How Switzerland's Oldest Bank Became a Meme Stock; Update on my Short Squeeze Bubble Basket and Dirty Dozen; When Bad Things Happen to Good Stocks; How a Diabetes Drug Became the Talk of Hollywood, Tech, and the Hamptons; I just saved a FORTUNE in taxes

1) I was puzzled a few weeks ago when a number of readers e-mailed the feedback line to ask if I thought Swiss bank Credit Suisse (CS) might be going bankrupt.

Readers don't generally ask about foreign stocks, and I hadn't heard anything about Credit Suisse... But this article in today's New York Times explains the mystery: How Switzerland's Oldest Bank Became a Meme Stock. Excerpt:

"Credit Suisse is probably going bankrupt."

It was Saturday, Oct. 1, and Jim Lewis, who frequently posts on Twitter under the moniker Wall Street Silver, made that assertion to his more than 300,000 followers. "Markets are saying it's insolvent and probably bust. 2008 moment soon?"

Mr. Lewis was among hundreds of people – many of them amateur investors – who had been speculating about the fate of Credit Suisse, the Swiss bank. It was in the middle of a restructuring and had become an easy target after decades of scandals, failed attempts at reform and management upheavals.

There seemed to be no immediate provocation for Mr. Lewis's weekend tweet other than a memo that Ulrich Körner, the chief executive of Credit Suisse, had sent employees the day before, reassuring them that the bank was in good financial health.

But the tweet, which has been liked more than 11,000 times and retweeted more than 3,000 times, was one of many that helped ignite a firestorm on social media forums like Twitter and Reddit. The rumor that Credit Suisse was in trouble ricocheted around the world, stumping bank executives and forcing them to call shareholders, trading partners and analysts to reassure them that everything was fine before markets reopened on Monday.

Reached via private message on Twitter, Mr. Lewis said all he had looked at before sending out his tweet was Credit Suisse's "low stock price and memes on Reddit."

A storied institution had become a meme stock.

My advice is to completely ignore the idiotic, destructive, and market-manipulating investing commentary on Reddit and Twitter (TWTR). I can't think of a faster way to lose your money.

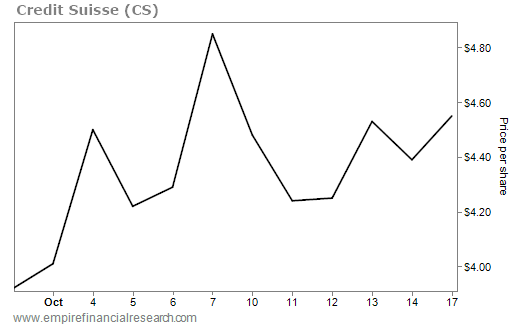

Just look at CS's stock over the past month... Rather than going to zero, as Mr. Lewis predicted, it's up 14% since his silly post:

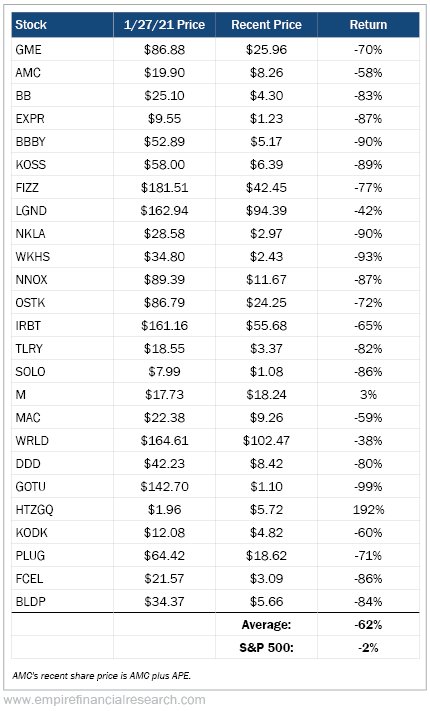

Or consider my Short Squeeze Bubble Basket – the 25 meme stocks I said to avoid the very day the meme stock bubble peaked on January 27, 2021. In a roughly flat market, they're down an average of 62%:

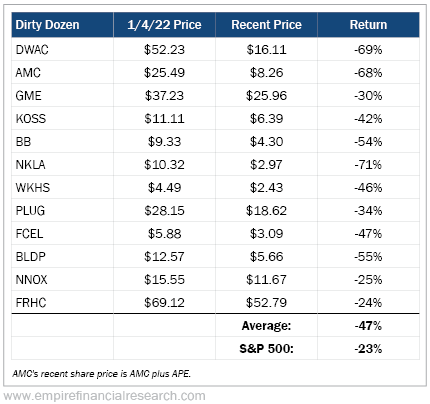

Lastly, look at the Dirty Dozen stocks I said to avoid on January 4 this year... The average decline is 47% compared with the 23% drop in the S&P 500:

A final example: I warned my readers about meme stock darling AMTD Digital (HKD) on August 3 (and multiple times since then) when it hit $2,118 per share, writing that it's "one of the most stupidly overvalued, obviously fraudulent stocks I have ever seen" and setting a price target of $1.36 per share.

Sure enough, it's around $30 today – down nearly 99% in two and a half months...

2) I neglected to send out an article by Jason Zweig in the Wall Street Journal when it ran a few weeks ago...

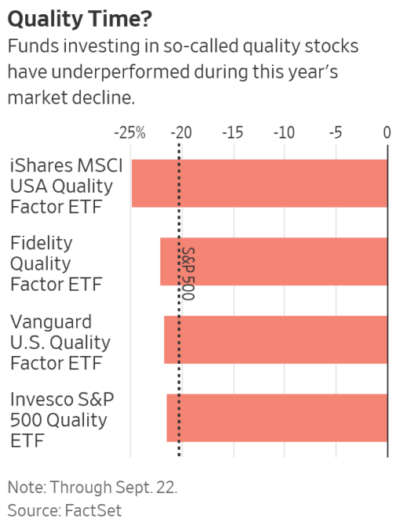

It further underscores that there have been few places to hide this year, even quality stocks, which have, very unusually, actually fallen more than the market because their valuations were so high: When Bad Things Happen to Good Stocks. Excerpt:

In this year's market bloodbath, you might think funds with "quality" in their name – and in their holdings – would lose less money.

You'd be wrong.

Quality funds, in Wall Street lingo, tend to own companies that are highly profitable, with steady earnings growth and low debt. In principle, such stocks as Home Depot (HD), Microsoft (MSFT), and 3M (MMM) are among the bluest of the blue chips. In practice, many funds holding them are in the red.

Over the past few years, exchange-traded funds specializing in quality stocks have grown to more than $60 billion. With the S&P 500 down 20% this year, several of these ETFs have fallen even harder, losing as much as 25%.

"It may have come as a shock to many investors that quality hasn't been performing defensively" in this year's market rout, says Denise Chisholm, director of quantitative market strategy at Fidelity Investments.

3) Following up on my September 22 e-mail that included a Barron's article about new weight-loss drugs, At Last, Weight-Loss Drugs That Actually Work, here's a Wall Street Journal article about how they're now "the talk of Hollywood, tech, and the Hamptons"... Very few people will admit to being on them, but Tesla (TSLA) CEO Elon Musk (to his credit) is one: How a Diabetes Drug Became the Talk of Hollywood, Tech, and the Hamptons. Excerpt:

The brand is not approved by the FDA for weight loss. But recently, Ozempic and other drugs of its kind have become the subject of conversations about weight loss, thinness and so-called biohacking in Hollywood, the tech industry, and beyond.

Ozempic, made by Novo Nordisk, is one of several brand-name drugs on the market containing an antidiabetic ingredient called semaglutide. Semaglutide stimulates insulin production and also targets areas of the brain that regulate appetite, according to the FDA. The federal agency has approved semaglutide for weight loss under the brand name Wegovy, which Novo Nordisk sells at a higher price than its cousin Ozempic.

Elon Musk, the Tesla and SpaceX CEO who has more than 100 million followers on Twitter, tweeted this month that he was taking Wegovy in combination with fasting to lose weight. Mr. Musk could not be reached for comment.

In late September, Andy Cohen, the Bravo host and "Real Housewives" executive producer, tweeted: "Everyone is suddenly showing up 25 pounds lighter. What happens when they stop taking #Ozempic ?????"...

"This is the Hollywood drug," said Patti Stanger, star and executive producer of the reality show "The Millionaire Matchmaker" who has also tweeted about Ozempic, in an interview.

"It's nationwide," Ms. Stanger said. "I have friends in Miami, I have friends in New York who are doing it."

Cat Marnell, a writer in New York City, said she first heard about Ozempic over the summer, while gossiping with friends about celebrities. "It's definitely a dinner conversation in the Hamptons," she said.

"Everybody I know is on it," Ms. Stanger added...

4) If you're like me and have complex tax returns due to running your own business and/or lots of income and losses from K-1s, investments, etc., you must hire a good tax preparer.

I had been doing my own taxes using TurboTax for my entire life, but this year I finally threw in the towel and hired someone a colleague referred me to: Ryan Deangler of Lombardo Ayers & Company in Annapolis, Maryland.

Thank goodness I did because Ryan discovered that TurboTax wasn't carrying over losses from previous years and, when he corrected for this mistake, it lowered my tax bill by a massive amount – exponentially more than what I paid Ryan.

I shudder to think how much extra I've been paying in taxes over the years by relying on TurboTax... What an idiot I was!

I hope you can benefit from my mistake...

If you want to hire Ryan, you can call him at (410) 263-4201 or e-mail him at RDeangler@lombardoayers.com.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.