Munger's wise words; We Believe Archer Aviation is a Lame Duck; Flying; VinFast; Amazing Estonia; Minimalist packing

1) These are some wise words from the legendary Charlie Munger:

2) Now that I don't run a hedge fund, I no longer do any short selling (thankfully – see this recent Wall Street Journal article: Surprise Stock-Market Rally Bulldozes Bearish Hedge Funds) nor does Empire Financial Research have any short-focused newsletters... but I continue to follow the smartest short sellers because I learn a lot, it's highly entertaining, and it helps me avoid landmines.

With that in mind, here's a well-done report by activist short seller Grizzly Research on air-taxi company Archer Aviation (ACHR): We Believe Archer Aviation is a Lame Duck. Excerpt:

Scarce Flight Activity; Recycled Video material; Misleading DoD Contract; Partners bought with cheap Warrants

- Archer Aviation (ACHR) is an eVTOL company that is seeking to be a leader in urban air mobility. Brought public through a SPAC, we believe the company has made a series of misrepresentations the latest of which being a contract award from the DoD which led a 40% run up in the stock.

- The DoD contracts ACHR received is a noncompetitive award with indefinite quantity and indefinite delivery, meaning the revenue could also be minimal and is also capped at $1.3m total revenue in 2023.

- The latest rise in the stock came after ACHR spun its last earnings announcement, which included the costly settlement of a legal dispute, as a big success: "ACHR secures $215M Investment from Stellantis, Boeing, United Airlines, ARK Invest." In reality, ACHR dished out $100M in free warrants for a $12,000,000 investment by Boeing, diluted shareholders by 25%, and must now purchase key tech from a competitor.

- ACHR's CEO has stated that ACHR is conducting daily test flights, sometimes multiple times per day. ACHR frequently uploads new videos that showcase flight testing.

- Our investigators visited ACHR's flight testing facilities in early August 2022 and late July 2023. Neighboring businesses and former employees reported seeing only a handful of flights conducted solely for special events, far fewer than the company's statements claimed.

- Our analysis shows that ACHR is recycling heavily edited videos of their earlier test flights to portray longer flight performance, more frequent testing, and a generally more advanced product than reality.

- ACHR has bought credibility through partnerships with two big companies, United Airlines and Stellantis. In both cases, the company awarded millions of shares for questionable or no compensation. Worse yet, ACHR discreetly amended and/or activated clauses to vest warrants early.

Archer's stock is up more than 275% this year but still remains down about 30% since its September 2021 SPAC merger.

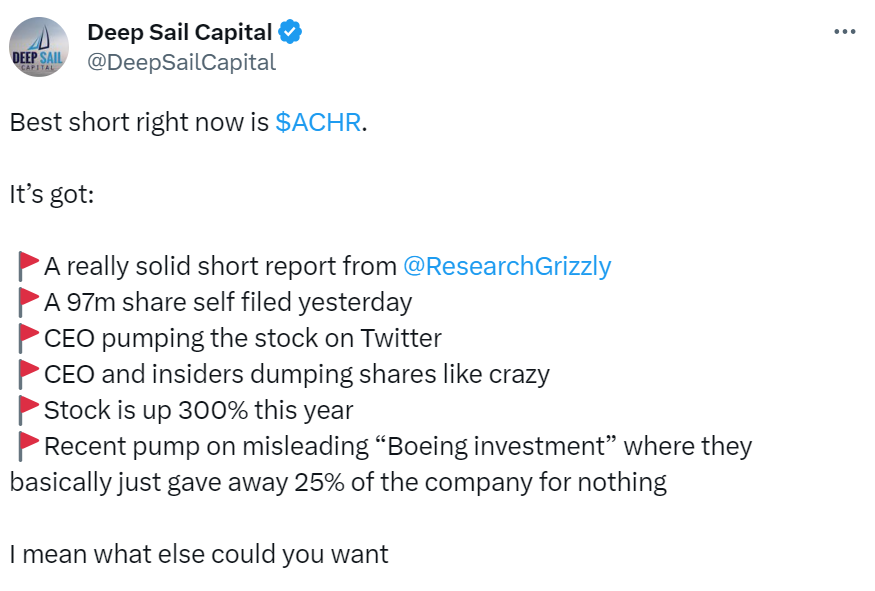

Archer is hedge fund Deep Sail Capital's favorite short:

3) Speaking of flying, while I'll never do this, it sure looks like fun! Check out this two-minute video:

4) Here's another stock to avoid...

In my January 6 e-mail, reporting from the Consumer Electronics Show in Las Vegas, I wrote:

The biggest auto display was by an outfit I had never heard of, VinFast, the only automaker in Vietnam, which was founded in 2017. It showed off four impressive-looking EVs, one of which, the VF 8, is starting to sell in the U.S...

The company has big plans, including filing a registration statement to go public here this year and open a $2 billion factory in North Carolina.

It's worth keeping an eye on this company, but I likely won't be tempted by the stock when (if?) the company becomes public based on these early reviews:

Fast-forward to last week, VinFast Auto (VFS) went public on Tuesday by merging with a SPAC and the stock promptly soared from $10 per share to a peak of $38.78 per share – giving it a market capitalization of $90 billion, far in excess of Ford Motor (F) ($48 billion) and General Motors (GM) ($46 billion).

This was massively stupid and didn't last long... speculators who initially piled in got destroyed as the stock closed on Monday at $17.58 per share.

Then the speculation was back yesterday, with VinFast jumping a stunning 109% to close at $36.72 per share. It's up again this morning... but speculators are once again poised to get crushed eventually.

Here are two Wall Street Journal articles with cautionary details:

- The EV Startup Worth More Than GM Had Troubled U.S. Rollout

- Already Time to Hit the Brakes on VinFast

5) Estonia is an amazing country of only 1.3 million people that reminds me of Singapore and especially Israel – I'll share more thoughts in a future e-mail.

On a percentage of GDP basis, Estonia is Ukraine's biggest supporter – largely because, to quote a friend, "they know the enemy all too well." One of the photos below shows the Ukrainian and Estonian flags in the capital Tallinn's Freedom Square.

My friend Jesse Jonkman and I spent the morning touring Tallinn's old town, which is one of the most magnificent in Europe because it's one of the few that wasn't destroyed in World War II. So many buildings are original, dating back nearly 1,000 years:

6) I've taken minimalist packing to a new extreme on this trip, traveling with nothing but the clothes on my back and the following items (pictured below) in my pockets: phone, earbuds, battery, travel plug adapter, small charger with cables to plug into my phone built in, two charging cables (to charge my phone and battery when I have access to an outlet), passport, cash, credit cards, folding toothbrush, toothpaste, floss, earplugs, eye mask, various pills, and (my one indulgence) a small bag of mixed candy/gum:

It all fit nicely in the pockets of my pants and vest, so I didn't need to bring a blazer, jacket, or backpack.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.