Interviews with Lee Ainslie, Chris Mayer, and Stanley Druckenmiller; FTX Sues Sam Bankman-Fried's Parents to Recover 'Misappropriated Funds'; Charity poker tournament

1) Today, I'd like to highlight recent interviews with three great investors I admire that I enjoyed and learned from...

Let's start with Patrick O'Shaughnessy's interview of my old friend Lee Ainslie, the founder of hedge Maverick Capital. Summary:

Lee started his investing career at Tiger Management where he worked for Julian Robertson. In 1993, he left to start Maverick and has built the firm into one of the top-performing hedge funds of the last 30 years.

Lee doesn't speak in public often so this is a fascinating insight into what it takes to build an enduring investment business – both psychologically and operationally. Throughout the conversation, we flick between his lessons building Maverick, his perspective on the market, and what he's learned about the craft of investing.

Here are the show notes:

(00:03:00) – (First question) – Lee tells us about his relationship with Steve Mandel

(00:04:29) – Why he thinks Steve gave him a hand into the role he excelled at

(00:07:22) – The concept behind investment talent

(00:13:08) – Steps he takes to hire the right individuals for his team

(00:16:14) – Why he stepped out on his own to start Maverick Capital

(00:20:48) – What he thinks makes for a great investment or stock purchase

(00:25:16) – How Maverick maintains its edge over other comparable firms

(00:28:31) – Features of a business that get his attention in a unique way

(00:32:03) – What he learned from Sol Price

(00:38:21) – The difficult aspects of portfolio construction

(00:42:04) – How zero interest rates affected the long short style of investing

(00:47:22) – Positioning his team for success against other competitors

(00:50:32) – How private market activity can affect public market activity

(00:54:27) – Software companies and their strengths and weaknesses in the investment market

(00:59:33) – Things he tells his team to watch for

(01:04:10) – What Lee's learned about money

(01:07:02) – The most important conversation he's had in Mavericks history

(01:12:38) – Advice for senior executives trying to pass on responsibilities to others

(01:17:54) – What the next ten years for Maverick Capital look like

(01:20:42) – Things Lee and Warren Buffett disagree on

(01:24:11) – The components of a great investment pitch

(01:25:08) – The hardest question anyone could ask him

(01:28:48) – What he thinks is important having started Maverick Ventures

(01:31:32) – The kindest thing anyone has ever done for Lee

2) Here's the transcript of an interview with another old friend, Chris Mayer, author of the book: 100 Baggers: Stocks That Return 100-to-1 and How To Find Them. Excerpt:

How do you know when you're wrong?

I got a lot of questions basically asking this (when to sell, etc.). I think selling is the hardest thing to do well in investing. And I don't know that I have anything particularly fresh or new to say about it.

One thing I'll say is it helps to write your thesis down. Clearly articulate why you own a certain stock. Use bullet points if that helps. Don't have too many. Maybe just three to five key points that are essential. You don't want to get lost in details that don't matter much. And you want to give your businesses some room to disappoint you now and again. Owning a business for a long time means you're going to own it during a stretch when it isn't at its best.

But if the long-term thesis is still intact, you're probably better off holding on. When the reason you own something is no longer valid, it's probably time to move on. Writing it down gives you a way to help keep yourself honest.

Selling is hard. Embrace a strategy that has you do less of it! I'm only half-kidding. For a great piece on "the art of (not) selling," I can't recommend this enough by Chris Cerrone at Akre.

Another way to think about it is to invert the question. Reasons not to sell? Thomas Phelps in 100 to 1 in the Stock Market offered the following:

- My stock is "too high"

- I need the realized capital gain to offset realized capital losses for tax purposes

- My stock is not moving. Others are.

- I cannot or will not put up more money to meet my margin call

- Taxes will be higher next year

- New management

- New competition

Number 4 is kinda funny. Kids, don't use margin!

In your experience, what is the most important trait an investor should develop for long-term success?

Patience. The ability to sit on a great business for two decades is a superpower worth cultivating. It's how 100 baggers are born.

If you were to be even more concentrated and own only three of the stocks from your portfolio – which stocks would you own?

1. Constellation

2. Copart

3. Teqnion

3) Lastly, here's a recent interview with Stanley Druckenmiller, where he confesses that across his entire 40-year career he doesn't think he's made money shorting.

I regularly write about stocks I think my readers should avoid, but don't recommend shorting. For a variety of reasons that I outlined in a series I published from December 12 to December 22 last year, it's just too hard. If even one of the greatest investors of all time can't make money doing it, what chance to the rest of us have?

4) I wrote extensively last year about the implosion of cryptocurrency exchange FTX and the arrest of its founder, Sam Bankman-Fried. While he is of course entitled to his day in court, which begins on October 3, my view is that he is knowingly committed brazen fraud and hence will be convicted and spend at least a decade, probably two, in prison.

In an interesting twist, it now appears that his parents, both professors at Stanford Law School, were also complicit in the fraud. Here's a story in the Wall Street Journal: FTX Sues Sam Bankman-Fried's Parents to Recover 'Misappropriated Funds' Excerpt:

FTX has sued founder Sam Bankman-Fried's parents to recover millions of dollars in "fraudulently transferred and misappropriated funds," the company said in a court filing late Monday.

Joseph Bankman and Barbara Fried, both Stanford Law School professors, "exploited their access and influence within the FTX enterprise to enrich themselves," the company, operated in bankruptcy by new management, alleged.

The lawsuit, filed in a Delaware bankruptcy court, is the latest attempt by FTX's chief executive, John J. Ray III, to claw back some of the funds that Bankman-Fried paid out to relatives and business associates prior to the cryptocurrency exchange's collapse last November.

And here's Bloomberg's Matt Levine with more. Excerpt:

... part of the evidence is that, while Fried is a political philosopher and a theorist of not blaming people, Bankman is a tax professor and, apparently, a theorist of not paying taxes. And he seems to have been involved in the tax structuring of how to get money out of FTX:

In a January 2022 email exchange with Friedberg, Bankman-Fried, and others, Bankman proposed a series of possible non-taxable methods to structure a transfer of $10 million from the FTX Group to himself and Fried. In fact, Bankman proposed that, "he easiest way is to add 10M to the 250M loan Sam has from Alameda. Then, Sam gifts the money. No current tax on either transaction. Eventually, Sam recognizes income when the loan is paid off or cancelled, at the dividend/capital gain rate, but that can happen in a year when he donates a lot, offsetting some or all of the tax"...

Heeding Bankman's advice, Friedberg agreed the $10 million gift should be papered as a loan to Bankman-Fried, and then be gifted to Bankman and Fried. Bankman-Fried could then transfer the "loaned" funds directly into an account belonging to Bankman and/or Fried. There is no indication that Bankman-Fried intended to repay the so-called loan. Indeed, both Bankman and Fried acknowledged that the $10 million payment to them was a gift, as indicated by an email from Bankman to Bankman-Fried, stating: "We are so touched by this gift. Mom is announcing retirement, which she would not have done otherwise."

And in the structuring of how to keep the money out of FTX:

In November 2021 ... Bankman began discussions about bankruptcy protection for the FTX Group. The General Counsel of Alameda and FTX Trading, in an email including Bankman, asked Law Firm-1 to schedule a call to discuss "how assets including primary residence can be structured to be bankruptcy-remote." (Emphasis added)

The following day, Bankman initiated a discussion with Friedberg and General Counsel of Alameda and FTX Trading opining that, "t would be great, all else equal, if we could, have the founders put money into property in the Bahamas," included a link to https://www.offshorecompany.com/trusts/bahamas-asset-protection/, and sprang into action to find outside counsel to pursue this effort. After collecting viewpoints from a fellow Stanford Law School professor, local counsel in The Bahamas, and his brother-in-law, Bankman determined that an overseas asset protection trust was "something we might use when we buy property in the Bahamas," but "the real issue is whether these things work in the U.S., and to what extent."

Yeah look if you help run a crypto company that goes bankrupt and loses $8 billion of customer money, you don't really want "https://www.offshorecompany.com/trusts/bahamas-asset-protection/" in your search history. Absolutely none of the words in that address sound good in this context. If you think that your exchange is going great and printing money and will never fail, and that there's plenty of cash to lavish on personal expenses, then you probably don't worry that much about keeping your assets bankruptcy-remote.

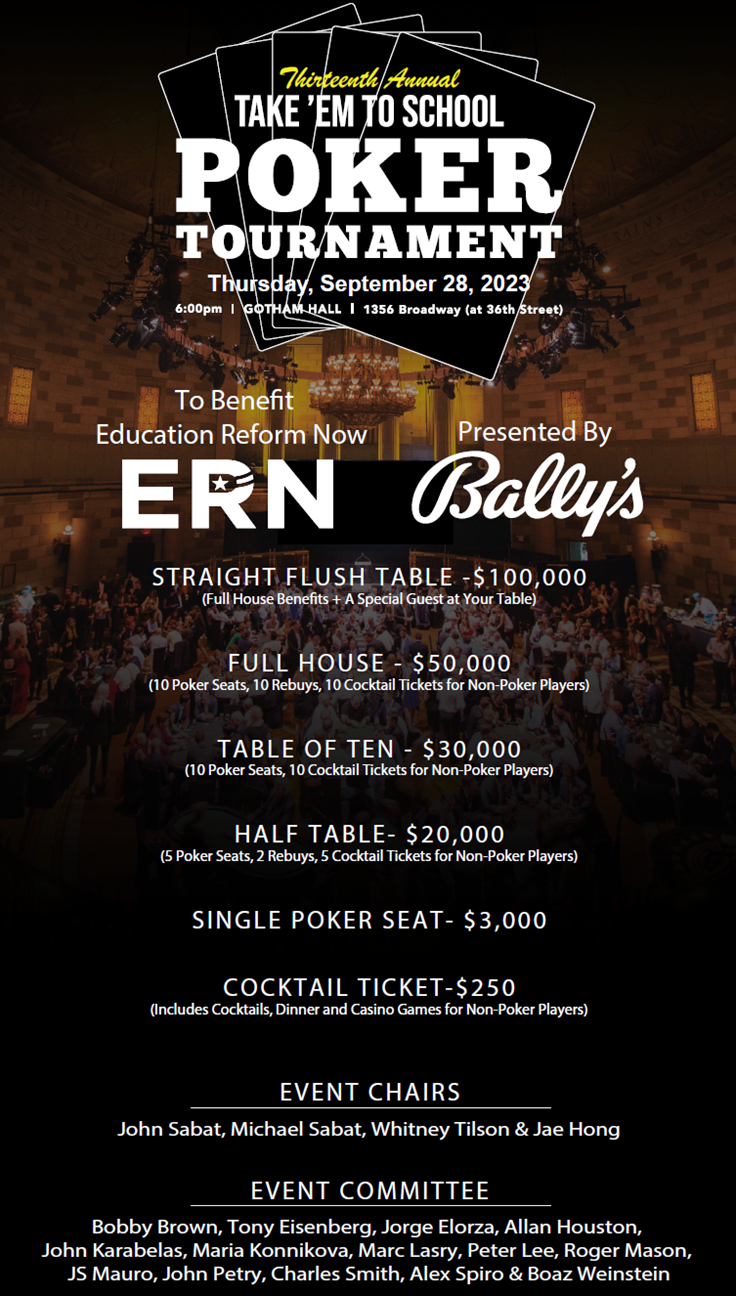

5) Please join me at the 13th annual Take 'Em to School Charity Poker Tournament at Gotham Hall next Thursday, September 28 at 6 p.m. Eastern time at Gotham Hall at 1356 Broadway in New York!

It benefits Education Reform Now ("ERN"), a wonderful nonprofit organization I co-founded that is committed to ensuring that all children have access to a high-quality public education – regardless of race, gender, geography, or socioeconomic status.

The event will feature poker players battling for prizes that in past years have included two courtside tickets to a Milwaukee Bucks home game with Marc Lasry (including private air transportation to the game), a Sebonack golf trip with one night cottage stay, a table at Rao's for four, power lunches with some of the world's top investors, a set visit for The Walking Dead, a poker lesson with Phil Ivey, four tickets to Hamilton on Broadway with a backstage experience, a four night stay at the Baha Mar resort in the Bahamas, dinner and DJ booth experience with Steve Aoki, a New York Jets training camp experience for four, tickets to the Grammys, and a two-night stay for four with four rounds of golf at Ardfin (including roundtrip airfare from New York City to Glasgow).

For those attending as cocktail guests there will be a variety of casino games, prizes, and entertainment. The event also features a full swing golf simulator, which will host the longest drive and closest to the pin contests.

Click here to view WPT's highlight video from last year's event.

For information about purchasing tickets or tables, e-mail events@takeemtoschool.org or visit our website.

I hope to see you there!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.