In This Episode

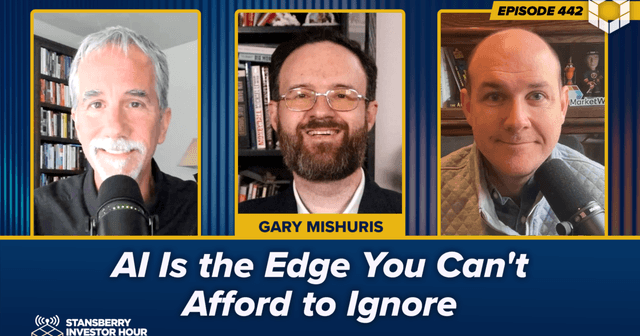

On this week's Stansberry Investor Hour, Dan and Corey are joined by veteran investor and bestselling author Larry McDonald. Larry founded The Bear Traps Report, an investment newsletter that looks at global political and systemic risks when making actionable trades. He is also a frequent contributor on CNBC, Bloomberg, and Fox Business News. His book A Colossal Failure of Common Sense has sold 700,000 copies, and his new book How to Listen When Markets Speak is now available.

Larry kicks off the show by sharing his history as a trader at Lehman Brothers and how certain parts of today's market mirror the 2008 crash. He notes that commodities are extremely cheap while semiconductors just hit an all-time high. Larry predicts that capital will migrate back toward real assets. He also discusses what a second Donald Trump presidential term would mean for the bond market, the huge risk with inflation, and a possible bright spot for the housing market as Baby Boomers age...

The Boomers have $79 trillion of wealth. $79 trillion. And the oldest Boomers are about 80 years old... So you think of like the next 10 years. A lot of those Boomers, because they're getting older, [are going to be] selling their homes. That's a lot of supply that's going to come onto the market.

Next, Larry breaks down his trading strategy involving capitulation. He brings up the extreme 20% discount in copper today and makes a five-year bull case for natural gas. This leads to a conversation about the current hot stocks in artificial intelligence ("AI"). Larry says that the AI mania has gotten so bad, chief financial officers at tech companies have to invest in AI even if they don't want to, for fear of losing their jobs. He believes we're in the early stages of an unwinding. He notes that many companies adjacent to AI, like those relating to the electrical grid, have been left for dead...

It's very similar to [the dot-com era] where you had the dot-com [mania] and you wanted to be long eToys, and Global Crossing, and Cisco Systems. But all these other great trades were left behind. Nobody talked about the Googles of the world. Nobody talked about all these other... companies that would end up being long-term winners.

Finally, Larry explains that the pain cycles following market bubbles should be longer, but quantitative easing has gotten in the way of that natural process. Bad businesses used to be cleaned out, but now they're able to survive. Larry condemns "evil" passive investing and talks about how much worse the practice has gotten in the past decade and a half. He then lists off a few specific stocks he finds attractive today and advises investors to be careful...

In a bull market like this one, if you get those early tremors, there's such a propensity in the market to buy any dip because the people have not been burned in a long time... The propensity and the incentive to buy the dip now is extremely high. So you can have any bit of bad news that kind of shocks the system, and they'll just come right back until they get their fingers and hands really burnt and then chopped off. And then that's when you get the bigger drawdown.

Click here or on the image below to watch the video interview with Larry right now. For the full audio episode, click here.

(Additional past episodes are located here.)

Dan Ferris: Hello, and welcome to the Stansberry Investor Hour. I'm Dan Ferris. I'm editor of Extreme Value and The Ferris Report, both published by Stansberry Research.

Corey McLaughlin: And I'm Corey McLaughlin, editor of the Stansberry Daily Digest. Today, we talk with Larry McDonald, veteran trader and author of a new book, When Markets Speak.

Dan Ferris: Larry has been there and done that, man, he's been around for a long time, worked at Lehman Brothers, wrote a whole book about it, and he is the progenitor, the creator, of the Bear Traps Report, which is exactly what it sounds like. He loves to buy beaten-down stuff that everybody hates and that they're selling. He really specializes in that trade, as he'll explain during the interview. I found him to be a really bright, wonderful guy who has a lot of anecdotes.

I can't wait for you to hear this interview. So let's do it right now. Let's talk with Larry McDonald. Let's do it right now.

Larry, welcome to the show. Glad you could be here.

Larry McDonald: Hi, Dan. Thanks very much.

Dan Ferris: All right, there's a lot to talk about, here. You had a book come out, this year, and you have quite a bit of experience on Wall Street. And I'd like to begin, if it's OK, because you're, I think, the second or third guest we've had who worked inside Lehman Brothers. And, you know, I'm just dying to – I just want to collect all the real world anecdote that I can on these things, on the show. And I'm wondering if you think there's anything during your time there that's worth talking about. You were there during the crisis, were you not?

Larry McDonald: Yes, I was a trader at Lehman. I ran a high-yield distressed book trading bond business, and I left just before the crisis. I mean, well, just before the fall, there's a group of us that left the bank. But the first book, it's now been translated into 12 languages, it's voted by the CFA Institute as the top 20 books all-time in finance. And it was called A Colossal Failure of Common Sense: The Inside Story of Lehman.

Dan Ferris: All right, [laughs] so you have a few things to say about that. Was there a moment when you said, "Oh, my God, it's much worse than I ever thought"?

Larry McDonald: Well, it's similar, today, with – like, you think about oil touched the all-time high on July 11th, 2008 – July 11th, 2008. Now think about that. They told us, a year later, that we went into recession in November 2007. So, this is what can happen with groupthink around, like, inside of Lehman, on Wall Street, the groupthink was so delusional that oil could go up 40% in a recession right ahead of the biggest economic crash since the Great Depression. So, many people forget July 11th, 2008, oil hit, like, 147, and it was really just mass delusion inside the bank and around Wall Street.

Dan Ferris: Wow. I mean, from the outside-in, I might've said that very same thing, but to hear it from the inside-out is a little – it's actually surprisingly disconcerting.

Larry McDonald: But it's similar to today where, I mean, what's interesting is the semiconductors just touched, on July 11th, 2024, the semiconductors touched an all-time high. And the delusion there is probably on par with the delusion of Lehman in terms of the distortion of the upside potential versus the downside risk.

Dan Ferris: Wow. History sure does rhyme, sometimes, doesn't it?

Larry McDonald: Yeah. [Laughs]

Dan Ferris: So, you sound like you're kind of a bearish guy, right now.

Larry McDonald: Well, bearish on, like – so here's what happened. The Lehman response – I'm bearish on some things, bullish on others. But the response to Lehman was a fiscal and monetary response of about $3.5 to $4 trillion. That was the response to Lehman Brothers, which was the greatest bank failure in the history of the world. And so, that was the fiscal and monetary response to Lehman. The fiscal and monetary response to Covid, plus the banking crisis of the last 12 months, you know, had Silicon Valley Bank go down, we had New York Community Bank, and Signature Bank. But that fiscal and monetary response has been $16 trillion.

So, $4 trillion versus $16. [Laughs] And the point is, is that, when you have that type of economic distortion, that kind of fiscal and monetary stimulus oozing its way through the system, it can really distort asset prices. So, financial assets, like, the Nasdaq 100 has now $24 trillion inside of it. A year-and-a-half ago, there was 12 trillion. So it's 100 stocks with $24 trillion. A year and a half ago, it was 12 trillion bucks. Commodities like natural gas, oil, copper today, they are extremely cheap. In other words, if you add up all the copper companies, all the uranium companies, all the oil and gas companies, you're probably $18 trillion, maybe $19 trillion less than the Nasdaq 100.

So, the Nasdaq 100 is essentially $19, $18.5 trillion greater in value than all the copper companies, all the oil and gas companies, all the uranium companies, and all the metals combined. So, that's where just the distortions are right now. So, we see a big flip where capital migrates back toward real assets, right, back toward hard assets, in the coming 12 to 24 months.

Dan Ferris: Well, you're speaking my language. I've been singing that song for several months, better part of a year, actually. So, that would be welcome to my portfolio and to my readers' portfolios.

Let me ask you a question. I hadn't planned on asking this, but it's something that's been on my mind and you just reminded me of it. You reminded me of it by making a basic bullish case for commodities, which sometimes accompanies an uptick in inflation, could accompany an uptick in rates. What do you think are the prospects that, say, Donald Trump gets elected, what do you think the prospects are? Do you think that means anything to the bond market? Do you think we get another sort of mini or full-blown bond market riot like we did in 2016 to 2017? I think the 10-year went from 1.8 to 2.5 in 3 months or so.

And maybe what does that say for equities is the ultimate question to our listeners.

Larry McDonald: Well, literally, since that first debate where Trump won the debate, more by default by Biden, you know. But the curve, what we call bear steepen, all bear steepening means is that the 2-year, say, here's the 2-year treasury and here's the 30-year treasury, normally, the curve will steepen coming into recession by the 2-year going down. And the 30-years maybe going down, but the 2-year going down more. A bear steepener is when the 30-year goes up and into potential economic weakness, and that's what's been happening.

So we steepened about 30 basis points on 2s, 30s and some of it was what's called bear steepening. And so, if you talk to global investors, because we had an assassination attempt and because we had this potential Trump president, all this dislocation, there's less confidence. So, 30-year bonds are, with all the debt that has to be issued, right now, everybody knows, we're running a 6% to 7% fiscal deficit. That's like World War I, World War II levels. So, because we have to issue so much paper and because it's Trump, which is considered an MMT, modern monetary theory, kind of cowboy presidency, and because his vice-president still kind of wants a potential dollar reset, which he's been documented in all kinds of videos and writings and interviews, a depreciation of the dollar kind of regime.

All of this has long-term bond investors very, very uneasy. And, you know, that's, I think, exactly what's going to happen is, the long end of the curve is what we call the term premium. All that means is, it's a complicated Wall Street term for meaning that there's less confidence in the longer-term treasuries now than there has been historically. And people would rather own the shorter term because they're worried about Trump and the potential implications of a Trump presidency.

Corey McLaughin: Are people worried about inflation, too, just being higher than it's been in the last, I don't know, however far you want to go back, moving ahead? It just feels like these institutions aren't taking inflation, from the outside, they're not taking inflation seriously, when you have a Fed saying, "We're going to cut rates," when the rate's still above that supposed 2% target. And it just doesn't seem to make sense, if inflation is still high, but we need to juice the economy.

Larry McDonald: Right, yeah. And if you look back, Corey, over the last 2,000 years or something like that, we've studied this in our book, but you go back 1,000, 1,500 years, but any civilization with even a 3% inflation rate can be very, very, very problematic. And that's why the government officials and the Fed, they will always say in every press conference that long-term inflation expectations remain well anchored. They say it over and over and over and over again, because they're dealing with the serpent, the beast, and they're dealing with some dangerous things, right?

They don't want civilization and the voters to get uneasy. It's like the pilot on the plane, right? If you have an engine on fire, he's going to say, "Ladies and gentlemen, just stay in your seats. Everything's going to be fine," right? And so, it's the same thing with inflation. Inflation's come down, good, you know, because they've hiked some rates, but they're also, like you said, Corey, softening the path forward. And it's very, very easy, every time they have just softened the message a little bit, inflation expectations bounce again, what we call financial conditions start going crazy. And that's, you know, people investing in the market, speculating, and that's very inflationary.

Wealth effect is inflationary. So, yeah, there's no question that inflation normalizes, in the next regime, you know, 2.5% to 4%, versus the previous regime was 1 to 2% inflation.

Dan Ferris: I'm glad you mentioned financial conditions. What do you make of higher than 40-plus years' interest rates and housing unaffordability at extreme levels and really loose financial conditions as indicated by the Goldman Sachs Financial Conditions Index? Those don't seem to go together, to me.

Larry McDonald: No, and it's one of these situations where people are in their homes, in their homes, they're not selling, so there's that, like you said, there's not a lot of supply. But anything that triggers – the dangerous thing about rate cuts now is, if you do cut rates 100 basis points, that, typically, the last 20, 30 years would help the economy. But now, if you cut rates 100 basis points, there's a lot of people that are stuck in homes that are just going to be that, because rates are lower, people can buy your home now, and therefore, there could be this massive supply.

What we talk about in the book is, the Boomers have 79 trillion of wealth, 79 trillion, and the oldest Boomers are about 80 years old. So it's an easy thing to remember, close to 80 trillion of wealth, and the oldest Boomer is 80 years old. So you think of the next 10 years, a lot of the Boomers, because they're getting older, selling their homes, that's a lot of supply that's going to come on the market. So there's a lot of complacency around the housing market right now, because prices are up because there's no supply. But the Boomers, like I said, control 80 trillion of wealth, the oldest Boomers are 80, so they're going to be selling assets over the next 10 years, at a much faster clip than they were before.

Dan Ferris: Yeah, I've heard that, I've heard that argument a lot. My initial reaction to any kind of massive demographic trend like that is, it tends to stay far in the future, you know, and then all of a sudden one day it's there. I grew up hearing people say, "You know, one day, everybody in China is going to buy a refrigerator," that kind of stuff. And then, whoa, then all of a sudden, you know, the commodities markets go wild, like, 30, 40 years later. But you think, you know, if they're 80, I would assume they would be selling within the next decade or so, no?

Larry McDonald: Yeah, it's not a near-term thing, but it's just something that – the bigger threat to housing is probably rate cuts, because the rate cuts bring rates down. Then, if you're a younger couple and you're looking for financing, you're at a lower interest rate, and that lower interest rate will potentially bring out some supply of those people that are stuck in their homes.

Dan Ferris: Sure, yeah. I, frankly, kind of whiff on housing. I got bullish on it last year, and now I'm out because there would be more supply. There would be more demand, too, right? I mean, and I don't have a good feel for which one would, you know, if they would match or if the supply would overwhelm the demand, et cetera, et cetera. It seems more difficult, to me, rather than saying, "Well, be careful, 'cause there's new supply," no?

Larry McDonald: Yeah, well, one of the things we talk about in our book, our new book, When Markets Speak, is all the companies that feed into the secondary housing market. Like Whirlpool, for example, Home Depot, there's just been a lot of stocks, Masco, there's been a lot of stocks, ADT, security systems, there's been a lot of companies that feed into that secondary, that existing home sales, which are really at extremely low levels. And so, there's a lot of companies that have been suffering because of that, the existing home sales versus the home sales, you know. So there's just all these distortions in the market that are absolutely insane.

I mean, you've got, like today, you've got a big miss, Polaris miss, they make kind of recreational sporting equipment like jet skis and skis and snowmobiles and things like that. So, the stress on, like, Joe Lunchpail out there, the financial conditions in that level is really high. And you're seeing that in Darden Restaurants, you're seeing that in a lot of the travel names, like, Southwest Airlines is your real airline to the middle-class. So your middle-class consumer is in extreme recessionary pain, but the top 10 to 20% are richer and have higher income and higher wealth than ever.

Dan Ferris: All right, now, Larry, you're a trader, right? And yet, most of the traders I talk to, they don't talk a lot about big economic fundamentals. They want to talk to me about cutting losses and letting winners run and their system and how they are agnostic to the market and everything. You don't sound so agnostic. And when I look at just the bullet points and sort of leaf through your book, there's a lot of stuff like that long-term demographic thing that you mentioned. I guess all I'm saying, Larry, is you talk a little different than the dozens and dozens of traders that we've spoken with on this show over the past few years.

Larry McDonald: Well, thank you for that, Dan. We have a theory of buying capitulation sell-offs. We did this with oil in 2020, uranium in 2021. What we try to do is buy into the capitulation sell-off, sell the rally one-third, but accumulate for a five-year trade into the future. So in other words, you're, essentially, I would call it dollar-cost-averaging, but you're buying a third, one-third, two-thirds of, say, Exxon when it's in real capitulation selling, or Cameco 2021, real capitulation selling in some of these commodity names.

And then you're lightening into strength, but you want to be there with at least one or two-thirds for the next five years. So, we'll trade around some of the position. Right now, probably the most attractive, today, what I see is, and it's not a hardcore capitulation, but it is a very interesting capitulation relative to how bullish the upside is, and that's the copper names. So, Freeport-McMoRan is off 20%, I think, from the highs, recent highs, 20% off. Copper is off a lot, too.

But if you look around the world, if you look at the U.S. power grid, you look at artificial intelligence, this is one of these trades where everybody kind of got sucked into the copper names in the first quarter. And they've really cheapened up for a whole bunch of different reasons, whether it be China, economic risk creeping in. Because the Fed's telling you they're going to cut because they're worried about the economy slowing, so that's going to slow down, that's going to reduce the price of copper. So right now, you can buy the copper names 20% off the recent levels, and the upside is greater and better than ever.

Dan Ferris: Did you hear that, Ferris Report readers? [Laughs]

Corey McLaughin: I was just going to say, that's good news to Dan's ears. He's been talking up copper for a while. The macro case [crosstalk].

Larry McDonald: [Crosstalk] and same thing with natural gas, where what happens, is you get a bull thesis that the media starts to run with on, say, copper. And there's so many sexy elements to it in the first, second quarter of this year, artificial intelligence, the power grid, blah, blah, blah, you can go on and on and on. But then, like Dan's saying, there's a trading aspect to it, too, where things get too pumped up. It's the same thing with natural gas. You know, natural gas, a couple of years ago, Putin's invading the Ukraine, Europe needs the United States' supply of natural gas, so everybody overproduced.

And that's the thing with natural gas is, you know, Jimmy Rogers once said, he said trading natural gas professionally at a high level is equivalent to four years at Harvard Business School. [Laughter] And he's joking around, but it's such a long-term supply versus demand. Natural gas takes so long to get to market, and the dislocations between supply and demand, because of transportation, get so out of whack. And right now, the bull case, the next five years for natural gas is better than ever. And you've had this huge drawdown that came out of that Putin, Europe, LNG exports.

Everybody thought, like, a year and a half ago, that we were going to have this new consumer of U.S. natural gas in Europe. And that's all true, but it takes a while to set it up, things got overbought, and now you can buy companies like Antero, company's bought back 11% of its stock, trading at, I guess, 8 to 10% free cash flow yield. You're buying something at three times EBDA, you know, just really cheap. Tourmaline in Canada, these incredibly cheap natural gas plays that have just been taken out to the woodshed.

And so, yeah, those are the types of things we're looking at. In our book, When Markets Speak, it's all about artificial intelligence, the power grid, and kind of energy demand for the next 20 years.

Dan Ferris: Yeah, we had a guest on, Rick Rule, who has spent his whole career in commodities, and he mentioned Tourmaline, as well as Peyto and Birchcliff, and a few U.S. names, as well. But that was the one, actually, I talked about, at Rick's event in July of last year, I talked about copper. But this year, I talked about natural gas. [Laughs] So, same page. And part of my thesis was, at the time when I was first getting into it, it was below two bucks. And break-evens all around this country are basically three-ish, except for Permian, which is negative because of all the other stuff they produce.

So I thought, well, you know, here we are again with uranium, the industry is basically in liquidation at that point, right? So, those are the moments [crosstalk].

Larry McDonald: Yeah, that's where they say it's uninvestable. And whenever you hear that word, back up the truck. When Wall Street tells you it's uninvestable, that's the time you back up the truck.

Dan Ferris: Yeah, or if Wall Street says, "You know, we're shutting down our commodity operation or our natural gas trading," or whatever, go, that's your green light, right?

Corey McLaughin: Yeah, this ETF is closing [crosstalk]. Yeah.

Larry McDonald: Dan, there's a scene in my book, When Markets Speak, when we talk about, I'm in Calgary with Rafi Tahmazian, he's a very highly respected asset manager in the energy space in Canada. And Rafi looks out the window and he says, "Look at all that office space." And he said, "You know what the local wildcatters, the billionaire, brilliant kind of players do is that, whenever they see that office space in Calgary go up, square footage from whatever it is, $5 or $10 a square foot to $25 a square foot, the real money wildcat players, the venture capital, they sell everything." 'Cause they know here comes the New York bankers, you know, here comes all the bankers back [crosstalk].

Dan Ferris: Right, the out-of-town money, yeah.

Larry McDonald: [Crosstalk] it's the top of the market.

Dan Ferris: Right. It was just like all the out-of-town money going into homes, in like the Southeast, particularly, during the housing bubble, right? It was out-of-town money from everywhere. Yeah, out-of-town money is a good one. I like that.

Corey McLaughin: And Larry, just going back to the AI stocks. So how would you be, are you fading those, at this point, given where they're at now? I mean, just 'cause I saw, I think yesterday, I read that the hedge funds selling the tech stocks is, last week, at the same rate that it was in January 2021. Which, going back, that was the top of the big tech buzz, at that time, and the meme stock stuff and all that stuff. Are we at the point where you're, like, "Hey, I am selling all of the fancy AI names"?

Larry McDonald: Corey, you wouldn't believe. So, behind me, we run a Bloomberg chat, there's 600 people in there, a lot of them are hedge funds, mutual funds, and pension funds. And what we do is we have most people just observe the chat. So if you're a pension fund manager in Canada, the only thing you're going to say, and it's like a conversation, the only thing you're going to say all year is, "Merry Christmas and Happy New Year," [laughter] you know what I mean? 'Cause, you know, you're 30 years old, you're a pension fund manager in Canada, whatever it is, or you're at one of these mutual funds.

But there are veteran people, let's just say you worked at Moore Capital for 20 years, and now you're running the family money from Monaco or Palm Beach. Or, say, you worked with David Tepper for 20 years at Appaloosa, and now you're running the family money from Hawaii. Wherever it is, those people can actually be part of the conversation. And so yesterday, we had an interesting chat where, it's a private conversation with a guy in The Valley that is really good friends with all of the CFOs of the MAG-7, he's been out to dinner with them hundreds of times.

He's been in The Valley for over 30 years, and he's run hedge fund money, now he's running his family money, at a high level, probably running at 400 or 500 million bucks. And then we had another guy who has been trading the semiconductors for 20 years, professionally. And they were having this conversation around artificial intelligence, and the one thing both said, it was two main points, it was actually three. But the main point was it's like the Manhattan Project where, if you're a CFO in The Valley and you're not doubling or tripling your capex the last year and a half in artificial intelligence, you're just fired.

They're so terrified to be, like, two years from now, left on the outside. And so, what's fascinating is the capex has gone from, like, 30 billion a year to 160 billion a year, with no visibility, Corey, or Dan, no – and I'm telling you, this comes from a guy that talks to them – there's zero visibility on return on capital, right? So, this is capital expenditures just being deployed at a sick, aggressive, insane pace. He called it a Reagan-Gorbachev arms race, right, where CFOs have a gun to their head, they have to invest.

And what's happened is it's created these distortions where Wall Street analysts are falling all over themselves to upgrade Nvidia. But this capex trajectory is just not sustainable, and the market's starting to figure it out now, right? Because the amount of capex, that growth rate, is what's fueling the Nvidias of the world. And their point is, like, take the Blackwell chip, for example, this is like the new Nvidia. If you look at Nvidia's chips that they have been selling over the last year versus the next generation, they should fall 90% in price because of the new chip.

And so, you've got this new generation coming on, you've got this supply of existing chips, and you've got this capex, and the whole thing is starting to kind of just the very early stages of unwinding. And the last thing I'll say, and this is the most important thing, when I pushed back and said, "What makes you think this is just starting to unwind?" and he said, he goes, "Larry, I've been trading the semis for 20 years. I always look at the reaction function." And that's really important for people listening to us, right, like, "What's the reaction function?"

What that means is, think of ASML or Taiwan Semiconductor, last week, they came up with OK numbers, you know, it was called a nice beat for Taiwan Semi, it was considered very good numbers. And the stock sold off kind of violently on pretty good news. And so, four or five months ago, six months ago, these stocks would've been up to 20% on that news, right? Then the White House comes up with this announcement of a regulatory restraint, potentially tariffs, whatever it was around semiconductors in China, the whole thing.

We've seen this headline, like, six times over the last six months, but lo and behold, all of a sudden, the reaction function, these stocks sold off on that news, as well. And it was like, OK, this is the first time that the hottest stocks in the hottest sector are actually selling off on news and they're reacting to this. And that tells you that there's some type of change going on in the SMH. So the SMH with the semiconductors, it recently was 44% above the 200-day. Intel was 22% below the 200-day moving average, within the last 4 weeks.

So Intel was 22% below, the SMH was 44% above. If you go back 15 years, the SMH has only spent, essentially, two weeks here. So, yeah, so you're going to see this big drawdown in semis. And if you want to be long semis, I would move into something like Intel that's been destroyed, that hasn't participated.

Corey McLaughin: All right, that's great, you're confirming my suspicion here, so that was good. I mean, if nothing else, that helped me out. Because me and Dan were having this conversation, we've talked about Nvidia a lot, and thinking back a couple months ago, their last earnings report, and I said out loud, I was, like, "You know, their revenue is up 280%, or whatever, from the year before. It's hard to imagine that that continues." And so, even if it slows down and it's still 100%, you know, and then the bad news starts piling up or people start paying attention to, "Hey, maybe this doesn't have all the potential that we thought it was."

It seems to me like trademark topping out, at this point, in terms of the AI potential. That whole narrative feels like it could be at its peak, like, two months ago.

Larry McDonald: Well, let me give you another example. So, within the last month, Nvidia traded 90% above its 200-day moving average. That's for Nvidia. It was 44% for SMH, but Nvidia got 90% above its 200-day. And that was at a more than $3 trillion valuation. The best Apple could ever do, right, in the history of Apple, September 2020, it got about maybe 50% above the 200-day, you know? And the best Microsoft could ever do was 36%, and Apple was high-50, maybe 60%, I think it was 60. So Apple was 60-ish% above the 200-day moving average.

And it takes a lot to move a $3 trillion company, so to keep a $3 trillion company like Nvidia that's 90% above the 200-day moving average, it takes a tremendous amount of capital to keep it there, right? And like I said, the best Apple could ever do was in the 60s, and the best Microsoft could ever do was in the high-30s to 40s. So, yeah, that tells you what's about to happen, the jaws are about to come back down in terms of normalization.

Dan Ferris: Yeah, isn't this just classic mania? Isn't this just a classic mania, this AI? It's like dot com, I mean, the technology could be as transformative as they say, although I'm not convinced of that entirely at all. And the very best companies in the space, we don't argue that Nvidia isn't a great company that created incredible products, but we know how this goes, right?

Larry McDonald: And the worst part is, like, the sexiest part of the story, the energy, the infrastructure, all of this stuff's been left for dead. And so, if you believe the assumptions of, say, the Nvidia CEO, or all the Wall Street analysts, then, you know, you're talking about a whole new power grid rebuild in the United States. You're talking about small modular uranium nuclear capacity, which will increase the price of uranium probably double. So there's so many trades out there that have been kind of left for dead.

It's very similar to dot com, where you had the dot com and it was, like, OK, [inaudible] eToys and Global Crossing and all these different Cisco systems, but all these other great trades were left behind. You know, nobody talked about the Googles of the world, nobody talked about all these other technologies, the match.com. All these other companies that would end up being long-term winners were left for dead or nobody cared about them.

Corey McLaughin: Yeah, when you mentioned your friend in the chat, there, talking with the other CEOs, like, "We're just going to go along with this because we feel like we have to." [Laughs] That's essentially what I'm hearing, you know.

Larry McDonald: Oh, yeah, it's musical chairs for sure, yeah.

Dan Ferris: It seems insane. I mean, why is it so easy for us? I mean, I guess career risk is that real, right, that must be the answer. Because it's so easy for us to look from the outside into it and say, "Well, that's insane behavior. That can't end well." And yet, it's just par for the course, it happens every single time in this kind of a situation, doesn't it? The answer must be career risk is that important. That's the only thing I can come up with, 'cause the behavior is crazy.

Larry McDonald: Yeah, if you're a CFO in The Valley and you're not doubling, tripling your capex, you will be fired, you know? And it gets to the point – now, there's a whitepaper by Sequoia that came out that's starting to question this return on capital. And there was a very controversial Goldman piece that came out a couple weeks ago. So for the first time, for the first time, for the first time, we're starting to see this group of intelligentsia in the research space that's starting to question, like, "Have you actually done the math behind this capital spending splurge? Have you actually connected how you're going to actually make a return on capital?"

Because these businesses, like in the MAG-7, these companies have been very capital-lack-of-intensive. In other words, they've been cash cows, right?

Dan Ferris: Right, that's been the whole appeal.

Larry McDonald: So now you've got [crosstalk] just been producing cash and producing, whatever it is, dividend buybacks, whatever you want to call 'em. And now they're going to be cash-intensive businesses. The same thing happened in the shale industry, right? They just had to, like, if you didn't invest into that bubble of shale exploration in 2010, '11, '12, '13, you would be fired. And we saw what happened there. It's very similar.

Dan Ferris: Yeah. Yup, I mean, at this point, I'm in my early 60s and I've seen, you know, just the bubbles come and go. I'm sure you've seen it, too. You know, you see the bubbles come and go, and the behavior, the situation may vary, right, the asset is different, the particulars are different, but the human behavior is absolutely identical every single time. It boggles my – it's like they don't remember all the money that was obliterated the last time. It reminds me of that bumper sticker in Silicon Valley, in 2002 or so, you know, "Just one more bubble, please," you know? [Laughs]

Larry McDonald: Well, remember, there's a line in my book, When Markets Speak, and that's the last plug [laughter] [crosstalk]. But there's a line in my book that, Dan, when you don't allow the business cycle to function over longer and longer and longer and longer and longer periods of time, you create – the pain of bubbles, those pain cycles should be longer. But what's happened is, because we've gone into an easing process right after, obviously, dot com, right after Lehman, right after Covid, we don't allow the business cycle to really clean out, creative destruction.

We're not allowing that to cleanse the bad guys, right? So nobody really has any pain at all, right? So there's no recognition of pain, there's no memory of pain, and that's what creates this behavior.

Dan Ferris: And I wonder if there is an accumulative effect somewhere brewing that's really going to bite us all in the rear end, after 40 years of falling rates. And decades of, basically, easier and easier monetary policy, among other things. I worry about that. I worry about that coupled with the rise of passive, you know? So, what happens when that algorithm of receiving a dollar of capital, buying a dollar of equity, totally mindlessly with no reference to fundamentals, and the warm feeling we get believing that all we need to do is keep interest rates low and policy easy and we'll all be fine, what happens when that doesn't work and that algorithm reverses? That truly scares me.

Larry McDonald: Right. Yeah, well, the passive thing is, it's so evil, it's so despicable. I mean, to have the three companies be 24, 23% of the S&P 500's market cap, 3 companies. In 2019, this number was 8 to 9% in the top 3 companies, right? And don't forget, in the '80s and the '90s and the 2000s, the top 3 companies in the S&P, the most they ever got was 8 or 9% of the market composition, right? Not 23%. And that's just, like you said, it's dumb, idiotic money going into fewer and fewer stocks. But Jack Bogle, you know, God rest his soul, is looking down and he probably says this is the unintended – this was with the best of intentions passive was created, and now it's setting up for a really nasty turn here in the next probably 24 months.

Dan Ferris: Right. And even he admitted that, you know, if it gets to be too much of the market, it's going to be a disaster. And lots of people have said that, but to hear Bogle say it, that was something. [Laughs]

Larry McDonald: Well, in my book, I said we sit down with David Tepper, we sit down with David Einhorn, we sit down with Charlie Munger from Berkshire before he passed away. But Einhorn said, at some point, he didn't say passive is evil, at some point, but what he said was it's at the point where – I said that he didn't, but it's at the point where he's on these conference calls with his analysts and nobody's on the calls. Because BlackRock and Vanguard and State Street own so much of the stock, right, that you don't have these active investors that are on these calls, pushing back, asking the more difficult questions. And so it's, like you said, it just becomes the blind leading to blind, over time.

Dan Ferris: Yeah, I thought Einhorn had a particularly smart way of thinking about it, where he said, well, we're not going to get situations where you basically get multiple recovery, right? You have to get the return elsewhere. You have to get it from cash, basically, dividends, share repurchases, or some other, you know, maybe a restructuring or something like that, something much more tangible and direct to the shareholder. Rather than a re-rating, as we all used to call it. It used to be the standard thing that value investors like him would do is, you know, buy the beaten down stock, because you think it's going to re-rate due to x, y, and z fundamental reasons.

But he said, no, we had to stop doing that, and we had to go for, like, 15% free cash flow yields and buybacks and so forth. So, you can still do it, but, man, it just, it got harder and harder.

Larry, do you care to share a name or a particular trade or something very specific that you're doing right now, with our listener?

Larry McDonald: Well, like I said before, we're about to do a trade alert, I believe in the next day or so, on Freeport-McMoRan, in the copper space. You know, we like First Quantum, which is a Canadian company in the copper space, as well, that's been destroyed because of this. Nobody talks about the political risk to copper, right? So think of the copper mines in the planet, right, that are supposed to rebuild the power grid, everything's supposed to support AI. And you have one of the most productive copper mines on earth, in Panama, that was just shut down for political reasons.

And if you look at capacity to produce in, say, Chile and Peru, which is 30 to 40% of global copper supply, that's also down for, also, political risk perspectives. So, yeah, so I think that the copper names here are extremely attractive. You know, I do like being short the SMH versus long Intel. You know, that's a hard one to put on, but you just buy a one-year put spread on the SMH and buy a one-year call spread on Intel, that's extremely dislocated. And then, on the Trump trades, your Schlumbergers of the world are going to be in a really good spot, because you've got deregulation, exploration, "drill, baby, drill." And if Trump wins, that's probably a double over the next couple of years is Schlumberger. So, those are three ideas that we're talking about.

Dan Ferris: Sounds good to me. Thank you for that. I appreciate it. And I know our listeners do, too. I mean, we're mostly in the business of teaching people how to fish, but we like to throw'em a fish, and so, we're happy when our guests can do that.

Larry McDonald: Well, you know, our bear trap support is pretty good, because what we do is we take the – it's not so much a newsletter. We recap the conversation. So we have this conversation during the day, it's like a live ideas dinner with the professionals, and we recap it for the high-net worth investor, the family office that doesn't have Bloomberg, right? 'Cause Bloomberg is, like, 30,000 bucks a year, not everybody can be on that terminal behind me. And so, we're trying to democratize information.

Dan Ferris: A worthy cause, yeah.

Larry McDonald: Yeah, and make a buck in the meantime. [Laughs]

Dan Ferris: Well, yeah, you're trying to provide a valuable service, so, yeah, it's not worth zero. And you shouldn't charge zero for something that's worth more than zero. [Laughter] But, actually, I don't have the book, but I think you've got me convinced. So I've had it on my screen on Amazon the whole time, so I'm hitting the Buy Now button here, just so you know.

Larry McDonald: Thank you. And I tell my wife, as a former Lehman trader, my wife Annabella, if we sell a million books, we'll break even on our Lehman stock. [Laughter]

Corey McLaughin: Oh, boy.

Larry McDonald: But the first book, we sold 700,000 in 12 languages, and then the second one just came out, so, eventually we'll get there.

Corey McLaughin: I want to ask you about, just one more, about Lehman. You made money, a lot of money, betting against that subprime crisis, too, right? First, in your own, in your trading, while you're there seeing what's happening. What was that emotion like? You know, you're making these bets, but you're also kind of there seeing the problem and what's causing it.

Larry McDonald: It was just like today, you had these trades on, for months and months and months and months on end, a lot of these trades were going nowhere, you had to, like – I was short MTG and Radian, which were two big mortgage companies, back then, kind of like tertiary. So I was trading high yield-bonds and distressed bonds. But our bosses, you know, Mike Gelband was an incredible boss. Alex, Larry McCarthy, they would allow us to put on hedges. And so, I was short MTG and Radian, then they announced the merger, right, and the stocks went up in my face and I lost millions of dollars in one day.

To the point where I had traders on the desk mocking me for being in this kind of like mortgage trade. And you just had to hit singles, hit singles, be careful. And I think at the end of the day, you just don't deploy the big capital until you really see the trade breaking your way. If you're too early, we were short MTG and Radian, we eventually made money on that. We were short New Century... that was a really good one. But then, New Century, think about this. New Century went down in February 2007. This is one of the biggest subprime mortgage brokers.

And then, that's February 2007. So the whole thing went on another year and a half before the real big payoffs came. So you've just got to be careful with your entry points.

Corey McLaughin: Yeah, that's something we've heard from a lot of people, you know, there's one decline, and then there can be a heck of a lot more after that, so. [Laughter]

Dan Ferris: Yeah, understatement of the century, Larry McDonald, "Be careful with your entry points." [Laughs]

Larry McDonald: Well, you know, and the way to recap and the way to end is, the reason that is the case is that, in a bull market like this one, if you get those early tremors, right, there's such a propensity in the market to buy any dip, because the people have not been burned in a long time, right? So 2022 was the lowest, so there's just a lot of people that, really, the propensity and the incentive to buy the dip now is extremely high. So, you can have any bit of bad news that kind of shocks the system, and they'll just come right back, until they get their fingers and hands really burnt and then chopped off. And then that's when you get the bigger drawdown.

Dan Ferris: Burnt and chopped off. This is a good place for me to pose my final question to you, which is the same for every guest, no matter what the topic, even if it's nonfinancial. And if you've already said it, by all means, feel free to repeat it. If you need a minute, just take your time with the answer. But it's a simple question. If you could leave our listener with a single thought today, what would you like that to be? Take your time. No rush.

Larry McDonald: OK, are you ready? J. P. Morgan, 1907, one of my favorite quotes of all time. This is after the panic of 1907, J. P. Morgan said, "There's nothing in this world which will so violently distort a man's judgment more than the sight of his neighbor getting rich."

Dan Ferris: I hadn't heard that one. That's great. Oh, yeah.

Corey McLaughin: That's from the heart, there.

Larry McDonald: That's what's happening today. Yeah, that's what's happening today.

Dan Ferris: Oh, that's good. I have that book, I think Bruner was his name, who wrote about the panic of 1907. I've got to find that in there and mark it. That's awesome. Yeah, FOMO. J.P. Morgan talking about FOMO, in 1907. [Laughter] It is crazy, isn't it? And I was talking about that very thing, actually, when I was talking about natural gas and copper, you know, I found some good work by the folks at a little company in St. John's, Newfoundland, called Altius Minerals. I've known them for years and I've written about them.

And they did some work on the incentivization price of copper, and they said right now it's about five bucks a pound, you know, that's when capital should be expected to move into it. But then they said, wait, historically, it requires 10 bucks, it requires double the incentivization price for the capital to start to move. [Laughter] Because you know what happens, Larry, you know, your neighbor doubles his money and you say, "I'm going to wait," right? But then he starts getting rich and you're all in.

So I love that quote. I'm going to find that. I'm probably going to steal it and write about it, soon. It's great. Thanks a lot. And thanks for being here. I really enjoyed this.

Larry McDonald: It was a great, great. Thank you, Dan. Thank you, Corey. It was a lot of fun. OK, all the best.

Dan Ferris: You, too.

Larry McDonald: OK, bye-bye.

Dan Ferris: Man, that was a fun talk. Larry's a fun guy, and smart and experienced, lots of good anecdotes. And while we were sitting here, I bought both of his books, actually. [Laughs] I just, I was, like, "Wow, OK, I like this guy. I'm going to buy his books." Really enjoyed that.

Corey McLaughin: Yeah, his book hits on a lot of those points that we talked about, you know, inflation, passive, oil and gas. Anybody who has the outlook of higher inflation above 3 to 4 or 5%, I am fully onboard with that idea. And so, I'm not going to argue with him on that at all, and I think if you have that outlook, it kind of can help. I'm not saying you have to have that outlook, but if you do, it can help inform a lot of other things that I think are happening today and might happen in the future.

Dan Ferris: Yeah, I looked at the bullet points on the book on Amazon and I noticed that 3 to 5% inflation call, and, you know, bullish on energy and things, too. Larry is our kind of guy I think is what it amounts to. I could never be a hard-hitting "gotcha" journalist. I could never go into an interview knowing, "We're trying to get this guy," 'cause I just, I'd rather find smart, great people and just let'em talk. And, you know, we did that with Larry like we always do, and he had lots of great ideas for us. Including, you know, virtually all of which we've had already, so, you know, just –

Corey McLaughin: Yeah. I liked what you pointed out about, you know, he's a little different sounding than a lot of the traders that we've had, very more macro and has opinion on what's going to happen, too. Or what will likely happen. He's not just, I mean, and then he's entry points, exit points, that sort of thing, too. But obviously has a clear opinion on what might happen, should happen, what he's seen happen before, so.

And it was interesting hearing what he's been hearing about AI and those executives, as well. Which strikes you as, like, strikes me, at least, as, not shocking, but typical hype behavior, when you're a leader of a company, like, "Oh, well, if I don't do this, I'll get fired, so let's do it. It's probably not the best thing for the company, but I'll do it anyway." So, that's essentially what I'm [crosstalk].

Dan Ferris: Yeah, I mean, look, we know that dynamic, right? And I didn't mean to harp on it so much, but it just, every now and then, it just catches my mind and I say, "Wait a minute, why do people do this again? Why do people behave crazy like this again? Do I really understand this?" You know, I think I do, and I certainly accept the fact that it's not going to change any time soon.

But it's nice to hear about it sort of, I guess in that case, second-hand from the inside kind of. Yeah, great talk. I look forward to reading his books. I mean, it was just a really, really fun conversation, fun interview.

And that is another interview and that is another episode of the Stansberry Investor Hour. I hope you enjoyed it as much as we absolutely did.

We do provide a transcript for every episode. Just go to www.investorhour. com, click on the episode you want, scroll all the way down, click on the word Transcript, and enjoy. If you liked this episode and know anybody else who might like it, tell them to check it out on their podcast app or at investorhour.com, please.

And also, do me a favor. Subscribe to the show on iTunes, Google Play, or wherever you listen to podcasts. And while you're there, help us grow with a rate and a review. Follow us on Facebook and Instagram. Our handle is @investorhour. On Twitter, our handle is @investor_hour.

Have a guest you want us to interview? Drop us a note at feedback@investorhour.com, or call our listener feedback line, 800-381-2357. Tell us what's on your mind and hear your voice on the show.

For my cohost, Corey McLaughlin, until next week, I'm Dan Ferris. Thanks for listening.

Outro: Thank you for listening to this episode of the Stansberry Investor Hour. To access today's notes and receive notice of upcoming episodes, go to investorhour.com and enter your e-mail. Have a question for Dan? Send him an e-mail, feedback@investorhour.com.

This broadcast is for entertainment purposes only and should not be considered personalized investment advice. Trading stocks and all other financial instruments involves risk. You should not make any investment decision based solely on what you hear.

Stansberry Investor Hour is produced by Stansberry Research and is copyrighted by the Stansberry Radio Network.

Opinions expressed on this program are solely those of the contributor and do not necessarily reflect the opinions of Stansberry Research, its parent company, or affiliates. You should not treat any opinion expressed on this program as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Neither Stansberry Research nor its parent company or affiliates warrant the completeness or accuracy of the information expressed on this program, and it should not be relied upon as such.

Stansberry Research, its affiliates, and subsidiaries are not under any obligation to update or correct any information provided on the program. The statements and opinions expressed on this program are subject to change without notice. No part of the contributor's compensation from Stansberry Research is related to the specific opinions they express. Past performance is not indicative of future results. Stansberry Research does not guarantee any specific outcome or profit.

You should be aware of the real risk of loss in following any strategy or investment discussed on this program. Strategies or investments discussed may fluctuate in price or value. Investors may get back less than invested. Investments or strategies mentioned on this program may not be suitable for you. This material does not take into account your particular investment objectives, financial situation, or needs, and is not intended as a recommendation that is appropriate for you. You must make an independent decision regarding investments or strategies mentioned on this program.

Before acting on information on the program, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser.

[End of Audio]