Nvidia's AI Surge Is Just Getting Started; AMC crashes; Wall Street Funds Discuss Potential Bankruptcy Plan for WeWork; DWAC scrambling; Corporate America's Chief Critic, Carl Icahn, Gets His Comeuppance; Edwin Dorsey's interview of Marc Cohodes goes awry; What I left behind for my trip

1) There have been some wild moves in five stocks about which I've often written...

Driven by demand for chips behind artificial intelligence, Nvidia (NVDA) reported blowout earnings and raised guidance – sending its shares briefly above $500 yesterday, a new all-time high.

At the closing price of $471.63, the stock is up an astounding 648% versus 31% for the S&P 500 since February 5, 2020, when we included it as one of five stocks in an in-depth report on electric and autonomous vehicles in our Empire Stock Investor newsletter. (If you aren't a subscriber, you can learn more about Empire Stock Investor right here.)

We took half our money off the table long ago after it quickly doubled, but are letting the rest ride for reasons outlined in this Wall Street Journal article: Nvidia's AI Surge Is Just Getting Started. Excerpt:

Such a run obviously can't last forever, but Nvidia gave strong indications Wednesday evening that its ride is far from over. The company projected about $16 billion in revenue for the current fiscal quarter – nearly double the highest quarterly revenue it had ever reported before Wednesday. Chief Financial Officer Colette Kress said on the company's earnings call that its "demand visibility" extends into next year and that it expects to be able to increase the availability of its chips over the next several quarters.

"We're not shipping close to demand," Chief Executive Officer Jensen Huang told the Wall Street Journal in a later interview.

Nvidia's biggest customers seem to agree. In their recent financial reports for the quarter ended in June, Microsoft, Amazon, and the parent companies of Google and Facebook signaled a strong intention to keep spending on generative AI capabilities even as they moderate other areas of their capital investments. Microsoft, which kicked off the rush into generative AI services, had a record $8.9 billion in capital expenditures in the June quarter, and the company expects that amount to increase sequentially every quarter in its new fiscal year as it boosts investments in "AI infrastructure."

2) At the opposite end of the spectrum, four stocks I've long warned my readers to avoid are crashing...

On August 1, I included theater operator AMC Entertainment (AMC) under the heading, "A mini-bubble forming among a new group of meme stocks." Shares were then trading at $50 (adjusted for a recent 1-for-10 split). Yesterday they crashed another 27% to $14.37, down 71% in less than a month.

At least there's no longer an inexplicable price discrepancy between the company's regular shares and its preferred stock, which trades under the ticker APE. As I explained in my August 15 e-mail, after a court ruled that each APE share could convert into an AMC share, they should have been trading at the same price, but that day AMC closed at $3.25 (pre-split... $32.50 post-split) while APE was at $2.11, 35% lower. The trade would have been to go long APE and short AMC because since then, AMC is down 56% while APE is "only" down 33%, removing the discount.

I stand by my conclusion that day:

Over the long term, AMC is a zero.

The business looks structurally unprofitable, so there will be massive dilution over time as the company issues stock to fund its losses. Eventually, shareholders will be wiped out entirely when AMC files for bankruptcy so it can do the restructuring that's needed.

3) WeWork (WE), which I mockingly called "Whee" in 2019 when it was run by its insane founder, Adam Neumann, is down to $0.14 per share as it prepares to file for bankruptcy: Wall Street Funds Discuss Potential Bankruptcy Plan for WeWork. Excerpt:

A group of Wall Street firms that lent hundreds of millions of dollars to WeWork is exploring the possibility of a bankruptcy filing that could help the company exit from expensive office leases, one of several options under discussion, according to people familiar with the creditors' talks.

After WeWork raised doubts about its ability to stay in business a few weeks ago, fund managers including BlackRock, King Street Capital, and Brigade Capital are holding preliminary talks about the company's restructuring options and indicated that they would support a plan for WeWork to file for chapter 11 bankruptcy, the people said.

The creditors haven't presented proposals related to a bankruptcy or debt restructuring to the company's board, according to the people.

Bankruptcy could allow WeWork to shed a portion of its expensive commercial real-estate leases and in the process hand over control of the company to creditors like themselves, the people said. If a bankruptcy process is pursued, WeWork would likely restructure its debts and offer creditors shares in the reorganized company, they said.

There will be no recovery for the equity, so WeWork is also a zero.

4) Digital World Acquisition (DWAC) has tumbled from a high last week of $18.68 per share to yesterday's close of $13.93 per share because the company hasn't yet been able to get enough shareholder votes to extend the time it needs to complete its merger with Trump Media and Technology Group, owner of Twitter-knock-off Truth Social. If it doesn't get the votes by September 5 – a week from Tuesday – it will liquidate on September 8 and shareholders will only get $10 per share.

Therefore, with the stock trading at a nearly 40% premium to this, every shareholder should vote for the extension. But they're apparently not paying attention, so the company has resorted to issuing desperate press releases: Digital World Acquisition Corp. Urgently Asks All Stockholders to Promptly Vote for the Extension Deadline to Vote for Extension Approaches – EVERY VOTE IS NEEDED BY SEPTEMBER 5, 2023 TO PREVENT LIQUIDATION ON SEPTEMBER 8, 2023! Excerpt:

Eric Swider, Chief Executive Officer of the Company, noted, "Although so many of our stockholders have already voted for the Extension, today's vote count shows that we still have a ways to go to pass the amendment and extend the life of the Company. While we currently fall short of the necessary votes to extend the liquidation date, we urge our stakeholders to come together and support this extension. We believe in the value and prospects we bring to the table and to a true democracy in the United States, and with the continued support of our shareholders, we can navigate this challenge successfully and potentially complete the proposed business combination with Trump Media and Technology Group Corp. ("TMTG"), which we know so many of our stockholders believe in. If more of our stockholders do not promptly vote for the Extension, we will be forced to liquidate on September 8, 2023."

Mr. Swider added, "As our loyal stockholders know, a vote for the Extension is a vote for freedom of speech and a vote for innovation and growth. Every single share voting for the Extension is critical to help us progress our proposed merger with TMTG. Whether you have one share or 1,000 shares we please ask you take a few moments to vote."

The most likely outcome here is a liquidation, meaning shareholders today will lose another $4 per share, but I removed it from my "Dirty Dozen" list of stocks to avoid on April 14 because it's a bad short. My view hasn't changed from what I wrote then:

The stock closed yesterday at $13.14 per share, only slightly above DWAC's cash. Given that I think there's almost no chance the deal to acquire TMTG goes through and it's likely too late to find another deal, DWAC is almost certain to liquidate and return $10 per share to shareholders.

In this case, anyone who's short the stock at today's price will pocket a gain of $3 per share, so why not stick around?

Because "almost certain" isn't the same as "100% certain" – and, as we've seen, this stock can trade almost anywhere, totally disconnected from its fundamentals.

I'm wary of picking up pennies in front of a steamroller, which I discussed at length in my January 20 e-mail.

No matter how likely the outcome, it doesn't make sense to risk losing tens of dollars (and possibly more than $100) per share to make $3...

5) Lastly, the New York Times is adding its voice to the chorus criticizing Carl Icahn and his company Icahn Enterprises (IEP), which investors would be wise to continue avoiding: Corporate America's Chief Critic, Carl Icahn, Gets His Comeuppance. Excerpt:

Such bare-knuckle tactics have made Mr. Icahn the nightmare of many a chief executive and changed the fate of some of America's best-known companies, including Apple, RJR Nabisco, Blockbuster, and Netflix.

But in May, Mr. Icahn, 87, found out what it's like to be on the receiving end when Nathan Anderson, a 39-year-old short seller, published a report questioning the setup at Icahn Enterprises, his publicly traded company. Mr. Anderson suggested that the company was paying shareholders a dividend it could not afford. This month, Icahn Enterprises succumbed to the pressure, slashing its dividend by half.

"It is very, very embarrassing for Carl because this guy beat him and beat him at his own game," said Mark Stevens, the author of a 1993 book titled King Icahn: The Biography of a Renegade Capitalist.

6) I've read/watched/listened to a lot of interviews over the years and can't recall ever seeing one go off the rails as quickly and badly as this one...

Three days ago, Edwin Dorsey of The Bear Cave newsletter interviewed his mentor, old-school short seller Marc Cohodes, and started out by asking him to respond to critics of a few of his long investments that haven't worked out, which sent Cohodes into a rage. You can listen to it here or here (the juiciest parts are the first 11 minutes and the last 45 seconds).

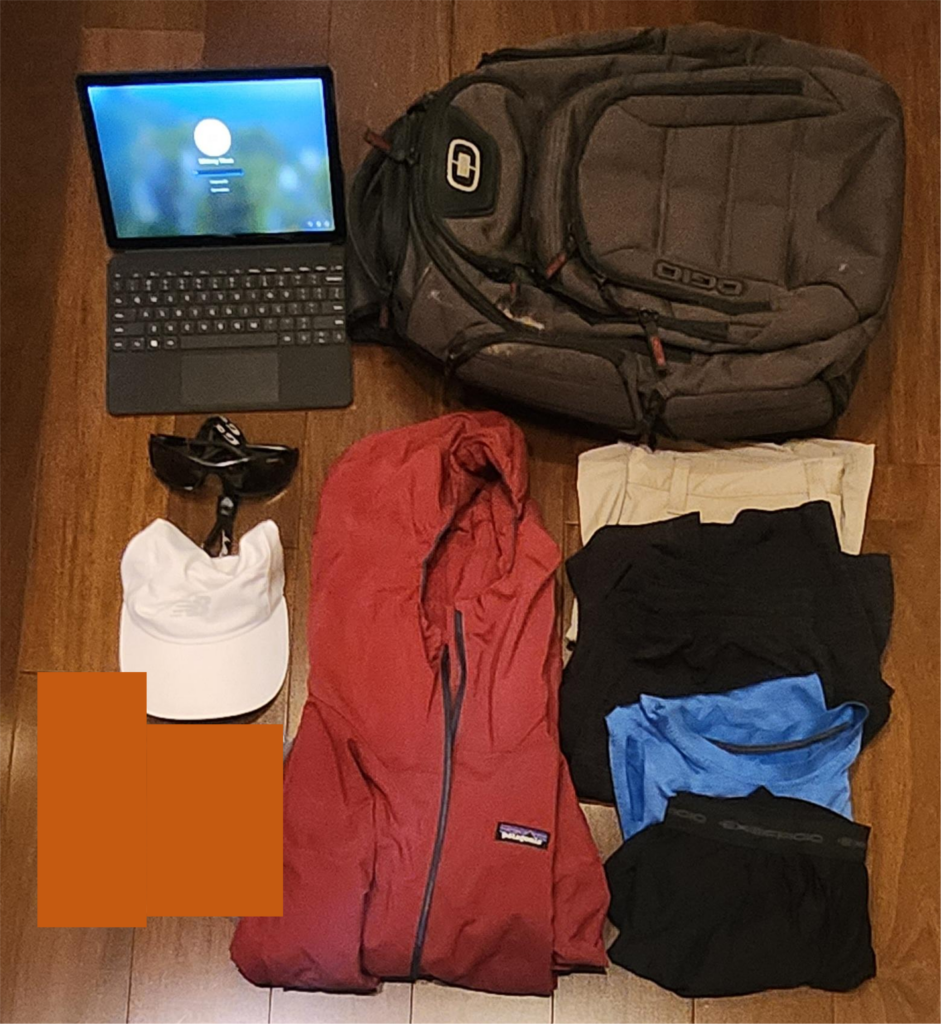

7) To travel so lightly on my four-day trip to Latvia, Estonia, and Sweden earlier this week, I had to leave a number of things behind because they would have required me to bring a backpack: a Microsoft Surface Go 3 (the smallest full-feature PC), sunglasses, hat, razor (missing from the picture), lightweight jacket (Patagonia Nano-Air Light Hybrid Hoody), shorts, athletic shorts (with liner, so doubles as a bathing suit), short-sleeve athletic shirt, and second pair of underwear:

It would have been nice to have all of these items, but I was fine without them – and traveling without a backpack was even nicer!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.