One of the Stock Market's Best Years Ever... So Far

The Weekend Edition is pulled from the daily Stansberry Digest.

The market hasn't been this "good" since 1997...

The market hasn't been this "good" since 1997...

Things don't seem that great in the world today. Real-world inflation is still high. Major wars in Eastern Europe and the Middle East continue without an end in sight. The U.S. just suffered through two major hurricanes. And the U.S. political scene continues to leave much to be desired with a presidential election less than a month away.

But you wouldn't know it by looking at the stock market...

Based on the price action, times have rarely been better. The benchmark S&P 500 Index started October up more than 20% since New Year's Day. That's its best performance in the first nine months of the year since 1997.

The S&P 500 is now about 2% higher this month. It has made 46 new all-time highs so far in 2024. And it's trading solidly above its longer-term 200-day and short-term 50-day moving averages – two ways of measuring the trend in prices...

And on October 11 – when the index was up 21.9% year to date – the S&P 500 hit another milestone. It was one of the best first 197 trading days of the year in stock market history. In the past, that has been a good sign for the rest of the year.

Here's a chart from market analyst Charlie Bilello showing the details. This year's time frame ranks No. 13 on the list...

We're also seeing a similar trend for the equal-weight S&P 500 Index. It's up 14% year to date.

That's not as strong as the market-cap-weighed S&P 500 Index... But if you think this bull run has longer to go, this trend suggests "other" stocks could still catch up to the mega caps.

On the other hand, you could see this performance and argue that mega-cap leaders have room to fall. However, companies like Nvidia (NVDA) and Meta Platforms (META) are trading at or near all-time highs again.

Regardless, as we'll show, this market outperformance doesn't match what we're seeing in the economy right now...

I'm not saying this is "right"...

I'm not saying this is "right"...

The stock market's performance feels disjointed from the economy that many Americans are experiencing.

And there's a good case to be made that it's a smart time to sell mega-cap tech stocks.

But stock investors certainly don't seem to mind the Federal Reserve "juicing" the economy. That's despite the unemployment rate falling over the past two months... a potential return of high(er) inflation down the road... and fiscal policy that's fueling mind-boggling government debt.

You could even argue we're already seeing inflation reignite via the stock market (except the energy sector, which is one place to find "cheap," high-quality stocks today).

That said, this Melt Up could go on a bit longer...

That said, this Melt Up could go on a bit longer...

Jeff Havenstein, a senior analyst on Dr. David "Doc" Eifrig's research team, recently warned of some volatility ahead in the stock market – perhaps tied to the U.S. election, but also typical October trading behavior. However, he said, this "isn't necessarily a bad thing."

As Jeff pointed out, one of the reasons is that after a banner year like this one, the next year is generally good, too.

As he wrote last week in an edition of Doc's free Health & Wealth Bulletin...

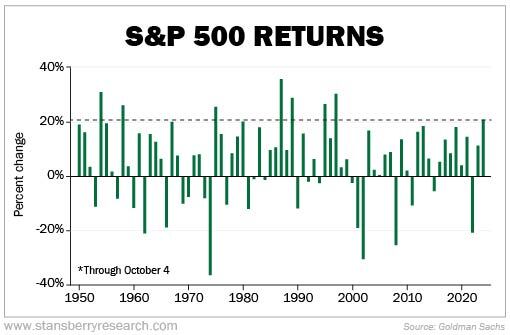

The chart below looks at S&P 500 returns since 1950. The index has only posted a better return than what we're seeing this year seven times in that 74-year span. And returns were positive the next year in six out of those seven instances. Take a look...

Jeff told readers to expect the markets to get rockier the rest of the month. But with this above chart in mind, he reminded folks of one more thing...

Bull markets don't die on a whimper. We have yet to see any real signs of euphoria – folks are still too cautious today. Stocks have plenty of room to run from here.

Still, be careful about what you buy...

Still, be careful about what you buy...

Yes, "expensive" stocks can keep getting more "expensive." And, yes, it might feel like everything can go up when stocks are trading at all-time highs and the Fed is willing to help juice the economy.

Monday looked like one of those days. Nearly every major S&P 500 sector was higher. Energy stocks were the only exception, with oil prices turning lower as the OPEC oil cartel cut its demand forecast. And the sector has continued to turn lower since then.

After the recent run-up in oil prices on the heels of more warring in the Middle East and China's stimulus plans, the haircut in expectations was welcomed for now. But weakness in oil is not exactly a good signal for the global economy.

Remember, while 1997 was followed by two more euphoric years (a nearly 27% return for the S&P 500 in 1998 and about 20% in 1999), the dot-com bubble burst in March 2000.

In short, it's possible this bull market could run longer than many might think... but we know the "good" times won't last forever.

Good investing,

Corey McLaughlin

Editor's note: The S&P 500 is posting one new high after another... the Fed has started cutting interest rates... and stocks like Nvidia are experiencing an incredible run-up. Many folks are wondering, "Can this bull market continue?" Our founder Porter Stansberry recently went on camera to share a warning about what's coming next – and to reveal the one change you should make to your portfolio to prepare... Get the details here.