David Einhorn: The Long and Short of Investing; David Einhorn's 2007 presentation on Lehman Brothers; Kudos to Twitter; On my way from Poland to Jackson Hole

1) I met Greenlight Capital's David Einhorn when we were both newbies in the business two decades ago. In addition to becoming a good friend, I've learned a lot from him over the years, so I never miss an opportunity to hear him speak.

With that in mind, I recommend listening to his latest thoughts in this episode of the Invest Like the Best podcast: "The Long and Short of Investing" (on Apple Podcasts here and Spotify here).

If anything, he's become even more of a value investor. Here's a summary:

My guest today is David Einhorn. David is the President of Greenlight Capital, a long-short hedge fund that he co-founded in 1996. He is a prominent value investor with a reputation for rigorous security analysis. In 2002, he revealed a short position in Allied Capital, which was ultimately proven correct and similarly in early 2008, he told the Sohn Conference he was short Lehman Brothers.

Over his near three decades managing money at Greenlight, he has delivered impressive returns but it has not been without challenge. Our conversation covers both the highs and the lows, his views on the current banking issues, and how he has evolved as an investor.

Show Notes

(00:03:50) – (First question) – Why he is glad he started his fund in 1996 rather than today

(00:05:58) – His view of how companies' personnel and goals have changed since the '90s

(00:07:01) – His counter-momentum approach to markets and how he views current trends

(00:11:17) – The jelly-donut theory of monetary policy

(00:14:46) – His outlook on inflation and the Fed from a fiscal perspective

(00:15:45) – Commodities and other assets that become relevant

(00:16:48) – The evolution of Greenlight's portfolio and philosophy through history

(00:20:11) – Periods in his career that stand out as the most challenging

(00:25:58) – How tech advances have influenced his core concept of figuring out worth

(00:28:17) – His three-step process to picking investment targets

(00:29:10) – The companies he has learned the most from studying

(00:30:52) – His experience with investing in Apple

(00:33:33) – How he considers the notion of quality in a business

(00:35:05) – His views on shorting, concentration, and holding periods

(00:38:37) – What he learned from a deep dive on airline businesses

(00:40:31) – His perspective on sports franchises as an asset

(00:42:12) – His new interest in poker and how he got so good at it

(00:45:22) – Applying traditional valuation styles to the modern market

(00:47:13) – Cultivating relationships with his limited partner investors and his team

(00:51:06) – The joy and drive that keeps him buying and selling

(00:54:26) – His perspectives on the insurance space

(00:57:33) – The health of the economy and financial infrastructure as he understands it

(01:01:51) – How he thinks about housing and the construction industry

(01:03:54) – How AI and other high tech are affecting his investment decisions

(01:05:28) – Other topics on his mind, from national politics to social psychology

(01:08:22) – The kindest thing anyone has ever done for him

2) David is perhaps most famous for predicting the demise of once-storied-now-disgraced investment bank Lehman Brothers.

The media generally credits him with making this forecast at the Ira Sohn Investment Conference in the spring of 2008, about five months before Lehman went under, but in fact he first did so at my Value Investing Congress on November 29, 2007.

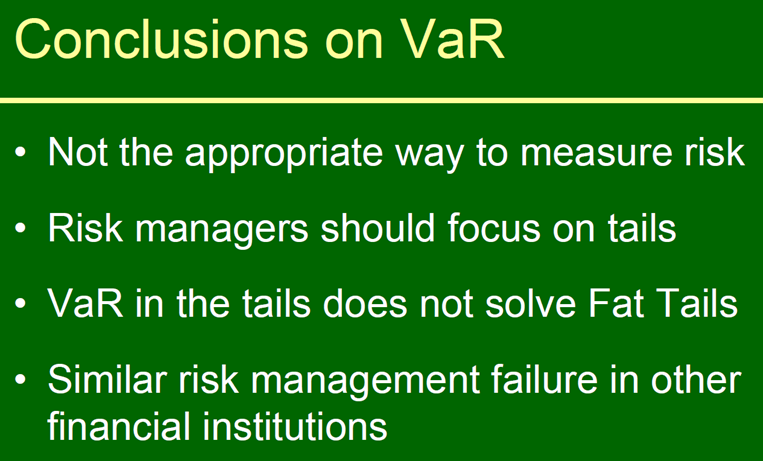

I know this because I was standing next to David on stage and still have a copy of his 34-slide presentation, which you can see here. He started by raising questions about a common measure used by banks called Value-at-Risk ("VaR"):

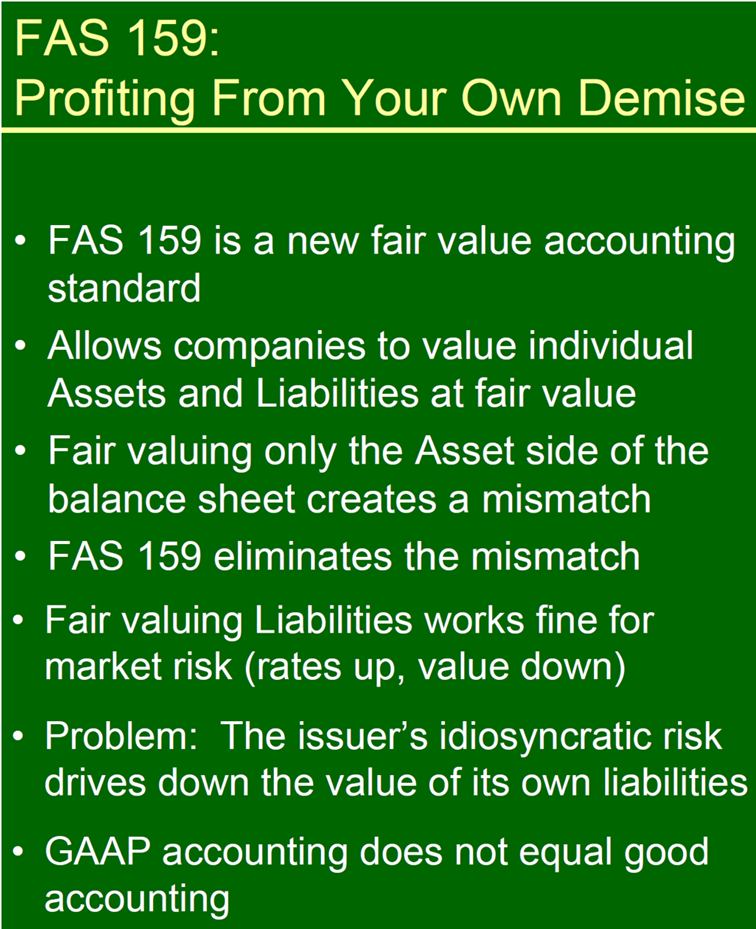

He then heaped scorn on Financial Accounting Standard ("FAS") 159:

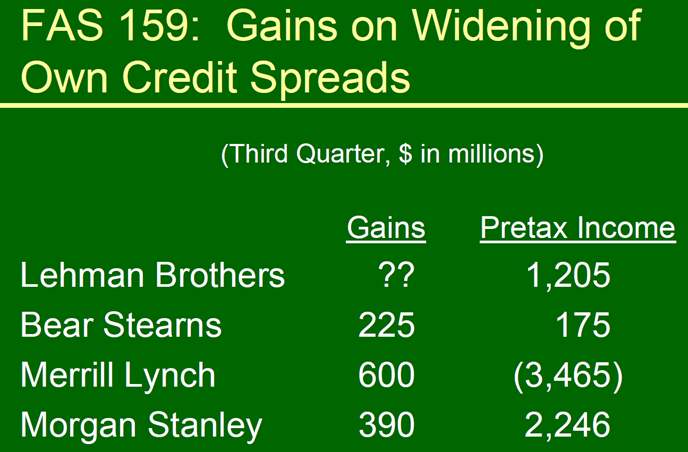

He showed the total absurdity of FAS 159:

If your own credit spread widening counts as revenue... and you pay compensation as a percent of revenue... the most profitable and lucrative day in the history of your firm will be... THE DAY YOU GO BANKRUPT!

David then showed how four major Wall Street firms booked big gains in the third quarter of 2007 because their credit spreads widened:

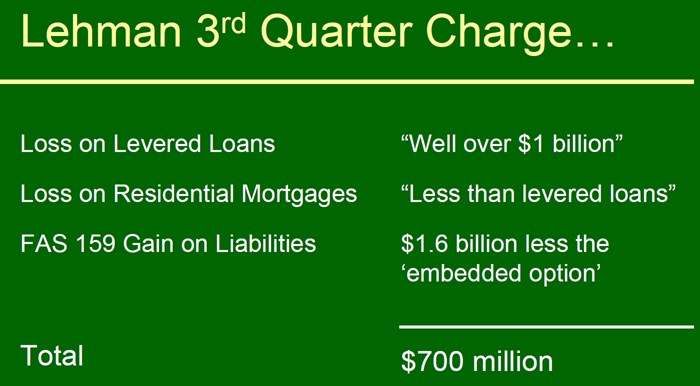

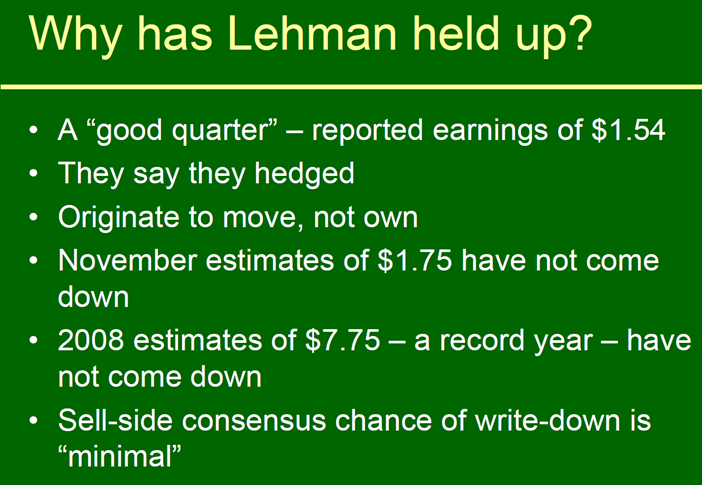

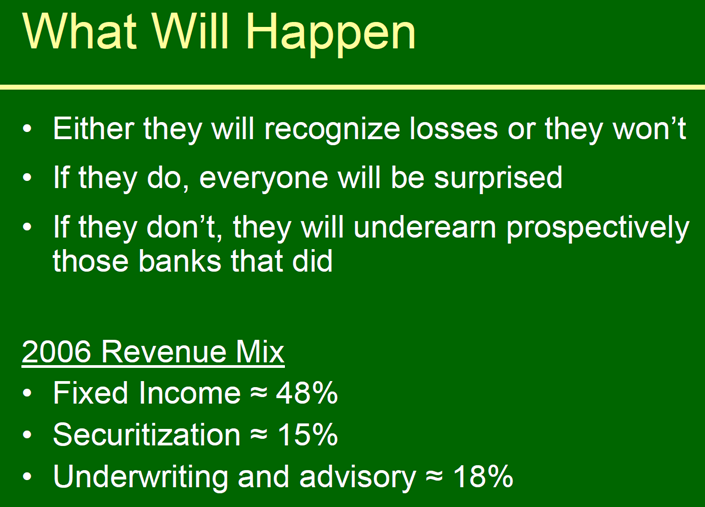

He then zeroed in on Lehman:

After showing Lehman's highly levered balance sheet and many dangerous exposures, David concluded:

On that day, I recall the stock was around $73 per share. Less than 11 months later, it was a zero!

3) I've been quite critical of some of the things Elon Musk has done at Twitter, but I want to give credit where it's due...

A few days ago, a friend forwarded me a solicitation he had received on Twitter – an obvious crypto scam of some sort – that appeared to come from me.

Sure enough, when I typed my name into the Twitter search bar, two accounts impersonating me appeared, both with my picture, but a tiny difference in the handle. I'm @WhitneyTilson and the two impersonators were @_WhitneyTilson and @WhitneyTiIson – the former put a hard-to-see underscore in front of my name and the latter used an even-harder-to-see capital "I" ("eye") instead of a lowercase "l" ("ell") in the third letter of my last name.

I was able to report both accounts on Twitter's website in only a few minutes (I had to upload a picture of my passport or driver's license to verify my identity) and, to Twitter's credit, within one day, I received two e-mails from Twitter support reading:

Hello,

Thanks for sending us your report. We reviewed the account, and removed it for violating our rules regarding impersonation.

We appreciate your help! Just so you know, any documents you sent us to review will be deleted.

Thanks,

Thank you!

4) As you read this, I'm on yet another flight – this time to Jackson, Wyoming...

I'd bet my last dollar that I'm the only person who has ever done the following itinerary: Newark to Rzeszów, Poland, three hours on the ground, back to Newark last night, 11 hours on the ground, then a 6:20 a.m. flight this morning from JFK to Salt Lake City, and finally on to Jackson.

While so much travel can be exhausting, it's also amazing how much work I get done on these flights without the distractions of phone calls, meetings, etc. Sometimes I'm even tempted to book a flight to the West Coast and back just to finish a particular piece of work I've been procrastinating on!

My cousin has a condo that's a five-minute walk to the tram at Jackson Hole and the snow is supposed to be incredible, so I invited six of my buddies to get five final days of skiing in this winter.

(And maybe they won't be my final days. Jackson Hole is in a national forest, so it's being forced to close for the season on Sunday, but I'll bet places like Snowbird, where I still have five days left on my Ikon Pass, will stay open into July...)

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.