In This Episode

On this week's Stansberry Investor Hour, Dan and Corey welcome Charlene Chu to the show. Charlene is the China and India macrofinancial senior analyst at the independent global research firm Autonomous Research. Dubbed the "rock star" of Chinese debt analysis, she joins the podcast to talk all about China and India's current economic happenings.

Charlene kicks off the show by explaining her macroeconomic background and experience studying China's economy. She discusses whether China is still worth investing in, which specific area of the Chinese market looks most promising, and what's going on right now in China's property sector. Charlene also goes in depth on President Donald Trump's tariffs that will impact China and what the administration is potentially hoping to gain in negotiations...

One of the things the Trump administration has been saying is, "We actually signed a trade deal in 2020, and you did not live up to the commitments." And the commitments were increasing purchases of U.S. goods... Most likely that would be agriculture and energy... They may be looking for Chinese investment in U.S. companies as an option as well.

Next, Charlene explores India's weaknesses versus China in becoming a global manufacturing hub – this includes its bureaucracy, onerous labor laws, and lack of infrastructure. She says that India is currently where China was in the 1990s, and the country will require much more development and investment to catch up. Charlene then talks about the good and bad economic effects of China's communist government, China's looming debt crisis, and how the average Chinese consumer differs from an American one...

One of the things I learned from being in China is they are really on top of their investments in a way that I have not seen anyone in the U.S. [be] unless they're in the financial sector. People were looking at their portfolios on a daily basis... They're shifting their money around all the time.

Finally, Charlene examines China's demographics and explains why she believes the country's population will fall 60% to 70% by the year 2100. However, despite birth rates dropping, AI and technology may be able to make up for the declining number of humans in manufacturing roles and fill those gaps for several decades. And Charlene closes the conversation by urging U.S. investors not to worry too much about the Trump tariffs just yet...

I do believe the Trump administration is trying to address some longstanding imbalances here with the Chinese economy. And I do think a lot of the measures they're rolling out – even though they're going to hit the allies very harshly – they're really ultimately directed at China... There is a method in the madness.

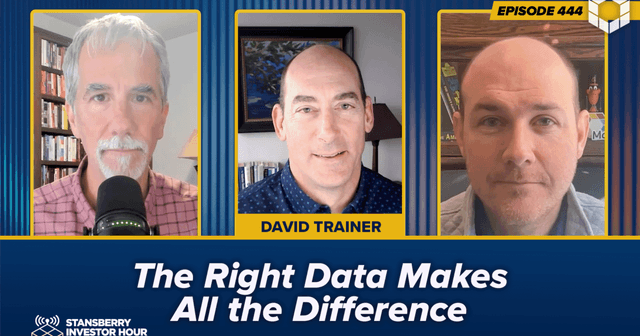

Click here or on the image below to watch the video interview with Charlene right now. For the full audio episode, click here.

(Additional past episodes are located here.)

The transcript is coming soon.

This Week's Guest

Charlene Chu is the China and India macrofinancial senior analyst at Autonomous Research. Before joining Autonomous in 2014, she worked for eight years as a senior director in the Financial Institutions Group at Fitch Ratings in Beijing, where she oversaw the credit ratings of Chinese financial institutions. Prior to that, Charlene served as a senior analyst in the Emerging Markets & International Affairs Group at the Federal Reserve Bank of New York, where she focused on financial sector reform and monetary-policy development in China and other Asian countries.

Charlene holds both a Master of Business Administration and a Master of Arts in international relations from Yale University. She is also an elected member of the U.S. Conference of Business Economists.

Dan Ferris: Hello and welcome to the Stansberry Investor Hour. I'm Dan Ferris. I'm the editor of Extreme Value and The Ferris Report, both published by Stansberry Research.

Corey McLaughlin: And I'm Corey McLaughlin, editor of the Stansberry Daily Digest. Today we talk with Charlene Chu of Autonomous Research.

Dan Ferris: We're going to talk about China a whole lot and India a little bit. It's very interesting. Take notes. It's a complicated discussion. There's a lot of moving parts to it. And so, let's do it. Let's get to it right now. Let's talk with Charlene Chu. Let's do it right now.

Corey McLaughlin: For the last 25 years, Dan Ferris has predicted nearly every financial and political crisis in America, including the collapse of Lehman Brothers in 2008 and the peak of the Nasdaq in 2021. Now he has a new major announcement about a crisis that could soon threaten the U.S. economy and consume bankrupt millions of citizens. As he puts it, there is something happening in this country, something much bigger than you may yet realize, and millions are about to be blindsided unless they take the right steps now.

Find out what's coming and how to protect your portfolio by going to www.americandarkday.com and sign up for this free report. The last time the U.S. economy looked like this, stocks didn't move for 16 years, and many investors lost 80% of their wealth. Learn the steps you can take right away to protect and potentially grow your holdings many times over at www.americandarkday.com.

Dan Ferris: Charlene, welcome to the show. It's good to see you.

Charlene Chu: Thank you. Thank you for having me.

Dan Ferris: You're a new guest to our audience, so I think it's probably best for us to just sort of – maybe you could give us the quick background story and how you got to where you are today.

Charlene Chu: OK. I work for a small equity sell side research firm called Autonomous Research. Even though we're very equity focused we're not that way when it comes to China. We tend to focus much more on top-down research, and we're known for our deep dives and very thorough investigations into what's happening and very data-driven work. I’ve been here for 10 years. I opened our office in Hong Kong in 2014. Before that I was living in Beijing for eight years and I headed financial institution ratings. So, Chinese financial institution ratings, [inaudible] ratings in Beijing. And then before that I was at the Federal Reserve in New York and the emerging markets group covering greater China and India and South Korea.

Dan Ferris: So, that's a macro-ish background.

Charlene Chu: It is, yes.

Dan Ferris: Which is cool right now in the world. It's cool to be macro. Of course, we wanted to have you on the show because in, in researching you, I found out that the Wall Street Journal called you the "rock star of Chinese debt analysis" back in 2013.

Charlene Chu: Yes.

Dan Ferris: We've got to have a rock star on the show.

Corey McLaughlin: And that was Edward Chancellor, right? If I'm correct.

Charlene Chu: It was. Yes. I think it was. Yes. It's been so long now.

Corey McLaughlin: It's a great book that Price of Time book, Dan, by the way.

Dan Ferris: Yeah. It's a fraught moment right now, right? Every day it seems there's a new headline and it may or may not apply to China. I think we're still in, we've put a 10% tariff on China. I think that was the last big one I heard about China. But you never know because it's a new, every day is a new day. So, who knows what we're going to hear about China or Taiwan or anything? To me, I'm not a diehard sort of China focused macro guy, so I don't know. Does the Trump administration make your life extremely difficult as a China analyst?

Charlene Chu: Absolutely. No question about that. We're only, I think, on Week 5 here and it has been a very big adjustment. I wouldn't say that I have completely adjusted yet. Trade is definitely front and center. There's no question about that. And I think 10% tariffs that were put on China a month ago or not a month ago, I guess maybe a month ago at this point were related to fentanyl trafficking and China's involvement with that. So, that is a very specific type of tariff. I do think we're going to be getting a big announcement on China tariffs here as soon as April 2.

If you looked at the press conference yesterday with the cabinet meeting President Trump and Secretary Lutnick suggested that there's going to be a very big announcement on reciprocal tariffs for a number of countries on April 2, and I would think that China will feature very significantly in that. There was an "America first" trade policy memorandum that went out on Day 1, and there were a lot of sections relating to China on that, and investigations that are supposed to be wrapped up by April 1 and then remedies proposed. So, our assumption is things have been pretty quiet so far, relative to how afraid everyone was in terms of what was going to happen on Day 1 in terms of tariffs on China.

It's been relatively quiet, but I think we are going to get something big in April. And then I would just also note that the administration has come out with proposed fees on Chinese ships that stop at U.S. ports. They also got rid of the de minimis rule for small packages, which impacts China significantly. The steel and aluminum tariffs and potentially the tariffs on autos and pharma and other areas will also impact China.

So, if there is actually more that's been happening that will impact China than people realize, but I do still feel like April is going to be where the big announcement comes. And then the big, then the negotiations will really start. That is when the Chinese will know what is the U.S. looking at in terms of tariff levels, and then they'll know exactly what they're willing to offer in terms of trying to get a deal.

Dan Ferris: All right. Even with all the uncertainty that's going on, I still have seen some contrarian sort of buy China takes here and there. Where are you? Is China investable at all? Maybe we should just start with that.

Charlene Chu: So, we do have this conversation a lot with clients, and my view is when I talk to people who have a global portfolio and can invest anywhere, that to me is a pretty straightforward answer in terms of the risk that you are taking on by being exposed to China in many cases are just not worth it. And I think it is better to be focusing on other markets where there's more predictability and you don't have the same volatility and the geopolitical risks. However, we do have a lot of clients whose sole remit is I am supposed to deploy this money into China, and you can't really say this is not investable because –

Dan Ferris: Yeah, doing your job.

Charlene Chu: Exactly. So then, it becomes a more granular conversation of, well, how strong is the economy right now? What sectors are doing well? Do we need to be worried about the banking system and a debt crisis at some point? What's going on with the meltdown in the property sector, right?

Dan Ferris: Regardless of Trump, right? Regardless of trade issues.

Charlene Chu: Oh yeah, absolutely. Absolutely.

Dan Ferris: Now that you've broached this, I'm dying to know what you tell them is maybe not so bad. What's like the, I don't know, would this be the best worst thing or the worst best thing? What would be the least Loaded with risk China bet that you could ever tell a client to take?

Charlene Chu: I think the market has this right now where the focus is really the big Chinese Internet platform. So, Tencent, Alibaba, JD, they are the most dynamic part of the economy, the most innovative, the most plugged into AI, the most plugged into the consumer and not as reliant on borrowing and government projects and government support and that type of thing. To a degree, they're insulated, but, until recently, those stocks have been very volatile and not done particularly well over the last three years because in the background from three years of zero-COVID and a meltdown in the property crisis and deteriorating demographics, we actually have a very weak consumer in China.

And if you are an internet platform selling a bunch of things to consumers it hasn't been great for you. And so, there's been a real big correction in those share prices versus where they were a few years ago. But there's been a rally recently after the big deep seek announcement and people starting to realize that, wait a minute, China may have more innovation going on here in the IT sector than we realized.

Dan Ferris: When I heard deep seek, and I think the figure was on AI training, the training of the AI model was something like 5.2 million, when I heard that I immediately wondered, are we off by a zero or a million? Do you have a thought about that?

Charlene Chu: So, I'm definitely not by any means an expert in AI, but the people I've spoken to about this believe that figure relates to one stage of the process of the build out of the model. And if you were to really add up all of the costs, you are looking at multiples higher than that, but still lower than what it is costing some of the models here in the U.S. So, there's still a big price advantage.

Dan Ferris: Still not tens of billions.

Charlene Chu: But it's not necessarily as stark.

Dan Ferris: Yeah, that makes a lot of sense, doesn't it? Just because they always seem to find a way to do everything super dirt cheap over in China. So, the basic advice is avoid if you can and if not, stick to the real businesses that are making money and not dependent on government financing. How bad is –

Corey McLaughlin: Has the property sector trouble there slowed down or what does that look like right now?

Dan Ferris: I was going to say, how bad is it in this?

Charlene Chu: So, we are entering our fourth year of the correction here. Things have started to get a little bit better the last few months because the authorities came out in September and October last year with various announcements of stimulus packages and measures aimed at what they called stopping the decline in the sector, but it is not rebounding by any means. So, it's basically going from deeply negative contractions each month to either slightly negative or slightly positive. But most of the people we talked to on the ground are very skeptical that there’s staying power to this because they feel like what is happening in the background here is we have a weak Chinese economy.

There's job insecurity. There's wage insecurity. And certainly, if we get into a severe tariff situation with the U.S., all of that is going to create issues with confidence, which is keeping people on the sidelines in addition to a significant decline in property prices. Because of that, I think we're in this little sweet spot here where there's been a positive response to last fall's measures. I don't know if that will really last for the full year. And then, we do need to see what happens with trade and what the spillover is there because a lot of what the Trump administration is doing even when it looks like it is directed at other countries it is actually indirectly targeted at China, and they are going to be impacted significantly by all of this trade stuff.

Dan Ferris: Do you have an example of that, Charlene? The indirect, like, how do you get the – ?

Charlene Chu: So, the steel aluminum tariffs, and they've proposed them also on autos, pharma, semiconductors, I think lumber and copper as well, but that group is less formulated. So right now, in terms of where we've really had executive orders going out it’s on steel and aluminum. China is the largest exporter in the world and the U.S. is the largest importer in the world. And if you read the executive orders on this, they're basically saying we tried to put tariffs in, in 2018 to deal with these problems and we gave a bunch of countries who were Allies exclusions. But what happened was China rerouted a lot of the exports to other countries and then that wound up back in the U.S. and we actually are producing less steel and less aluminum today than we were back then, and that is the exact opposite outcome we wanted.

So, we are going for 25% tariffs for everyone around the world on these goods, which comes across as extremely harsh, and if you look at who is most exposed, oftentimes it's Canada and Mexico are our biggest sources of imports of some of these goods and their allies, clearly. But the U.S. administration is trying to address this issue of what do we do about a country when they are overproducing so much relative to what the domestic economy can absorb, dumping it in global markets, and then it winds up here at very low prices and undercutting our manufacturers?

So, this is a really blunt approach they're taking. But I can, at the same time, understand why they're doing this. And I do think it's going to be interesting to see, will they open the door to Allies being able to get some exclusions or some sort of relief here? Or are they really going to hold the line on this? And that remains to be seen. But I think the deadline for those to go into effect is March 12. So, we're pretty close to that.

Dan Ferris: Do you have an expectation of that outcome or you're just waiting?

Charlene Chu: I don't, to be honest. Things happen, things swing significantly these days in a very rapid fashion.

Corey McLaughlin: What do you think is up for negotiation between the U.S. and China, a month or two months down the road? I know that fentanyl is the justification for the beginning of it, but what is the U.S. trying to get out of it specifically? What could China concede presumably?

Charlene Chu: So, the first thing I would say, if we go back to, because we went through a tariff war with China in 2018, '19, and then we got a deal actually in early 2020, right before the pandemic. And one of the things the Trump administration has been saying is we actually signed a trade deal in 2020, and you did not live up to the commitments and the commitments were increasing purchases of U.S. goods. So, I do think that would be one big element of negotiation where the U.S. would be looking for China to increase its purchases of U.S. goods. Most likely, that would be agriculture and energy. So, [liquefied natural gas (LNG)] and oil and gas because I think that it's complicated given all the restrictions we now have on some of the IT exports.

So, that will be one element. They may be open, and if you listen to the press conference yesterday, President Trump did signal that we are open to Chinese investment in different sectors here, but I think there are certain areas where there's national security sensitivities, but they may be looking for Chinese investment in U.S. companies here as an option as well. And then there are things like the deal with TikTok, obviously Taiwan is a big issue in the relationship that they would be talking about as well. So, there are a host of things that I think could be under discussion.

Dan Ferris: It makes me wonder, Charlene what your day is like now, these last five weeks. What is your day like? Does your compass work? Do you know what direction you're going in?

Charlene Chu: It was always overwhelming to read all of the news on China on a daily basis because it's overwhelming relative to every other market around the world. But this has just ratcheted it up to a whole other level. I do believe that we are in the middle of the Trump administration really trying to create a shift in the global trade order.

None of us know how significant that is going to be, what the fallout is going to be, what things are going to look like two or five years from now. But I spend a lot of time trying to think about all that. And the first thing is just to pull all the numbers and try to understand where the exposures are.

Dan Ferris: I see. Are you exclusively China focused as an analyst at Autonomous?

Charlene Chu: We've done some work on India on the macro side as well and we are going to be launching a global tariff handbook here as we go through this whole process, and there's going to be some work there on the U.S. economy as well because I do think it's important for us to be tracking what is happening in the U.S. economy because between the tariff stuff, as well as what is happening in terms of budget cuts and shifts in the bureaucracy here, there's real potential for slow down here. And I think that will potentially act as a break in terms of the extent to which the administration could push really hard and aggressively on some of these issues. So, I do think for anybody to understand where the trade thing is going to be going we need to know where is the U.S. economy going.

Dan Ferris: China versus India has been an interesting question to me for the last I don't know 15 or so years. It's been about that long since I've been to India, but if you told me this one country they're going to be less top down, less centralized in their approach, and then this other country is going to be really, really top down and really almost dictatorial in their approach to their markets, I would have guessed that India would have thrived, and China would have struggled. And now we have this guy in place who says, "I'm going to be the leader of this country for the rest of my life, essentially."

Whoever would have guessed this? I wouldn't, but here we are, and China's economy is massively larger. I obviously I had it wrong over the years, but what does India look like to you? The knock on it has been partially that it's highly bureaucratic and that there was a lot of corruption at many levels of government. What do you, just overall, can you characterize, do you think India has China potential or what do you, how do you look at it?

Charlene Chu: So, I think on paper, and particularly when there was this initial push by multinationals that we need to shift supply chains away from China, some of the destinations like Vietnam or Malaysia are simply too small to really absorb the operations that would need to shift en masse to these locales. And that's really why people were looking at India and saying, look, population-wise, demographic, wage, costs, all of this makes sense. But the reality is what you said, which is it is incredibly bureaucratic. It takes a long time to get things done. The labor laws are very onerous, and the workforce is just not used to working in manufacturing in the degree that the Chinese workforce is.

And then layer on top of that much, much poorer infrastructure in the country. That has been a really big issue for multinationals operating in China because they believe that China has an unparalleled logistics network. You can get anything from anywhere. You can source any input for your good from within China. It is very easy to transit all types of things, and they've really built out the deep water ports and everything. So, that is lacking in India and that I think has been a big impediment as well. I think more broadly the big issues that we have in India are that there's still a very large portion of the population that is agricultural. We just have not gotten to the point where we've moved a lot of those people out of that lifestyle and out of those types of jobs.

And then on top of that, we need to keep in mind that there's in terms of female labor force participation it is still very low in India relative to the rest of the world. You're actually talking about a large country, but a significant portion of half of that population is actually not involved in working at all. So, this is where you start to get into the low-income type of trap that they've been in. What I would note is, economic-wise, yes, there's no doubt that China has surpassed every other emerging country in terms of the ability to develop so rapidly and grow so rapidly.

But if you look at the investment returns, they've actually been better in India for an investor than they have, an equity investor than they have been in China because there's so many issues with depressed profitability in China because of overcapacity and these types of things. And you don't have the free market really providing the same discipline that you do in other countries.

Dan Ferris: I had a perception years ago of an enormous amount of, call it frozen capital in lots of little parcels of land and lots of personal gold holdings. Am I right about that in your opinion?

Charlene Chu: You’re talking about India or you're talking about China?

Dan Ferris: India. I mean you ride up and down the highways and you see all these rows of white stones, and it's folks in the city have their little plot of land out in the country. But you said yes, that is basically right?

Charlene Chu: I think there's definitely a degree of truth to that. Yeah. India is still very much where I would say China was in the 1990s. And what changed in China is the U.S. in particular, but the global economy welcoming China into the [World Trade Organization ("WTO")] and basically saying we are willing to help you develop by moving some of our manufacturing operations to China, which just set off this massive export boom and got us to where we are today, but of course has led to a lot of negative blowback. India's economy looks very similar to where China was before all of that, but we don't necessarily have a force like WTO entry that can propel India forward as rapidly as we saw with China, and that's where I think this is just going to be a longer story to unfold, but a healthier one.

The domestic economy, the domestic demand, the consumer dominates in India in the same way it does in the U.S. In China, by contrast, it's all about fixed asset investment by companies and local governments who require an inordinate amount of debt to do all of that. And then you wind up with all of these big debt problems. The dynamic I still think is healthier overall in India from that perspective.

Dan Ferris: Well, Charlotte, I want you to know I'm happy for you that you're able to focus on India somewhat because I can't imagine what it's like to come to work and spend all your time in a country that is uninvestable unless you absolutely have a mandate or something. That's gotta be a little tough on you, isn't it?

Charlene Chu: Oh, it definitely has been. I mean that, there was a time if we go back five and certainly 10 years ago when everybody wanted to talk about China all the time. And now it's just less and less interest and people now seeing it more as a risk and what can go wrong, which is actually what we specialize in what can go wrong. We're still in demand in terms of having those conversations, but it is a very different environment.

Dan Ferris: OK. So, I want to go back to my earlier mistake in assessing India versus China. And how much of a concern is it really? Well, let me say, I heard an anecdote once that not too long ago from an investor who, I'll leave his name and the firm's name out of it, but they know China very well, huge firm, known China for years. And he said, "Well, I was talking with somebody like the finance minister in China" and he was expressing real concern. He was like, "We hear these stories about I'm sorry, Mr. Minister, people disappearing in the night and all kinds of things like that you hear about a place like China."

And the finance minister said, "Oh, that's not my department." So, the assessment from the analyst telling the story was, it's very sort of Soviet and very blocked off and he just said, "Well, that's not my department. I really can't comment on that." So, my ultimate question is, how concerned should I be about the longer-term future with a guy like Xi who's just going to stay in power as long as he can? Does that bother you as well?

Charlene Chu: The longer-term future in terms of where he is taking the country politically?

Dan Ferris: Right, and its effect on their ability to well, frankly, fix their debt problem among other things. So, as an investor, I look at this and I think, hmm, does that really worry me? Because the nature of the top down really, it's a communist government. The government should have, I thought it was going to keep me away from China. And I thought, "Oh, India will probably be a better bet or something." But, as you can see, I'm struggling to, to figure this out because the economy has done better under this extreme top-down regime than I ever would have thought. You know at some point eventually is my broken clock going to be right or should I just not worry about that so much?

Charlene Chu: I do think we absolutely need to be focused on where is this country going politically and to be honest, I think a key reason why we have this depressed consumption situation in China is because of people's concerns on the ground about where the country is going under the current set of policies that they've got. If you look at the index of consumer confidence, it is as low today as it was during the Shanghai lockdown in the spring of 2022, which is really stunning when you see that. So, there's clearly a confidence problem here. I think that's the clearest manifestation of it in that particular indicator, but it ultimately does drive how people behave on the ground, and it is driving some of the earnings reports of the tech platforms and other companies in China.

So, it’s definitely something to keep in mind. Now, all of that said, I think, top down and I've been looking at China for almost 25 years now, and I do believe that the top-down control that they have has played a role in maintaining stability through some really big imbalances. I think we would have had a financial crisis in China if the debt numbers were what they were in any other country around the world, but that has not happened in China because they control the behavior of lenders, and they control the behavior of borrowers and they control the behavior of people operating in the market. And so, they're able to keep things from melting down in the way they did in 2008 during the global financial crisis, but the downside of that is it allows the bad problem to just grow even bigger and not get flushed out.

So, it does create an environment of stability, but you still wind up with an issue with big challenges not really fully getting addressed and property is a good example, until you have a massive meltdown, and then the debt is another one. And I know that debt issue, you do not read as much about it today as you did in the past, but it is very much alive. The banks have not begun to record the bad debt associated with all of these property problems. And that's one of the big question marks for the next few years is how is that whole process going to work itself out?

Dan Ferris: I actually, I have a book somewhere on my shelf. I think it's called Asian Financial Statements, and the author's main point was they're so bad that we need to write a whole book about it and show you all the ways it can go wrong and all the things that aren't there that should be. When you talk about banks haven't even begun to reflect the debt destruction on their balance sheets, it makes me wonder, well, will they ever? How do we ever know? Have we gotten signals that maybe we are aware of our accounting problem, and we need to up the standards to match the rest of the world? Do you have a view on that on the relative state of Chinese accounting standards right now versus the rest of the world?

Charlene Chu: So, they publish financial statements that are quite comprehensive and detailed and yet don't necessarily reflect reality. It can be difficult to square that circle, but what is effectively happening is it's extend and pretend when it comes to the debt and the banking system. So, they're rolling over all of the loans and not calling them nonperforming. And one of the things the authorities did last fall in those stimulus press conferences, was they allowed for about 40% of the loan book to be rolled over through the end of 2027 without reclassifying any of the stuff as nonperforming if it is non-performing. So that opens the door for this to go on for another few years.

So, it's very unlikely that we would suddenly have banks reporting all of this bad debt before 2027. But in the meantime, that the portfolios are deteriorating in the background, and your question is a very valid one. What happens in 2027? Do they just say, "We'll do this until 2030?" What tends to happen in other countries around the world is the market at some point loses confidence in the banking system and they start selling the shares and so, the equity prices are coming down or the bonds are being sold off and you start to get market volatility and then the authorities actually have to do something about the problem to restore confidence. And that's when they need to fess up to what's going on.

I don't know if or when that will happen in China, given, the strong influence that the authorities have over the markets, but we have increased our analysis of the banking system recently, and one of the things that's very clear to us is the earnings of these companies are really starting to hollow out even though they're not reporting that much bad debt at all. So, there is a real risk in the next couple of years that the market is going to wake up to the weaknesses here, and we could potentially have the markets forcing some sort of issue, but until then, it stays pretty quiet.

And to be honest, the bank stocks have been among the most, the best sectors the last few years because the Chinese people view that as a substitute for investment in government bonds with a higher dividend yield. So, despite all these problems nonintuitively that has actually been a very good performing sector, an example of how difficult it is when it comes to investing in China on fundamentals.

Dan Ferris: Wow, yeah, and it makes me wonder. Do you take that 40% then and you have to model it somehow, right? You have to say, well, maybe it's deteriorating at X rate per year or due to certain milestones or events or whatever. You have to have some kind of way of assessing that, don’t you?

Charlene Chu: Yes, we've certainly looked at it and the banks do report two sets of asset quality data, and the market focuses on the first one. And we've been telling people that real signals are in the second set of data, which is showing some deterioration. But then, of course, you're right. You need to think about all the pressures going on in the broader economy and the property sector and what would be a more realistic loss rate here that the banks may be incurring which, we're trying to do that in the background, definitely, and trying to stay on top of this.

Dan Ferris: So, Charlene, there's a popular statistic about the Chinese people that they have something like three-quarters of their savings in property. Is that, was that ever true? Is it still true? And what if they never sell? It's an odd state of affairs it seems.

Charlene Chu: It is. Depends on what data you use, but roughly speaking, you're talking about 60% to 75% of household wealth is tied up in property and property prices by the official data are down anywhere from upper single digits to around 15%, but in reality on the ground, we tell people you need to multiply those official figures by two to three times, depending on where you're at. So, there have been some severe declines in property prices.

And if that was your nest egg for retirement that is now down by a third, let's say and you've got to make that up. And the only way to make it up is by saving more in this environment. And this is a key reason why the consumer is so weak on top of other issues that we have. But yes, it is true. It's one reason why the property crisis has had such a severe impact on consumption.

Dan Ferris: Yeah, talking about counterintuitive, your property's down between whatever, 30%, 40%, whatever it is, and you're buying bank stocks because you think it's safe as government bonds. It's just, that's a head scratcher, isn't it?

Charlene Chu: It is a head scratcher. One of the things I learned from being in China is they are really on top of their investments in a way that I have not seen anyone in the U.S. is really like that unless they're in the financial sector. People were looking at their portfolios on a daily basis. They're thinking about, well, this bank is only offering me a 1.5% deposit rate, but that one is offering 2.8 and they're shifting their money around all the time. So, what they're looking at right now is basically higher dividend yield at banks relative to the deposit rate and saying why don't I just buy these bank stocks?

So, I can understand that, and I feel like it's a core part of the economy and the government will never allow a crisis, but I don't think they know the stuff that we know in terms of how imbalanced everything is and how this was a $9 trillion U.S. dollar banking system in 2008 and it's a $60 trillion U.S. dollar banking system today just 16 years later. The world's never seen that kind of growth. That type of stuff they don't really know about.

Dan Ferris: Yeah, it sounds almost if you had stopped in your discussion there at the moving money around, searching for yields, I would say that sounds like yield chasing behavior, which tends to, can work out not so well. And yet you characterize them as just really – it sounds like they're focused more on return though than risk, I would think. Just that behavior that you described and the fact that the property, they know the property is not worth what it is, but they're still chasing those yields and bank stocks, my American mind sees a disconnect there. I guess I'm just going to have to accept it.

Charlene Chu: I think it comes down to the fact that the largest banks in the country are state owned. So, they view them as an extension of the government as opposed to a JPMorgan or a Bank of America to us. To them, it's a quasi-government investment, actually buying a Chinese state bank share.

Dan Ferris: OK. That certainly makes a lot more sense.

Corey McLaughlin: I want to ask you about another thing from that you may be hearing from people on the ground there. And you mentioned briefly demographics, right? And this other number, the youth unemployment rate that was reported. I can't remember when it stopped being reported, but I remember when it was very high was what I remember. What's the state of the demographics as you see it now and projecting it out? What are we talking about there in terms, I've seen various numbers on the population decrease projections and that sort of things, so I'm wondering just your take on the demographics in general.

Charlene Chu: This is a huge challenge. I think the population is going to decline by 60% to 70% by 2100. This is a massive decline. I don't think the world has ever seen this at least in recorded history where we're having what was the most populous country facing a contraction of that magnitude. The way we get to that number is basically, it's a very simple way of approaching it, the people who are going to be here in 2100 is all the people who are going to be born between now and then. Most of us on average, we're all going to be gone. So, it really comes down to how many people are being born in China every year right now?

This past year was high at 9 million, but that was because it's the year of the dragon and a bunch of people try to have babies in the year of the dragon. The previous year I think was 7.8 million in terms of unofficial data, the official data is a little different. But if we really think about the fact that the female population is declining, last year only 6 million couples got married. We're probably looking at an average annual number of births over this period in the 6 million range, right? So, if we're talking about roughly an 80-year time frame and 6 million births on average a year, that's 480 million people and the population right now is 1.4 billion. So, even if you said OK, six is too low, it's going to be seven.

Then you're talking about just 560 million people, right? So, you're still looking at massive declines here. The government is starting to wake up to this more. There's more proposals about what they should do about it, but I wouldn't say that there's anything particularly aggressive going on. We do have some local governments testing, paying families who, basically subsidizing more births. That hasn't really worked very well. There are some places where it worked last year. But again, I think that's a year of the dragon issue. So, I think we don't really have a big solution and we're looking at a big problem. Now from an economic and an investor point of view, you could look at that and say, "Oh, my God, that's a total disaster."

And it is, but that is 75 years from now. In the meantime, we do still have about 1.4 billion people in China. There's still a lot of people on the ground and this is still a big market. So, it will take time for this to play out, but longer term. And certainly, when I'm talking to CEOs of multinationals operating in China and they're trying to think about long-term investment and that type of thing, this is when it becomes very relevant and very important for anybody looking at China.

Corey McLaughlin: Yeah. Wow. I was not totally expecting to hear that, that 60% to 70% number. In some ways it's, China's a lot different than the U.S., but the youth problems here too with just keeping up with inflation and not being able to buy a house and that sort of thing. In China, I'm not an expert at all, but it seems like when I see that youth unemployment rate and then it just kinda disappears, I'm like, what is going on? What is really going on there? Because I suspect that they're experiencing that youth, they're probably experiencing similar-ish problems to what people here are.

Charlene Chu: Yes, but I would say exacerbated really. Ultimately, these are the least experienced people in the economy. And so, when there's a slowdown, it’s the hardest for them to find jobs, but they're suffering for a host of reasons. That three years, zero-COVID policy was devastating for many parts of the economy, and they simply haven't recovered. Then on top of that, we had the crackdown on education, tech sector. So, this would be private tutoring, virtual private tutoring type of jobs. That disappeared overnight and that was a big absorber of youth employment. There was also a crackdown on the internet platforms and tech companies.

That was a big source of hiring. And then of course, we've had the property collapse, and I think there are broader unemployment issues in China that don't really show up in the official data. It's one of the weakest data sets that exist in China. But the clearest evidence of it is in the youth employment numbers. And it's just taking people who would have found a job six months out of school, it's now taking them two years, and that weighs on confidence as well. It's one of the reasons why we had only 6 million marriages last year, why the birth rates are low. All of this is like together.

Dan Ferris: And the prospects for China saying, OK, we've been this sort of insular culture for thousands of years. Maybe we need a lot of immigrants. It's probably pretty low probability there.

Charlene Chu: Yes, it will be very interesting to see, do they get aggressive about this at any point? Last year, when the economy was not doing so well, mid-year, there was a talk about will they announce some stimulus? That is actually tied to encouraging births. For example, we will give handouts to households who have a second child or a third child. That kind of policy could make a difference, particularly in the rural areas of China where the handouts would be substantial.

Urban areas, I think it would probably be too small. So, that's where, if we stay on the current trajectory, we're looking at a decline of 60% to 70%, whether or not they come out with something and say, we got to get off that path and have some kind of new policy to address that we'll see. But so far, they haven't been particularly aggressive.

Dan Ferris: And then on the demographic side, there's India.

Charlene Chu: Yes.

Dan Ferris: Different picture.

Charlene Chu: Different picture. Yes, although the birth rates there are slowing as well, which is just the phenomenon of women starting, more women starting to join the workforce and realizing they don't need to stay at home and have six or seven kids, that they can actually go to work and have two. And that leads to demographic issues as well, although clearly not the same magnitude that we're talking about with China.

Dan Ferris: I forget who it was. I'm trying to remember. I think it might have been somebody like Peter Zeihan who said China's just not going to exist in however many years. As we know it today, it simply will not exist.

Charlene Chu: I think it will be different. I still think it will be particularly for the next few decades, I don't know where we'll be by 2100, but they are getting very advanced in robotics. I don't know if you've seen all the stuff that's going on with the humanoid robots, but they seem to be leading the world and some of this stuff. And one of the issues when you have such a sharp population decline, of course, is going to be well, we’re the manufacturer of the world and all the labor is going to be gone.

How can we continue to play that role? But if you can really move up the tech chain here and replace a lot of that labor with AI and with robots and that type of thing, China could retain, continue to retain a pretty central role here. And that's how I see it playing out in terms of, let's say, the next 10 or 15 years. I don't know about longer than that, but I think that's one of the reasons they're pushing so aggressively.

Dan Ferris: It makes me wonder if there are any relevant historical examples here of the extreme demographic decline. And yet, they pulled it out with technology for a few decades or so. It's such a large country, though. No country's ever been that large, right?

Charlene Chu: Exactly. I basically tell people in recorded history we've never seen this. There probably has been at some point when nobody was keeping track of all of this. We may have had this type of dynamic before, but we've certainly not seen it since people have been keeping numbers on this type of thing.

Dan Ferris: So, I asked about immigration, but maybe the dynamic goes the other way, and there's a kind of a Chinese diaspora that goes someplace like Africa and gets involved economically there, invests heavily there, and becomes the world's investor or something like that, invest in where there are, where the demographics are more favorable, it becomes one of the big investors there. And I know there are plenty of Chinese investors in Africa. Am I too optimistic about that? Is that just not going to be done? Is that just too lousy of an idea I guess simply put?

Charlene Chu: We're definitely seeing the government trying to open up as many other markets around the world as possible to offset all of this trade tension with the U.S. and with the EU. That's part of the long-term solution is let's try to reduce our reliance on the U.S. and the EU as a destination for everything. So, that involves going out and setting up businesses and setting up relationships and a lot of smaller countries. So, China's been doing it. They'll continue to do it.

I don't know that we will see a large movement of the Chinese population to those places, just because in my experience and talking with people who've gone there, it does feel very foreign to them, and they still feel more attached to home. I actually think it'll be interesting to see what happens with the gold card that was just announced yesterday here in the U.S. and to what extent do we actually have Chinese people saying that they're willing to come over here for $5 million. There's certainly a lot of interest and demand for coming over here.

Dan Ferris: Interesting.

Corey McLaughlin: Yeah. Sign me up for that. I was thinking like, if we could take some of the empty housing from China and dump it over here as well. Just completed, not the materials, but everything, that would probably be welcomed by some people. So, we'll see. How did you get involved and interested in China to begin with? I'm curious, just going back 25 years, but what personally attracted you to, I assume you could have done a bunch of different things. Why China? Why emerging markets?

Charlene Chu: I think I've just always been interested in economics and international relations, and I'm half Chinese and China was up and coming in the late '90s, early 2000s. And it just made sense to focus on it, and then it just really took off. And it has been, I think it's probably the only country I could have followed for 25 years and kept my interest just given how complicated things are and how opaque they are and how challenging it is. So, it can pull you in and in a way that I think analyzing other countries can't. That's for sure.

Dan Ferris: Gotcha. All right. We've actually reached our time for our final question, which is the identical question for every guest, no matter what the topic, even if it's nonfinancial, same question, if you've already said the answer, feel free to repeat it. But the question is simply, it's for our listeners, and if you could give them one takeaway, just leave them with one thought today, what might that be?

Charlene Chu: I guess the thought I would leave them with is I think there's a lot of anxiety in the U.S. right now over what is happening with tariffs in terms of inflation and what is the spillover? And why are we doing this? I know that there's a lot of worries because if you look back in the 1930s and the climb in tariff levels at that time, that was one of the reasons cited for the Great Depression. And this is why so many economists are so down on this. But at the same time, I do believe the Trump administration is trying to address some long standing imbalances here with the Chinese economy and I do think a lot of the measures that they're rolling out, even though they are going to hit the allies very partially, they're really ultimately directed at China and that is where we all need to really be focused in terms of how is this trade war going to play out ultimately.

Because there's been a lot of anxiety about what is happening with Canada and Mexico and the EU and this type of thing, but I think a lot of this is orchestrated at Beijing, and we need to just see how that works out. And of course, it's possible there's a deal ultimately between China and the U.S. and China and the U.S. and a host of other places. I would just say that to soothe people's minds there. And then on top of that and this is just based on conversations that I have with family and friends who are very anxious right now, we are seeing a lot of the growth negative things that the Trump administration is trying to do right now, but there are growth positive things that they're trying to do as well. They just haven't really started to take hold.

Now, we'll see if they really manifest. We don't know. But this is about deregulation, and it's about increased fiscal spending and trying to get countries to buy more U.S. goods, trying to get countries to invest more here. So, we'll see what happens. I completely understand the anxiety over the disruption and what's going on in terms of the U.S. bureaucracy and government spending and that type of thing and the tariffs, but I think there's a lot of moving parts here and there is a method in the madness, I think. We'll have to see how it plays out, whether it plays out the way they hope it does or not, but we'll see.

Dan Ferris: All right. Thank you for that and thanks for being here. It's been really, really interesting to hear you talk about China and India and Trump and everything else. Thanks a lot.

Charlene Chu: Sure. Thank you for having me.

Dan Ferris: All right. We’ll see where all this goes with Trump and we'll have you back in a year or so to see, and God forbid China should ever become investable again, then we'll really have you back. Maybe we'll see you again in the future.

Charlene Chu: Sure. Sounds good.

Dan Ferris: All right. Thanks a lot. You've probably heard all kinds of crazy predictions about what President Trump has planned for our financial system. There are rumors he wants to create a strategic bitcoin reserve, which some analysts have suggested could push the price to $800,000. Trump himself has said he wants to turn America into the bitcoin capital of the world. Some people even say he's going to use bitcoin to pay off the national debt. But according to our crypto expert Eric Wade, all of those predictions miss the real currency story that's brewing in America right now.

It has nothing to do with gold, oil, or any of the new BRICS currencies, but it could escalate dramatically in the very near future, and Eric says it's already making some people a lot of money. Your savings, your retirement plans, every dollar you have saved, Eric says this currency shock could have a dramatic impact on it all. The problem is almost no one in the media has connected the dots about what's really going on here. That's why Eric just agreed to share everything he knows about this story completely free of charge. For a limited time, you get up to speed 100 percent free of charge by visiting newtexascurrency.com. That's newtexascurrency.com for your free copy. Quite the education, eh?

Corey McLaughlin: Yeah, I just right after we wrapped up, I just told her thanks for the education. So yeah, it was a lot there. I feel more informed about China. The population numbers kinda surprised me a little bit, although I had heard her say some things in previous interviews about it. So, I guess if you're a CEO, like she said, and think your company is going to be around in 100 years, then this is something you want to pay attention to.

Dan Ferris: I know. I mentioned that quote from Peter Zeihan where China's not going to exist. He says things like that and who knows what it really means, but in this case, wow. 60%, 70% decline in population over 75 years, most populous country in the world at one point, if it isn't still. That’s going to be a big one for planet earth. That's going to be one for the history books.

Corey McLaughlin: For my kids or grandkids at some point. Yeah. It’ll be things moving around, potentially.

Dan Ferris: Yeah, we won't get to see it, but we'll see some of it if we live, knock wood, if we stay healthy for a good long time here from our current ages we'll see some of it. We'll get a feeling hopefully if I live another 30 years which my father lived that long, so maybe I will too. Both my parents did. Fingers crossed that I get to see some part of the most populous country in the world losing a big chunk of its population without creating some big crisis, hopefully.

That alone will make the next several decades very interesting. And the discussion about India was a good one too. Maybe we need to have our old friend Rahul Saraogi back and a couple other folks that we've talked to about India over the years too. Maybe we need an India update. We sure got a good China update today.

Corey McLaughlin: We did. Yeah, and I think just picking up on her like uncertainty about the tariffs and the trade war and she's in deep and very knowledgeable about it. I think just hearing that uncertainty kind of reflects what you see a lot in the market these days, too, just the constant stream of headlines like what does this mean? I feel like a lot of people are thinking that what and whether they should be or not is a whole nother matter. How much right how much emphasis you want to put in these things is debatable to our investing health and mental health probably, but I think it just shows you the tone out there, too, especially with China, when we're talking about China and trade. There's a lot of uncertain things, but that's probably up there on the top of the list.

Dan Ferris: Yeah. And I'm glad you mentioned the possible exception. If you must put money in China, go for the big tech companies because they're not tied to the government so much. Everybody's tied to government in China, but in terms of their financing, which, I've seen some people who I think are really smart saying, "Oh yeah, that's what we're doing." Was good to hear that. Really just very, very interesting. We could probably get every China analyst that we've had on the show and do the most interesting series of discussions. Because as Charlene said, it sucks you in. She spent a career at it because it's just, it's practically like she was telling it, I just can't turn away from it.

I can't stop wanting to know and lots of people in the financial world, of course, are the same way. Interesting stuff, man. Interesting stuff. That's another interview and that's another episode of the Stansberry Investor Hour. I hope you enjoyed it as much as we really, truly did. We do provide a transcript for every episode. Just go to www.investorhour.com. Click on the episode you want. Scroll all the way down, click on the word "transcript" and enjoy. If you like this episode and know anybody else who might like it, tell them to check it out on their podcast app or at investorhour.com please.

And also do me a favor, subscribe to the show on iTunes, Google Play, or wherever you listen to podcasts. And while you're there, help us grow with a rate and a review. Follow us on Facebook and Instagram. Our handle is @investor hour. On Twitter our handle is @investor_hour. Have a guest you want us to interview, drop us a note at feedback@investorhour.com or call our listener feedback line, (800) 381-2357. Tell us what's on your mind and hear your voice on the show. For my cohost, Corey McLaughlin, until next week, I'm Dan Ferris. Thanks for listening.

Announcer: Thank you for listening to this episode of the Stansberry Investor Hour. To access today's notes and receive notice of upcoming episodes, go to InvestorHour.com and enter your email. Have a question for Dan? Send him an email. Feedback@InvestorHour.com This broadcast is for entertainment purposes only and should not be considered personalized investment advice. Trading stocks and all other financial instruments involves risk. You should not make any investment decision based solely on what you hear. Stansberry Investor Hour is produced by Stansberry Research and is copyrighted by the Stansberry Radio Network.

Opinions expressed on this program are solely those of the contributor and do not necessarily reflect the opinions of Stansberry Research, its parent company, or affiliates. You should not treat any opinion expressed on this program as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Neither Stansberry Research nor its parent company or affiliates warrant the completeness or accuracy of the information expressed on this program, and it should not be relied upon as such. Stansberry Research, its affiliates, and subsidiaries are not under any obligation to update or correct any information provided on the program.

The statements and opinions expressed on this program are subject to change without notice. No part of the contributor's compensation from Stansberry Research is related to the specific opinions they express. Past performance is not indicative of future results. Stansberry Research does not guarantee any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment discussed on this program. Strategies or investments discussed may fluctuate in price or value. Investors may get back less than invested. Investments or strategies mentioned on this program may not be suitable for you.

This material does not take into account your particular investment objectives, financial situation, or needs and is not intended as a recommendation that is appropriate for you. You must make an independent decision regarding investments or strategies mentioned on this program. Before acting on information on the program, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser.

[End of Audio]