My interview from the Berkshire Hathaway annual meeting; The bear case for Berkshire and my reply; 13-Fs by Berkshire, Baupost, Starboard, and Coatue; The Complete List Of Hedge Fund Letters To Investors Q1 2023; Testy moment on the tennis court

1) I did a 14-minute interview with my friend James Early just after the Berkshire Hathaway (BRK-B) annual meeting ended. Here's a summary:

Whitney Tilson, founder of Empire Financial Research, chats with BBAE CIO James Early after the Berkshire Hathaway 2023 meeting in Omaha about what Berkshire will look like after Buffett and Munger, getting started investing, and how a proliferation of value investors and technology like AI will affect the future of value investing.

2) Speaking of Berkshire Hathaway, in response to my two e-mails after the annual meeting, in which I explained why I continue to believe that it's America's No. 1 retirement stock, one of my longtime readers sent me this e-mail with a more cautious take (with my thoughts on each point below):

As a 25-year Berkshire Hathaway shareholder, I have followed the company closely.

I think your e-mails last week, while not incorrect (I agree with much of what you said about culture, etc.), were perhaps a little too sanguine.

A few reasons:

1. While decentralized, BRK's growth rate depends hugely on its capital allocation since the operating companies are slow but steady growers, and how much confidence can we have that Todd Combs and Ted Weschler (and Greg Abel) remotely compare to Buffett?

Frustratingly, Buffett has carefully concealed the investment track record of both Todd and Ted (and one of them inexplicably is also running Geico, which reflects poorly in my opinion on the investment succession strategy). And Abel has only worked in one industry, while the brilliance of Buffett is his grasp of so many different industries.

Can you honestly expect any of them to make an investment such as the huge investment Buffett made in Apple (AAPL), or even in the energy companies in 2022, (and most definitely not in the five Japanese trading companies)?

I give as an example of succession issues, the managers of the Sequoia Fund (SEQUX). Since Bill Ruane's death, they have gradually lost their way, most notably with a too-large, catastrophic bet on Valeant. In the aftermath, Bob Goldfarb resigned in 2016 – and since then, the fund has trailed the S&P 500 index by 3% per annum. This reflects the difference, in my opinion, between an investment genius (Ruane), versus competent, but run-of-the-mill managers.

Similarly, I can easily imagine Combs and Weschler being unfavorably compared to Buffett in a few years. Don't you wish you knew how they have performed since they joined Berkshire over a decade ago?

And have you heard Greg Abel say anything especially insightful? I haven't. I am sure he is a very competent operational executive, but capital allocation at this scale takes something very special.

Whitney comment: I agree that Combs, Weschler, and Abel are somewhat question marks and will be hard-pressed to come anywhere near Buffett's investment and managerial brilliance.

2. I don't know how long Buffett will live, but your point that Munger is still mentally sharp at age 99 has zero bearing on his life expectancy (mental twins, yes, but not genetic twins!). I think the correct answer is that Buffett's expected life expectancy is between a few months and maybe a few years based on actuarial tables. So the post-Buffett era may be with us much sooner than the five years you suggested.

Whitney comment: You are much too pessimistic about Buffett's life expectancy. If you simply plug in his age (92 years, 8 months) and gender into the Social Security Administration's website, it says the average American male of his age will live another 3.5 years.

But Buffett isn't average: he's in excellent health, receives great medical care, loves his work, is surrounded by loving friends and family, etc.

When I filled out a more comprehensive form on The Living to 100 website, answering more than two dozen questions (making guesses on many of them), it says he'll live to 97. And I'd take the over on that...

3. The analogy you make with Apple's performance post-Steve Jobs is, in my opinion, inapplicable, Apple had a huge organic tailwind from the worldwide growth of the iPhone and iPad (i.e., the transition to mobile devices), both of which were developed by Jobs.

We can agree that Tim Cook has done a masterful job, but he inherited a business with a massive organic tailwind. In contrast, Berkshire is a stable, slow grower whose future growth will depend materially on superior capital allocation.

Whitney comment: I still like the Apple analogy. If anything, Berkshire is a safer bet to continue to outperform after Buffett because it's not a technology business. I don't think you're fully appreciating the incredibly powerful "flywheel" that Buffett and Munger have created.

4. Ajit Jain is 71. How long will he work once Buffett has gone? 99.5% of people want some retirement. Will he work and live into his 80s? And who on earth will replace him? Buffett constantly says how important and unique he is, but there is no obvious successor.

Whitney comment: I think Jain, like Buffett and Munger, is highly likely to live – and work – into his 90s.

5. Of course Buffett and Munger want Berkshire to prosper after they have gone, but I think they are both astute and self-aware enough to know that it doesn't matter because they will be dead. Whether BRK flourishes or flounders won't affect them in any way, shape, or form.

They won't be looking down from heaven basking in the glow of their legacy! They are too smart and rational. They built a great business during their lifetimes and of course hope it will continue to prosper, but what happens doesn't actually matter to them since they won't witness it.

Whitney comment: I 100% disagree with you about how much Buffett and Munger care about their legacy – it's extremely important to them.

6. As Buffett constantly reminds everyone, Berkshire at best will modestly outpace the S&P due to its size. And that only gets a bit harder every year. So given the choice between an index fund and Berkshire under new management, I think many shareholders will choose the S&P.

In addition, there are many large, loyal Berkshire shareholders, some with a large percentage of their portfolios in the stock. In my opinion, they will gradually (or quickly) sell down once he is gone. The only reason they don't now is the combination of a huge tax bill and the fact that Buffett might be around a few more years. Of course, that doesn't mean the stock will fall, but I think it will be another headwind, on top of the Gates Foundation selling down the stock Buffett leaves it.

In summary, I agree that neither Berkshire's business nor the stock will collapse when he dies. And I agree there's no Buffett premium in the stock today.

But if I had to make a bet, for all the reasons I listed, Berkshire will underperform the S&P 500 in the decade after he dies.

Whitney comment: I agree with you (and Buffett) that "Berkshire at best will modestly outpace the S&P due to its size." That's why I concluded in my May 8 e-mail that:

It's important to have reasonable expectations. Given its moderate undervaluation today, I think over the next five years, Berkshire's stock is likely to do two to three percentage points (compounded annually) better than the S&P 500. In other words, if the S&P compounds at 5%, Berkshire will do 7%-8%.

Thank you for sharing these thoughts!

3) I often find good investment ideas by seeing what smart investors are buying and selling, which they reveal in quarterly 13-F filings.

Let's start with Berkshire Hathaway, which just reported in its just-released 13-F that it took a new stake in Capital One Financial (COF) with 9.9 million shares. It increased its stake in Apple (AAPL) by 20.4 million shares to 915.6 million shares and Bank of America (BAC) by 22.8 million shares to 1 billion shares. It also added to Occidental Petroleum (OXY), HP (HPQ), Paramount Global (PARA), Citigroup (C), and Markel (MKL).

It cut its stake in General Motors (GM) by 20% to 40 million shares and exited positions in RH (RH), Bank of New York Mellon (BK), Taiwan Semiconductor (TSM), and U.S. Bancorp (USB).

Here's the summary for Seth Klarman of Baupost Group (whom I discussed in yesterday's e-mail):

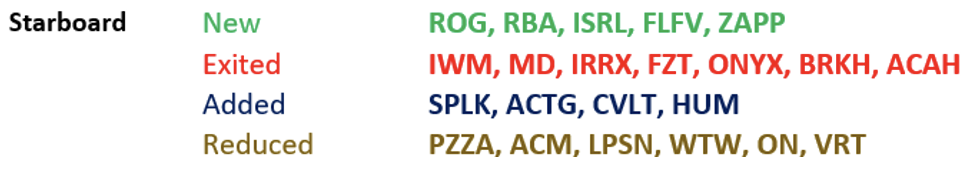

Here's Jeff Smith of Starboard Value:

And here's Philippe Laffont of Coatue:

4) For more insights on what smart investors are doing, see this collection of nearly 50 hedge funds' first-quarter letters, compiled by FinMasters: The Complete List Of Hedge Fund Letters To Investors Q1 2023.

I especially enjoyed the letters of Greenlight's David Einhorn and Bronte Capital's John Hempton.

5) There were some testy moments during my U.S. Tennis Association 4.0 doubles match last week...

Twice in the first set, maybe 10 minutes apart, I was at the net and slammed two balls at the feet of the opposing net guy, Frank. But my reflexes were a little slow, so they both went toward his midsection, which he fortunately deflected before they hit him. The second time, he glared at me and said, "That's twice." I said sorry, but I didn't think much of it – this kind of thing happens all the time, and I certainly wasn't trying to hit him.

But then in the second set, I rushed forward for a ball and hit a short return to Frank's partner, Jules, who hit it straight back at me. My momentum had carried me all the way to the net, so I had no time to react, and the ball hit me in the face, just below my left eye.

Fortunately, Jules hadn't hit it very hard, so I wasn't hurt. He immediately apologized, but Frank clapped his hands in glee and – at the changeover shortly thereafter, as Jules apologized again and I said, "No big deal" – Frank audibly said, "That's karma."

I didn't say anything, we closed them out, and all shook hands (and even played another set), so it didn't amount to anything. But it's pretty low-class to clap and cheer when your opponent gets hit in the face...

There are both life and investing lessons here. All of us have to deal with people behaving badly on a daily basis. But how you handle them is entirely up to you. Do you respond in a tit-for-tat fashion that escalates the situation? That generally doesn't end well. As Gandhi is reported to have said, "An eye for an eye will leave everyone blind."

Similarly, the market often "behaves" badly, gyrating wildly and crushing your favorite stocks. It often feels like a personal attack. When this happens, can you keep your cool and unemotionally make the right decisions? That's the key to long-term investment success...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.