...

Despite the reporting requirement, Cohen did not mention his purported plan to sell in his amended 13D. That was misleading. And it was material too: meme stock investors "reacted positively to his filing," sending the stock price soaring "by over 70%" that same day.

Cohen offers a competing inference. He "decided to exit his position when the price unexpectedly increased to a value that exceeded what he believed it was worth." Plausible enough. But to accept this story, the Court must view Cohen's amended 13D as a lucky happenstance. In his telling, he had no concrete plans to sell on the morning of August 16. He then filed a 13D, and, as it had in the past, the price surged. Then (and only then) Cohen formed his plan to sell. That is a stretch.

Levine isn't buying the judge's argument:

Is it? He had bought this stock, it had gone down, he had a loss, he was legally required to file an updated disclosure of his position that contained no new information. He filed it, the stock shot up, he was suddenly sitting on tens of millions of dollars of gains, and he very sensibly said "well this is the best chance I'm gonna get" and blew out of the stock.

He didn't have a concrete plan to sell when he was sitting on a big loss, and he didn't concoct a nefarious plan like "I am going to file a 13D with no new information in it, which will drive up the price, and then I'll sell," because that would be insane. Why would re-disclosing your existing stake, with no new information, cause the stock to shoot up? Except that it did, and he seized the moment.

I rarely disagree with Levine, but I think he's completely wrong. Far from being insane, I think Cohen knew exactly what he was doing.

That said, I think the shareholders are going to lose this suit, unless they get lucky and, during discovery, find some e-mails or texts in which Cohen was dumb enough to put his nefarious plot in writing...

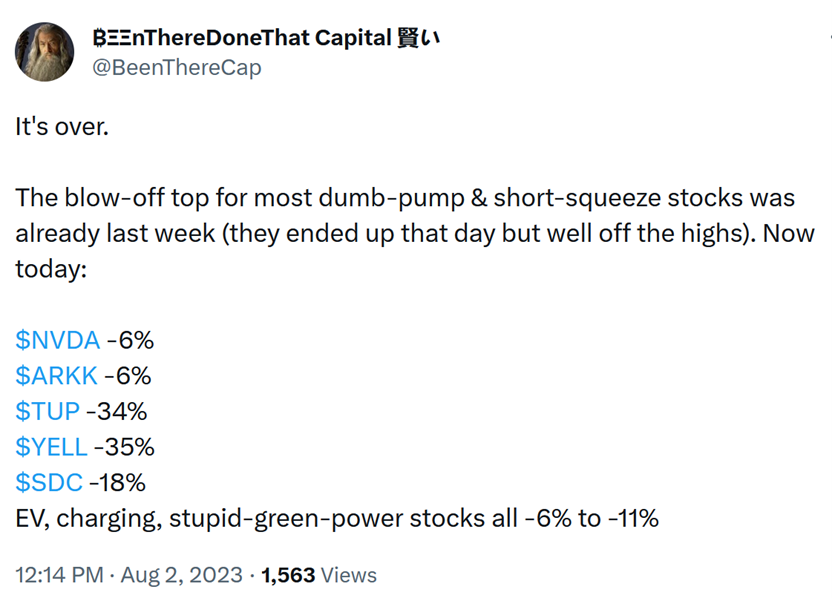

3) It's good to see this mini meme-stock bubble bursting before it costs naïve investors any more money:

4) At the Sundance Film Festival in January I watched The Deepest Breath, a documentary/love story about free diving, with my heart in my mouth. As an adventure sports junkie who has done a tiny bit of free diving, I have a very good idea of what motivates the athletes and what they're feeling as they risk their lives.

It's not too dissimilar to my rock climbing – for example, here's a picture of me climbing Devil's Tower in Wyoming two years ago:

There's a massive difference, though...

While what I do looks death-defying, it's actually fairly safe because I only climb when I'm roped to a professional guide (who took this picture – if you look closely, you can see the rope, which will catch me if I lose my grip).

In contrast, the free diver in The Deepest Breath who is trying to set the world record really is risking her life on every attempt. It's an insane level of risk I would never assume – similar to Alex Honnold free soloing El Capitan, captured in a similar movie, Free Solo.

Anyways, The Deepest Breath is a great movie, which is now available on Netflix here (with trailer).

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.