Herb Greenberg on CNBC; Doug Kass: Believe Half What You See and None of What You Hear; Paul Krugman: Light at the end of the inflation tunnel?; The U.S. Consumer Is Starting to Freak Out; India's Adani Group Fails to Halt Short-Seller-Driven Decline; Gabriel Grego: The dark side of Darktrace; Greetings from Switzerland

1) On Monday, my colleague Herb Greenberg made an appearance on CNBC – discussing interest rates, market sentiment about the Fed, and stocks making a comeback. You can check it out below:

Also, if you haven't seen it yet, make sure to check out Herb's new presentation...

In it, he shares the details about a series of "money blackouts" poised to hit 235 U.S. cities this year.

As Herb says, if you're one of the lucky few who get out in front of this and take one simple step to protect your money from the aftermath, you could come out of this in a far stronger financial position than ever before. Watch his presentation right here.

2) My friend Doug Kass of Seabreeze Partners hasn't turned bearish, but he's getting more cautious – and I think he's right... Here are excerpts from one of his recent missives:

Believe Half What You See and None of What You Hear

- Stay independent of view

- Ignore the growing and "made up" narratives promulgated daily

- And always assess upside reward vs. downside risk

There are simply too many made-up narratives on the markets, in an attempt to explain the daily market moves. These narratives are noise, rarely thought out and almost never facts-based.

They are a reaction to the notion that "price is truth," but price has a way of influencing sentiment (and obscuring the facts).

Facts change and the markets are a dynamic in an ever-changing mosaic...

A year ago we were "told" by the pundits and "talking heads" that inflation would be transitory. The Fed, the gang that can't hit it straight, were in on it – predicting (one year out, like today!) that inflation would be only about 2.7% and that the Fed Funds Rate would be less than seventy basis points. Oops... and markets were pummeled over the next twelve months.

As the month of January (2023) progressed, stock price momentum accelerated to the upside and many are now convinced that a new bull market had commenced in the wake of impressive breadth thrusts and price action. (As I noted yesterday, the action had become consensual – typically a warning sign!)

But too few were focused on a changing market structure that was importantly influencing market direction as ETFs, quant strategies and products, and now the speculation du jour, ODTE options, have likely become the tail that wags the market's dog. Defensively positioned Commodity Trading Advisors, retail, and hedge funds all contributed to the market's swift advance over the last few weeks, with a heavy dose of FOMO (accumulating with every uptick).

Finally, the growing consensus acceptance that inflation had been licked became a fixture of the bullish cabal's narrative. (It was, for a while, my view as well and an important factor in why I expected a better first half).

Those bullish narratives continue even in the face of:

- A 29% rise in the price of gasoline over the last 45 days.

- Sugar has risen by 21% since October and is trading at an all-time high.

- Lumber is up 32% year to date.

- Iron ore is up 44% in three months.

- Copper is up 10% year to date and 23% in the last three months.

- The price of corn is up 21% from its lows.

Bottom Line

Too often consensus has a foul odor.

Stay independent of view and be aware of... what's going on!

Above all, dismiss made up narratives that bend with the market's wind and are designed to fit into and be compatible with the last tick of stock prices.

Keep their views away from your portfolios and from your children.

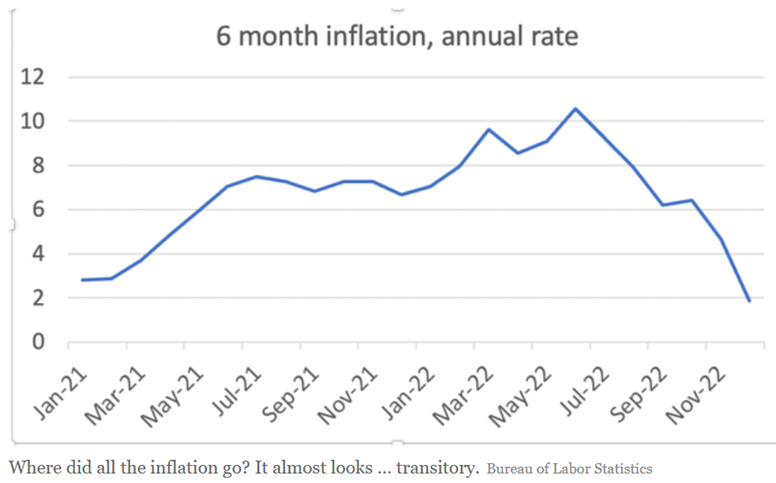

3) Speaking of inflation, yesterday Nobel Prize-winning economist and New York Times columnist Paul Krugman shared his latest arguments – which I think are likely correct – on why inflation will keep coming down and we'll have a soft landing: Light at the end of the inflation tunnel? It depends who's looking. Excerpt:

But inflation just kept rising. Team Transitory was proved wrong, and I admitted as much.

At that point, however, the debate shifted. High inflation had happened, but how hard would it be to get it down again? Again, economists took sides.

One side – call it Team Stagflation – argued that it would take years of pain and high unemployment to restore price stability, which is what happened after the high inflation of the 1970s.

The other side, call it Team Soft Landing, argued that the situation was very different this time...

So where does that leave us? I'd say that these various temporary factors are more or less a wash, and that underlying inflation really has come down a lot; the inflation surge may not be completely behind us, but there's good reason to believe that we can restore price stability without huge economic pain.

4) This headline of this front-page story in yesterday's Wall Street Journal makes it seem like a recession is right around the corner: The U.S. Consumer Is Starting to Freak Out.

But if you read the article and examine the data closely, a more accurate headline would be: "The U.S. Consumer Is Pulling Back a Bit," which is good news for the economy, inflation, and stocks... Excerpt:

The engine of the U.S. economy – consumer spending – is starting to sputter.

Retail purchases have fallen in three of the past four months. Spending on services, including rent, haircuts and the bulk of bills, was flat in December, after adjusting for inflation, the worst monthly reading in nearly a year. Sales of existing homes in the U.S. fell last year to their lowest level since 2014 as mortgage rates rose. The auto industry posted its worst sales year in more than a decade.

It's a stark turnaround from the second half of 2020, when Americans lifted the economy out of a pandemic downturn, helping the U.S. avoid what many economists worried would be a prolonged slump. Consumers snapped up exercise bikes, televisions and laptop computers for schoolchildren during lockdowns. When restrictions were lifted, they rushed back to their favorite restaurants and travel destinations.

And they kept spending, helped by government stimulus, flush savings accounts and cheap credit, even as inflation picked up. Faced with four-decade-high inflation last year, Americans outspent it. Through most of 2022, consumer spending growth exceeded price increases by about 2 percentage points.

Now the forces that helped keep spending high are unwinding, while inflation remains elevated.

5) India's Adani Group's 413-page response to the activist short report by Hindenburg Research failed to assuage investors' concerns, as this front-page story in yesterday's WSJ notes: India's Adani Group Fails to Halt Short-Seller-Driven Decline. Excerpt:

A giant Indian conglomerate couldn't stop the free fall in its shares and bonds set off by an American short seller in what has grown into a bitter fight over the empire created by one of India's richest and most politically connected businesspeople.

Adani Group, an energy and infrastructure company, released its 413-page rebuttal to the short seller's claims just as the trading week began in Asia. Investors weren't convinced and dumped shares of the company on Monday, bringing the total value lost to $64 billion since last week.

The fight could have wide implications for India's power industry and for its transition to clean energy. It has also caused billions of dollars in losses for Indian investors who have helped drive up the company's share price to stratospheric levels.

6) Another day, another activist short seller friend of mine is out with a scathing report...

This time, it's Gabriel Grego of Quintessential Capital, who recently released a 70-page report, The dark side of Darktrace, on the U.K. cybersecurity firm that's closely linked to executives behind one of Europe's most notorious frauds, Autonomy, which duped Hewlett-Packard (HPE) into buying it a dozen years ago. Here's a summary:

- We targeted Darktrace ("DT") with a deep investigation into its business model, selling practices, international partnerships, and sales force

- We are skeptical about the validity of DT's financial statements and fear that sales, margins, and growth rates may be overstated and close to a sharp correction

- Detected numerous transactions in the period leading to DT's IPO seemingly involving simulated or anticipated sales to phantom end-users through a network of resellers

- DT seems to have repeatedly used marketing activities to channel funds back into its partners as payment for apparently fictitious purchases

- These alleged channel stuffing and round-tripping activities may have involved shell companies in offshore jurisdictions manned by individuals with ties to organized crime, money-laundering, and fraud

- We have detected a pattern of transactions suggesting that a portion of Darktrace's past recurring software sales may instead be one-off sales of hardware appliances

- Accounting anomalies involving deferred revenue suggest possible problems with DT's revenue recognition, providing a potentially misleading picture about the Company's cash generation

- Presence of serious accounting red flags consistent with reality detected in the field

- Multiple executives, board members, line managers not adequately disclosing their involvement with Autonomy and selling shares

- Increasing competition, questionable product value, "front loading" of existing contracts, high churn rates, and lack of sustainable cash generation, point to a rapid, possibly sharp, deterioration financials

- Employment, website traffic, and search volume metric suggest a sharp slowdown may be underway

We are of the opinion that Darktrace's financial statements may not be relied upon as the company looks like a sophisticated replica of the Autonomy debacle.

Here's a Financial Times article about it: Darktrace shares dive after short seller attack.

7) Greetings from Klosters, Switzerland, the next town over from Davos, where the World Economic Forum just finished. I flew to Zurich last night and took the train here this morning to attend my friend Guy Spier's annual VALUEx conference, which starts today and continues through Friday.

Here are pictures of me in the center of town with the gorgeous mountains in the background and with Guy at the conference:

I come all this way because there are always interesting people pitching great investment ideas – I'll be sharing my latest valuation of Berkshire Hathaway (BRK-B) – plus there's fabulous skiing (Guy very cleverly schedules the conference from 3 p.m. to 10 p.m., so everyone can ski all day)!

I'll share the most interesting things I hear/learn (unless they're off the record) in my upcoming e-mails... Stay tuned!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.