Inflation continues to trend downward; The only Sam Bankman-Fried interview you should believe; More possible bad news for Bankman-Fried; Day trip to Toronto; The best way to get to Newark Airport from NYC

1) A week from tomorrow (December 13), the U.S. Labor Department will release its latest inflation report for the month of November.

After peaking at 9.1% in June, inflation has been declining (as I predicted) for the past four months: 8.5% in July, 8.3% in August, 8.2% in September, and 7.7% in October.

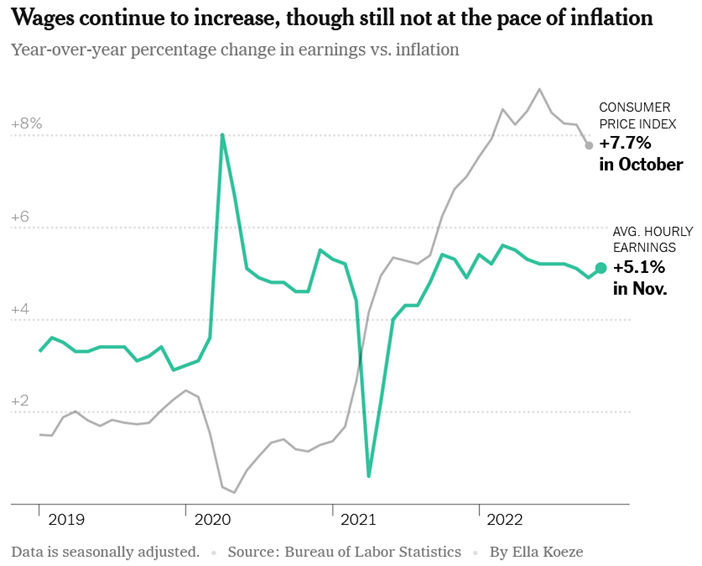

I believe inflation is almost certain to continue declining, even though wage growth was 5.1% in November – slightly higher than expected.

Here's a chart showing both inflation and wage growth over the past four years (from this New York Times article: U.S. Job Growth Remains Strong, Defying Fed's Rate Strategy):

The government's inflation number is based on roughly three equal factors: wages, shelter, and goods and services (gas, food, etc.).

As you can see from the chart above, wage growth, while substantial (a good thing for workers!), is pulling inflation down.

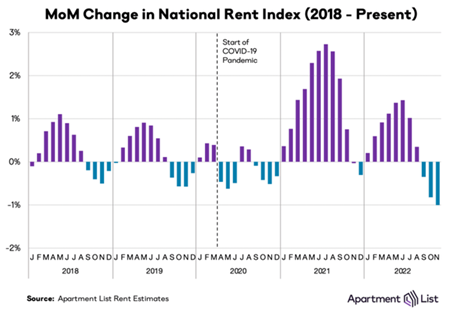

As for shelter, the government measures this on a blended historical average, which doesn't yet fully reflect the sharp, rapid pullback in both rents and housing prices. Here's NYT columnist and Nobel Prize-winning economist Paul Krugman on this:

About Powell's speech: I was especially gratified to see him noting that market rents have been moderating fast, a development that will predictably lead to a falloff in official shelter inflation – which in turn plays a huge role in standard measures of underlying inflation – some time next year. Unfortunately, the chart he presented showed changes over the past year, which is too long a stretch: The big falloff in rents has taken place just over the past few months. For example, here's rent data from Apartment List:

Rents normally decline in the fall, but the recent decline was much bigger than seasonal factors alone can explain. So one main component of inflation is set to come way down.

And already, if we use market rents instead of the official shelter measure, which lags rents by many months, we get "core" inflation of less than 3% recently. But I wouldn't go to the wall for that estimate on its own.

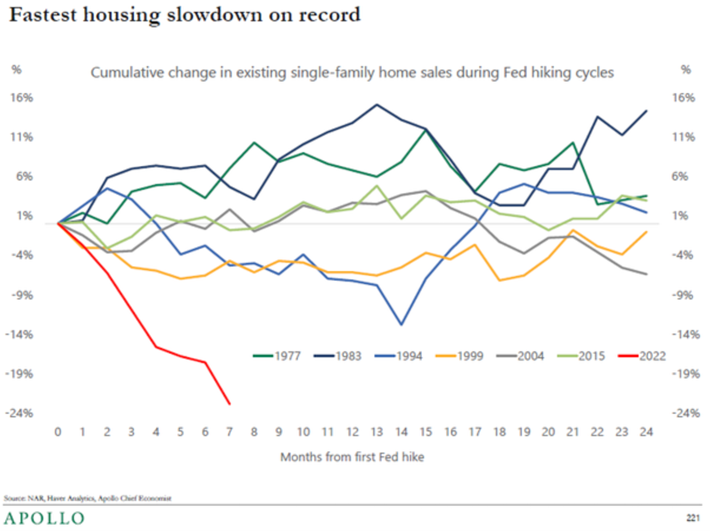

Here's another chart on the housing market:

Finally, here's one more:

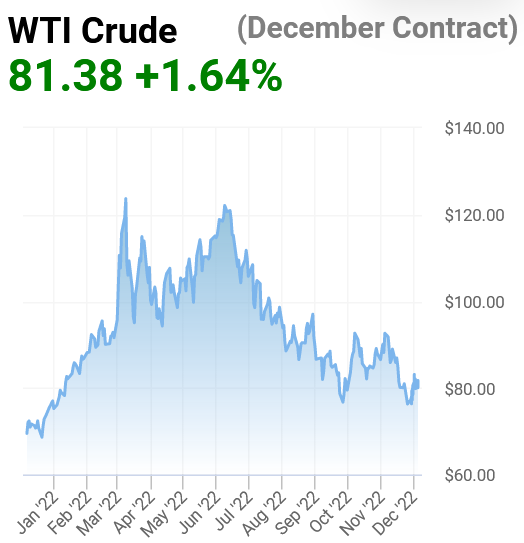

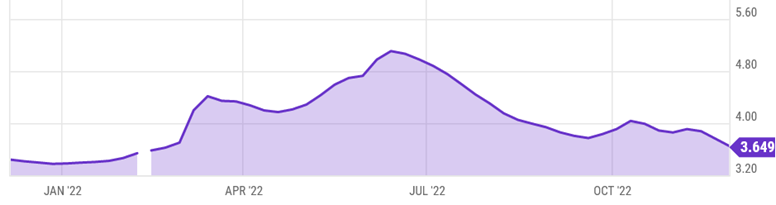

Lastly, the prices of most everything else are falling as well. This chart shows the price of oil over the past year:

This has translated into lower prices at the pump – as this chart shows, gas prices are down nearly 30% from the peak in mid-June:

Used car prices are crashing, as this tweet shows:

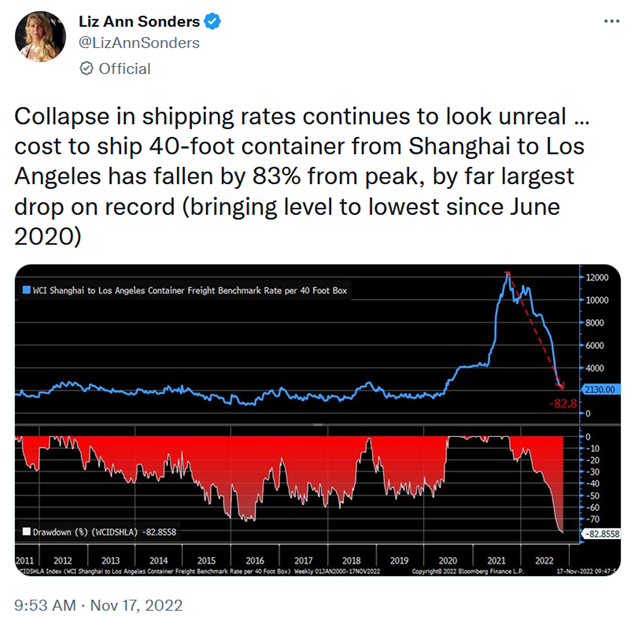

Shipping rates have plunged, as this next tweet shows:

And this tweet shows that supply chain pressures have eased:

In conclusion, inflation is on a nice downward trajectory, which means the Fed will likely start easing up on its tightening campaign – setting up the market for a strong 2023.

And I'm not alone with this outlook... My colleague Herb Greenberg shares my optimistic views on the market in 2023.

In a brand-new presentation, he explains why he's so bullish... and shares one of his favorite stocks to buy right now, ticker symbol and buy-up-to price included. You don't need to enter an e-mail address, credit-card information, or phone number for this free stock pick.

This presentation won't be available for long... I urge you to watch it while you still can by clicking here.

2) Sam Bankman-Fried ("SBF"), the disgraced founder of FTX and Alameda Research, has been giving so many interviews that I can hardly keep up with all of them...

For those of you who share my fascination with this train wreck, here are links to the latest interviews with and articles about him:

- FTX Founder Sam Bankman-Fried Says He Can't Account for Billions Sent to Alameda (Wall Street Journal)

- 'We kind of lost track': how Sam Bankman-Fried blurred lines between FTX and Alameda (Financial Times)

- What Does Sam Bankman-Fried Have to Say for Himself? (New York Magazine)

I'm mostly ignoring all of the recent interviews because he's clearly lying like crazy to try to stay out of jail...

However, there is one interview I do trust: the one that was published by Vox on November 16, Sam Bankman-Fried tries to explain himself, in which he messaged for an hour with Kelsey Piper, whom he thought was a friend (and thus thought it was off the record and revealed what he was really thinking).

He wrote:

- "F**k regulators"

- "I didn't mean to do sketchy stuff"

- "All the dumb sh*t I said, it's not true, really"

- "yeah, I mean that's not *all* of it, but it's a lot"

- "ya, hehe, I had to be, it's what reputations are made of, to some extent, I feel bad for those who get f**ked by it, by this dumb game we woke westerners play where we say all the right shiboleths and so everyone likes us"

3) It's possible that this is a case of mistaken identification... but if Caroline Ellison – SBF's ex-girlfriend and former head of Alameda Research – is, in fact, in the U.S., this is likely bad news for SBF, as outlined in this tweet:

This New York Magazine article highlights why: Sam Bankman-Fried May Regret His Comment on Caroline Ellison.

4) The funny memes continue to pour in – this 28-second video is hilarious:

5) As you read this, I just landed in Toronto – I'm here for just a few hours for a friend's father's funeral.

It's an easy day trip from New York, especially since I'm flying Porter Airlines from Newark to Billy Bishop Airport, which is much closer to downtown Toronto than the main Pearson International Airport (imagine there was an airport on Roosevelt Island in New York City).

The worst part of the trip is getting to and from Newark – but it's not so bad now that I've discovered taking public transportation rather than a taxi.

I rode my bike to Penn Station, took an NJ Transit train (costing $15.50) for three stops, hopped on the AirTrain (no charge if you scan your train ticket), and was at Terminal B 80 minutes after I left my apartment – sweet!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.