Lordstown Motors Files for Bankruptcy; Green shoots for NYC commercial real estate; Another deadly epidemic

1) I wasn't surprised to see this news out of the Wall Street Journal this morning: Lordstown Motors Files for Bankruptcy and Sues Foxconn. Excerpt:

Lordstown Motors (RIDE), the electric-truck startup once cheered by investors during the SPAC boom and lauded by former President Donald Trump as a savior for a closed General Motors factory in Ohio, has filed for bankruptcy, the company said early Tuesday.

Lordstown's filing came after talks with its investment partner, Taiwan-based contract-manufacturing giant Foxconn Technology, for it to purchase $170 million in shares of the electric-truck maker fell through, Lordstown said...

Lordstown is the latest company in a crop of aspiring EV manufacturers that have so far failed to deliver on their promises to revolutionize the car market. Many raised billions of dollars during the SPAC trend of a few years ago – reaping sensational gains on their initial public offerings – only to have their valuations deflate as they struggled to launch factory operations.

Lordstown once said it would produce hundreds of thousands of vehicles in the former GM plant in Lordstown, Ohio, but so far it has made only a handful of trucks. The company's market capitalization has fallen to $47.49 million as of Monday, from a peak of about $5 billion in February 2021.

Even better-capitalized EV companies, including Rivian Automotive and luxury carmaker Lucid, have seen their cash piles and share prices dwindle. Both Rivian and Lucid have failed to meet earlier production goals as they faced parts shortages and manufacturing problems.

I've been warning my readers about this company (and similar crappy stocks) for more than two years (full archive here)...

On May 20, 2021, I wrote:

In the electric-vehicle sector, for example, avoid over-hyped, revenue-less dogs like Nikola (NKLA), Workhorse (WKHS), and Lordstown Motors (RIDE), and instead buy Germany-based Volkswagen (VOW3.DE) – which is up 14% since we recommended it in Empire Stock Investor in March – or the Global X Lithium & Battery Tech Fund (LIT) – which has doubled since we recommended it in February 2020.

On June 15, 2021, I added:

I hope my readers heeded my warnings about electric-vehicle startup Lordstown Motors (RIDE) in March, April, and May because it continues to crater after announcing last week that it doesn't have enough cash to start commercial production and issuing a "going concern" warning. The stock collapsed another 19% yesterday after the board found evidence of inaccurate statements and the CEO and CFO were forced out.

Don't be tempted to bottom-fish here, as the company still sports a $1.6 billion market cap – there's a lot more downside...

And on November 16, 2021, I noted:

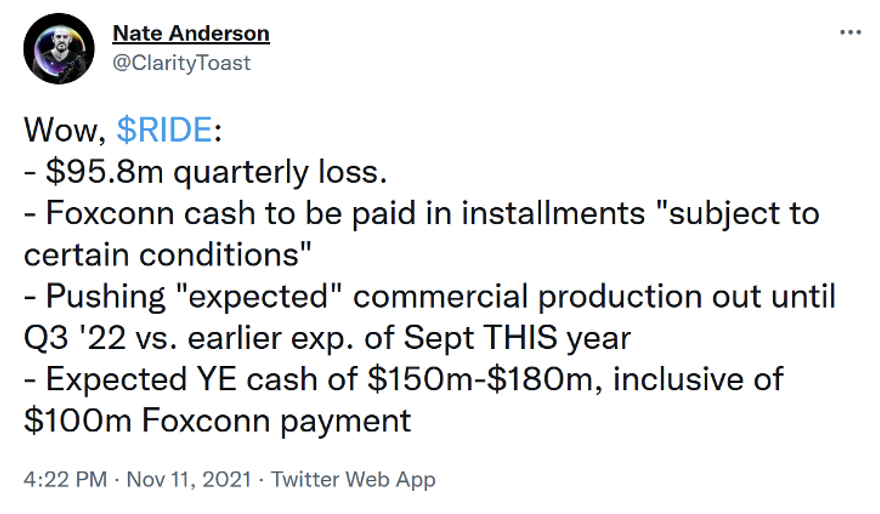

The stock of electric vehicle ("EV") developer Lordstown Motors (RIDE), which I covered in March, May, June, and July, is down 81% from its peak earlier this year. The company recently reported dismal earnings, which activist short seller Nate Anderson of Hindenburg Research summarized in this tweet:

Even with the stock down 81% from its peak on the day I wrote this, it was still at $5.49. Today, it's under $2 – and going to zero.

It reminds me once again of the saying: "What's the definition of a stock down 90%" Answer: "One that's down 80% – and then gets cut in half!"

Lesson: Beware of bottom fishing among stocks of speculative companies with unproven business models.

This, more than anything, is what distinguishes successful investors from unsuccessful ones: The ability to correctly assess whether a beaten-down stock is on its way to oblivion (like RIDE) or poised for a turnaround (like some of the best investments in my career – think McDonald's (MCD) in March 2003 or Netflix (NFLX) in October 2012).

2) In last Tuesday's e-mail, I included an excerpt from former hedge fund manager Eric Rosen's recent blog post about the awful state of the commercial real estate market in New York City.

I always like to present alternative viewpoints, so wanted to share these two articles:

SL Green sells off 245 Park stake in breakthrough for office market. Excerpt:

In the largest office sale since the Federal Reserve's rate hikes froze commercial real estate markets, SL Green (SLG) sold a stake in 245 Park Avenue in a deal that values the tower at $2 billion.

It's a major breakthrough for the city's office market, providing price discovery as investors try to figure out how to value office properties in an era of hybrid work and high borrowing costs.

And this one from the New York Times, New York Landlord Vornado Bets $1 Billion That More Commuters Will Return. Excerpt:

Employees frequently cite the dreaded commute as their biggest reason for avoiding the office. But one of America's most prominent landlords is featuring the commute as a selling point for a 9-million-square-foot real-estate project surrounding Manhattan's Penn Station.

Vornado Realty Trust (VNO) is spending $1.2 billion overhauling two of its office buildings near the midtown transit hub, which serves commuters from several subway lines, Long Island, New Jersey and, starting in 2027, Westchester County, N.Y., and Connecticut.

"We think this is the most important development in the city and perhaps way, way beyond the city," the New York firm's chairman, Steven Roth, said in an interview.

Roth told Vornado investors that Friday office work is "dead forever" and "Monday is touch-and-go." But he believes workers will continue to commute a few days a week so long as it is an easy journey. He calls train rides to Penn Station a "one-seat commute" because office employees won't then need to take the subway to their offices.

I continue to think that commercial real estate nationwide is going to be weak for years as employers adjust to far more workers working from home, so I'm not tempted to buy the stocks of SNG or VNO.

Instead, I think the opportunity is in bank stocks. Commercial real estate loans will be a headwind for many banks, but I don't think they're going to crash the entire banking sector and this headwind is more than priced into bank stocks today, making this is a fertile area.

We recently did a deep dive and recommended six of our favorite mid-, small-, and micro-cap bank stocks in two recent issues of Empire Investment Report. Click here to subscribe and gain immediate access to our entire archive.

3) A heartbreaking 1.13 million Americans have died of COVID since the deadly virus struck a little more than three years ago.

Over the same time, nearly as many Americans have died of another deadly disease that causes high rates of diabetes, heart disease, 13 types of cancer, osteoarthritis, high blood pressure, sleep apnea, dementia, various forms of mental illness, body pain, and poor physical functioning.

Worse yet, it is immediately obvious who is suffering from this disease and there are terrible stigmas associated with it. Those suffering from it are widely assumed to be ugly, lazy, lacking willpower and moral character, having bad hygiene, and being less intelligent. Not surprisingly, therefore, sufferers feel anxiety, depression, and shame.

By now you've probably guessed that the disease I'm talking about is obesity.

More than 70% of Americans are overweight, almost half of whom qualify as obese.

This leads to a myriad of lifelong health problems, culminating, for many, in early death: An estimated 300,000 Americans and between 2.8 million and 4.7 million people worldwide die each year from being overweight or obese.

These horrifying numbers rival COVID's, yet the responses to these deadly epidemics couldn't be more different.

When the virus hit, pretty much every government, scientist, and person on earth reacted with alarm and took dramatic measures to reduce the impact of the pandemic.

And it worked! In record time, vaccines were developed and made widely available, for free, which saved millions of lives.

In contrast, we've basically done nothing as the obesity epidemic has spread across America and around the world...

In fact, things have rapidly been going from bad to worse in recent decades. According to this 2019 New York Times article, You're Not Getting Much Taller, America. But You Are Getting Bigger:

Meet the average American man. He weighs 198 pounds and stands 5 feet 9 inches tall. He has a 40-inch waist, and his body mass index is 29, at the high end of the "overweight" category.

The picture for the average woman? She is roughly 5 feet 4 inches tall, and weighs 171 pounds, with a 39-inch waist. Her B.M.I. is close to 30.

That's a not at all how Americans used to look. New data show that both men and women gained a whopping 24 pounds on average from 1960 to 2002; through 2016, men gained an additional eight pounds, and women another seven pounds.

The story is similar around the world.

However, things may be about to change radically for the better thanks to three weight-loss drugs – Ozempic and Wegovy (semaglutide), made by Novo Nordisk (NVO), and Mounjaro (tirzepatide), made by Eli Lilly (LLY).

Numerous studies show that people taking these drugs lose 15% to 22% of their body weight and keep it off. For a 240-pound person, that's a life-changing/extending/saving 36-53 pounds! And there are even more promising drugs under development (see article below).

I know more than half a dozen people on Mounjaro (which appears to be the best of the current drugs, with the greatest weight loss and fewest side effects) and they're all thrilled. One friend has lost 90 pounds in nine months – I can hardly recognize him! The worst outcome among my friends is a still-amazing 22-pound loss in five months.

But in a scandalous side of the story, these drugs aren't widely available. It is very difficult to get health insurers to pay for them, and few people can afford their $1,200 monthly cost.

As a result, they're disproportionately being used by the wealthy, despite the fact that it's lower-income people who need these drugs the most, because they're more overweight and have inferior access to health care to treat all of the terrible consequences of obesity.

Can you imagine the outcry if this is how we had handled the COVID vaccines?

In future e-mails, I'm going to do a deep dive into these drugs, but for today, I'll just highlight two recent pieces of good news...

Experimental drug could offer more weight loss than any drug now on the market, study finds. Excerpt:

An experimental drug from Eli Lilly has the potential to provide greater weight loss benefits than any drug currently on the market.

The experimental drug, retatrutide, helped people lose, on average, about 24% of their body weight, the equivalent of about 58 pounds, in a mid-stage clinical trial, the company said Monday from the American Diabetes Association's annual meeting in San Diego. The findings were simultaneously published in The New England Journal of Medicine.

If the results are confirmed in a larger, phase 3 clinical trial – which is expected to run until late 2025 – retatrutide could leapfrog another Lilly weight loss drug, tirzepatide, which experts estimated earlier this year could become the best-selling drug of all time. Tirzepatide is currently approved for Type 2 diabetes under the name Mounjaro; FDA approval of the drug for weight loss is expected this year or early next year.

The new findings, according to Dr. Shauna Levy, a specialist in obesity medicine and the medical director of the Tulane Bariatric Center in New Orleans, are "mind-blowing."

Levy, who was not involved with the research, said the drug seems to be delivering results that are approaching the effectiveness of bariatric surgery. "It's certainly knocking on the door or getting close," she said.

No More Shots: Pill Versions of Ozempic-Like Drugs Are Coming. Excerpt:

In the works for people flocking to Ozempic to shed lots of pounds: Weight-loss medicines that come in a pill.

Drugs such as Ozempic that have surged in popularity for weight loss must be injected. Yet many people despise needles, prompting drugmakers to explore formulations that could be swallowed.

The chemistry isn't simple. But if researchers can pull it off, the tablets could appeal to the sizable number of people who fear needles, while also costing hundreds of dollars less than their injected cousins.

Lastly, I've just created a new personal e-mail list to which I'll send articles and commentary about these new weight-loss drugs. To subscribe to it, simply send a blank e-mail to: weightlossdrugs-subscribe@mailer.kasecapital.com

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.