Judge McCormick mostly rules against Elon Musk; Kohl's terrible Q2 and reckless share repurchases; Stock Buybacks and Dividends Become a $1.5 Trillion Political Target; Many types of leisure time activities may lower risk of death for older adults

1) As Twitter (TWTR) and Tesla (TSLA) CEO Elon Musk prepare for the upcoming trial that will determine whether Musk has to honor the contract he signed to buy Twitter for $54.20 per share, the combatants are engaged in preliminary skirmishes about the scope of discovery that each side will be permitted.

On Wednesday, the Delaware Chancery Court judge who is hearing the case, Kathaleen McCormick, heard arguments. Yesterday – less than a day later – she issued three rulings that were, on balance, very favorable to Twitter. In one instance, she gave Musk a true smackdown...

Defendants' data requests are absurdly broad. Read literally, Defendants' documents request would require Plaintiff to produce trillions upon trillions of data points reflecting all of the data Twitter might possibly store for each of the approximately 200 million accounts included in its mDAU count every day for nearly three years.

Plaintiff has difficulty quantifying the burden of responding to that request because no one in their right mind has ever tried to undertake such an effort. It suffices to say, Plaintiff has demonstrated that such a request is overly burdensome.

Here's a friend's take on the events of the day:

Judge McCormick continues to impress and managed to spit out her rulings in record time.

In short, Musk got nothing except for 9,000 entries from Twitter from an analysis they had run for the fourth quarter of 2021. She dismissed the rest of Musk's request, calling it "absurd."

She ended the ruling with a stern warning to Musk: "As a word of caution, Defendants are reminded that a large volume of logged entries can raise a red flag for the court."

In summary, Twitter got 90% of what it wanted and Musk got 10%. More importantly, McCormick's tone makes me even more convinced Twitter will prevail 100% in terms of the final verdict following the October trial.

As this becomes clear to Musk, I can imagine him tweeting: "Twitter is not responding to requests for settlement talks; what's wrong with these people?"

The answer, of course, is that Twitter is more confident than ever that they will get $54.20 per share, perhaps with some damages in addition, so they have zero interest in any settlement.

Which of course means that there may still be a settlement...

2) My friend David Berman of Durban Capital closely follows every major U.S. retailer, so I paid attention when he sent me this e-mail after Kohl's (KSS) reported second-quarter earnings last week...

Kohl's took down EPS guidance from $6.45-$6.85 to $2.80-$3.20 – CRAZY!

In the last three years, sales are down 8%, yet inventories are up 10% – not good. And payables are 60 days – already stretched.

Worse yet, they announced a $500 million accelerated share repurchase program, which is ludicrous.

In the past year, net debt has nearly doubled from $4 billion to $7.4 billion thanks to massive inventory build, capex, and recklessly buying back $1.2 billion of stock.

This is a classic example of how a weak CEO and board can possibly put a retailer into bankruptcy.After shocking second quarter numbers, due largely to dumping excess inventory, they're making a bad situation worse, straining their already stretched balance sheet by buying back stock to try to increase EPS through accretion. How myopic.

There's a high chance that the company will become distressed, resulting in the sacking of CEO Michelle Gass.

Shareholders should be furious about the company's foolish buybacks, but they're apparently either short-term oriented or just don't get it.

Thank you, David!

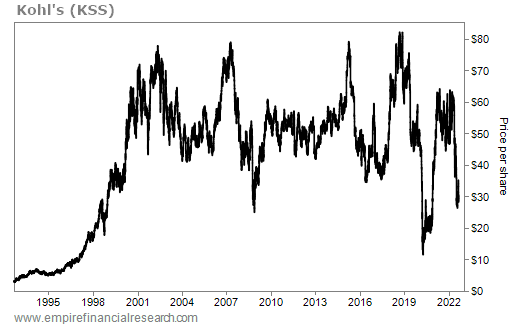

His e-mail led me to run some numbers on Kohl's. First, I pulled up a long-term stock chart. I discovered, to my great surprise, it's back to the price it first reached in 1999, as you can see in this 30-year stock chart:

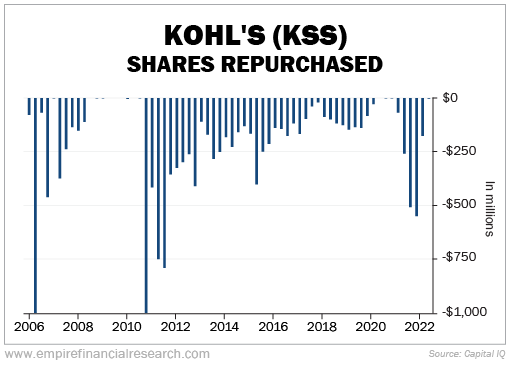

Then I looked at how much Kohl's has spent on share repurchases each quarter since the company started the program in early 2006:

In total, the company has spent a staggering $13.2 billion buying back its own shares.

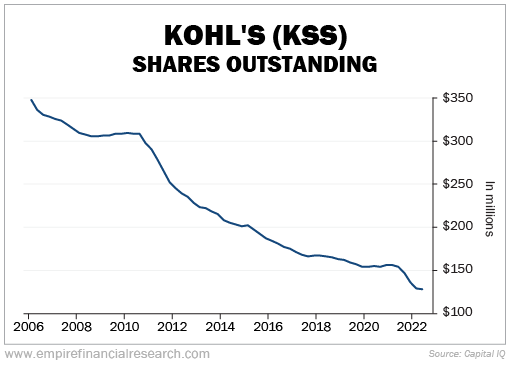

As a result, the share count has dropped by 63% from 347 million diluted shares to 128 million:

So was that $13.2 billion of shareholders' capital well spent? To answer that, look at the stock, which exceeded $50 when the program began more than 16 years ago versus $30 today, and consider that the company today has a market cap of only $3.9 billion (plus $7.4 billion of net debt, for an enterprise value of $11.3 billion).

3) Though I decry misguided share repurchases, I have no problem with the concept. Done wisely, they can be a smart use of excess capital and create tremendous value for shareholders.

Just look at auto parts retailer AutoZone (AZO), which has bought back an astonishing 87% of its stock in the last 24 years, which has been a major contributor to the stock going up 75 times!

The key words, however, are "done wisely." AutoZone is a much better business than Kohl's. It generates consistent, strong free cash flows, which is why substantial, sustained share repurchases make sense.

Here's a recent New York Times article on this topic: Stock Buybacks and Dividends Become a $1.5 Trillion Political Target. Excerpt:

Despite the rocky stock market and the slowing economy, corporate America is sending more money to shareholders than ever before.

The amounts are staggering, which is why these huge sums, sometimes called "windfall profits," have become a political target.

The landmark climate and tax legislation that now goes to President Biden for his signature includes a new 1 percent tax on buybacks, for example.

Senator Chuck Schumer, the New York Democrat and Senate majority leader, announced the new tax with a succinct critique. "I hate stock buybacks," he said. "I think they are one of the most self-serving things that corporate America does."

Yet buybacks and dividends are immensely important to investors.

Consider that companies in the S&P 500 will spend more than $500 billion on dividends this year and more than $1 trillion on share buybacks, according to Howard Silverblatt, senior index analyst for S&P Dow Jones Indices. That's a combined $1.5 trillion, more than ever before.

No wonder these enormous cash flows are capturing attention.

As investors, consumers or just plain citizens of the planet, it's worth considering the significance of buybacks and dividends – whether they are a form of self-serving corporate profligacy, a wise use of capital or perhaps something in between...

4) Good news for active seniors! Many types of leisure time activities may lower risk of death for older adults. Excerpt:

Older adults who participate weekly in many different types of leisure time activities, such as walking for exercise, jogging, swimming laps, or playing tennis, may have a lower risk of death from any cause, as well as death from cardiovascular disease and cancer, according to a new study led by researchers at the National Cancer Institute, part of the National Institutes of Health.

The findings suggest that it's important for older adults to engage in leisure time activities that they enjoy and can sustain, because many types of these activities may lower the risk of death, the authors wrote.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.