My Sina interview; Why I've trimmed my portfolio; Leon Cooperman and Doug Kass' thoughts; WeWork Co-Founder Adam Neumann Sues SoftBank Over Failed $3 Billion Deal

1) I did an interview with Chinese online media company, Sina (SINA), with my take on the Berkshire Hathaway (BRK-B) annual meeting. You can watch it here (6:24).

I really enjoyed it and thought it went well. It's already been viewed more than half a million times.

2) Like Berkshire CEO Warren Buffett, I'm long-term bullish on America and, as such, have nearly all of my long-term savings invested in the S&P 500 Index and blue-chip stocks.

In the short- and medium-term, however, I'm as cautious as Buffett is, and as my friends Leon Cooperman and Doug Kass are (see below). We're in uncharted waters in so many ways – with the economy in another Great Depression, as much as a quarter of our workforce unemployed, and budget-busting spending to try to offset the tremendous hardships that millions of businesses and people are facing.

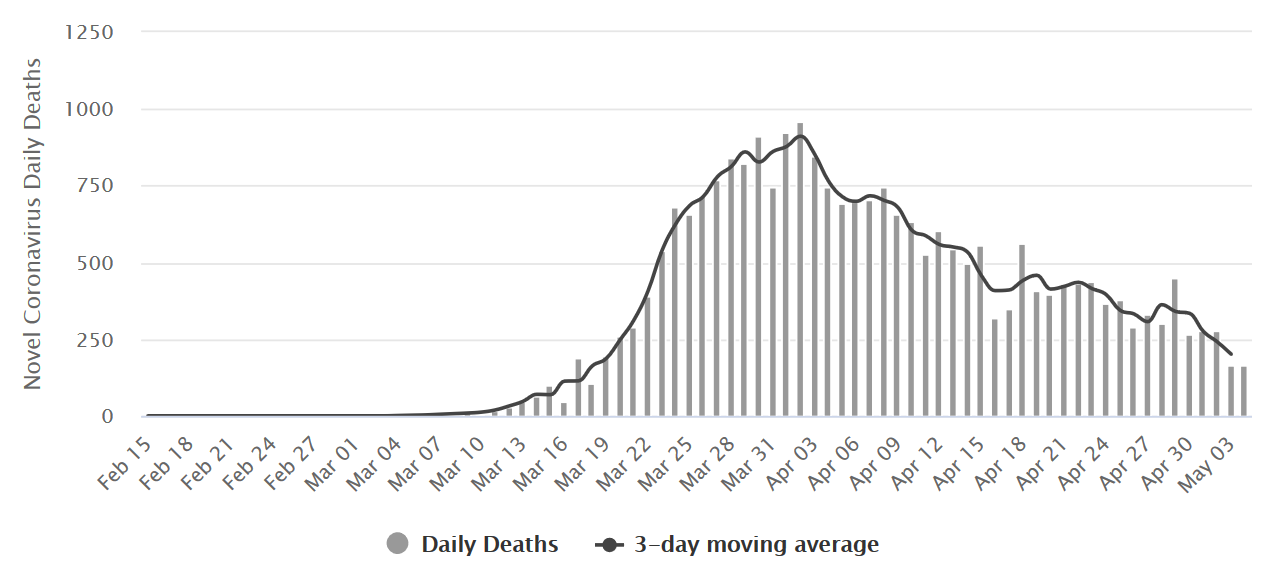

And let's not forget that the coronavirus is still raging here, even as the majority of states are ending their lockdowns. Take a look at this chart of daily new deaths in the U.S.:

Yes, the trend is favorable – but barely... Contrast this with two other hard-hit countries, Spain...

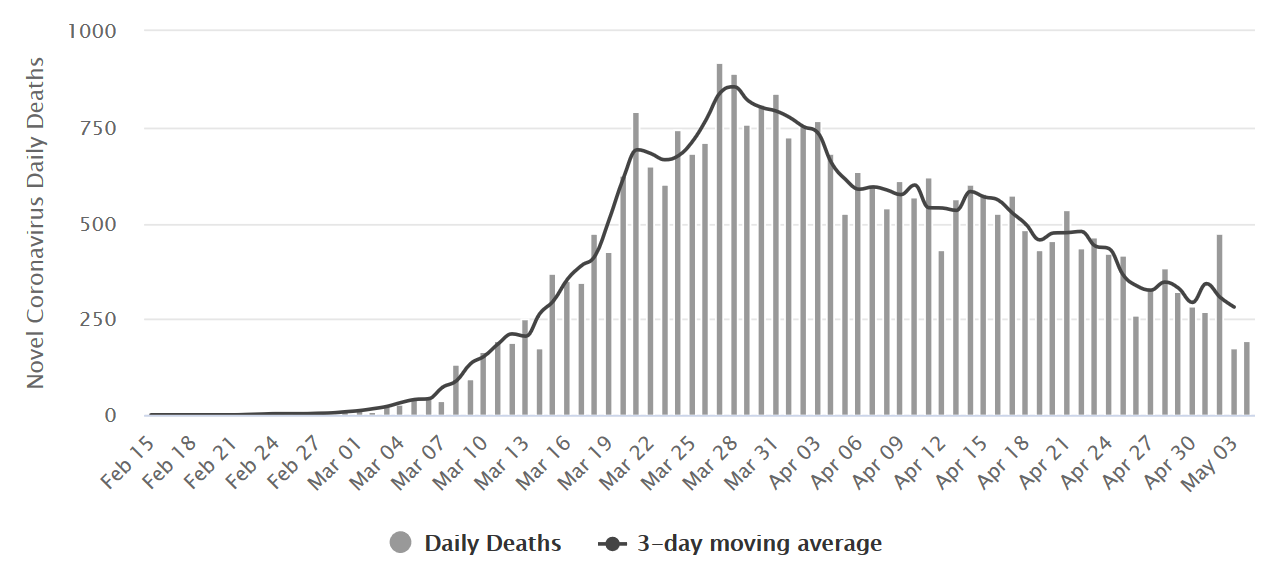

And Italy...

Our reality is captured by this meme that's circulating:

Yet despite all of this grim news and uncertainty, the S&P 500 is down a mere 11.9% for the year (as of yesterday's close).

Thus, in my smaller trading account, I've been doing quite a bit of selling – I'm banking the profits I made by investing aggressively from March 9 through April 1.

At its peak, the total equity exposure of my combined accounts, reflecting my entire net worth except the value of my apartment, was more than 70%. Today, it's 55%... so I have plenty of "dry powder" to put to work should the market get volatile again in the next few months, which I think is likely.

But to repeat: I don't think any of this will matter in five years or more, so you don't need to do anything with your long-term savings.

3) My friend and investing legend Leon Cooperman gave me permission to share this e-mail that he sent me:

I am optimistic on solving the virus problem and that the economy will start opening up in May, but I am concerned about the long-term implications of what we have gone through. Why?

- Capitalism as we have known it will likely be changed forever. When the government protects you on the downside, they have the right to regulate the upside.

- The country is moving to the left and taxes are going up – quickly if Biden wins and more slowly if Trump wins.

- As I have been saying for three years, low interest rates are indicative of a troubled economy and in themselves not bullish. We have negative rates in Japan and Europe, yet their are lower than ours.

- Debt is growing much more rapidly than the economy and thus more of our national income will have to be devoted to debt service.

- Demand is likely to come back slowly. We will need a vaccination with a card to get access to sporting events and concerts – at least a year away.

- Businesses will incur substantial compliance costs.

- There will be substantial equity issuance to replace lost capital (e.g., UAL move).

- Stock repurchases, which lifted , are over!

- Profit margins were at an historic peak in January and they tend to be mean reverting.

- Credit is cheaper than stocks. High yield, excluding energy, is yielding 7.25% – this equates to 14x earnings.

- I'm a watcher of Buffett and Munger for good reason. Uncharacteristically Buffett sold airlines into weakness and he doesn't seem to be too active despite his liquidity. If the greatest investor in my generation can't figure it out, who am I to be bold?

My bottom line: a fair P/E on the S&P 500 500 is 17x – higher than historical but low relative to interest rates. I apply that to normalized earnings of $150 and it gives me fair value of 2,550 presently (versus yesterday's close of 2,843). I'm allowing for an undershoot and an overshoot and assume 2,200 to 2,800.

PS – Individual stocks with some hair are better than the S&P 500!

Everyone stay safe and healthy and help others less fortunate than yourself!

4) My friend Doug Kass of Seabreeze Partners has similar concerns:

* A further look at Warren Buffett's actions suggests that there are more uncertainties today regarding the trajectory of economic and profit growth than existed in March 2009

* Stocks may have a short-term bias slightly higher (bearish positioning, curve flattening and medical innovation) – and could move back towards the higher end of the recent trading range

* I "think" stocks are generally fairly valued to slightly overvalued today

* I start the day between a small- and medium-sized net long exposure

* My portfolio investment positions look attractive from an intermediate term perspective – I believe many of my holdings are trading at a S&P Index equivalent of 2,200 (or so)

"Uncertainty is the only certainty there is, and knowing how to live with insecurity is the only security."

– John Allen PaulosWe can distill Warren Buffett's message of keeping a large war chest at Berkshire Hathaway (BRK-B) into two core reasons:

* Berkshire Hathaway's empire has grown appreciably over the years – as whether measured by the size of its revenues or its growing asset base. As such, it needs more money to support its portfolio of fully owned companies in the event Covid-19 spreads further in 2020-21.

* There is optionality in a large cash position ($1 today may be more valuable than $1 in the future) to buy back Berkshire's stock, do a sizable acquisition and/or to opportunistically acquire more equities for Berkshire's stock portfolio.

Warren views the pandemic as a Black Swan, an unexpected and multiple sigma event that has risen many standard deviations above a normal distribution of events.

In other words, these are very uncertain times.

My April 30th column, A Time to Plant And a Time to Pluck Up That Which Is Planted outlined about 15 of the uncertainties investors face:

* The Value Proposition No Longer Exists – At the core of my reversal of market view is price – more specifically a changing upside reward vs. downside risk, that has been turned on its head as a result of the scope and (brief) duration of the rally from the March lows. With the recent 31% rise in the S&P Index, valuations are once again stretched relative to my S&P EPS estimates contained below.

* Sell The News – The last leg higher in the market has been delivered by some scientific progress (delivered by Gilead Sciences' (GILD) remdesivir drug yesterday) and by the continued evidence of curve flattening evident over the last 10 days. I expected this six weeks ago and bought very aggressively, I am selling the news that I anticipated.

* Did Investors Jump The Shark on Remdesivir? – On Wednesday, I was surprised by the misleading way in which the press reported a statement by Dr. Fauci about the drug remdesivir. The headline in the Huffington Post read, "Drug Proves Effective Against Coronavirus as Economic Damage Rises." Politico's headline read, "A drug can block this virus: Fauci Hails Covid-19 treatment breakthrough." Wonderful news – if true. But do we really have an "effective treatment" against coronavirus? No, we do not. Here is what Dr. Fauci actually said in a much-hyped White House announcement:

"The data shows that remdesivir has a clear-cut significant positive effect in diminishing the time to recovery... The mortality rate trended towards being better in the sense of less deaths in the remdesivir group – 8% versus 11% in the placebo group. It has not reached statistical significance, but the data needs to be further analyzed."

I am not a statistician, but let me share my lay understanding of Dr. Fauci's statement about remdesivir's effect on the mortality rate: If something "has not reached statistical significance," the outcome is indistinguishable from an outcome determined by chance. (Dear readers who are statisticians: I know the precise definition involves sampling error, testing hypotheses, and the null hypothesis, but those concepts won't add clarity here.) As to the "positive effect" cited by Dr. Fauci, he was describing a reduction in the mean duration of hospitalization from 15 days to 11 days. That is good, but hardly "an effective treatment against coronavirus" or a "drug that can block the virus" as the HuffPo and Politico headlines blared this morning.

* A Fall Back? – Though an arguably scientifically ignorant President confidentially predicts that if we have "embers burning" in the fall "we will put them out," if citizens prematurely abandon "stay at home" practices and fail to continue to adopt "social distancing" and utilizing masks (something the President and Vice President reluctantly do not conform to) – a return of Covid-19 in the fall (something Dr. Fauci "guaranteed" yesterday) could be devastating economically and socially.

* My Baseline Case of An Erratic and Unsteady Profit Improvement in 2020-21 Remains In Place – Through my company contacts, Directorships, etc., I have a good view of the corporate revenue and profit outlook over the next 18 months. Consensus recovery estimates appear too optimistic given the cyclical and secular uncertainties and challenges. Specifically, we will not likely return to or above 2019 S&P EPS ($164/share) until 2023. My 2020 EPS (e) is about $110/share, 2021 EPS (e) $135-$140/share and 2022 EPS (e) $155/share.

* My S&P EPS Estimates Are Well Below Consensus – The bottom up consensus for 2020 S&P EPS, according to Refinitiv's David Aurelio, is a lofty $134/share – well above my forecast of only $110 share and in line with my forecast a year later (in 2021).

* Secular Concerns and Economic Challenges Are Plentiful – Many important industries (travel, hotels, leisure, entertainment and others), have been damaged structurally and will take much time to stabilize and improve to anywhere near they were pre-Covid-19.

* Market Structure Has Likely Exacerbated The Recent Rally (As It Exaggerated the February-March swoon) – As I have repeatedly noted, "buyers live higher and sellers live lower," in a world dominated by the rebalancing of ETFs and quant strategies and products that worship at the altar of price momentum. As I did in mid-March, I want to capitalize on the stock price artificiality of passive investors today – with the movie in reverse (machine buying now, machine selling then).

* Market Positioning May No Longer Be "Market Friendly" – My sense and (more importantly) the sense of my institutional trading contacts, is that a lot of short covering has occurred in the last three to five trading sessions. This is in marked contrast to many points in the late March-April rally, in which many confidently suggested that a retest of the lows was in the offing, and many shorted into that belief.

* Extreme Bearish Investor Sentiment Readings Have Receded – Investors, as they are wont to do with rising prices, have become more optimistic in the last two weeks.

* The Fed's Bazooka, Unexpected in Might Six Weeks Ago, Is Now Well Recognized – We are probably at or near "Peak Fed Influence" – for if the Fed has gone "all in," that means it may not be able to be expansively forever.

* There Is a Limitation to the Magnitude of the Fed's and The Treasury's Monetary and Fiscal Responses – Lowering interest rates into negative grounds (which is essentially near where we are today) will gut our banking and pension plan systems.

* I Am Not Confident That The Implementation of Fiscal Programs Will Be Smooth and Efficient – It is no secret that I have a low view and esteem for the quality of human capital in the Administration. Already a lot of bottlenecks have been uncovered with the delivery of the fiscal assistance to consumers and small businesses. The hand-off will not likely be smooth.

* But The Unprecedented Rise in The National Deficit and in Federal Debt Comes at a Cost – Slowing Domestic Economic Growth – Debt is a governor to growth, which will be exacerbated by any rise in interest rates. Should inflation percolate (not currently a concern over the near term) our economy would be in deep doo-doo.

* Given Our Government's Wanton Spending, Will Our Currency Lose Its Meaning and Reserve Position?

* The Country Is Moving to The Left – A Democratic President Win Could Be "Market Unfriendly" – Trump's polling, in swing states (especially in the Upper Midwest and Florida), has materially deteriorated in recent weeks. The President's path to a second term is growing less likely. A Democratic Administration will bring on some kind of VAT tax and a marked rise in marginal tax rates for the wealthy in order to make a dent on the deficit and national debt load. I recently wrote (facetiously) that the next president, Joe Biden (with the support of Treasury Secretary Mike Bloomberg), will take marginal federal tax rate up by +10% at least in his first year in office, with smaller gains implemented over the next several years of his Administration. In 2024 the then President Amy Klobuchar or President Kamala Harris might raise it by +10% or more to accomplish the same objectives.

* Buyback Activity (The Dominant Force In The Demand For Stocks Over the Last Few Years) Will Likely Be Markedly Curtailed Over the Balance of 2020 – And a Democratic November Presidential win could curtail the prospects (for company repurchases over the next several years). So will a disappointing trajectory of profit recovery reduce the willingness and ability to buy back shares.

* The Chances of a "TINA Ripper" Are Moderating – While short term Treasuries have collapsed, we must keep a keen eye on the cost of (corporations') capital. While there has been an improvement from the lows, the costs of borrowing (across the credit spectrum) remain very elevated against levels of two months ago.

* Pension Plan Problems Are Accumulating at Breakneck Speed – Lower than expected interest rates (for longer) coupled with lower revenues and profits (in the private and public, especially state level) pose large risks.

* The Divergence Between The Messages of Bonds and Stocks Has Widened – Peter Boockvar puts it well this morning, "The discrepancy between the stock market and the US Treasury market is glaring again just as we've seen before. I believe the stock market seems to be mostly focused on the direction of the economic improvement that will come with a reopening while the Treasury market is likely more focused on the degree of that improvement."

* Private equity holds a large cash hoard of over $1 trillion for future leveraged buyout deals

* Antagonism Between the U.S. and China Appears to Be Accelerating and Could Worsen In The Months Ahead – I would not be surprised that, particularly if the President's popularity slumps (and in light of his desire to strengthen his base), Trump will look more to China as a Covid-19 scapegoat. A growing rift could undermine a global economic recovery especially if the Administration attacks China (and raises trade tariffs).

For the above reasons I took down my overall exposure last Thursday – with emphasis on reducing my cyclical investments (like Federal Express (FDX), Disney (DIS), Micron (MU), Verizon (VZ) – yes, it's cyclical!), and my entire list of energy long rentals.

Buffett's message was clearly one of uncertainty. The Oracle might have effectively said that, in a flat (and flattening) and interconnected global economy, the domino effect of Covid-19, or anything else that is multiple standard deviations from the norm, is a greater threat than at any time in history.

Buffett is maintaining his war chest because he recognizes that the domino effect might be more debilitating for a longer period of time than at previous points in history.

The Oracle simply doesn't know what the trajectory of economic and profit growth will look like, with certainty. Indeed, it appears that will remain uncertain for a while.

At the core of my investing is the notion that I can, with reasonable accuracy, pinpoint the intrinsic value of an individual equity or of the Indices.

My methodology is looking at three to five separate scenarios (of interest rates, inflation, domestic and global economic growth, policy, profits, valuation, etc.) that are weighted by probabilities.

An individual fair market value is calculated.

But the aforementioned uncertainties that Buffett and others see, underscores the deficiency of having a specific number as an estimate of value because of the multiple, growing, and unusual character of Covid-19 and its influence.

Given these uncertainties, perhaps what I should really produce is a range of intrinsic value – and I might do this in the future.

For example, it might be more appropriate, rather than to deliver a precise 2,800 S&P fair market value, to use a range of 2,700-2,900.

For now I am going to stick with a specific figure (2,800) as well as continuing my estimate of a three to six month trading range (2,550-2,950) – but I think you all get my point.

(As noted by Buffett), the unusual nature of Covid-19 will produce a wider range of outcomes, rendering precision of forecast ever more difficult.

This morning's lesson? The only certainty is the lack of certainty.

5) Here's another chapter in the annals of you-just-can't-make-this-stuff-up! WeWork Co-Founder Adam Neumann Sues SoftBank Over Failed $3 Billion Deal. Excerpt:

WeWork's co-founder and former chief executive Adam Neumann sued SoftBank Group Corp., accusing the Japanese technology group of breaking a key provision of a deal that gave SoftBank control of the shared-office-space company.

The civil complaint, filed in Delaware's Chancery Court, is the latest legal tussle over SoftBank's multibillion-dollar rescue of We Co., the parent of WeWork, and caps the dramatic falling out of SoftBank founder Masayoshi Son and Mr. Neumann.

Tokyo-based SoftBank in April terminated an offer to pay up to $3 billion for shares in WeWork, saying conditions to complete the stock sale weren't met by an April 1 deadline. As part of that deal, which led to Mr. Neumann's ouster from the company's board, Mr. Neumann had the right to sell up to $970 million in stock to SoftBank.

I haven't looked into it, but knowing how incompetent Son and SoftBank are, it wouldn't surprise me if Neumann has a good case!

Best regards,

Whitney