I may have called another bottom to the day; Bill Ackman and my differing views on inflation; The joys of seven daughters

1) Last Wednesday, tech stocks had another terrible day, with the Nasdaq Composite Index falling 3.2%... bringing its year-to-date losses to a staggering 27.4%.

It smelled like a bottom to me, so I was buying aggressively in my personal account that day and the next – and shared this with my readers in Thursday's e-mail:

I'm starting to buy things I can value – the beaten-down stocks of real businesses that generate real cash flows.

Unfortunately, to prevent conflicts of interest, we at Empire Financial Research aren't able to own in our personal accounts anything we've recommended in our newsletters, so I can't buy my absolute favorite ideas, which include Berkshire Hathaway (BRK-B), Alphabet (GOOGL), Meta Platforms (FB), Amazon (AMZN), and Netflix (NFLX).

Yesterday and this morning, however, I did buy an exchange-traded fund ("ETF") that holds many big-cap Internet stocks, an online payments giant, a leading retailer, and a basket of four large bank stocks.

And in Friday's e-mail, I told the story of my friend's 12-year-old son, who's been a perfect contra-indicator, and concluded:

I don't want to put too much weight on one kid's behavior, but just as his tears marked the top of the bubble a year ago, his capitulation may well mark the bottom today...

Sure enough, the Nasdaq ripped 3.8% on Friday and another 2.8% yesterday, so I'm increasingly thinking that I may have correctly called another bottom to the day. Time will tell...

2) One of the reasons I've turned bullish on stocks is my view on inflation. In last night's special event (if you missed it, you can still catch the replay right here), I reiterated my view, which I've discussed at length in many previous e-mails, that it has peaked and I expect it to fall to around 4% – roughly half the current level – by the end of the year.

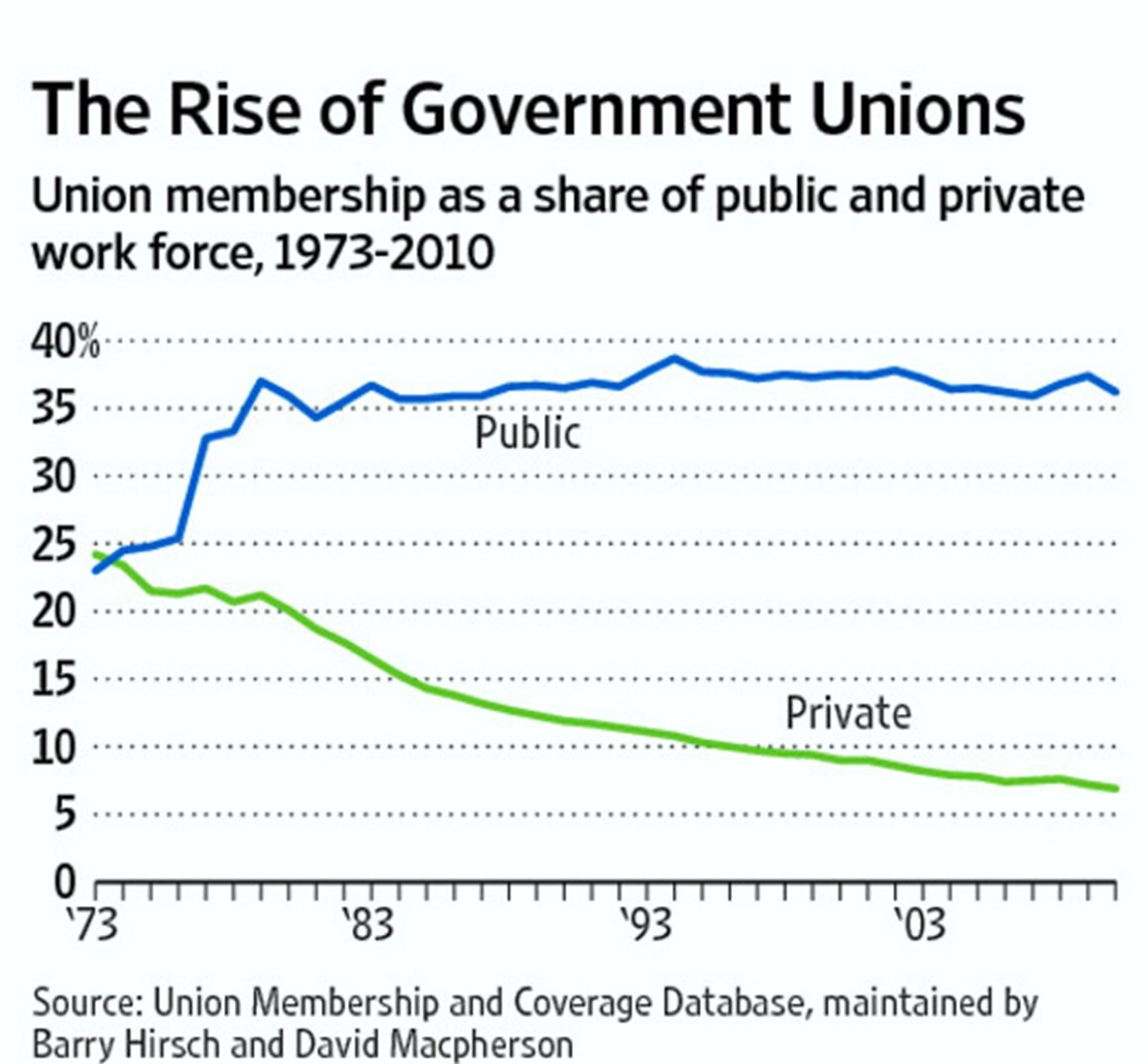

One little-discussed reason for my view is that unionization had dwindled to almost nothing in the private sector in the U.S., as you can see in this chart (the latest 2021 data is 6.1% for the private sector and 33.9% for the public sector):

While there have been some well-publicized successful unionization efforts at Starbucks (SBUX) and Amazon, the overall trend hasn't changed... which will make it difficult for employees to demand consistently higher wages that could fuel inflation.

I also think we're likely to avoid a recession, for the simple reason that consumer spending accounts for 70% of our gross domestic product – and it's on fire, as this Wall Street Journal article captures: U.S. Consumers Are Almost Too Healthy. Excerpt:

Retail sales are one of the first places investors turn to figure out how U.S. consumers are faring, but the sales data might be understating just how heady consumer demand is.

The Commerce Department on Tuesday reported that retail sales, which encompass spending in stores, at restaurants and online, rose a seasonally adjusted 0.9% in April from a month earlier. That was slightly below the 1% economists had forecast, but since it came alongside a big upward revision to the March retail sales figures – the Commerce Department now says they rose 1.4% from a month earlier as opposed to 0.5% – it counted as a solid report.

It counted as solid even with the context of what is happening with inflation, with sales last month rising at a faster clip than the 0.3% increase in overall consumer prices in April from March that the Labor Department reported last week...

Tuesday's report was taken on Wall Street as a sign that despite worries over inflation and the Federal Reserve's effort to slow the economy, the consumers are alive and kicking. They might be propelling the economy way past the Fed's goal posts.

If I'm right that inflation has peaked and we avoid a recession, then stocks are likely to rip going forward.

3) My view on inflation appears to be well out of consensus – most people I know think inflation is going to remain high and that the Fed will have to raise interest rates many times to rein it in, which would continue to pressure stocks.

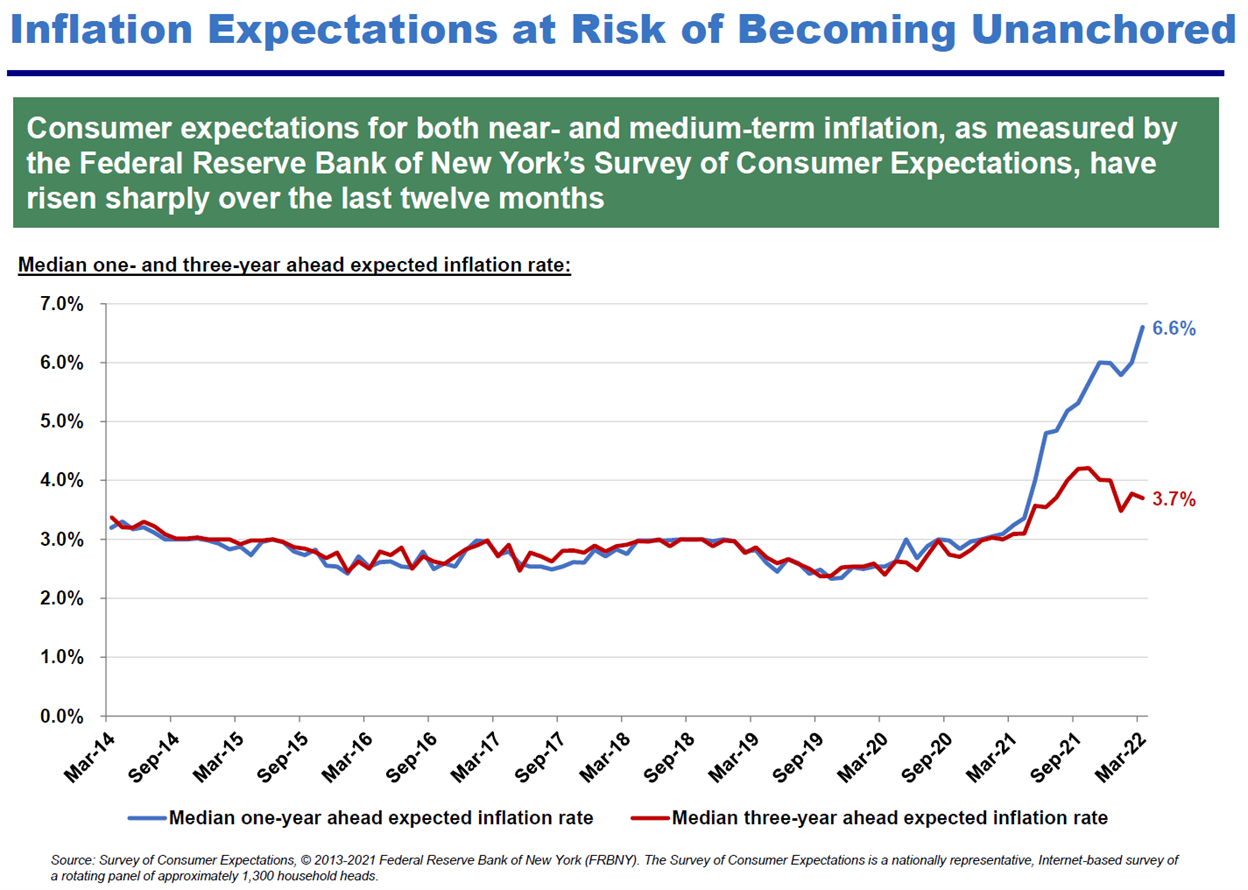

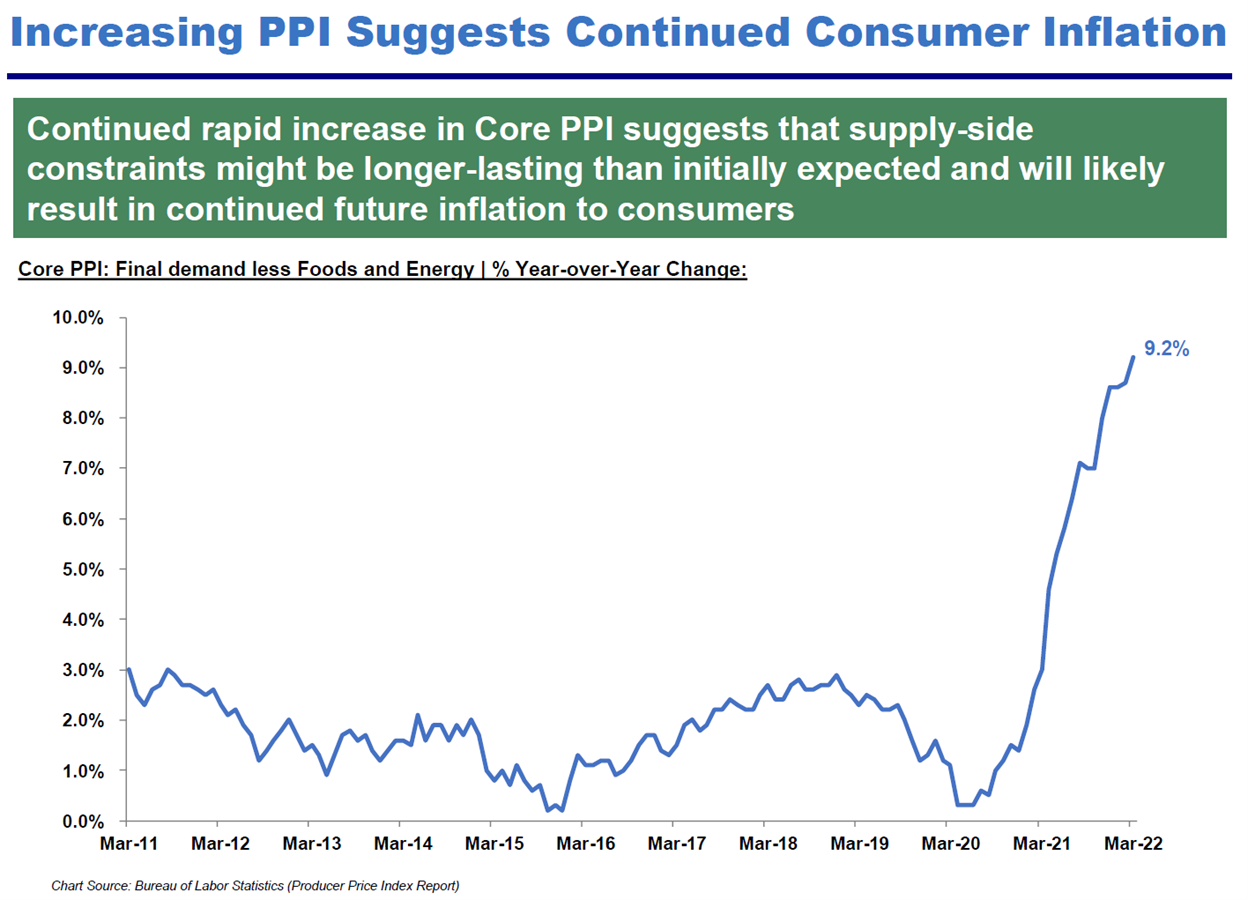

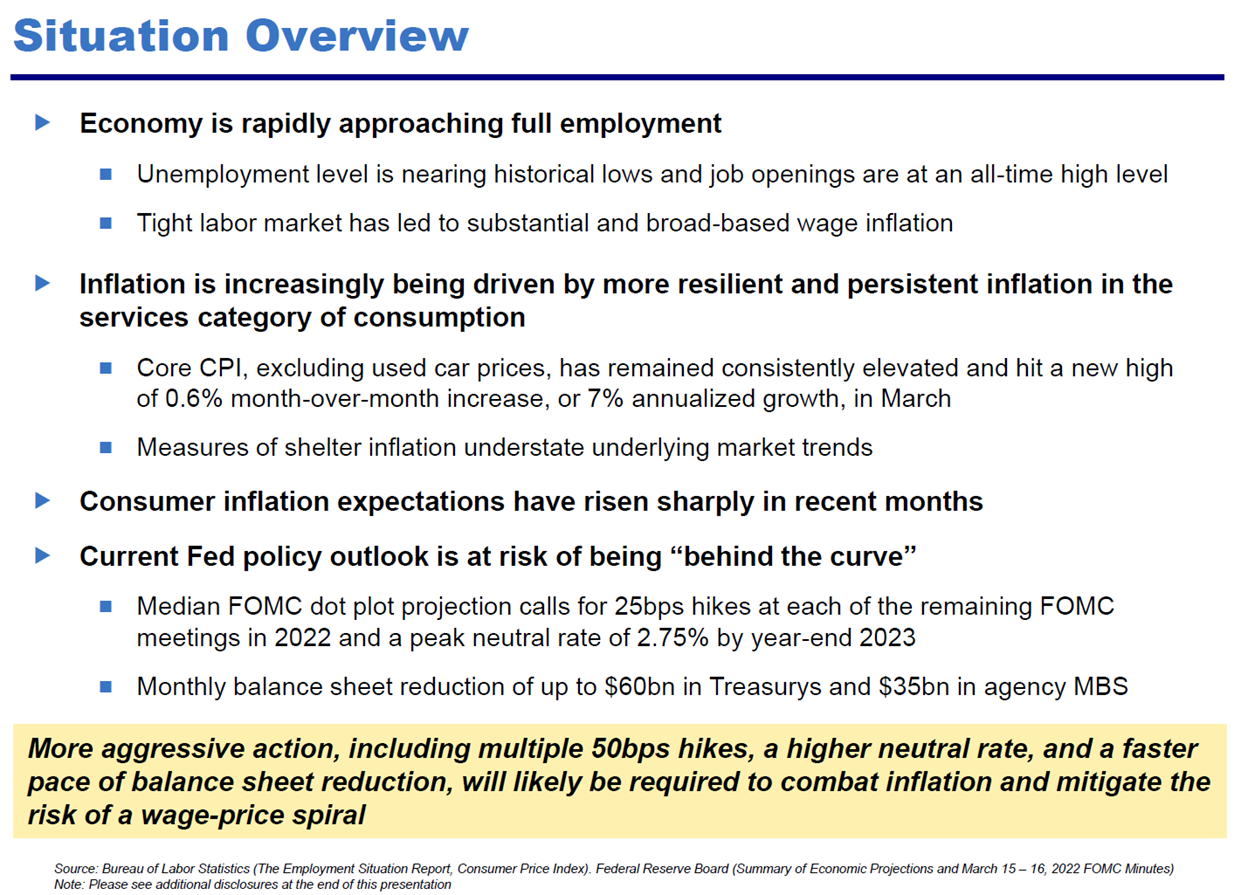

One such person is my college buddy, Bill Ackman of Pershing Square Capital Management, who recently tweeted a link to the 17-slide presentation he gave to the New York Fed on April 13.

Here are a few key slides from his presentation:

4) While Bill and I disagree on the outlook for inflation, we definitely agree on how wonderful daughters are – he has four, while I have three. I got him a customized version of my favorite T-shirt that reads, "You can't scare me. I have three daughters," as you can see in this picture from a year ago:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.