How I became a value investor; Small-cap stocks are trading at a multidecade relative valuation low; These Stocks Are Trailing the Market by the Widest Margin in 25 Years; Final pictures from Namibia

1) When I launched my first hedge fund on January 1, 1999, in addition to Internet stocks, big-cap "Nifty Fifty" stocks were all the rage – having vastly outperformed in previous years.

I had bought a few of them like AOL, Dell, Intel (INTC), and Microsoft (MSFT) and, fortunately, still held them as 1999 proved to be the last year of the blow-off of the giant bubble. I ended the year up 38.7% versus 21% for the S&P 500 Index.

And then, in mid-March 2000, the bubble burst. By the time the market bottomed two and a half years later, the tech-heavy Nasdaq Composite Index had crashed by nearly 80%.

By all rights, I should have gotten incinerated. I had been a late '90s bull market genius, riding popular tech stocks, irrespective of valuation. But just in the nick of time, I realized that these stocks were in a massive bubble and sold them before they took me down.

To some extent, I was lucky... but I also created my own luck by working hard and becoming a learning machine, sucking up all of the knowledge and experience I could.

You can only get experience in two ways: doing things yourself, which inevitably means making mistakes (of which I made plenty), or learning from others. Trust me, the latter is far preferable!

I was both lucky and smart in finding the right teachers, starting with my college buddy Bill Ackman.

I still remember a conversation we had in 1999. I was boasting about how well my fund was doing, and Bill asked me what stocks were driving my performance. When I mentioned AOL and Dell, he asked me to explain how I valued them and why I thought they were cheap. I sputtered something about them being great companies that were growing rapidly.

"Yes, I understand that," Bill said. "But why do you think their stocks are undervalued?"

I had no answer (because there wasn't one). His questions led me to rethink all of the high-flying tech stocks I owned...

I also owe a debt of gratitude to Warren Buffett and Charlie Munger. Bill had told me about them a few years earlier and I had recently attended my first Berkshire Hathaway (BRK-B) annual meeting.

Their teachings – especially their warnings about the Internet bubble – were slowly penetrating my thick skull.

At the same time, I was also voraciously reading the classics of value investing: Ben Graham's bible, The Intelligent Investor... Seth Klarman's classic, Margin of Safety... Peter Lynch's two books, One Up on Wall Street and Beating the Street... and Joel Greenblatt's You Can Be a Stock Market Genius. The collective wisdom of these investing giants was also starting to sink in.

I remember how excited I was when I discovered that Greenblatt was teaching a course on value investing at Columbia Business School in the spring of 2000.

I found out when and where the class was held, showed up on the first day, and sat quietly in the back of the class. When it was over, I approached Greenblatt, told him I was a big fan and had just started my own little fund a year earlier, and asked if I could sit in on the class for the rest of the semester. He frowned... "Well, I'm not supposed to do this," he said. "But if you sit in the back and don't say a word, I'll allow it." I never missed a class.

Learning from a brilliant, legendary value investor at the exact time that the tech bubble was in its final blow-off phase was a transformative experience. It was the defining moment that caused me to shift away from my old, speculative ways and become a true value investor.

While of course I wish I had sold all of my tech stocks, I at least began trimming them – replacing them with small-cap value stocks, which were trading at all-time low absolute and relative valuations.

And I made an especially large and well-timed bet on my favorite stock, Berkshire Hathaway...

I still vividly remember the day the Nasdaq peaked on Friday, March 10, 2000. Berkshire and the other value stocks in my portfolio had been getting pounded for months as every investor on Earth seemed to be selling them and plowing money into tech stocks. It felt like it would never end.

For more than a year, I had been praising Buffett and recommending shares of Berkshire in my letters to investors and articles I was publishing on the Motley Fool website – and had nothing to show for it but egg on my face.

Berkshire's A-class shares had traded between $55,000 and $70,000 for much of 1999. But in the first quarter of 2000, they kept drifting lower and lower, eventually hitting a multiyear low of $40,600 on that historic day in March.

As I rode in a taxi that afternoon on the way to the airport to fly south for spring break with my family, I kept asking myself, "What am I missing?!"

Of course, I wasn't missing anything. Berkshire (the company) was doing fine. The stock was simply suffering from the massive amount of money flowing out of value stocks.

I had no idea when it would end, but I said, "Screw it, I'm all in!" I called my broker and bought six Berkshire A-shares for $41,500 each, making the stock nearly 30% of my tiny fund.

Fortunately, my courage and stubbornness paid off – and my timing turned out to be perfect...

The following Monday, the Nasdaq started to decline and value stocks took off. Just three months later, I began to trim the position, selling four A-shares at $60,300 – a 45% gain from where I had bought in March.

This launched what turned out to be a decadelong winning streak – nearly tripling my investors' money in a flat market – driven in part by blue chips like Berkshire, McDonald's (MCD), and Home Depot (HD), but also to lots of smaller stocks like restaurant chains CKE Restaurants and Jack in the Box (JACK), mall operator General Growth Properties, and HVAC company AAON (AAON).

I attributed my market-crushing returns to my investing genius of course, but looking back, I realize that I had a big tailwind: I had a portfolio with lots of cheap small-cap stocks during a time when they were recovering from a period of historic undervaluation and outperforming their larger peers.

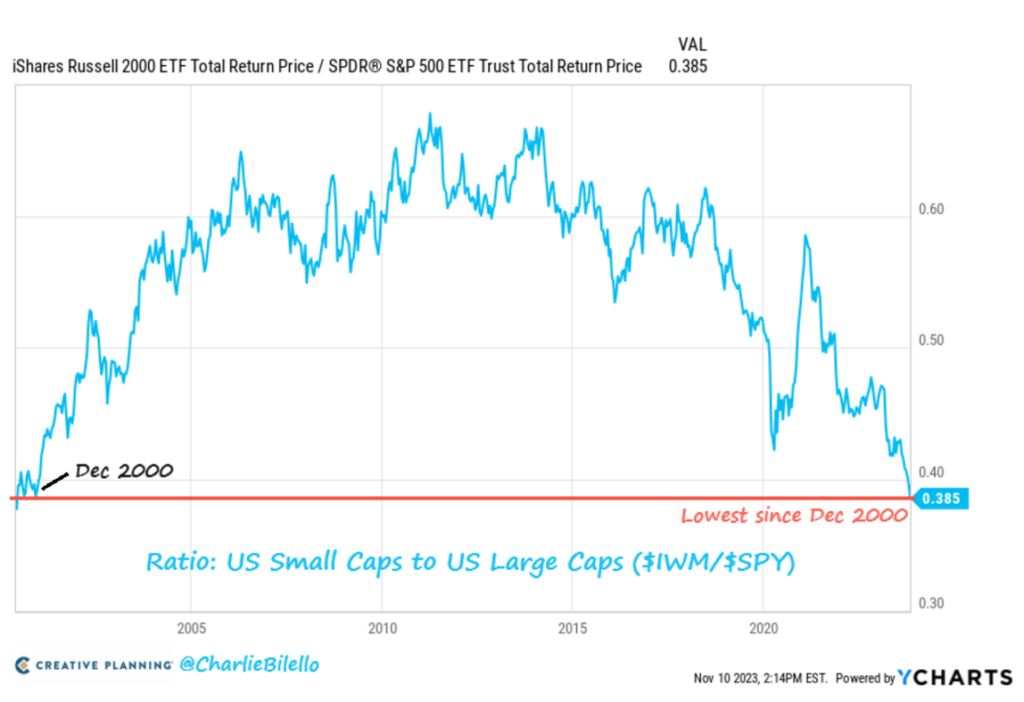

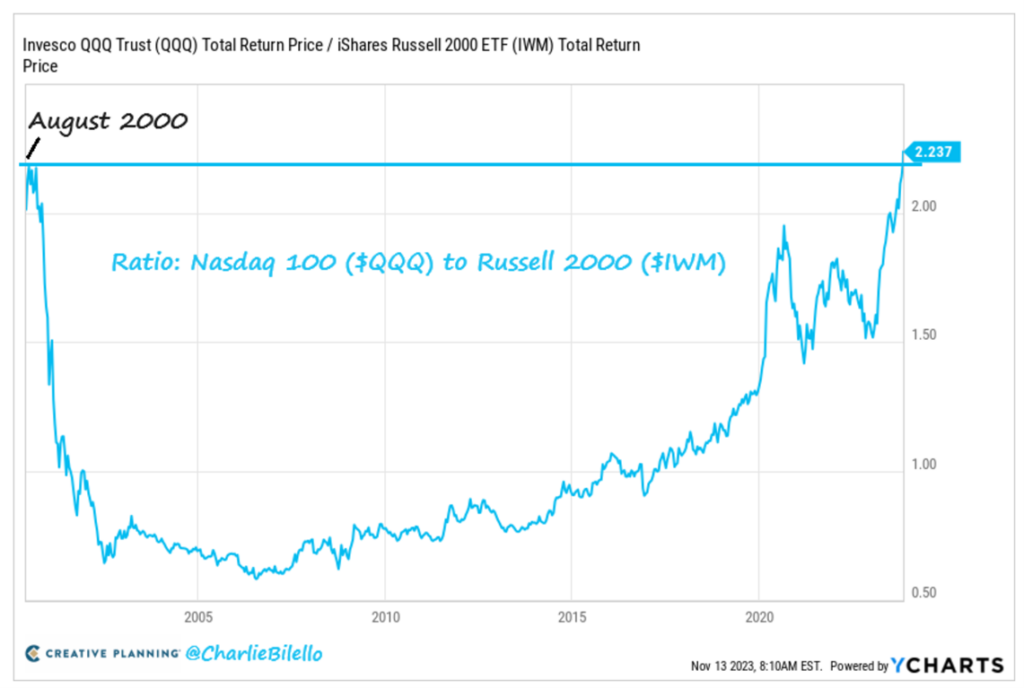

2) I'm reminded of this history because small-cap stocks are back to 2000 levels based on their valuation relative to large caps (the S&P 500, SPY) and big tech (the Nasdaq 100, QQQ), as shown in these two charts in Charlie Bilello's recent Week in Charts:

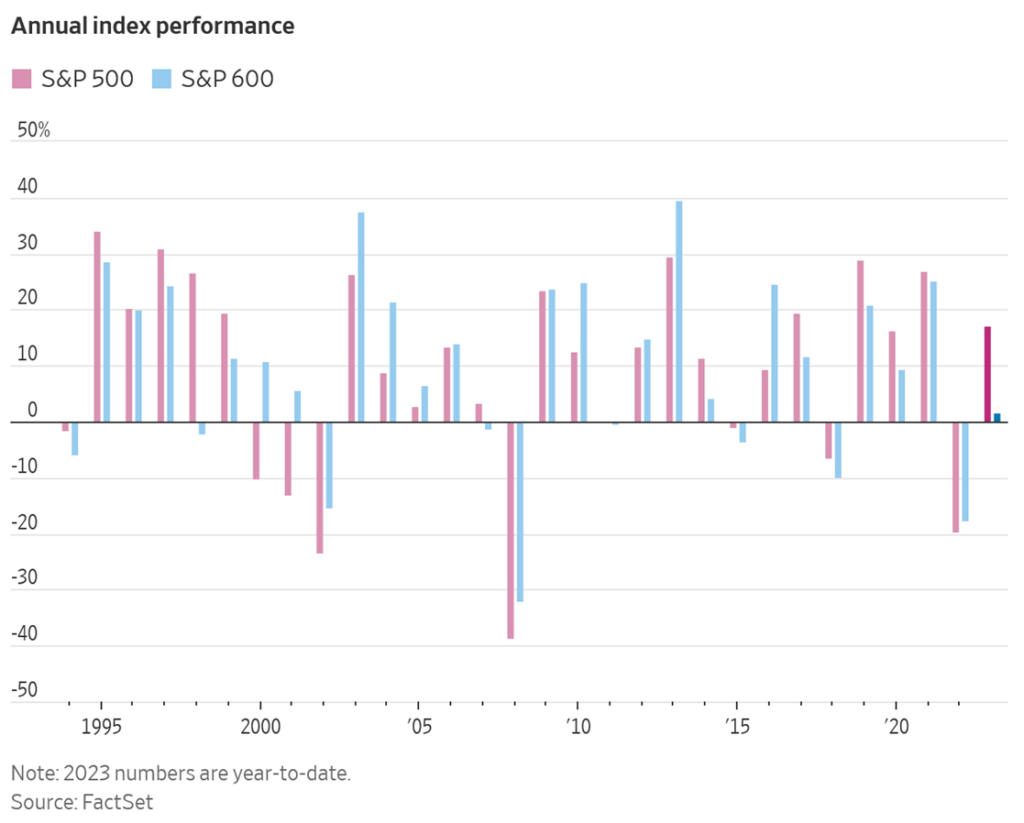

3) Here's a recent Wall Street Journal article on this, These Stocks Are Trailing the Market by the Widest Margin in 25 Years, which has this fascinating chart:

As you can see, large caps outperformed massively from 1997 to 1999, the small caps ruled the day for the next seven (and 13 of the next 14) years through 2013, but in seven of the nearly nine years since then, large caps have again outperformed – with this year, the largest outperformance in a quarter century.

So my takeaway from this is simple...

While I wouldn't dump my favorite large caps like Berkshire, Alphabet (GOOGL), Amazon (AMZN), or Meta Platforms (META), I think outperformance – not just next year, but for many years – is likely to come from smaller (and cheaper) stocks...

4) After two days at a camp in northern Namibia, we flew south and spent two days in the pretty coastal tourist town, Swakopmund. We went to an interesting museum and did a super-fun two-hour ATV trip – zooming up, down, and around the sand dunes outside of town.

We then flew back out into the desert, this time to the Kwessi Dunes Lodge in the Namib Desert, where we went ATVing again and drove to Sossusvlei and hiked an hour to the top of Big Daddy. It's one of the largest sand dunes in the world at 325 meters (nearly 1,070 feet), and then ran down and across the ancient clay lake with its 1,000-year-old dead trees.

Overall, Namibia isn't the first (or second) place I'd recommend in Africa... But if you've already done safaris in Kenya/Tanzania, seen the chimps and mountain gorillas in Rwanda, and spent time in Cape Town and the surrounding areas in South Africa, then Namibia is very cool and unique.

Below are a few pictures and I've posted more on Facebook here:

Best regards,

Whitney

P.S. I welcome your feedback – send me an e-mail by clicking here.