My updated estimate of Berkshire Hathaway's intrinsic value; Don't let your politics affect your investing; Bill Ackman's wise words; My birthday at the Nets game

1) Yesterday I analyzed Berkshire Hathaway's (BRK-B) third-quarter earnings report, and today I'll update my estimate of the company's intrinsic value...

If you've followed my work for long, you'll know that at various points over the years I've called Berkshire "America's No. 1 Legacy Stock" or "America's No. 1 Retirement Stock." I say this because Berkshire offers a unique combination of safety, growth, and undervaluation.

While the undervaluation right now isn't as great as it has been at certain times in the past, I still like the stock and think it's a good foundation for any conservative portfolio for anyone practicing "stay rich" investing rather than "get rich" investing.

As longtime readers know, I've used a consistent method to estimate Berkshire's intrinsic value for the past two decades. I believe it's similar to the one CEO Warren Buffett uses: take the cash and investments per share and add the value of the operating businesses.

At the end of the third quarter, cash and investments were about $448,000 per A-share. Since then, Berkshire's stock portfolio has declined by about $4,000 per share, so that's about $444,000 today.

Berkshire's trailing 12-month pretax operating earnings were about $25,000 per share. (I adjust for volatile insurance and investment income by subtracting it and then adding back half of the average over the past two years, which is $10.0 billion of pretax earnings. I think this is conservative, given that Berkshire's total insurance and investment income has averaged $8.7 billion annually over the past 10 years.)

The chart below shows how the two drivers of Berkshire's value – investments and earnings per share ("EPS") – have done since 2002. As you can see, there are occasional dips... but overall, these show an extraordinary record of consistent growth:

I apply a conservative below-market multiple of 11 times to Berkshire's pretax operating EPS of about $25,000 to arrive at a value of around $275,000 per share.

Thus, my estimate of Berkshire's intrinsic value is about $444,000 (cash and investments) plus roughly $275,000 (operating businesses), for a total of around $719,000 per A-share or $479 per B-share.

This table shows this calculation for each year-end starting in 2002:

The A-shares closed yesterday at $664,750, meaning that the stock is trading at a roughly 7.5% discount to my estimate of its intrinsic value.

That's not a bad discount... But again, the undervaluation isn't as great as it has been at certain times in the past.

For example, when my team and I recommended buying Berkshire's B-shares in our flagship Stansberry's Investment Advisory newsletter back in December, we calculated that the stock was trading at a 14% discount to intrinsic value.

(Investment Advisory subscribers can read that full issue right here. And if you aren't a subscriber, you can find out how to become one – plus gain access to our entire portfolio of open recommendations – by clicking here.)

Since our recommendation, the stock has risen 23% through yesterday's close – nearly matching the strong performance of the S&P 500 Index – but its intrinsic value has only risen about half that amount... which is why the discount has shrunk.

Does this mean it's time to dump Berkshire if you've owned it for a while and are sitting on nice gains?

Not at all...

It simply means you should have modest expectations right now – namely, that Berkshire will likely outperform the S&P 500 by one to two, rather than two to three, percentage points annually... which was the case when my team and I recommended it last year in the Investment Advisory.

In other words, if the S&P 500 compounds at 5%, I would expect Berkshire to do 6% to 7%.

2) With it being Election Day today, I want to repeat one of the most important lessons I've been writing about for a while...

Don't let your politics affect your investing.

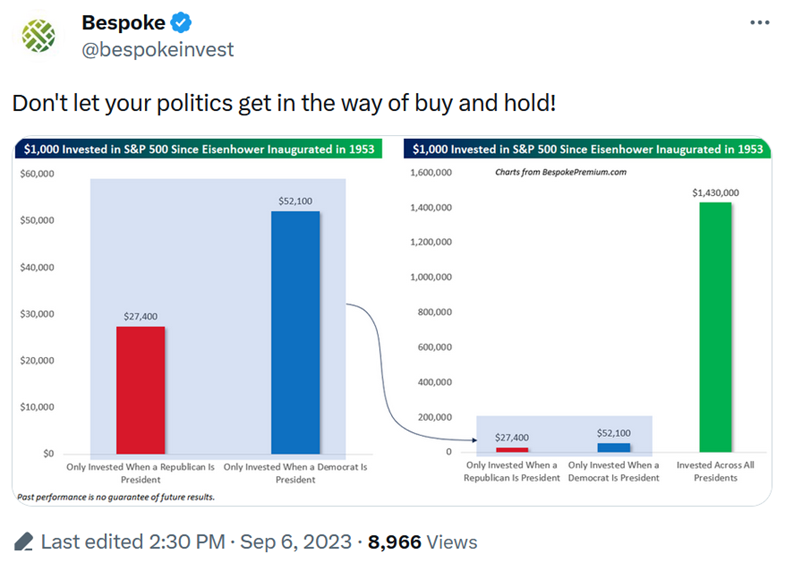

Longtime readers might remember the chart below that I shared last year... It shows how a $1,000 investment in the S&P 500 would have done over the prior 70 years had it been invested only when a Republican versus a Democrat was president – versus being fully invested the entire time.

As you can see, it is deadly to your long-term returns if you allow partisan political viewpoints to drive your investment decision making:

It's especially easy to make this mistake in light of today's highly polarized political environment...

I often hear from readers who tell me how terrible the economy is – and blame President Joe Biden for it – which mirrors what I heard from Democrats back when Donald Trump was president.

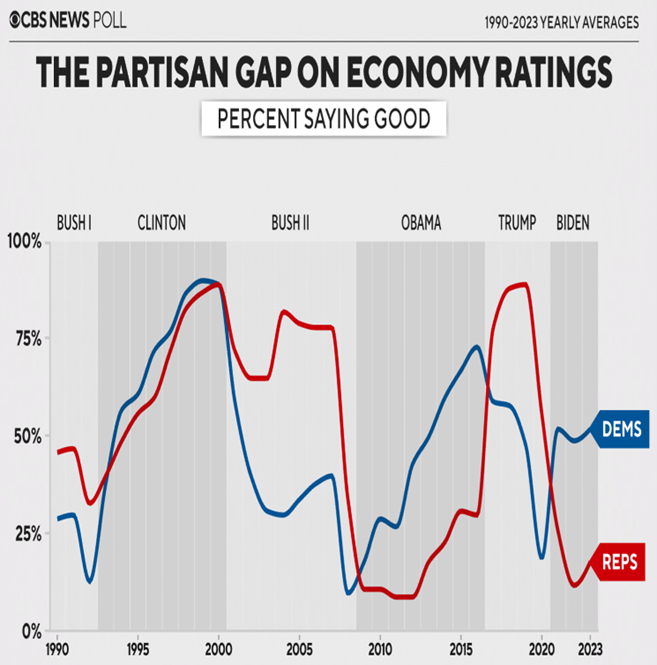

It wasn't always this way. Check out the below chart that a friend once sent me, which I included in that same e-mail last year...

It's based on a CBS news poll, and it shows how Americans used to have roughly similar views on the economy... But that has increasingly disappeared – especially in the past two administrations. Take a look:

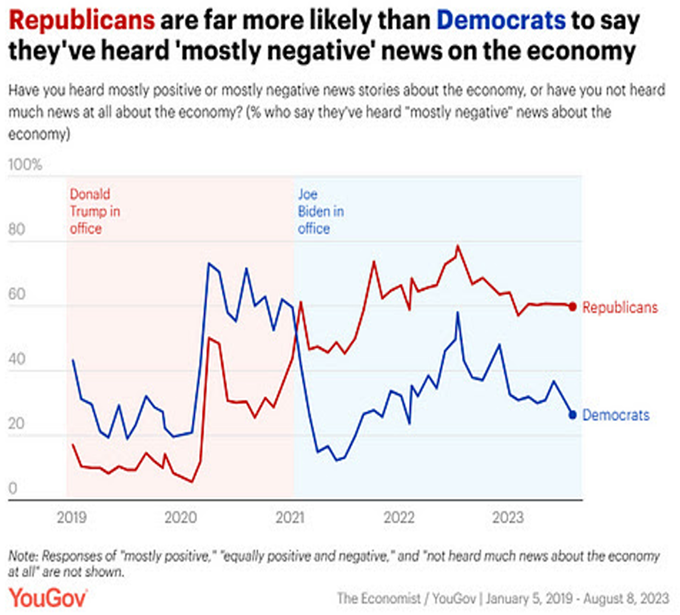

And take a look at this chart from the New York Times that I shared earlier this year – it shows how Democrats and Republicans since 2016 have nearly polar opposite views of the economy, depending on whether their guy was/is president:

And it's not just limited to the overall economy...

Below is another chart I shared earlier this year from Trahan Macro Research. It shows that as soon as President Biden was elected, inflation expectations among Republicans – and, to a lesser extent, independents – soared, while Democrats were far more sanguine. Then, as inflation began to decline, the gap had narrowed... but the former still expected nearly twice as much inflation as the latter over the next year. Take a look:

The next chart (which I also shared last year) explains why this is happening...

It shows how Republicans and Democrats are being fed completely different information by their respective media sources (note that this phenomenon exists in both directions, depending on who's president):

To be clear, I'm not expressing an opinion on which side is right or wrong...

The point of all of this is that if you want to be a successful investor over time, you can't let your emotions – which include your political leanings – affect your analysis of economic factors and your investment decision making.

As I've said previously, there are three key lessons here:

- Try to read, watch, and listen to a wide range of media so you hear both sides of issues.

- Stick to high-quality news sources. (For example, I rely heavily on the Wall Street Journal, the New York Times, the Washington Post, and the Financial Times.)

- Don't let your political viewpoints affect your investment decision making.

3) Many folks fear that Americans have been whipped into such a frenzy about the election due to both parties demonizing the other candidate that, when the result is announced, there will be violence.

I disagree for two reasons: I have confidence in the American people and I have confidence in our law enforcement.

In a post on X last night, my college buddy Bill Ackman shared some thoughts about this. Excerpt:

Approximately half the country will be unhappy about the election outcome, potentially devastatingly so. In this context, I think it is important to remember that we are one country, and we will survive whoever is our next president.

What we must avoid, however, is a world where our fellow citizens who are disappointed raise hell or otherwise revolt about the outcome. The peaceful transfer of power is a critical feature of our democracy that must be maintained for us to succeed.

The system is stronger than any one candidate. We will thrive long term no matter the outcome of this election because the system will heal itself. That's been a feature of our democracy for nearly 250 years and I expect it to continue.

Let's therefore be civil and accept the collective will of our democratic process. We have many enemies that want internecine battles in America to weaken us. We cannot let this happen. The world is a dangerous place and we need to be unified to protect our country and our children.

Thanks for the wise words, Bill!

4) And to end today on a lighter note...

Susan and I celebrated my 58th birthday (which was on Friday) with our older daughters last night by going to a Brooklyn Nets NBA game – and our middle daughter scored us courtside seats.

Wow – being so close to the action and seeing the size and speed of these athletes blew my mind! I've circled my feet in the lower right picture below to give you an idea of how close we were:

Best regards,

Whitney

P.S. I welcome your feedback – send me an e-mail by clicking here.