'Good artists copy, great artists steal'; No bombshells in Berkshire Hathaway's third-quarter 13-F; 45 hedge-fund letters; 71 third-quarter 13-Fs; Joby Flies Quiet Electric Air Taxi in New York City; Harvard, Columbia, and Penn Pledge to Fight Antisemitism on Campus

1) Apple (AAPL) founder Steve Jobs once said:

Picasso had a saying – he said, "Good artists copy, great artists steal." And we have always been shameless about stealing great ideas.

It strikes me as obvious that investors would be well served to adopt the same approach, but in fact just the opposite is often the case.

Though few will admit it, I've observed that many of my fellow investors, especially professionals, suffer from a "not invented here" syndrome. I think it's mostly rooted in intellectual arrogance. If another money manager already bought a stock, especially at a lower price, then their tender egos won't allow them to buy it because that would be a tacit admission that the other guy is smarter than they are.

For example, how many investors never bought Coca-Cola (KO) or Apple because these are well-known Warren Buffett investments?

Despite often being accused of having an overactive ego, I've never fallen into this trap. In fact, I go to an extreme in the other direction – I'm constantly seeking great ideas by talking to or following the smartest investors in the world.

I read dozens of investors' letters (I especially recommend Howard Marks')... I follow a handful of investors who have blogs (e.g., Harris "Kuppy" Kupperman, Chris DeMuth, Eric Rosen, Andrew Walker)... I attend numerous conferences like Guy Spier's VALUEx Klosters (and co-host my own, the Value Investing Seminar Italy)... I'm on the e-mail lists of friends like Doug Kass of Seabreeze Partners... and every quarter, I review the 13-F filings of many managers.

With this in mind, let's take a look at the latest moves by some smart investors...

2) The smartest of them all is Warren Buffett, who, along with Todd Combs and Ted Weschler, manages Berkshire Hathaway's (BRK-B) enormous stock portfolio – valued at $355 billion based on yesterday's closing prices (CNBC has a real-time tracker here).

On Tuesday, Berkshire filed its third-quarter 13-F, which didn't have any bombshells. Here's the Wall Street Journal with a summary: Warren Buffett's Berkshire Hathaway Sheds Investments in GM, J&J, and P&G. Excerpt:

Warren Buffett's Berkshire Hathaway eliminated its stake in a handful of American blue chips, including General Motors (GM) and Johnson & Johnson (JNJ), while the stock market's rally sputtered in the third quarter.

The company also sold off smaller positions in Procter & Gamble (PG), Mondelez International (MDLZ), and United Parcel Service (UPS), while trimming its investments in Amazon (AMZN), Chevron (CVX), and HP (HPQ), among others...

Berkshire's recent quarterly report showed the company was a net seller of stocks in the period, unloading just shy of $7 billion worth of shares, while buying $1.7 billion. This year through September, Berkshire has sold a net $23.6 billion of stocks, compared with net purchases of $48.9 billion in the same period a year ago, according to the company's filings.

3) A website called FinMasters has collected the third-quarter letters of 45 hedge funds and posted them here.

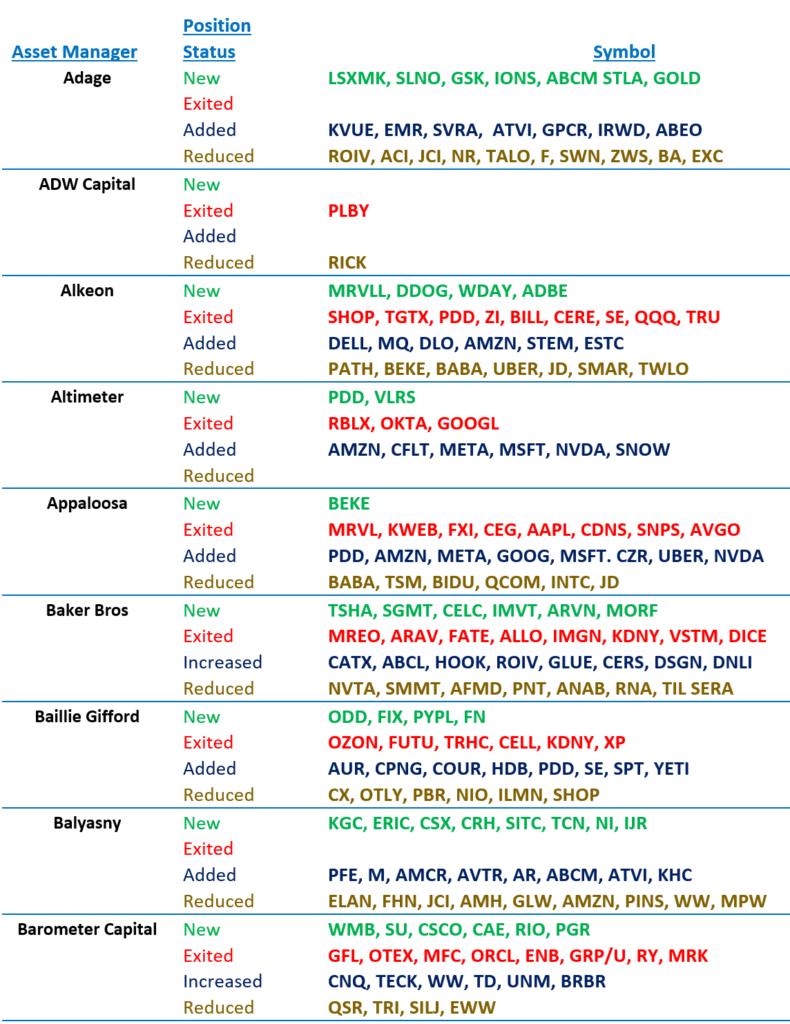

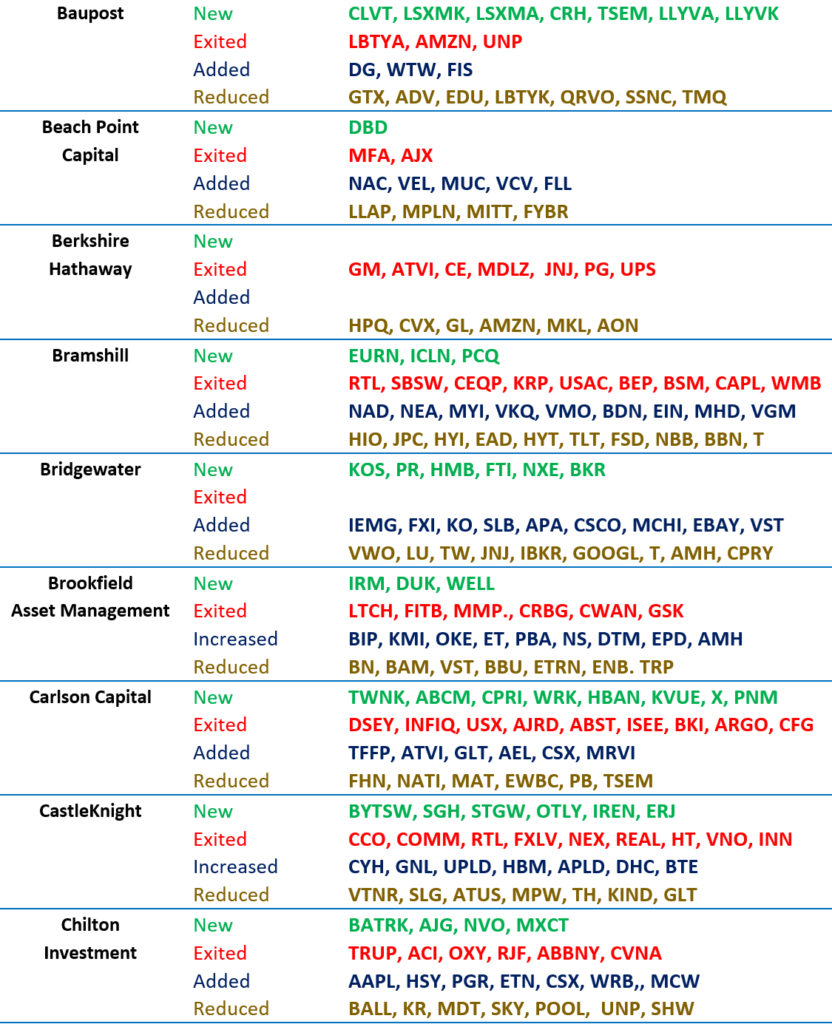

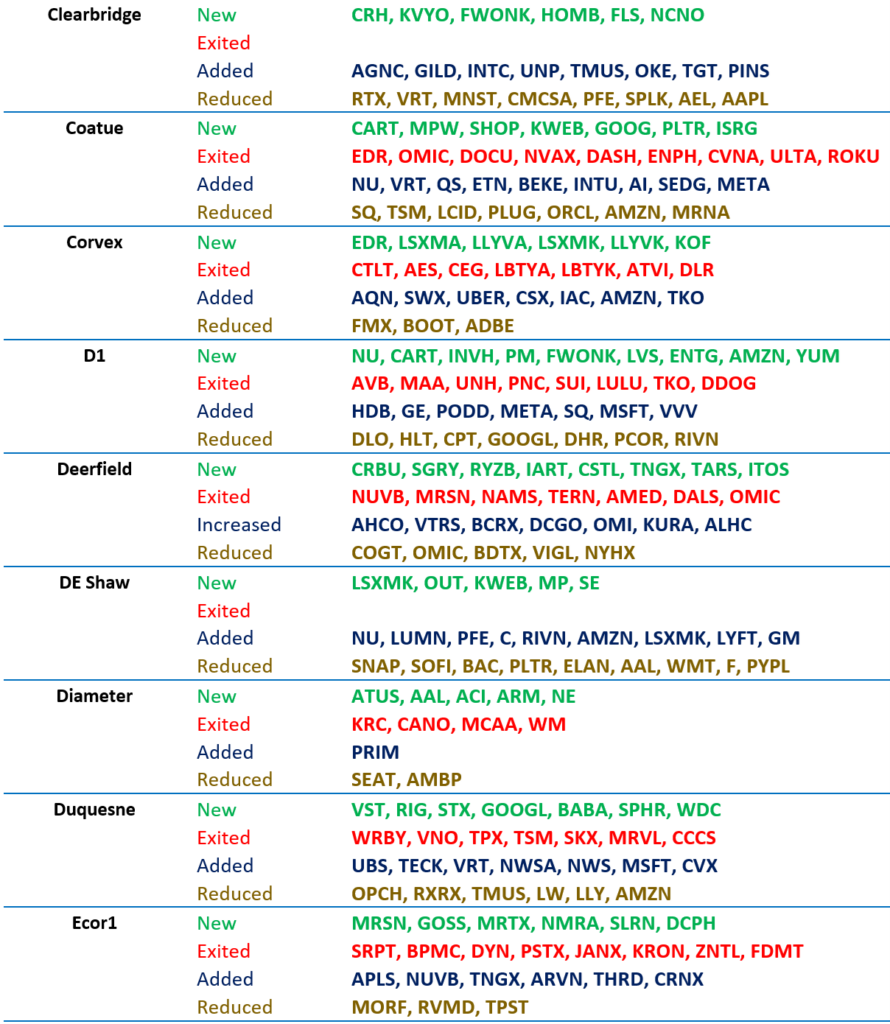

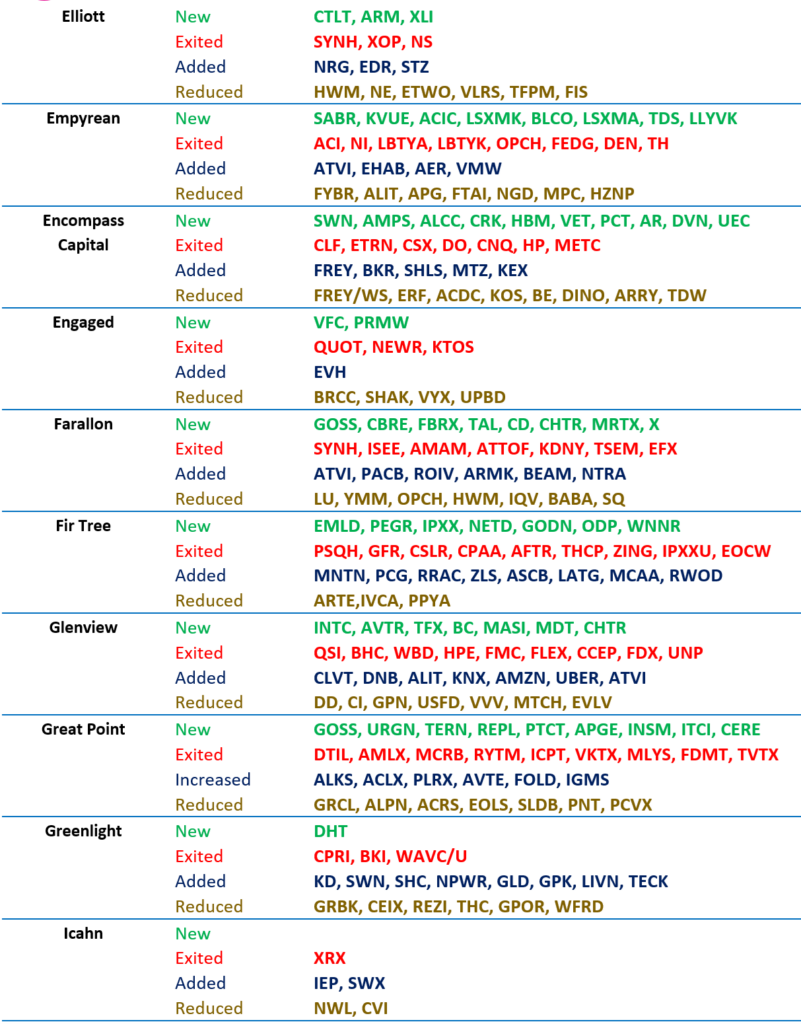

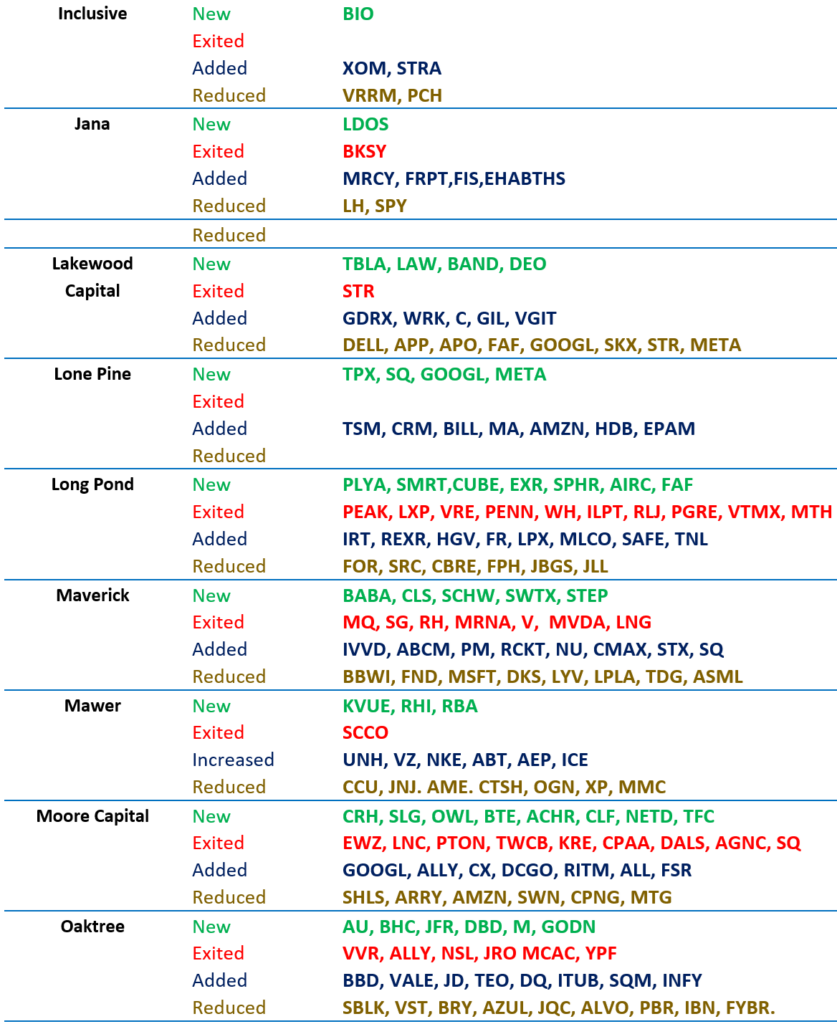

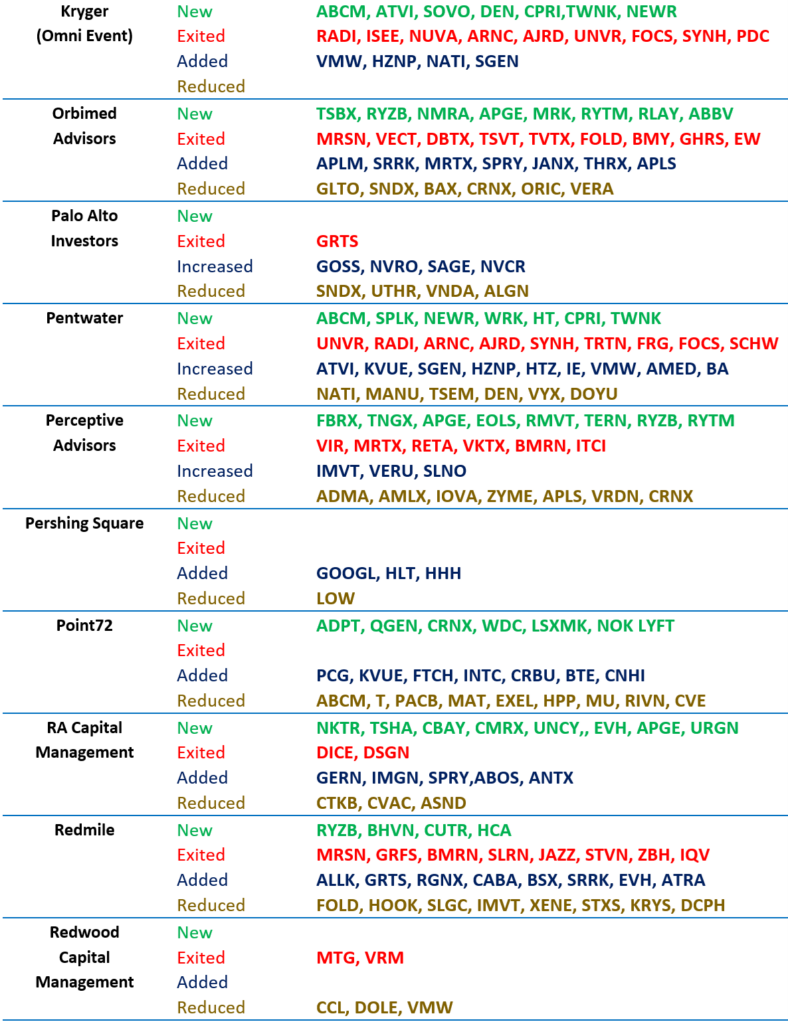

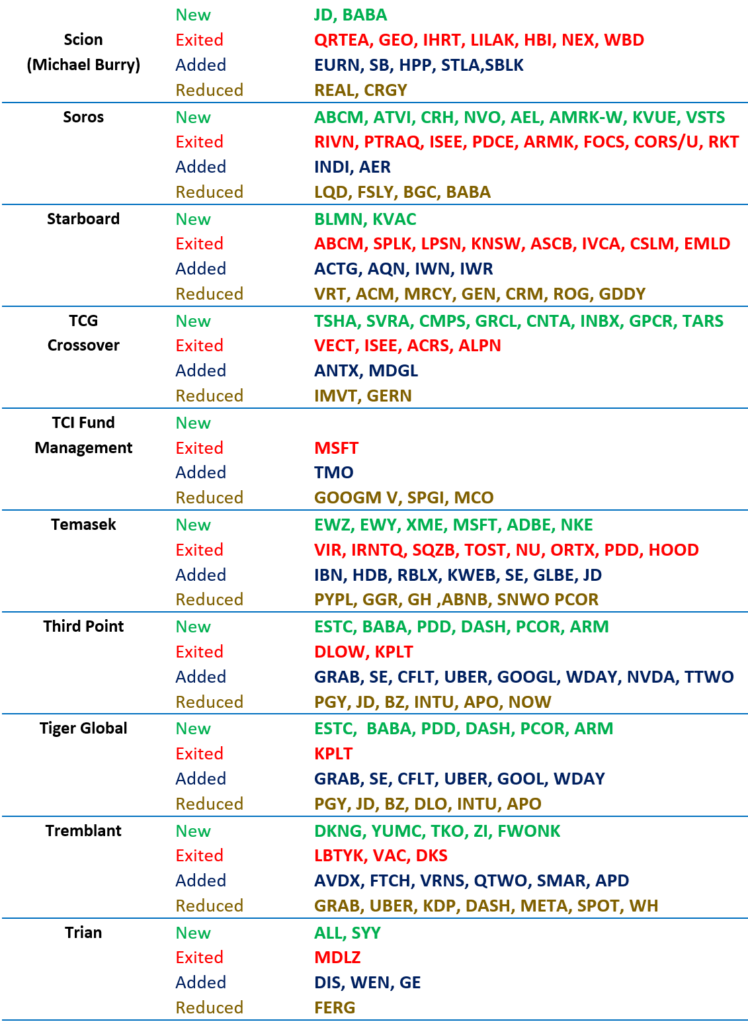

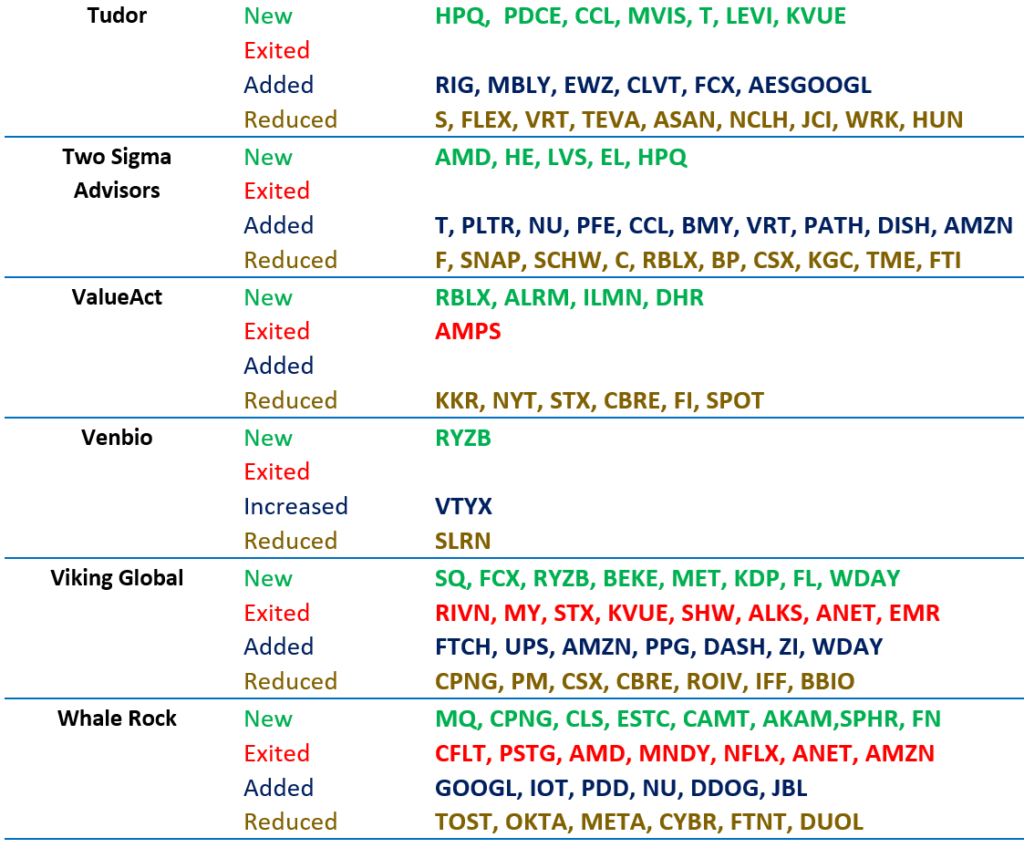

4) My friend Scott Tashman of Outset Global sent me a summary of the third-quarter 13-Fs for 71 of the largest, best-known money managers. I've included the full list at the end of this e-mail, but below are the ones I follow most closely (and know personally):

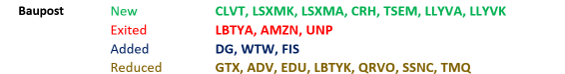

Seth Klarman:

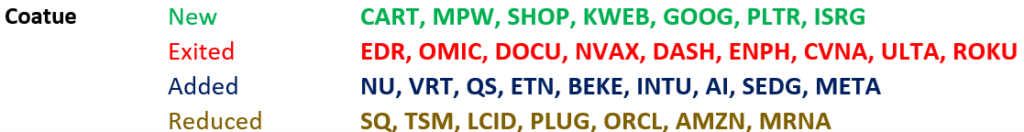

Philippe Laffont:

Larry Robbins:

David Einhorn:

Bill Ackman:

Michael Burry:

Jeff Smith:

Dan Loeb:

As I quickly scan these, the ones that catch my eye are Mike Burry and Dan Loeb establishing new positions in Chinese Internet giant Alibaba (BABA) and Bill Ackman adding to Alphabet (GOOGL) (along with Philippe Laffont and Dan Loeb), Hilton (HLT), and Howard Hughes (HHH).

5) When I was in the Bay Area in September, I spent a half-day each at the two largest air-taxi companies: Joby Aviation (JOBY) and Archer Aviation (ACHR).

At some point, I'll write more about them... but for now I'll just say that I was extremely impressed and think my short-selling friends are wrong (both stocks have a high short interest).

Joby representatives were in New York City last week, showing off the company's amazing electric vertical takeoff and landing ("eVTOL") aircraft. Here are two short videos Joby released: Joby Flies Quiet Electric Air Taxi in New York City and Bringing Quiet, Electric Flight to New York City.

6) I was quoted in the New York Times last week casting some shade on my alma mater: Harvard, Columbia, and Penn Pledge to Fight Antisemitism on Campus. Excerpt:

On Thursday, Whitney Tilson, a former hedge fund manager and a Harvard alumnus, said that he was so angry at Harvard for not standing up to antisemitism that he had declined an invitation to meet with a fund-raising officer from the business school.

"The damage that Harvard has done to its brand since Oct. 7 is only rivaled in history by New Coke and what Elon Musk has done to Twitter," he wrote.

Mr. Tilson said on Friday that he considered Harvard "the least needy charity on earth" and that he had made only "a few tiny donations over the years."

"But," he added, "I also have a megaphone: I sent that email to nearly 10,000 friends and readers on some of my many email lists."

Best regards,

Whitney

P.S. I welcome your feedback – send me an e-mail by clicking here.

P.P.S. Here's the full list from Scott of the third-quarter 13-Fs for some of the largest, best-known money managers: