My history with shorting; Beware Ryan Cohen, the Meme-Stock King; DWAC PIPE deal on the rocks; 'SPAC King' Chamath Palihapitiya Closing Two SPACs; Skandal! Bringing Down Wirecard; Top 20 One Hit Wonders of the '80s

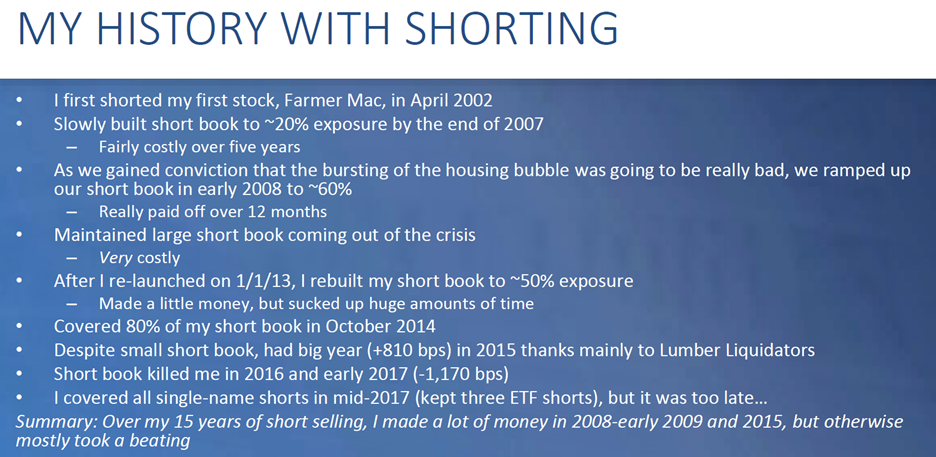

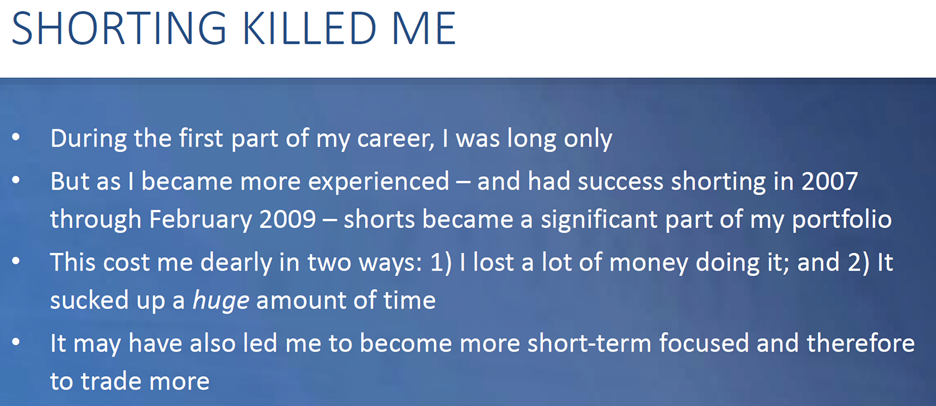

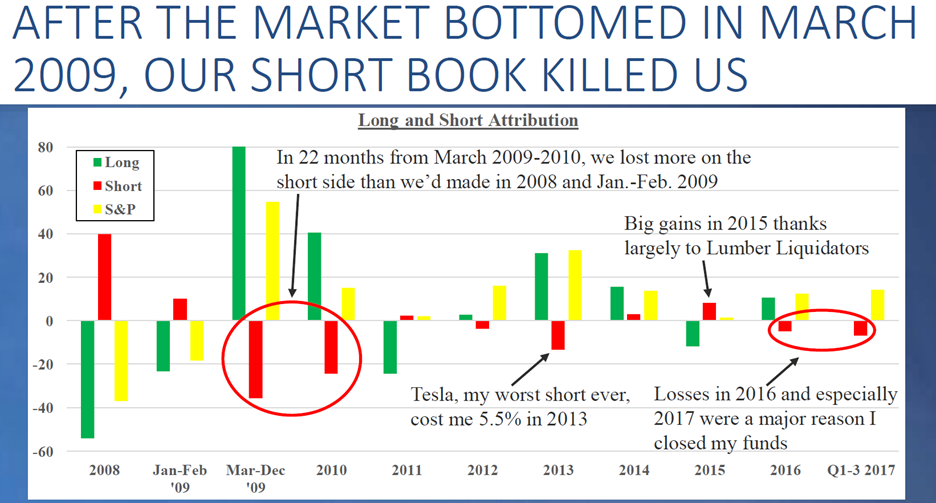

1) Continuing my discussion of short selling, here are the next three slides from my presentation, "Lessons From 15 Years of Short Selling":

2) I'm quoted in this New York Magazine article about Ryan Cohen's pump and dump of Bed Bath & Beyond's (BBBY) stock: Beware Ryan Cohen, the Meme-Stock King. Excerpt:

It's hard to allege Cohen committed a securities violation on the basis of simply making accurate regulatory disclosures and legally selling stock on the open market – which has made many on Wall Street all the more upset. "The way he did it reeks of a pump and dump, just reeks of it," says Whitney Tilson, the CEO of Empire Financial Research, who filed a complaint with the SEC alleging Cohen engaged in securities manipulation through a pump-and-dump scheme. "This has been going on for forever – Ryan Cohen just came up with a clever, innovative, nefarious twist."

In the days following Cohen's sale, however, the true extent of Bed Bath & Beyond's woes became clear. "I think it's highly problematic for Ryan Cohen to place individuals on the board, dump all of his shares, and then the next day we learn that Bed Bath & Beyond has hired restructuring experts and now they're engaged in some financial difficulties," says Daniel Taylor, a Wharton professor who specializes in fraud...

The more respectable players in the market have turned on Cohen. "He has absolutely destroyed his reputation," says Tilson...

He's convinced throngs of retail traders he's a genius even while he's betrayed them, leaving them holding the bag of a worthless stock. As long as people like Cohen and Musk are able to do that, then there's no telling what they can do to the market or who can stop them, besides the apes themselves.

3) The bad news continues to pile up regarding my least favorite stock, Digital World Acquisition (DWAC)...

A key to the deal was that when it went through, the company could receive $1 billion via a PIPE (private investment in public equity) which, as I wrote on December 8, "allows the investors in the PIPE (mostly hedge funds, I assume) to rip the faces off of retail investors by buying the stock for a 40% discount to the market price and immediately dumping it in the market for a quick 67% gain."

The PIPE deal expired yesterday and the company is scrambling to renegotiate it... But it's not going well, as this Financial Times article documents: Investors in Donald Trump's media SPAC push for better terms as clock runs out. Excerpt:

Donald Trump and the backers of a blank-cheque company that plan to take his Truth Social media business public are scrambling to renegotiate a $1bn financing package with investors ahead of a crucial deadline for the deal.

Investors who committed to provide funds to the company through a so-called private investment in public equity ("PIPE") transaction are in discussions with Patrick Orlando, the chief executive of Digital World Acquisition, to secure better terms, said two people familiar with the talks.

The revised agreement would shift more of the risk associated with the transaction to Trump and his backers, the people added.

The $1bn deal with investors was scheduled to expire on Tuesday. If they choose to withdraw their support, Truth Social owner Trump Media & Technology Group will receive much less cash even if its planned merger with DWAC, a so-called special purpose acquisition company ("SPAC"), goes through...

Orlando has also been asking PIPE investors to agree to a 10-day extension, said the person involved in the talks, though they are skeptical that Trump would agree to the new terms. "Trump wants to make sure he doesn't face a lot of dilution," said one person involved. "Optically, he wants to avoid a $2 floor. It looks weak and he doesn't want to look weak."

Here are three additional articles underscoring the increasing desperation by those backing this putrid deal:

- Trump's Truth Social Exploring Legal Action Against SEC for Alleged Delays in Company Merger Approval Process

- An online petition (with fewer than 1,000 signatures): Demand the SEC allow the TMTG/DWAC merger to proceed

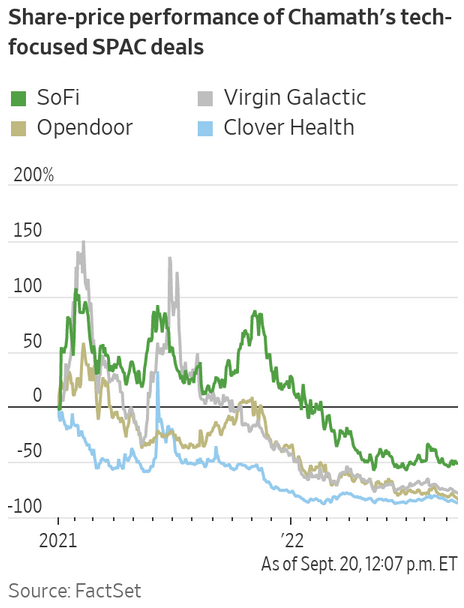

4) Speaking of con men engineering pump and dumps on gullible retail investors, this is good to see: 'SPAC King' Chamath Palihapitiya Closing Two SPACs After Failing to Find Deals. (My colleagues and I have heaped scorn on Palihapitiya for years – archive here.) Excerpt:

One of the biggest promoters of SPACs is shutting down two deal-making efforts that together hold more than $1.6 billion after the market collapsed, wiping out tens of billions in startup market value and punishing individual investors.

Chamath Palihapitiya will wind down and return cash from the two special purpose acquisition companies to shareholders after failing to find companies to take public. Giving up is an admission by the brash venture capitalist dubbed the "SPAC king" that the market that helped make him a mainstay on business television has effectively shut down.

Share prices for companies he took public in earlier deals, like space-tourism venture Virgin Galactic and personal-finance app SoFi Technologies, are down more than 60%, causing big losses for his followers. With that track record, it wasn't clear investors would support his deals, making his SPACs less attractive to startups they might try to acquire. SPAC investors have been pulling money out of nearly all deals lately, making it difficult to complete mergers.

5) I covered the fraud and subsequent collapse of German payments giant Wirecard over nearly two dozen e-mails from 2018 to 2021 (archive here), so I watched with great interest the new documentary about it, Skandal! Bringing Down Wirecard, which was just released on Netflix. (Hint: You can see the 93-minute movie in an hour if you watch it on your phone, tablet, or computer at 1.5 times speed... If you stream it on your television, you can't speed it up.)

I wouldn't say it's great filmmaking, which is likely why it gets a good-but-not-great audience score of 67% on Rotten Tomatoes, but it should be required watching for investors, as it exposes how a company fooled so many people for so long, even after activist short sellers and a few brave journalists (most notably the FT's Dan McCrum) clearly documented that it was engaged in all sorts of fraudulent activities. Here's a review of the film: A Financial Scandal of the Highest Order.

McCrum also has a new book out about how he discovered and exposed the Wirecard fraud, Money Men, which I haven't yet had a chance to read.

6) I'm not much of a musician, so I learn a lot from Rick Beato's YouTube videos...

Wow, did this one bring back memories (I went to high school and college from the fall of 1980 to the spring of 1989)! Top 20 One Hit Wonders of the '80s (14 minutes... less than that if you speed it up).

You will date yourself if you know the answer to this question: What are the next four digits of this phone number? 867...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.