Profiting From Wall Street's Toxic Sludge

Leave it up to Wall Street to take one of the safest income strategies of all time and turn it into toxic sludge.

When I first started trading options at Goldman Sachs, few people understood what that was... and even fewer cared. I had to spend hours and hours explaining to family and friends what I was actually doing each day at work.

Meanwhile, my group was generating massive profits for Goldman.

Wall Street may have already understood how lucrative – and safe – options trading can be... but my friends and family needed convincing.

Still, I truly believed that selling options wasn't just for the Wall Street elite. It could be for anyone interested in a steady stream of income.

Trouble was, there weren't a lot of resources explaining options in plain English. That's why I launched my options-focused newsletter, Retirement Trader, in 2010... to demystify the options world, little by little.

Many thousands of subscribers took me up on my offer. And over the next decade, we closed more than 500 trades with average annualized gains of 14%.

Then the pandemic hit... and the retail options market got a shot of adrenaline. Folks were stuck at home and bored. Armed with stimulus cash, they took to the markets to trade anything they could... from meme stocks to options.

In my 2023 review for Retirement Trader subscribers, I talked about the growth of covered-call exchange-traded funds ("ETFs"). The total assets in these funds surged from just $3 billion in 2020 to nearly $60 billion in 2023, with almost half of that total arriving in 2023 alone.

Investors continued flocking into these funds in 2024. One covered-call ETF, the JPMorgan Equity Premium Income Fund (JEPI), now has about $37 billion in total assets. In other words, this single fund now has more than 10 times the assets on its own of the entire covered-call-ETF industry just more than four years ago.

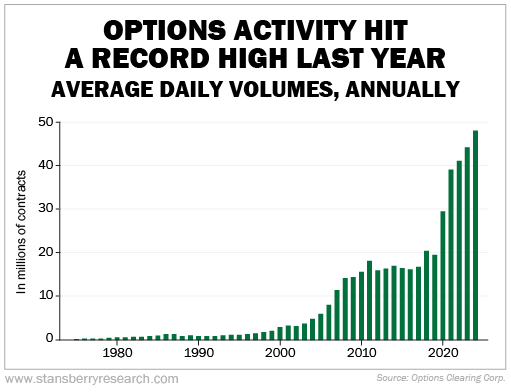

The chart below shows the total volume of option trades over the past few decades. As you can see, it has skyrocketed since the pandemic. It's not slowing down, either...

Options trading may not have been popular among retail investors back when I traded for Goldman. But today, more people than ever are interested in options.

That doesn't mean they're doing it the right way.

Big Wall Street firms are masters of keeping the best moneymaking strategies for themselves, then luring gullible traders into making terrible bets.

That's what I see with options selling. In Retirement Trader, we sell options on steady blue-chip stocks that the market has mispriced or is unduly worried about. They're also stocks that we wouldn't mind holding long term.

That's key as we begin a year that a lot of folks are anxious about thanks to the threat of looming inflation, volatility, and a massive political shift.

I've shown folks how to earn consistent and safe income...

- To pay themselves during the chaos of the 2020 COVID-19 crisis...

- To help provide some extra cash as grocery prices spiked to double-digit inflation...

- To soften the painful downturn of 2022...

- To stomach the market volatility of 2023...

- To keep collecting payouts without having to chase AI-hyped stocks in 2024...

Looking back at all the trades, both winners and losers over an incredible 15-year span – has a cash-generating "win" rate of 95%.

I don't know of many other market strategies that can match that – do you?

That's why, today, I invite you to join my "New Year Money Challenge."

In fact, I'm inviting at least 500 people to join me for a short project where I'll teach you a strategy that could help you collect cash from the stock market, month after month.

You could even collect this extra money from the market multiple times per month if that's what you decide to do.

All I'm asking, though, is that – if you accept my challenge – you learn about this strategy and consider trying it at least ONCE.

That's right, just once.

If you're ready to drastically change how you invest this year, click here to learn all about my challenge.

What We're Reading...

- Did you miss it? How to lose money the smart way.

- Something different: How the ancient Egyptians cooled their homes.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 13, 2025