Foot Locker: Is Cramer being a contra-indicator again?; Steve Madden pitch; Why EVs Are Piling Up At Dealerships In The U.S.; Scott Galloway on the new weight-loss drugs

1) In Friday's e-mail, I wrote that CNBC's Jim Cramer is often a good contra-indicator for a stock, citing his throwing in the towel on Meta Platforms (META) late last year – right before the stock tripled.

Well guess what? Cramer is at it again...

On his Mad Money show last night, in front of the words "DAY OF ATONEMENT," he confessed to another terrible mistake in recommending shoe retailer Foot Locker (FL) after the company brought in a highly respected new CEO, Mary Dillon, last year.

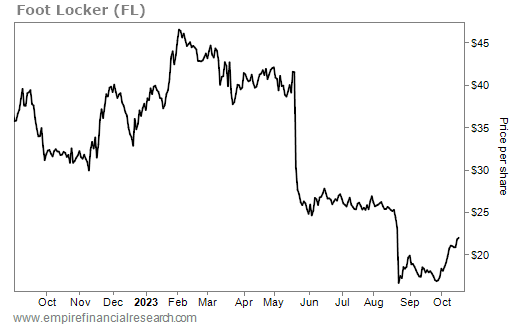

Since Dillon took the reins on September 1, 2022, Foot Locker's stock has been a disaster:

It reminds me of a famous Warren Buffett maxim:

When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.

Cramer, to his credit, confesses that he forgot this and made "a colossal error – a disastrous mix of ignorance and arrogance on my part."

So, does Cramer falling on his sword after a stock has collapsed indicate that it's time to buy?

At first glance, my bottom-fishing, value-investing heart started beating faster when I looked at the long-term stock chart and saw that Foot Locker first hit today's levels 37 years ago in 1986!

But a quick look at the financials extinguished that initial enthusiasm: declining revenue, profit, and free cash flow, with rising debt and inventories.

Smells like a value trap!

2) In contrast, another company in the shoe business, Steve Madden (SHOO), caught my eye when it was pitched three days ago on my favorite stock idea website, ValueInvestorsClub. Because it's a members-only site, nonmembers will have to wait 45 days to access it, so here's an extended excerpt:

Steve Madden (Madden/Shoo) is a good business with a solid management team at an attractive price. There is a reasonable path to 40% upside by 2025 with minimal downside. Shoe stocks have had a rough year as excess inventory, a slow-down in the North America wholesale channel, and looming concerns about the health of the consumer weighted on the sector.

This has created a good risk/reward in Shoo given the quality of the balance sheet, a history of good capital allocation, and a reasonable valuation on an absolute basis, relative to peers, and relative to Shoo's historical valuation. As a pure-play branded shoe company, Shoo is also an attractive acquisition target, particularly for a strategic buyer; the company is profitable, has enough scale to move the needle/create diversification for a buyer, operates in good categories, and has a widely known brand. Steve Madden / CEO Ed Rosenfeld are rational owners who would sell if the deal was good. At a 15x multiple on $3/share in estimated 2025 earnings, Shoo could trade at $45/share versus $32 today, ~40% upside.

Shoo designs, markets, and sells footwear. Shoo is predominantly a wholesale business that sells relatively affordable on-trend shoes across many categories. In 2022, total revenue was $2.1B; $1.5B (74%) was from the wholesale footwear segment. Shoo's model is to take moderate inventory risk, adapt quickly to what products are working, and chase trends rather than make large bets in advance on what the trend will be. Among Shoo's largest wholesale customers are Nordstrom, Macy's, Walmart, Target, and TJX.

Shoo has a long history of profitability... Additionally, as discussed below, the debt-free balance sheet reduces the financial leverage. Shoo is steadier, more predictable business than one generally finds across retail where some combination of the fixed cost with stores, fashion-trend risk, and/or financial leverage create a more volatile business performance and stock price. Shoo's business and stock have historically been less volatile...

Shoo does not need to be at forefront of fashion and it does not need to redefine or disrupt a category. It needs to make good products, priced right for its customer, that it can support with good marketing and healthy distribution. The Steve Madden brand stands for certain intangibles around edge and style – and the namesake is one of those rare founders who imbues the brand story with the halo of a design genius. Shoo's provenance cannot be manufactured or recreated, therefore I think there is real intangible value in the brand.

Shoo has a reasonable change of good upside with downside protection in the form of a durable brand and model, a history of profitability, strong balance sheet, and the potential for a takeout.

At a first glance, Steve Madden's financials – unlike those of Foot Locker – look favorable: revenue and profit are down a bit this year but remain near all-time highs... free cash flow is at an all-time high... and the company has steadily bought back stock, reducing the share count by 24% over the past year.

I'm definitely going to take a closer look at this stock...

3) I sent this yesterday to my personal Tesla e-mail list (to sign up for it, simply send a blank e-mail to: tsla-subscribe@mailer.kasecapital.com):

I'm not surprised that inventories of electric vehicles ("EVs") are increasing in the U.S. in light of the many new models hitting the market, but I'm shocked that overall EV sales have slowed so much... See this CNBC video, Why EVs Are Piling Up at Dealerships in the U.S., and this Wall Street Journal article: Automakers Have Big Hopes for EVs; Buyers Aren't Cooperating. Excerpt:

The auto industry's push to boost sales of electric vehicles is running into a cold, hard reality: Buyers' interest in these models is proving shallower than expected.

While EV sales continue to grow – rising 51% this year through September – the rate has slowed from a year earlier and unsold inventory is starting to pile up for some brands.

Some car companies, such as Ford Motor (F) and Toyota Motor (TM), are tempering their expectations for EVs and shifting more resources into hybrids, which have been drawing consumers at a faster clip.

The first wave of buyers willing to pay a premium for a battery-powered car has already made the purchase, dealers and executives say, and automakers are now dealing with a more hesitant group, just as a barrage of new EV models are expected to hit dealerships in the coming years.

"The curve isn't accelerating as quickly as I think a lot of people expected," said John Lawler, Ford Motor's chief financial officer at a conference in September, on the EV adoption rate. "We're seeing it flatten a bit."

The abrupt slowdown in EV sales is a contrast to a year ago, when carmakers found themselves caught off guard by long waiting lists for battery-powered cars and trucks. It is also a troublesome sign for the car manufacturers plowing billions of dollars into building factories and battery plants to support what they hope will be a strong pickup in demand for plug-in models.

4) This was a nice note from a reader about my new e-mail list to which I send out articles, information, and commentary about the new weight-loss drugs (to join it, simply send a blank e-mail to: weightlossdrugs-subscribe@mailer.kasecapital.com):

Thank you for weight loss articles!!! Bless you, Whitney Tilson. You're helping me change my life, after dealing with obesity since I was a child. 👏🏾🙏🏼

Following up on last Tuesday and Wednesday's e-mails about these drugs (I've compiled two PDFs with everything I've sent to this list since I created it in June), NYU marketing professor Scott Galloway explains why he thinks they "could be an epochal step in human evolution" in this essay: Seconds. Excerpt:

If you scroll back through previous issues of this newsletter, you'll find a recurring theme: societal ills resulting from cravings. From meme stocks and Robinhood to TikTok addiction and Twitter enragement, to obesity itself, human weakness subjugated to our brain's reward circuitry is no less a threat to our well-being than climate change, authoritarianism, or cancer. According to Harvard's Grant Study on happiness, the factor most commonly present in the least-happy cohort was alcohol. It's that fundamental.

A drug that rewires these reward circuits could be an epochal step in human evolution. And why not? We've compensated for evolution in many other ways, from the protection of clothing to the assistance of eyeglasses to the power of wheeled transport. Perhaps we've reached the point where a salt/fat/dopa drive, evolved on the savannah of scarcity, can give way to a motivational superstructure suited for our era of superabundance. GLP-1 innovation may be scaffolding for instincts in need of updating.

Portion Sizes

Large health-care insurance companies and providers, starting with the U.S. Government, should make delivering GLP-1 drugs a priority (instead of pulling back, as the short-sighted insurance industry has done). Globally, the WHO and national health organizations could do the same. You can get Ozempic over the counter in five Emirates in the Gulf. And Americans are venturing to Mexico and Canada where cost is (spoiler alert) a fraction of what it is in the U.S.

Government funding will test the fulcrum between the obesity industrial complex (food, pharmaceutical, and hospital networks) and long-term economic thinking, because these drugs will register an enormous ROI for society as health-care costs decline and mental health improves. Depression rates among obese children are double those of average-weight kids and can haunt them in adulthood. A 5% reduction in weight can cut an obese person's medical costs by $2,000 per year, and it's estimated that a full transition from obese to a healthy weight saves nearly $30,000 in direct medical costs and productivity.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.