Report from my 26th consecutive Berkshire Hathaway annual meeting; My updated estimate of Berkshire's intrinsic value; Berkshire's first quarter earnings

1) I attended my 26th consecutive Berkshire Hathaway annual meeting over the weekend.

CNBC live-streamed it and posted the nearly eight-hour video here and a summary with 26 video clips here. It's amazing to see how Warren Buffett and Charlie Munger have maintained such stamina and razor-sharp minds at their ages (92 and 99, respectively)!

I did a 14-minute interview after the meeting, which you can watch here. Summary:

Whitney Tilson, founder of Empire Financial Research, chats with BBAE CIO James Early after the Berkshire Hathaway 2023 meeting in Omaha about what Berkshire will look like after Buffett and Munger, getting started investing, and how a proliferation of value investors and technology like AI will affect the future of value investing.

As always, I had a ball, catching up with old friends and meeting many new, interesting people (a huge number once again from China, now that the country has reopened). It was nice hearing from many of them that they enjoy and learn from my daily e-mails – not just the investing stuff, which is the focus, but also the life lessons, travel tips, tales of my frequent adventures and travels, etc.

I was really touched by one guy who thanked me because back in early 2008, when he was at a small community college in Texas without much money, he read my warnings about the upcoming housing crisis and how the bond insurers were going to blow up (see our May 2008 presentation here), so he bought a lot of deep-out-of-the-money puts on MBIA (MBI). He said he made enough money to transform his life, allowing him to transfer to the University of Texas and later earn a master's degree at Harvard.

Here are pictures from the packed auditorium, me yukking it up with Guy Spier, checking out the GEICO and NetJets booths, and trying out the flight simulator at the Flight Safety booth:

2) For a number of years, I've been calling Berkshire "America's No. 1 Retirement Stock" because it offers a unique combination of safety, growth, and undervaluation.

While the undervaluation isn't as great as it has been at certain times in the past (see analysis below), I still think the stock should be the bedrock of any conservative portfolio.

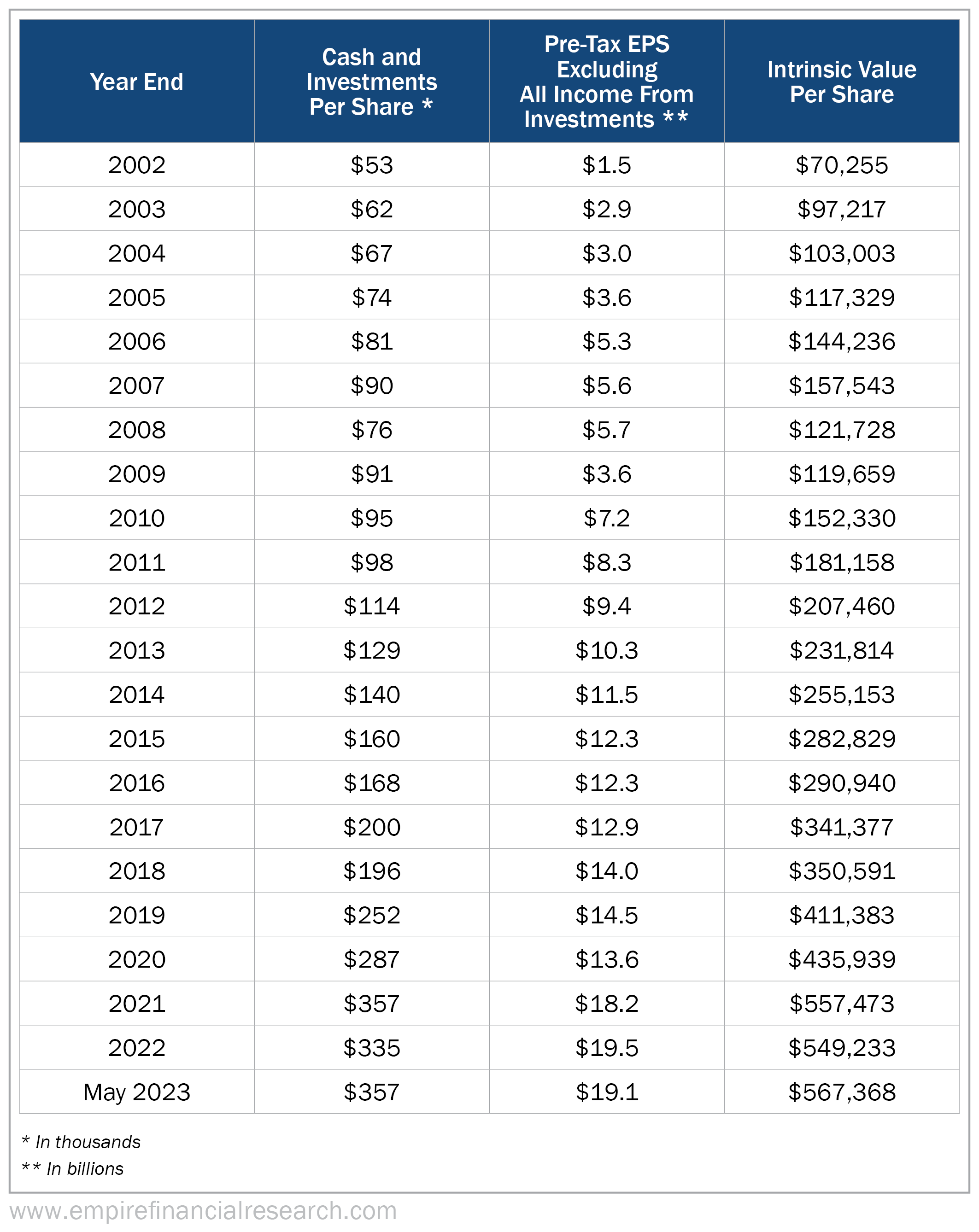

I've used a consistent method to estimate Berkshire's intrinsic value for the past two decades, which I believe is similar to the one Buffett uses: take the cash and investments per share and add the value of the operating businesses.

At the end of the first quarter, cash and investments were $349,000 per A-share. Since then, Berkshire's stock portfolio has risen by $8,000 per share, so that's $357,000 today.

Berkshire's pretax operating earnings over the past 12 months were $19.1 billion per share (excluding volatile insurance and investment income, but adding back an estimated $1.4 billion of annual normalized insurance earnings). To this, I apply a conservative below-market multiple of 11 times to arrive at a value of $210,000 per share.

Thus, my estimate of Berkshire's intrinsic value is $357,000 (investments) plus $210,000 (operating businesses), for a total of $567,000 per A share or $378 per B share.

This table shows this calculation for each year-end starting in 2002:

The A-shares closed Friday at $491,840, meaning that the stock is currently trading at a 13% discount to my estimate of its intrinsic value.

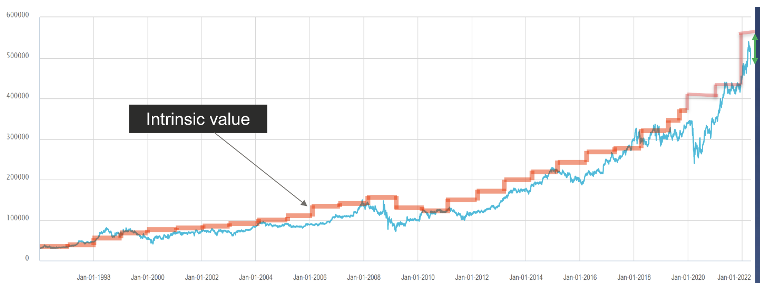

This chart shows Berkshire's share price (blue line) relative to its intrinsic value (red line, from the table above) going all the way back to 1996:

The company is incredibly safe, the stock is fairly cheap, and intrinsic value is growing nicely – what's not to like?

That said, it's important to have reasonable expectations. Given its moderate undervaluation today, I think over the next five years, Berkshire's stock is likely to do two to three percentage points (compounded annually) better than the S&P 500. In other words, if the S&P compounds at 5%, Berkshire will do 7%-8%.

3) As I do every quarter, I asked my longtime friend and former partner Glenn Tongue, who is the axe on the company, to share his analysis of Berkshire's earnings report. Here's what he sent me:

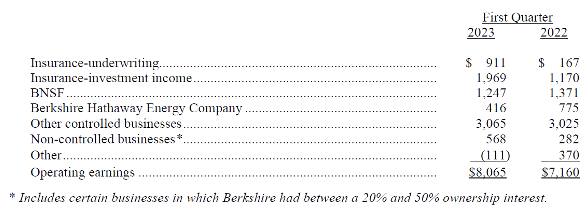

Berkshire reported first-quarter earnings on Saturday (earnings release and 10-Q here and here). GAAP net income soared, but this was mostly due to mark-to-market gains in the investment portfolio, which are largely meaningless over short periods of time.

But there was plenty of good news from the operations of Berkshire's wholly owned businesses, as you can see from this table:

Operating earnings grew a healthy 12.6% in the first quarter, as higher interest rates drove a 68% gain in investment income.

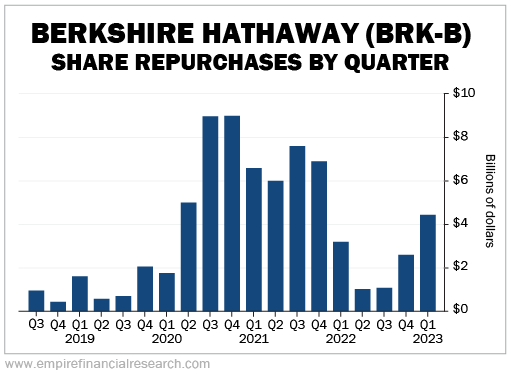

Buffett started buying back shares in 2018 and really ramped it up in 2020 and 2021. He slowed buybacks to a trickle in early 2022 as the share price hit an all-time high (and briefly reached our estimate of intrinsic value), but as the stock (and markets) pulled back, he resumed buying in size in late 2022, which has continued in 2023, as you can see here:

In the first quarter, Berkshire sold $13 billion of equity securities (it appears approximately $6 billion of Chevron stock and $1.8 billion of finance-related equities), while only buying $3 billion of stocks. It's notable when Buffett favors buying back his own stock over purchasing other equities.

Berkshire bought roughly 40% of Pilot Travel Centers in the quarter for $8.2 billion, doubling its stake in the business. This high-quality company is a good example of how Berkshire is able to acquire private companies at attractive valuations.

Thank you, Glenn!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.