I saved one of my readers $222,318; Comparing Tesla to Amazon; SEC Suspends Trading in 15 Stocks That Got Hyped on Social Media; For the Economy, the Present Doesn't Matter

1) I spend a lot of time in my daily e-mails highlighting risky sectors of the market, fraudulent companies, and/or overhyped stocks.

I do so to help my readers spot investments that might blow them up – either before they invest or, if they already own them, in time to dump them.

So I was really happy to read this e-mail from an old friend who was one of the first Lifetime subscribers to Empire Financial Research. He read what I wrote in my January 21 e-mail – "Veteran short-sellers know that hydrogen fuel cell company Plug Power (PLUG) is nothing but a long-running promotion, dating back more than two decades" – and took action:

When you sent your email on January 21 telling your subscribers what a turkey Plug Power is, it triggered a memory that one of the advisory firms I use owned the stock in one of my accounts.

Sure enough, when I checked, I discovered that I owned 10,350 shares (at a cost of around $8/share), with the stock trading at $63.80/share. I immediately ordered them to sell all of the shares based on your information.

As of this afternoon, it's now trading at $42.32, meaning you saved me $222,318... thus far!

Needless to say: thank you, and keep up the good work!

You know, I gotta figure out what's in the water this guy's drinking because he already made in excess of $10 million – more than 2,000 times his subscription cost! – on just one of our ideas, Virgin Galactic (SPCE), by buying the warrants when we recommended them in the December 2019 Empire Investment Report (at the time the stock was at $10.20 and the $11.50-strike warrants were at $2.50).

To my knowledge, that's an all-time record in the investment newsletter industry for profits made by one customer on one idea (in a matter of weeks, no less)!

And, for all I know, saving a client $222,318 (also in a matter of weeks) might be a record as well!

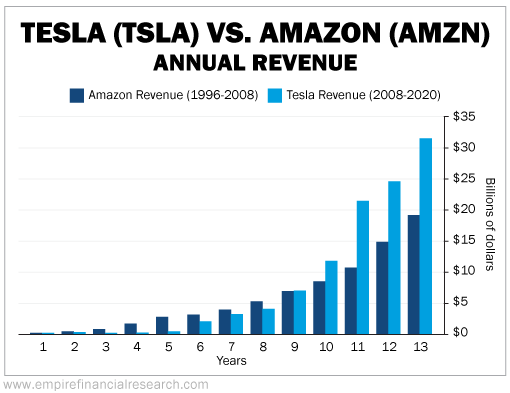

2) Following up on what I wrote about Tesla (TSLA) in Monday's e-mail, my analyst Kevin DeCamp put together this interesting chart:

As you can see, Tesla's revenue growth over 13 years, from 2008 through 2020, exceeded even the revenue growth of mighty Amazon (AMZN) during a comparable period from 1996 to 2008.

Ah, so this is powerful evidence that Tesla's stock might be a good buy today, right?

Not so fast...

While many investors seem to have forgotten this, valuation matters!

I asked Kevin, without looking at historical data, what he thought Amazon's market cap was at the end of 2008 – the last year shown in his chart – when the company generated revenue of $19.2 billion. His guess:

It was in the middle of the financial crisis, which would have depressed the stock price so... $60 billion, or 3 times sales? (All I know for sure is I blew it by missing that crisis low and didn't start buying the stock until years later when it was around $260 per share 😉)

My guess was $30 billion, or 1.5 times sales.

(Before you read on, take a guess...)

The answer: Amazon closed at $51.28 per share on December 31, 2008, giving the company a market cap of $22.2 billion... meaning it was trading at just 1.2 times sales!

In contrast, while Tesla has indeed grown its revenue faster – totaling $31.5 billion last year – its stock closed last year at $705.67 per share... giving it a mind-boggling market cap of $764.2 billion. That's equal to 24.3 times sales!

I e-mailed Kevin: "I'd buy TSLA all day long at 1.2 times sales, but not 24.3 times sales!"

To which he replied:

You could have (almost) less than two years ago...

On June 3, 2019, the day Tesla bottomed at $35.79 per share (adjusted for the subsequent 5:1 split), having been more than cut in half over the previous six months, the stock was trading at only 1.4 times sales.

In the 21 months since then, the stock is up 19 times!

So why didn't I buy it then? Because I'm an idiot!

That said, I continue to tell my short-selling friends that they're crazy to short an open-ended situation and ultimate story stock like TSLA, and I think those who are buying it today at 23.2 times sales are unlikely to do well over time due to the enormity of the market cap and the extreme valuation...

(But you have a 99% chance of doing better than the suckers buying GameStink (GME) at $250 per share – they will very quickly be incinerated once again! I am so disgusted and disheartened...)

3) With animal spirits once again running rampant in the markets yesterday, this is good to see: SEC Suspends Trading in 15 Stocks That Got Hyped on Social Media. Excerpt:

U.S. regulators are engaging in the stock market's version of whack-a-mole – racing to suspend shares of companies with dubious prospects that have been hyped to the moon on social media.

In a Friday statement, the Securities and Exchange Commission said it temporarily halted trading in 15 companies due to concerns that their stock prices were artificially inflated. One of the companies, a penny stock called Blue Sphere (BLSP), was recently highlighted in a Bloomberg News story after spiking in value following a barrage of posts on online message boards.

"We proactively monitor for suspicious trading activity tied to stock promotions on social media, and act quickly to stop that trading when appropriate to safeguard the public interest," Melissa Hodgman, acting director of the SEC's enforcement division, said in a statement.

The SEC crackdown adds to the fallout from the GameStop frenzy, in which an army of day traders banded together to drive long-ignored stocks to the stratosphere. The regulator has routinely sought to remove moribund companies from exchanges because it's worried about retail investors suffering losses, but that effort has picked up pace amid this year's wild trading.

In Friday's action, regulators are venturing further into one of the market's rowdiest districts, targeting penny stocks driven into price and volume frenzies by incessant social media pumping. Frenetic trading, often in profitless companies, on lightly regulated broker networks is perhaps the most extreme example of speculative excess in the 2021 market, a landscape that has also included the SPAC craze and soaring cryptocurrencies.

4) Here's a good article in the New York Times about the key challenges facing the economy and what investors should be keeping an eye on: For the Economy, the Present Doesn't Matter. It's All About the Near Future. Excerpt:

For a simple model of today's economy, think of it this way: A giant, complicated assembly line has been shut down for a year, and it is now being fired back up. Different stations on the assembly line are coming back at different speeds. The number of final products currently rolling off the assembly line is less important than the details of the progress all those different stations are making (or not) toward returning to full capacity.

In normal times, the total employment gains reported Friday would be a blockbuster number. But continuing to add jobs at that pace would still mean a two-year grind back to pre-pandemic employment levels. The question is whether job creation will accelerate in the months ahead as more Americans are vaccinated and begin to resume normal patterns of behavior, especially regarding travel and entertainment...

Things remain murky on the longer-term implications of the crisis. The surge in employment in February was entirely driven by people no longer being on temporary layoff – the number of these temporarily unemployed workers fell by 517,000 people. The number of permanent job losers remained steady at astronomical levels – 2.2 million higher than a year ago.

That raises questions about which jobs destroyed during the pandemic will come back. Are there certain patterns of behavior and business models that are gone forever? And what will the people who once worked in those businesses do now?

That's the hardest question about the future. It is easy to describe the pathway back for jobs at schools and restaurants. But true economic health will mean that those 2.2 million people find their way back into the ranks of the employed as well, and that could take more than just a shot in the arm.

Best regards,

Whitney