In This Episode

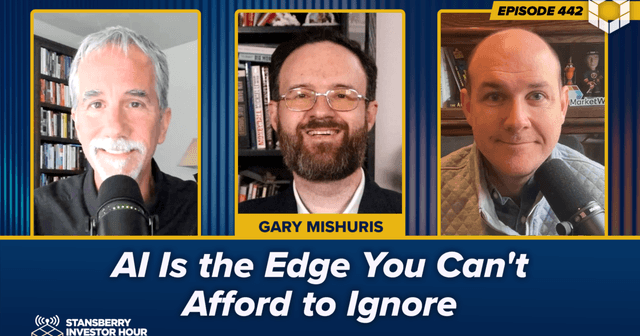

On this week's Stansberry Investor Hour, Dan and Corey welcome Brody Mullins to the show. Brody is a Pulitzer Prize-winning investigative reporter and author of the new book The Wolves of K Street. He joins the podcast to share insights from his two-plus decades spent investigating the Washington political scene.

Brody kicks off the show by discussing his history reporting on antitrust regulation. He notes that recently, both major political parties in D.C. have become less friendly to Big Tech companies and are using antitrust regulation to slow their growth. After, Brody talks a bit about how he got started in journalism, the importance of holding those in power accountable, and why he has dedicated his life to investigating companies...

Every time you write a story, it's sort of a mystery. You're sort of trying to figure out what does a company want, what's it trying to do to get it, who are they buying off, who are they influencing, how are they playing the game... My job is to go after big, important people, institutions, companies, and figures.

Next, Brody shares some details about his book. He points out that for most of this country's history, companies had very little influence in Washington. Things only changed in the 1970s once the economy cratered and stagflation hit. Then, companies began to lobby in order to twist regulations and gain an advantage in the market. Brody also explains lobbying in simple terms, including how lobbyists raise money for members of Congress. He argues that legal loopholes and undisclosed funds to influence constituents have made companies nearly untouchable...

Labor unions essentially don't exist in terms of a powerful interest in D.C. the way they used to in the 1950s and 1970s. So companies now are not lobbying against consumer groups or against labor unions or against environmentalists because all those groups don't have any power. That's why they're lobbying against themselves now. It's sort of company against company... The problem is that when policymakers or lawmakers or staff try to make policy, the only people influencing them are companies these days. There's no other side.

Finally, Brody discusses why there's still hope for the American people to fight back. He explains that negative public perception about these big, powerful corporations (such as Amazon and Google parent Alphabet) has influenced antitrust regulators to begin taking action. He also talks about insider trading among members of Congress and emphasizes that all of these conflicts of interest are nonpartisan...

It's not Republicans or Democrats. It's both. And it's being driven by corporate America and the interests of the lobbyists they want. Lobbyists in Washington... don't care whether Republicans are in power or Democrats are in power. They want to be friends with both of them. They give campaign money to both of them. They support the election of both of them. They have friends in both parties so that they win no matter [which party] wins.

Click here or on the image below to watch the video interview with Brody right now. For the full audio episode, click here.

(Additional past episodes are located here.)

Dan Ferris: Hello, and welcome to the Stansberry Investor Hour. I'm Dan Ferris. I'm the editor of Extreme Value and The Ferris Report, both published by Stansberry Research.

Corey McLaughlin: I'm Corey McLaughlin, editor of the Stansberry Daily Digest. Today, we talk with Brody Mullins, Pulitzer Prize-winning investigative reporter, and author of the book, The Wolves of K Street, about corporate interests in Washington.

Dan Ferris: Yeah, he won the 2023 Pulitzer Prize for investigative reporting for writing about high-ranking government officials basically trading stocks in companies that they regulate, which ought to be a no-no. He wrote about it and won himself a Pulitzer Prize, very smart guy. I'm really excited for you to hear this interview because we didn't know much about Brody going into this. He wasn't a famous investor or a famous trader, and we've learned so much that makes me want to dive into his book having just looked at a little bit of it. I can't wait until it arrives so I can just dive in and read every word of it, and I think you might feel the same way. Listen to the whole thing, and you're about to learn a whole lot of stuff about an area of business and government that hardly anyone writes about, so here it is. Let's talk with Brody Mullins, and let's do it right now. Brody, welcome to the show. Good to have you.

Brody Mullins: Thanks for having me.

Dan Ferris: I know you've got this book out, The Wolves of K Street, and we will definitely talk about that, but, actually, I was unfamiliar with your work when folks said, "Hey, why don't we have this guy on?" and I said, "Yeah." I just did a little quick search on the Wall Street Journal website, and quickly found out that you have a bee in your bonnet about a lawyer named Joshua Wright, do you not?

Brody Mullins: Yeah, I wouldn't say it's a bee in my bonnet, but yeah, he was a fascinating character who I wrote about in a three-part series in the journal that came out in June. He's a lawyer who is a leading figure in the antitrust movement in D.C. and antitrust policy circles advocating for a looser interpretation of antitrust rules, which is a topic that's really gaining steam in D.C. It turned out that he had a sort of secret sex life, where he had been dating as many as a dozen of his former law students, so it's sort of a sad tale of a once high-flying D.C. influence peddler who is now stuck in all these sexual harassment lawsuits.

Dan Ferris: This thing has a salacious Netflix miniseries or something written all over it. Have you tried to do that?

Brody Mullins: That's a good question. I need to talk to an agent about that. I was thinking about trying to make it into a book first, but maybe I could just skip the book and go right to Netflix.

Dan Ferris: There you go.

Corey McLaughlin: Yeah, just go right to video.

Dan Ferris: Yeah. Would you say antitrust is like your beat, a primary focus for you?

Brody Mullins: I sort of follow, and have for the last 20 years, companies and how they interact with government in Washington, and that has covered all sorts of different topics. It just seems like in the last three to five years, particularly with Big Tech, that we keep coming back to antitrust. It seems like Democrats, and really more importantly, Republicans, seem to be changing their views on antitrust and their views on big companies. For my entire life, the Republican Party and big companies have sort of been in lockstep on policy in D.C. – trade and tax and regulation and immigration – and now that alliance is falling apart. The Republicans I'm talking to, more and more are saying that these big companies, particularly tech but also other industries, are too big and too influential. I just find that fascinating because it's just so new to me, that the Republicans are normally best friends with their friends in corporate America, and now that falling out is stunning.

Dan Ferris: Right. They don't seem to be going after Rupert Murdoch, though. They seem to be going after all the leftie guys. Do you think that had a –

Brody Mullins: That's true.

Dan Ferris: That seems to have had a lot to do with it.

Brody Mullins: Well, you know what? It's interesting you say that, sorry to interrupt, because –

Dan Ferris: No, go ahead.

Brody Mullins: – it's not just tech. I've also seen it in ag, Wall Street, in music. It's in almost every industry. Republicans seem to be saying these companies are too big and too powerful, except for oil and gas, which I think might make your point, that no one is complaining about the size of Exxon and the big oil and gas companies, because they're still in bed with the Republican Party.

Dan Ferris: Should they complain? I don't understand why they really should complain about ExxonMobil. Should they?

Brody Mullins: I just meant that, overall, Republicans seem to be saying that these companies are too big and too powerful, and why are there three airlines and three railroads, and three or four commercial banks, but then when you look at the oil and gas industry, they don't seem to be complaining about the consolidation there.

Dan Ferris: Right, so the point is their inconsistency, which goes back to –

Brody Mullins: I think so, yeah.

Dan Ferris: Which goes back to why these industries, like why Big Tech, especially? I assume we're talking about Facebook, Google, maybe Amazon, and maybe still Microsoft, after a couple of decades, almost three decades after they started getting harassed for this stuff. Is that who we're talking about?

Brody Mullins: Yeah. The Republicans I'm talking to, including some leading conservatives at places like the Federalist Society, continually say that they feel like the companies have too much influence over their lives, and have too much influence in politics. Republicans look at that Hunter Biden laptop story in the last election, that everyone in the national media, including folks at the Wall Street Journal, said, "This is not real." It turns out it was real, but Facebook, they made some news the other day on this one, Facebook was among the companies who tried to slow the dissemination of that story because they thought it wasn't real. Republicans looked at that case and said, "Hold on a second. Why is Facebook trying to cover up this story?" which turned out to be true. Therefore –

Dan Ferris: It's a true story, yeah.

Brody Mullins: Yeah, and, therefore, a lot of Republicans have kind of turned against Facebook and the tech companies, or that's one of the reasons, I should say, that they've turned against those companies.

Dan Ferris: Right. I wonder, is that necessarily an antitrust issue, or do they use the antitrust issues to go after folks who are screwing with elections, and suppressing, let's face it, conservative views and things? It seems to me like it's more about that.

Brody Mullins: Yeah, no, this is not –

Dan Ferris: You're the guy who has studied it for 20 years.

Brody Mullins: Yeah, no, it's not an antitrust issue at all. But what it has done is turned the momentum, or sentiment, in the Republican Party against those tech companies, and then in order to try to reduce or curb their influence, they're using the antitrust laws to try to slow their growth or break them up, and we'll see what happens. A lot of these court cases are just taking place right now.

Corey McLaughlin: Hey, Brody, and for our listeners and viewers, in case anybody doesn't know, your 20 years in D.C., you can explain it, but the ins and outs, I think everybody can already understand that you're kind of very much plugged into the D.C. scene here, won part of a Pulitzer Prize. Can you just get into your background a little bit, just your experiences in D.C. and what you've seen through your time working?

Brody Mullins: Yeah, so I'm one of those strange people who was actually born and raised in Washington, D.C. and is still here. For some reason, I just sort of fell in love with politics and journalism at a young age. In high school and college, I would read presidential biographies of some of the greatest presidents and presidential campaigns. I went to Northwestern University out in Chicago because I wanted to be a reporter, and I desperately did not want to start my career in Washington, D.C. because that's where I was from. But unfortunately, if you want to cover politics in America, there is really one place to go, so I ended up back on my parents' couch not too long after leaving, and I've been a reporter ever since. Most reporters in D.C. cover the White House, or they cover the House or Senate floors and what legislation is being voted on that day, or what presidential Tweet is coming out.

I found that to be less interesting, and I've kind of tried to write about why those things are happening, why are presidents doing things, or why are certain bills getting to the floor and getting voted on, and others are not? A lot of times, most of the time, what's being voted on in Washington, what's happening is being driven by what corporate America wants, and so I started covering sort of that beat, what companies want in Washington and how they go about getting it, using either campaign donations, or lobbyists, or other sort of influence-peddling campaigns. Unfortunately, in Washington, despite how much power companies have, there is very little coverage of companies and lobbying. In fact, the Washington Post, which is, obviously, our hometown newspaper, doesn't even have a reporter dedicated to covering lobbying, which is sort of like Detroit not having a reporter covering the auto industry.

This is our industry, this is our game, and we have so many reporters covering politics. "Who is going to win the election? Are the Democrats doing to keep the House, or keep the Senate." But we don't cover companies, and companies seem to have all the power. Anyway, it's sort of niche that I found, and I find it fun to cover that area, because every time you write a story, it's sort of mystery. You're sort of trying to figure out what does the company want, what is it trying to do to get it, who are they buying off, who are they influencing, how are they playing the game? I feel like that's a pretty fun area, and important, too, of course.

Dan Ferris: Yeah, it sounds like it's just – doing that kind of thing sounds like you could learn things that would endanger your life, to me.

[Laughter]

I mean, it does.

Brody Mullins: That is –

Dan Ferris: Big money on the line –

Corey McLaughlin: You try not to think about that, right?

Dan Ferris: You know? I mean –

Brody Mullins: That is –

Dan Ferris: – have you ever ruffled feathers you wish you hadn't ruffled?

Brody Mullins: I have ruffled feathers, yes. I wouldn't say I wish I hadn't. But yeah, I've had several, more than a handful of talks with the security folks at the Wall Street Journal after getting e-mails, or texts, or threatening incoming messages. In fact, one time – I forgot about this one – several years ago, I got this weird voicemail at my office after I had written a story about someone, and I just kind of brushed it aside. Then, my wife called and said that she had gotten a call at her office, and I thought, "Uh-oh." It's one thing to send me a nasty e-mail or voicemail, but if you're talking to my wife, it means you might have a little bit of a problem. Yes, it's something that happens. My job, which I enjoy very much, is to go after big, important people, institutions, companies, and figures, and, therefore, that can be threatening to people's livelihoods or to companies.

Dan Ferris: Well, yeah. OK. I like the title of your book, Wolves of K Street. I worked at – where did I work in the late '80s? At 17th and L, I believe.

Brody Mullins: Yeah.

Dan Ferris: I remember there was a bar there called Ha'Penny Lion. I don't know if it's still there.

Brody Mullins: It is not there.

Dan Ferris: Yeah. But yeah, we were there every day, and it was a crazy time. During that time in my life, I learned about the D.C. work ethic, which it's almost like on call 24/7. At the time, the things I was doing aren't really important, but I got one gig working for a defense contractor, and they said, "We'll pay you whatever it is that you need to be paid, but we need you here when you're not sleeping. If you want to sleep here, we would really like that." That indoctrinated me a little bit. That was early on, and it indoctrinated me a little bit, and I didn't realize it at the time, but now I've realized big money and big power is at stake. The work ethic there, it's similar to I-Bankers on Wall Street, big money and big power at stake, and the people who pursue that, they're a different breed. What kind of breed are you? Are you one of these guys who is working all the time, like morning, noon, and night, seven days a week?

Brody Mullins: No.

[Laughter]

Dan Ferris: Thank goodness.

Brody Mullins: The news cycle has only sped up, obviously, since then, where we have multiple big stories every hour, it seems like, once in a while.

Dan Ferris: Yeah, sped up and no breaks.

Brody Mullins: No breaks, so luckily, for me, I try to practice a different type of journalism, which is more longform investigative pieces, or now books, where I'm sort of taking a broader topic, usually something that no one else is looking at, and I can really dig into it. For example, that Joshua Wright story that you mentioned, I didn't work on that for a year, but certainly for a solid six months, and no one else was really writing about it, so if that story hadn't published then and published next month, it would still be news to people. To me, he was just sort of an interesting guy, who no one really knew about, who had this secret sex life, but really was an important figure in helping Google and Amazon and Facebook fend off the federal government for more than a decade. Stories like that, if I had never written it, it never would have been written and no one really would care. But I try to find stories that are interesting and telling and are kind of behind the scenes so that I don't need to work 24/7 trying to chase the latest Donald Trump tweet.

Dan Ferris: OK, so now to your book, The Wolves of K Street: The Secret History of How Big Money Took Over Big Government. The first thing that comes to my mind when I just look at the title, forget about what might be in the book, when I look at the title, I wonder, there appears to me to be a chicken-egg question here, right? Which one was first? Was big government first, or was big money first, and which one goes after the other one more, because, obviously, people in power have lots of incentive to garner all the power they can get, and there is a lot of power in big money. I don't even know if you think that's a valid question, but it's just what came to my mind.

Brody Mullins: I think it is fair, and I think in terms of chicken or the egg, I think it was big government first. We have a couple chapters on sort of the evolution of lobbying and corporate power in D.C., and what's pretty clear is that companies – this is one of the reasons I got into this book, is that by covering Washington for 20 years, companies in my lifetime have always been incredibly powerful and have been in bed with the Republican Party, and sometimes the Democratic Party. I sort of assumed that companies had always been really powerful, and when I started researching for this book, I realized that for most of the country's history, companies had very little influence. In fact, from the 1920s to the 1970s, from the New Deal to the Great Society, companies had very little influence in Washington.

They didn't really have lobbyists in Washington, they didn't have many offices in Washington, and that's because they didn't really care about Washington. People were making money, industry was good, the economy was good, everyone was generally happy. But, during that time, the government kept growing and growing, creating all sorts of new departments and agencies, three-letter, alphabet soup departments, many of which were created with the support of companies, or at least not the opposition of companies, and sometimes with the support of Republicans. Think of the Environmental Protection Agency. That was created by Richard Nixon. You would sort of never think that, but back in that era, that was the era of the growth of big government.

Getting to your question, in the 1970s, the economy cratered with stagflation and inflation, if you remember, and company profits evaporated, and company CEOs started looking around saying, "What's the problem? Where did my profits go?" essentially. They realized how much time and effort and resources they were devoting to dealing with complying with all these new rules and regulations, and department and agency mandates that had popped up, and like any good business, they said, "How are we going to fix this?" and they started investing in their problem, and their problem was Washington. Companies started hiring lobbyists and making campaign donations, building relationships with Washington, at first to head off new rules and regulations, and sort of try to slow the growth of the government.

Then, much later, to really kind of push back regulations, or take regulations and kind of twist them on their competitors, or on consumers. What I mean is that instead of being defensive and trying to block regulations, they sort of embraced regulations and tried to figure out how to use regulations to create barriers to entry, or to help themselves and hurt their competitors, so the chicken-or-egg is that there was definitely big government first.

Dan Ferris: Yeah, I'm not surprised. When you get that big, concentrated political power, it wants to get busy. It wants to do something, and it wants to keep growing, so big companies are likely targets, and then they need to survive so they go – then, as you described, the evolution you describe, it actually gave me chills because I've talked about this, admittedly knowing far less than you do, not having done the research that you do. It just struck me over the years. I remember an article, for example, about H&R Block pursuing regulation of tax preparers, and at first, I thought, "Why would they do that? They're tax preparers," and then I thought, "Oh. That's why they would do that," to make it harder for –

Brody Mullins: That's how the game is played.

Dan Ferris: Yeah, they're the big incumbent. The big incumbents are all deeply involved into regulations and making it harder for other entrants.

Brody Mullins: Yeah. unfortunately, that's 100% how things work these days in industry after industry, and in company after company, that you're creating rules and regulations to gain an advantage in the marketplace. That's fundamentally not how business should work, but it is how it works today.

Corey McLaughlin: What I find fascinating, what you get into in the book, is when you get the history of just how this lobbying developed, but then, to the point where we are now, there are 13,000 lobbyists and there are only 500 members, or whatever, of Congress and how this practically works. I think to a lot of people, like most everyday Americans, they hear the word lobbyist and it's immediately a negative connotation, unless you are one, I guess. Why is there this middle-man between me and Congress, or whoever I voted for? Just to understand how it practically works, I think, is interesting.

Brody Mullins: Yeah, so great question. The government is incredibly big, sprawling, complicated, bureaucratic. You've got more than 100 federal agencies and departments. Each one has the office of this, and the division of that, and businesses should be focused on their businesses, not on Washington. But oftentimes – or always – companies are dealing with regulations and running into obstacles, and, "As a businessman, I want to do X, but in order to do X, I need to get this permit, or I need to deal with that regulation," and those are things you're not an expert in, so people hire lobbyists. Lobbyists are basically translators.

They're former staffers, they're former members of Congress, or officials that used to work at the EPA, for example, who can say, "OK, you've got a problem with this new tailpipe emissions standard. I used to work in the division, or I have a friend who works in that department, and let me set up a phone call, or let me figure out, first of all, who you should talk to, where in the EPA do you need to go." The lobbyists are usually not experts in the policy, but they can get you to the right place so that the companies can make the argument themselves. I think the best way of describing it is they're really a translator of how Washington works for businesspeople.

Dan Ferris: They're mostly lawyers?

Brody Mullins: Mostly lawyers, because in Washington, we make laws, and laws are made by lawyers. You don't have to be a lawyer to be a lobbyist, but many lobbyists are.

Dan Ferris: It just works out that way naturally. Sure.

Brody Mullins: Yeah.

Dan Ferris: Do you know lobbyists? Are lobbyists some of your very best friends?

Brody Mullins: Yeah. No, I wouldn't say very best friends, but as a reporter, you want to know the players and the teams you're writing about, so I should be spending my time going to lunch and breakfast and dinner and coffee with people who are lobbyists. Over time, you certainly make friendships. Sometimes, I'm sort of like a private eye, so I want to talk to a lobbyist or a company and give them protection so that they'll tell me the secrets of their competitors or of their companies. The lobbying world is super interesting and insular, and so I sort of want to make friends in order to figure out what's going on on the inside, sort of like if you're covering the Boston Red Sox, you want to know the players, you want to know the managers, you want to be friendly with them. I mean, not necessarily friends, but you want to have a good relationship where they trust you, so they can tell you information and know that I'm not going to write a story that gets them fired.

Dan Ferris: OK. If this question just doesn't land right, that's fine, but I just want to know. What you just said makes me want to ask, "OK. Well, what is going on inside there? What are the bullet points?" What are the two or three or four, however many things it is, that you've learned about lobbyists where it was kind of a little breakthrough for you to go, "Oh, that's how this works"? Anything?

Brody Mullins: Well, unfortunately, the way it works is oftentimes with campaign donations and money and politics. Members of Congress exist to get reelected. In order to get reelected, they need money, and lobbyists are a big source of that money. Many lobbyists sort of work part time as lobbyists representing companies, trying to get things for their clients in Washington, and the other half of their time they spend trying to raise money for members of Congress. The idea is that if a lobbyist can raise $100,000 for a member of Congress, and then the next day the lobbyist says, "Hey, member of Congress, I need help with a client. Would you mind meeting with the CEO of one of my clients?" the member of Congress is going to say yes, or it would be silly to say no, because you're upsetting someone who just raised money for you. That is a terrible system, but, unfortunately, it's what we have. Elections cost more and more because of the cost of television ads, basically, and members of Congress need money, and, to get that money, they turn to lobbyists. It's just how it works.

Dan Ferris: Should we even have lobbyists? Are they doing something fundamentally wrong? Are they doing something that ought to be illegal? I honestly don't know.

Brody Mullins: That's a great question. Lobbying is not illegal. It's protected under the First Amendment.

Dan Ferris: Well, you have to be registered, right?

Brody Mullins: There is one law, which says you have to register your activities, and that law has many flaws that we can get into. But going back to the beginning, the founders of the country foresaw a day when there would be lobbyists. They didn't call them lobbyists, they called them factions, and what they said was that they thought there would be a faction of pro-industry Americans, and there would be a faction of workers, and those factions turned out to basically be labor unions against corporate lobbyists. But what they saw was that there would be sort of a level playing field, and both sides would be of equal size and strength, and they would battle each other to a draw or to an equilibrium to make legislation. What we write about in our book is that starting in the 1970s, as I mentioned, when companies started investing in D.C., over the last 50 years, it really destroyed the other side.

Labor unions, essentially, don't exist in terms of a powerful interest in D.C. the way they used to in the 1950s and 1970s. Companies now are not lobbying against consumer groups or against labor unions or against environmentalists, because all those groups don't have any power. That's why they're lobbying against themselves now, sort of company-against-company. But back to your point, the problem is not that they are lobbying, it's that they're the only lobbyists in town. If they were lobbying against labor unions, then at least you would go back to what the founding fathers foresaw, which is a fair fight. So, no, it's not illegal, but the problem is that when policymakers or lawmakers or staff try to make policy, the only people who are influencing them are companies these days – there is no other side.

Corey McLaughlin: Yeah, and you did bring up registered lobbyists. I wanted to ask you about that.

Brody Mullins: Great.

Corey McLaughlin: That, inherently, seems to me like they're going to have some problems. Who is doing the registering? Who approves registered lobbyists? How does that work?

Brody Mullins: Exactly. Well, the answer is nobody. There is no oversight of this area, but the rule is that if you're a lobbyist, you have to fill out a form once a quarter, it's [inaudible due to audio distortion], and all you have to say is what your name is, what your address is, what clients you have, how much they're paying you, and generally what issues you're working on. Unfortunately, the law says that what a lobbyist is is someone who spends 20% or more of their time actually talking to members of Congress or staff on behalf of clients, and that's a huge loophole. What it means is that some people, 13,000 people are registered as lobbyists, but hundreds of thousands who are doing similar things don't register as lobbyists. I'll give you a couple of examples. In 2007, when the last lobbying law was updated, there were about 12,000 lobbyists.

Today, almost 20 years later, there are only 13,000 lobbyists, so in the last 20 years of the growth of the government, growth of the industry, and growth of the economy, we've only added 1,000 lobbyists? It just doesn't make any sense. Another point here, I told you I grew up in Washington, and Washington is a city with its suburbs of 3, 4, 5 million people, and our industry here is law and government. All we do here is make laws and make regulations, and there are the 500 members of Congress and their staff. But almost the rest, if you're not a schoolteacher or a bus driver, almost everyone else who lives in Washington is working on legislation. They're here in order to pass or block laws. We don't make cars, we don't make widgets, this is what we do, so then you say, "OK, how many of you are lobbyists? Thirteen thousand?" Get out of here.

It's a hundred times more, but the problem is the definition of lobbyist is this 20%, and something else we write about in our book is that the 20% threshold is people who actively talk to members of Congress. Well, there are also pollsters and people writing ads, and people doing surveys out in the states, and people working with third-party groups, all people who are in the middle and intimately involved in lobbying campaigns but don't actually talk to a member of Congress. The point here is that that 13,000 figure is just way understated.

Dan Ferris: I see. That's interesting. Yeah, that makes sense, too. It makes sense that there would be a bigger army of folks. It's pretty important –

Brody Mullins: I'll give you another example. One of the companies we write about in our book, or one of the lobbyists we write about in our book, is a guy named Evan Morris, who was a fascinating character. He worked for a big biotech company called Genentech. I was able to get some internal figures from the company, things that are not required to be disclosed, and that showed that when Evan Morris was a big-time lobbyist in D.C., he had a $50 million budget to influence legislation. Of that, $5 million was spent on actual lobbying, and $45 million was spent on other influence campaigns and influence activities that were not disclosed. That's a 10-to-1 ratio just for that one company, as in 10% being actually disclosed and 90% not being disclosed.

Dan Ferris: OK. I'm not sure even what you're telling me there. What was the other 90% spent on, do you think, in your humble opinion?

Brody Mullins: Yeah, so one of the things we write about in our book is sort of how lobbying has changed, and how lobbying has moved from hiring registered lobbyists to go up to Capitol Hill and ask for favors on behalf of clients, to moving more outside of Washington and running sort of public relations campaigns, as in you turn on the TV today and other than seeing all the political campaign ads, you'll see ads about the cost of prescription drugs, and drug companies saying, "These third-party middle-men, the PCBMs, or whatever, are stealing money from this company or that company." There is all sorts of advertising that goes on outside of Washington that is really part of lobbying campaigns. They're trying to get regular Americans to support one position or another on behalf of lobbyists. To me, that's all lobbying and advocacy, but it's not considered lobbying under the law.

The idea here is that companies have realized that members of Congress exist to get reelected, as we talked about, and, in order to get reelected, they need money, but they also need the support of 51% of their constituents. Members of Congress are very sensitive to the desires and the temperament of their voters. What companies realize is if you go out into a particular district and you get 51% of the constituents to support a free trade bill, or a tax cut, or a cap on prescription drugs or whatever, the member of Congress is going to follow, so a lot of lobbying now is not talking to the member of Congress but actually talking to their constituents. That's where that money is being spent that is not being disclosed.

Dan Ferris: If you don't mind, Brody, I have to say you seem like such a reasonable, intelligent, focused guy, and I wonder, I'm like, "This guy seems like a really good guy, and he's in Washington his whole life." Do you take a 90-minute shower at the end of every day? It's just like, are you scraping it off of you every day, the slime from the swamp every day?

[Laughter]

Brody Mullins: Right. Good question. I just feel like my job is to sort of write about the game and sort of how it's played and its players, and try to ignore how negative a lot of it is, and how pessimistic you can be.

Corey McLaughlin: Yeah, you're speaking my language. I started off as a sportswriter, actually. When you're in sports, you see the game, you see the players and whatnot in the locker room, things that fans don't see, and all that sort of thing, sometimes you have to take a shower yourself, too, and wash things off. But Dan and you bring up a point, or an idea. Is there any hope for lobbyists for, say, the American people? You talk about the decline of labor unions, which was kind of the counterbalance, I guess, to a lot of the lobbyists for corporations and businesses. Do people not realize the power that they do have with elected officials? What does this all mean to a regular person in any town –

Brody Mullins: Yeah, so good questions. I think that there is hope, and the hope is exactly what you just said, that the American people at the end of the day still have the power. The problem is the American people are not organized. They don't sort of speak with one voice – they're sort of disparate and all over the place. There have been examples, and we write about a couple of them in our book, when the American people come together on some policy or issue and are more powerful than the lobbyists. I can give you an example that you may not like, but when Donald Trump ran for president in 2016, everyone in Washington was against him. The establishment was against Donald Trump. The Republican Party, how many candidates were there, 13, 12, 16? Every single one of those people thought Donald Trump was a buffoon.

The Democratic Party was obviously against him, corporate America was against him, the establishment was against him, but Donald Trump had the people, and he was able to beat the establishment candidate in Hillary Clinton back then. We'll see what happens this time, but that's just an example that shows that when the people come together, they can outpower the Washington establishment and corporations. In terms of bills and policy, we also have a couple of examples in the book of when the American people come together to pass things that are opposed by some parts of corporate America. There is hope, it's just that companies need to – I'm sorry, constituents, voters, regular Americans need to come together and flex their muscles.

All too often, as I think you said, Americans sit back and don't get involved, and you know who is involved? Corporate America. They know what they're doing, they're organized, they're well-funded, and they're focused. If the American people could do that, then they would have more power. Finally, I should say in terms of is there any hope, this antitrust movement, this movement of Republicans and Democrats against big companies I think really could become something, and a lot of the corporate lobbyists who I talked to are actually all of a sudden worried about that. They think that members of Congress are siding with the people, and are moving more and more against big companies and industry.

Dan Ferris: That's a funny thing to say, though. Who doesn't use Google and Amazon? We don't all just use them – we find it hard not to. It's harder not to use them than it is to use them, and I try not to use Google too much because the results are a little weird, and I'm always trying to find alternatives to the conventional view. But with Amazon, I remember a few years ago when the product searches flipped from mostly on Google to mostly on Amazon, people just said, "Why go to Google? I'm just going to go straight to Amazon anyway and search," because they've got every product on Earth, practically. I don't know. I'm not sure what that observation is worth, but I guess what I'm saying is the idea that the people, Americans, generally might have a big problem with a company who they use a lot. Perhaps it's not altogether strange, but they're not boycotting it, are they?

Brody Mullins: No. Yeah, but –

Dan Ferris: They're not boycotting Amazon and Google.

Brody Mullins: True, but the perception of these companies as being too big and too powerful by most Americans has allowed federal antitrust regulators to file lawsuits against them. In the case of Google, the Justice Department just this month won a huge case – the biggest monopoly decision in a generation – against Google, saying that Google was using illegal tactics and is acting anticompetitively in Internet search. There is a second trial, a second antitrust case filed by the Justice Department, that goes to trial starting next week, or the week after, saying that their Internet advertising business is an illegal monopoly. Meanwhile, at the Federal Trade Commission, which is the other big antitrust regulator in D.C., they have a big case going on against Amazon. We'll see what happens with those, but those regulators don't act in a vacuum, and they see the wishes of the American public and try to act on their wishes. It's possible that while we're still shopping on Amazon and doing our searches on Google that government officials are acting on what they see the people want.

Corey McLaughlin: Yeah, let me throw a hypothesis at you, a theory here. You talked about, and you write in the book about the catalyst for regulations and lobbying, dealing with the regulations and the high inflation in the '70s. We just had this 40-year high period of inflation now. Do you think people are getting fed up just with the cost of things that there actually might be some interest in doing the kinds of things you're saying, maybe getting a little bit more organized, putting more pressure on politicians, like basically higher costs, inflation becoming more of a political issue again now?

Brody Mullins: Yeah. I think inflation is one of the reasons. But, also, I think there is an increasing number of Americans who think that there are two Americas. There is Washington and the establishment, and everyone who lives in Washington, whether you're Republican or Democrat, it doesn't matter, everyone in Washington is winning, whether it's Hillary Clinton or Donald Trump, or the lobbyists and the members of Congress. I think people see that they are losing, and I think if the people come together, and this is the AOC progressives, plus the populists in the Republican Party, if they come together, that's a pretty powerful group. Some of the people who support Donald Trump, and some of the people who support Bernie Sanders are saying the same thing: They're both against the establishment. They just need to realize they need to get on the same team, and they could really be powerful.

Dan Ferris: An interesting point at a time when people assume that those groups want nothing to do with one another. They do, they overlap, at least somewhat. This is an investment show –

Corey McLaughlin: That's what I was just going to say, Dan, too.

[Laughter]

Dan Ferris: Yeah, this is an investment show, and I have to wonder, you've been around, you've been working for years, you probably have a 401(k) somewhere, or your own discretionary account or something. This career of yours, has it helped, hurt, or in between your own personal savings and investment? How has it influenced you that way?

Brody Mullins: I can give you sort of a weird answer because I think it's really helped, but the reason it's helped is because I'm not allowed to own any stocks, and because I don't own any stocks, I'm in sort of broad-based mutual funds, which do really well over time. Yeah, so –

Dan Ferris: That's a great answer. It's hilarious, isn't it? It's like –

Corey McLaughlin: Yeah, no, it's –

Dan Ferris: – the fidelity study where the best-performing investors were the ones who were dead, right?

Brody Mullins: Right. Yeah, but it's true. I'm not allowed to own stocks in particular companies, and that's because at any point I could be writing a story about a company that I own, so I can't own individual stocks, and I can't own industry-specific funds. Therefore, I have these just broad-based ones through Fidelity that do well. There is a big issue in Washington that I covered for a long time, also, which is about insider trading in D.C., and the perception of insider trading in D.C., and there are two elements of that. One is that members of Congress are continually being talked to by lobbyists and meeting with corporate heads, and those corporate heads, or anyone in the company is going to come to a member of Congress and say, "Hey, we're really worried about inflation," or "We're really worried about this," or "Here is a problem we have," or "China is starting this new import that's going to cause…" or whatever.

They're giving members of Congress constantly, essentially, insider information about those companies. Yet, most members of Congress still invest in companies, and many members of Congress are continually trading stocks in those companies. That sometimes seems crazy to me because if that happened in New York, if that happened on Wall Street, you violate rules and you go to jail, but in Washington, it's perfectly fine.

Dan Ferris: That's right.

Corey McLaughlin: Yeah, or your family members, in the case of some people –

Brody Mullins: Right, right.

Corey McLaughlin: – Nvidia stock, famously the Pelosi Nvidia trade.

Brody Mullins: Right.

Corey McLaughlin: I know there is some legislation proposed in Congress about banning Congress from trading. Do you think there is any chance of that happening?

Brody Mullins: The answer is no, and that's because members of Congress are very good at making rules for other people, but they don't like to make rules for themselves. In fact, this is true in the ethics rules, in the ethics handbook that every member of Congress gets at the start of a term that guides their conduct, and tells them what they can and can't do. It says that members should be allowed to own stock in companies, because if they didn't own stock in companies, they would be removed from the interests of their own constituents, as in most constituents own stock – if members of Congress didn't own stock, then they wouldn't know how to deal with their constituents. They wouldn't know what their constituents are going through, which is sort of a crazy logic.

But the rule on Capitol Hill, in Congress, is disclosure. They basically say members of Congress can buy and sell whatever they want, but they have to file an annual report on their stock trading and on their investments, and voters and constituents can look at those forms and say, "Hey, I don't like what Congressman So-and-So is doing," and vote against them, or not. But the rule in Congress is disclosure, disclosure will handle all problems, and I'm not sure if it does, but that's at least their rationale.

Corey McLaughlin: Yeah. I guess to your point, you would need a lobbyist to move forward some type of legislation like that, perhaps.

Brody Mullins: Right.

Brody Mullins: Interestingly, there's another sort of niche industry in D.C. that's made partially of lobbyists but really other sort of analysts in D.C., people who have worked for Wall Street companies and worked for investors and spent all their time trying to figure out, "Is this bill going to pass, or is that bill going to pass, or is this regulation going to pass?" and how those regulations and laws would affect stocks. Again, in New York, there is obviously a ton of market-moving information that floats around, but, in D.C., there are also these big policies. Fed policy, for example, can have a huge impact on the market, but so can tailpipe emission regulations out of the EPA, or a new defense contract going to Lockheed Martin, or is SpaceX going to get the next deal to launch satellites. All those things affect stocks, and it's all market-moving information, and there is a niche industry in D.C. of people trying to figure out what those new policies are going to be so you can trade on them.

Dan Ferris: Brody, I want you to know while you were talking there, I did glance down at my computer, and I just want you to know I decided, "I like this guy," and I bought the book.

Brody Mullins: Thank you.

Dan Ferris: I'm lazy. Corey read it before you got here, and I thought, "Well, I have too many damn books," like behind me is like a fraction of what I –

Corey McLaughlin: Yeah, I've got to catch up to Dan, but yes.

Dan Ferris: Yeah, so –

Brody Mullins: Thank you.

Dan Ferris: Yeah, I had to. It sounds like you've focused on an area that's very important to me, and something I've certainly thought about, and you've confirmed some of my thinking about it, so I want you to teach me all that you can. I think reading the book is probably a great way to do that.

Brody Mullins: Good.

Corey McLaughlin: Yeah, and I think for people, like this is a topic you think about, but you don't really hear or see anything. To your point, the Washington Post isn't even covering this, so it's something that's, I think, so big and influential, just all of these dynamics that you're talking about that we inherently know but don't understand, and have no idea, like it's a huge part of the system. How do we understand it? How do we navigate it as investors or just as people? The more you know about this, I think, the better.

Dan Ferris: Right, and as an investor, I want to take that and I want to flip the idea, like we said, chicken and egg, big government came first, and maybe business is not supposed to work the way it's working here. But, as an investor, it makes me want to read your book, every word of it, and figure out – well, we talked about one way that it affects companies, right? We said, "Well, the big incumbents are in Washington lobbying to maintain an advantage over their competitors, over new entrants, especially," we said. It makes me wonder what other ways, like what companies are the really good lobbyers? Are they good companies, or are they just good lobbyers? You know what I'm saying?

Brody Mullins: Well, I think, unfortunately, companies realize now in order to be successful in the marketplace, you need to have lobbyists in Washington, and that shouldn't be part of good business, but it is. One of the things we write about in our book is the rise of Google and Google's lobbying operation in D.C., and Google came after Microsoft. Microsoft, when it was run by Bill Gates, famously wanted nothing to do with Washington – they were the smartest people in the world, they're running their company and doing great, and they wanted Washington to stay away. That worked for a long time until a bunch of lawyers at the Justice Department decided Microsoft was an illegal monopoly, and sued Microsoft, hauled them into court in D.C.

Microsoft eventually prevailed after a decade, but people say the reason that Google exists right now could be that Microsoft was spending so much time distracted, focusing on its defeating antitrust regulators in D.C., that they let their eye off the ball, and all of a sudden, Google pops up. Google is Google, and Bing is Bing. I mean, Bing could have been Google if you're [inaudible].

Dan Ferris: Sure. Yeah.

Brody Mullins: The interesting lesson here is that when Google got founded, Google realized, "We're not going to be Microsoft. We're going to keep our eye on Washington. We're going to hire lobbyists. We're going to make relationships with members of Congress and keep people at the Justice Department and at the Federal Trade Commission." In 2010 or 2011, when the Federal Trade Commission did in fact file, or did in fact pursue an antitrust lawsuit or investigation saying that Google was a monopoly, Google was able to defeat that at the agency level before the FTC could file an antitrust lawsuit against them. The point is that Microsoft ignored Washington and lost, Google paid attention to Washington and won. To your question, having a wired set of lobbyists in Washington is good for business.

Dan Ferris: Period, yeah.

Corey McLaughlin: Yeah. You know what else I'm thinking now –

[Crosstalk]

Dan Ferris: – very simple, aren't they?

Corey McLaughlin: You know what else I'm thinking, off that point, Dan, I don't know if you agree with it, to me, I'm hearing the value of companies that aren't involved in this at all at this point, like aren't on Congress' radar for regulations, are able to grow without getting into all of this, from an investment level if you're looking at companies. Before you get to the point of a Google or a Microsoft, you're in the crosshairs for whatever reasons, mostly probably because they're posting things that some congressman doesn't like, or isn't helping them get reelected, I guess. If you can be involved in the smaller companies – this is bullish for smaller companies. This is part of a bullish case for smaller caps, and whatnot.

Dan Ferris: Right, so you want to find, like Brody said, Microsoft didn't want anything to do with Washington, they were doing great, making money hand over fist, you want to find that company today, right? But I also noticed another thing. Basically, when the government really goes after somebody, like the way they went after Microsoft, the way they went after the tobacco industry, slightly different – not antitrust, per se – but there was concentration there, and when the government goes after them, you know it's an incredible business. You know it's a –

[Crosstalk]

Brody Mullins: Yeah, all so true.

Dan Ferris: – right? It might go both ways. We want to know who the government is going after because they're making money hand-over-fist, and we also want to know who is in that sort of Microsoft pre-government involvement stage? These are –

[Crosstalk]

Corey McLaughlin: Right, and how long have people been talking about Amazon as a monopoly, potentially, so that's not new. They're still doing fine.

Dan Ferris: OK. Brody, we have reached the moment when we ask our final question. Our final question is the identical question for every guest, no matter what the topic, even if it's nonfinancial. If you have already said your answer to the final question, by all means just feel free to repeat it, there is no problem there. If you need to take a minute, because I'm springing this on you and you don't know what it is, just take your time and we can edit if you just need to sit there and think for a minute. It's perfectly fine. The final question is simply this: If you could please leave our listeners with a single thought, a single idea today, what would it be?

Brody Mullins: I think the single thought is sort of one of the premises of our book, which is that if you're sitting around the country and you're a Republican, you think everything wrong in Washington is because of the Democrats. If you're a Democrat, you blame it on Republicans. What we're saying is that it's not Republicans or Democrats, it's both, and it's being driven by corporate America in the interests of the lobbyists that they want. Lobbyists in Washington, the big corporate lobbyists don't care whether Republicans are in power, or Democrats are in power. They want to be friends with both of them. They give campaign money to both of them. They support the election of both of them because they have friends in both parties, so that they win no matter who wins. Looking at this election, you would think, "Oh, companies want Republicans to win." Companies really don't care. They just want to be with a winner, and, for the last 50 years, they have been.

Dan Ferris: All right. Great answer. Brody, thanks for being here. I'm really looking forward to –

Brody Mullins: Awesome.

Dan Ferris: – reading your book. I just picked it up off Amazon. It will be here in a few days, and I'm going to dive right in.

Brody Mullins: Thank you so much.

Corey McLaughlin: Thanks.

Dan Ferris: OK. I didn't know where we were going to go, and I thought that turned out great. I really enjoyed talking with him, and he knows a lot about this topic. He was great.

Corey McLaughlin: Agreed. Loved it. I was excited to talk to him just because it's a topic that I'm personally interested in, and I think other people are interested in, as well, but you don't hear a lot about it, mostly because there are very few like him doing the actual work of writing about it and reporting it, and interested in it. It's a case for journalism, I would say, on one hand, or free press, and all of those things, all those very important things. Then, on the other hand, there is all of the subject matter about lobbying, lobbyists, how it came to be, how it developed, why, how it works, what it all means. It's definitely worth [inaudible] book, and there are –

Dan Ferris: It is.

Corey McLaughlin: – interesting characters in there, too, like from, as you can imagine, the actual people doing this work.

Dan Ferris: Oh yeah, the characters. Yeah.

Corey McLaughlin: You've got to be a special kind of person to do that.

Dan Ferris: Right. I meant to compliment him, actually, on this thing that he has done with his career, seizing the low-hanging fruit of the intersection of big government and big business at the lobbying level there. It's cool because, as he mentioned, nobody is covering it, so you would think there would be more guys like him around who are interested in covering it in great detail, but there aren't, and he's doing it. Whenever I see someone like that, I'm very impressed. I'm impressed with him just as a journalist, and having made the choices that he's made in his career.

Corey McLaughlin: Yeah, and I can tell you, I was full-time journalism, straight up at one point, and a lot of friends in the industry. To his point about the fact that he's a modern journalist, you would think he's driven by 24/7 news cycle, but the fact that a lot of this isn't covered at all allows him to get into a meaty topic like this and produce a book of this caliber, where it's actual quality and actual informative journalism with great narrative in it, and whatnot.

Dan Ferris: Without having to be part of that 24-hour grind that –

[Crosstalk]

Corey McLaughlin: Without having to tweet or write a quick web story on whatever some doofus tweeted or something.

Dan Ferris: Yeah, it's a great choice. Yeah. All right. Have you read the whole book?

Corey McLaughlin: No, just parts of it, and some reviews about it.

Dan Ferris: Yeah, I just dipped in a very little bit, but I want to read the whole thing because I'm becoming – we write about macro trends in The Ferris Report, and war and government and law, and all that stuff is part of the deal there. I'm going to start reading this book, and by the time I get to the end, I'm going to have a new stock pick. I can smell it, so we'll –

Corey McLaughlin: Yeah, I'm sure you will.

Dan Ferris: – see if I'm right.

Corey McLaughlin: You'll figure that out. Yeah.

Dan Ferris: Yeah. Great talk, smart guy, I'm really looking forward to the book, and wow, this is why this job is a lot of fun. That's another interview, and that's another episode of the Stansberry Investor Hour. I hope you enjoyed it as much as we really, truly do. We do provide a transcript for every episode. Just go to www.investorhour.com, click on the episode you want, scroll all the way down, click on the word "Transcript" and enjoy. If you liked this episode and know anybody else who might like it, tell them to check it out on their podcast app or at InvestorHour.com, please. Also, do me a favor and subscribe to the show on iTunes, Google Play, or wherever you listen to podcasts, and while you're there, help us grow with a rate and a review.

Follow us on Facebook and Instagram. Our handle is @investorhour. On Twitter, our handle is @investor_hour. Have a guest you want us to interview? Drop us a note at feedback@investorhour.com, or call our Listener Feedback Line, 800-381-2357. Tell us what's on your mind and hear your voice on the show. For my cohost, Corey McLaughlin, until next week, I'm Dan Ferris, and thanks for listening.

Announcer: Thank you for listening to this episode of the Stansberry Investor Hour. To access today's notes and receive notice of upcoming episodes, go to InvestorHour.com and enter your e-mail. Have a question for Dan? Send him an e-mail, feedback@investorhour.com. This broadcast is for entertainment purposes only, and should not be considered personalized investment advice. Trading stocks and all other financial instruments involves risks. You should not make any investment decision based solely on what you hear. Stansberry Investor Hour is produced by Stansberry Research and is copyrighted by the Stansberry Radio Network. Opinions expressed on this program are solely those of the contributor and do not necessarily reflect the opinions of Stansberry Research, its parent company, or affiliates. You should not treat any opinion expressed on this program as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion.

Neither Stansberry Research, nor its parent company or affiliates, warrant the completeness or accuracy of the information expressed on this program, and it should not be relied upon as such. Stansberry Research, its affiliates, and subsidiaries are not under any obligation to update or correct any information provided on the program. The statements and opinions expressed on this program are subject to change without notice. No part of the contributors' conversations from Stansberry Research is related to the specific opinions they express. Bad performance is not indicative of future results. Stansberry Research does not guarantee any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment discussed on this program. Strategies or investments discussed may fluctuate in price or value. Investors may get back less than invested.

Investments or strategies mentioned on this program may no be suitable for you. This material does not take into account your particular investment objectives, financial situation, or needs, and is not intended as a recommendation that is appropriate for you. You must make an independent decision regarding investments or strategies mentioned on this program. Before acting on information on the program, you should consider whether it is suitable for your particular circumstances, and strongly consider seeking advice from your own financial or investment advisor.

[End of Audio]