Stock pitches for BERY and SRG; Short thesis for SRG; We stumbled upon the bobsled world championships and discovered a new sport

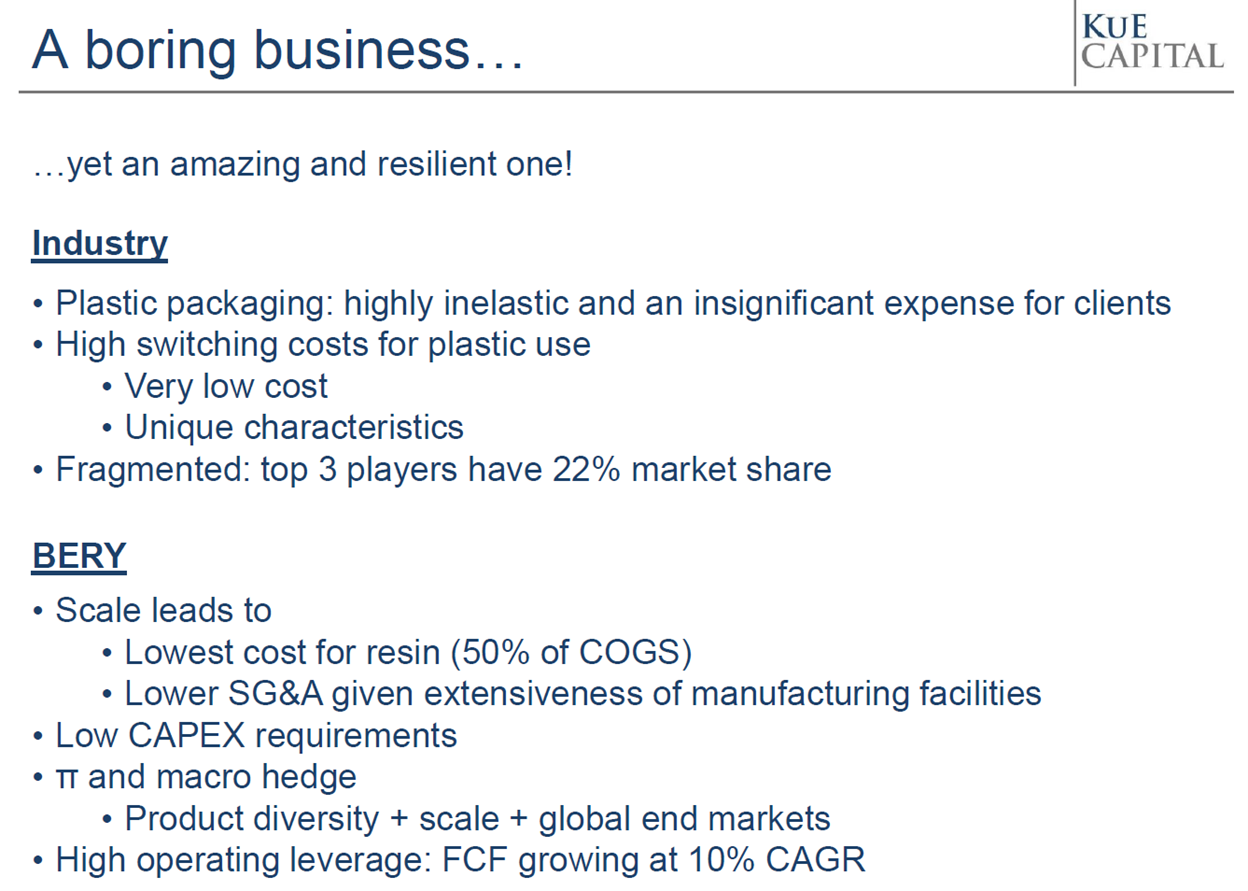

1) Continuing my coverage of the best ideas I heard last week at Guy Spier's VALUEx conference in Klosters, Switzerland, Rodrigo Lopez Buenrostro of Mexico City-based KuE Capital pitched a company I had never heard of: plastic packaging manufacturer Berry Global (BERY).

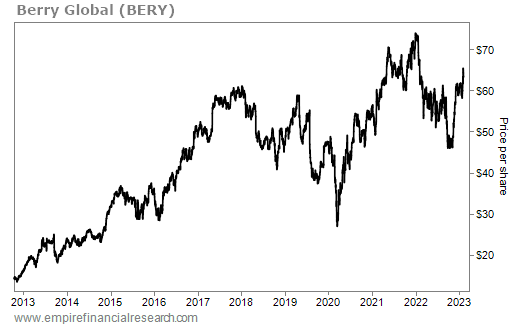

The company went public a decade ago, the stock quadrupled from $15 per share to $60 per share by mid-2017, and it trades around that level today:

Berry trades at an undemanding 1.2 times trailing revenues, 8.2 times EV/EBITDA, and 11.1 times earnings, and yields 1.6%.

You can see Rodrigo's six-slide presentation right here, and below are his two overview slides:

Here's a picture of Rodrigo and me:

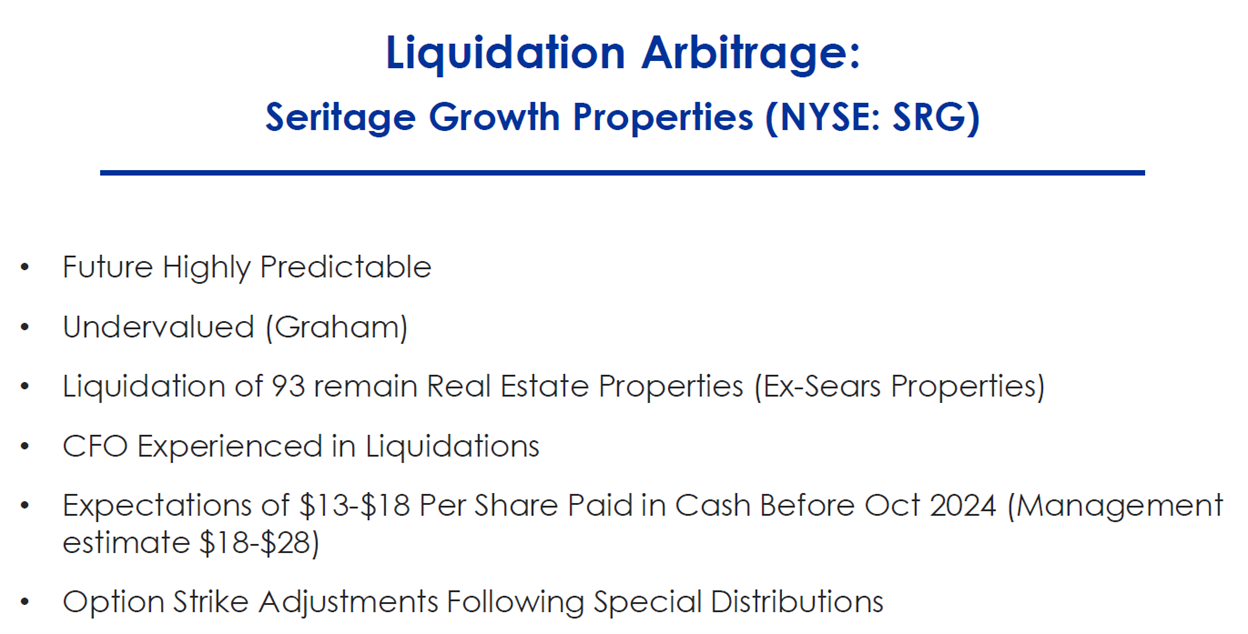

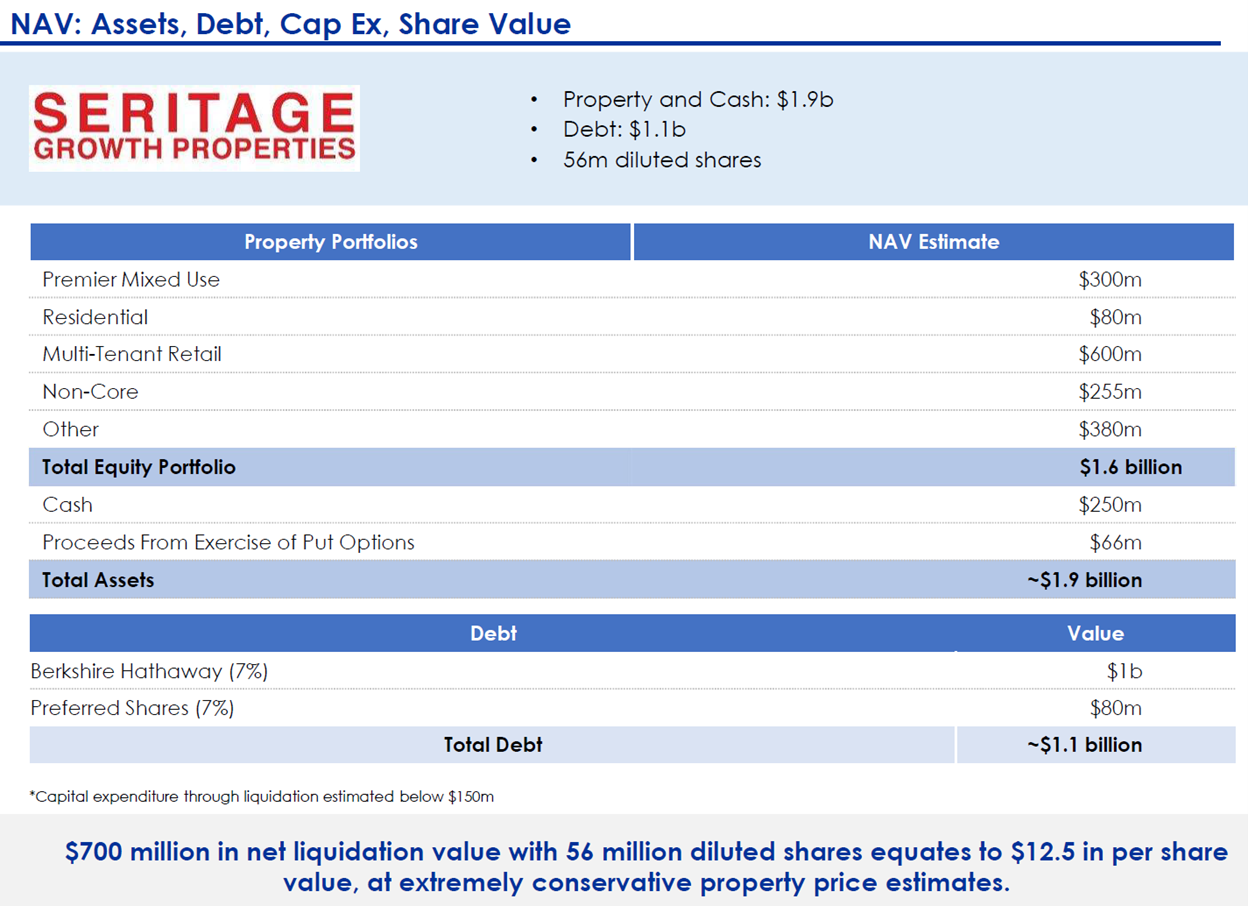

2) Matthew Peterson of Peterson Capital Management pitched another idea, a liquidation play of real estate company Seritage Growth Properties (SRG).

This has been a popular – and controversial – stock in the hedge fund community for a long time, having been written up eight times (five long, three short) from 2015 to 2022 on ValueInvestorsClub.

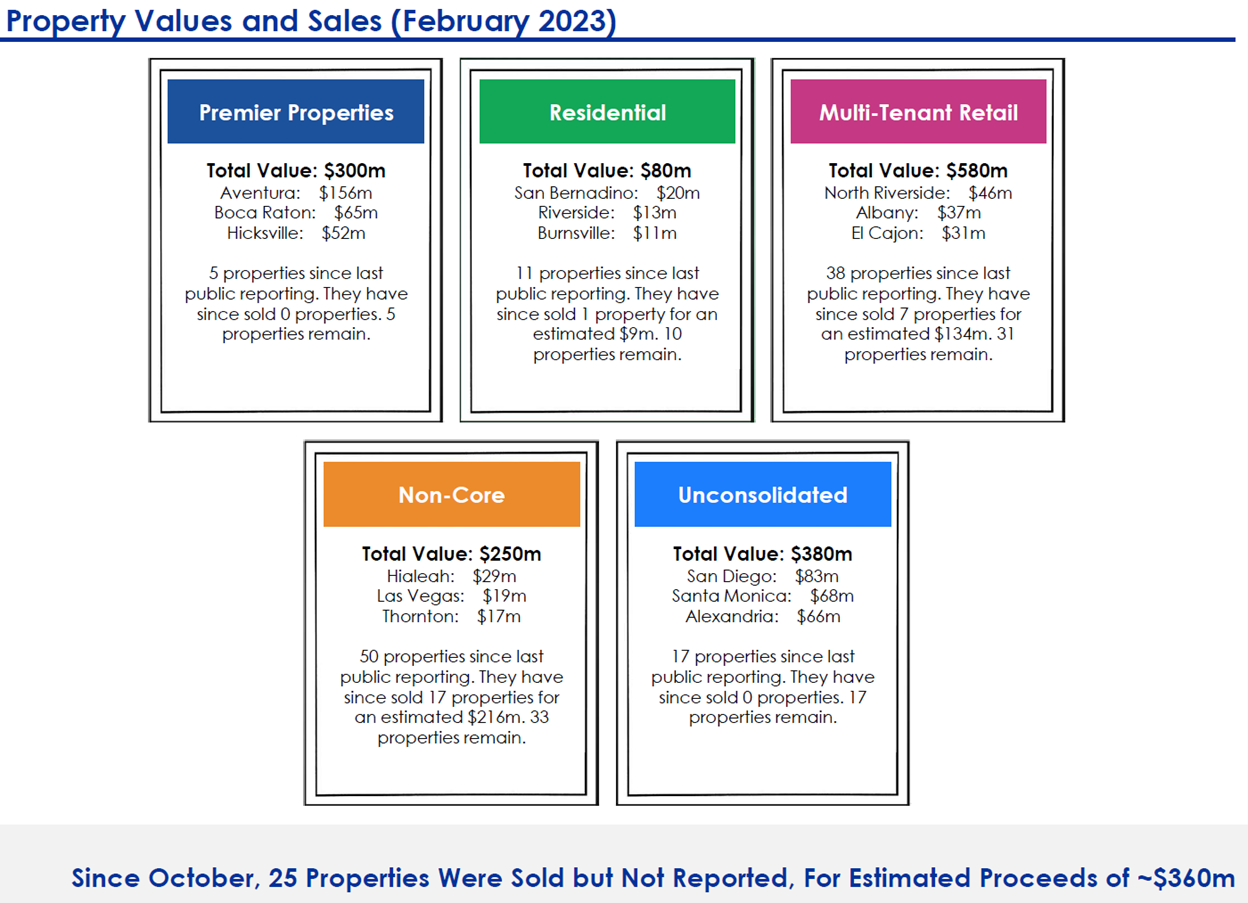

Seritage is winding down, selling its remaining properties, and returning cash to shareholders as it does so.

Management projects that it will return $18 to $28 per share by October 2024, while Peterson is more conservative, estimating $13 to $18 per share – both of which are well above the current share price of around $13.

You can see Peterson's 15-page presentation right here, and below are his three overview slides:

3) As noted above, Seritage is a controversial stock, so be sure to also consider this short thesis which was posted on ValueInvestorsClub last March. Excerpt:

I ultimately found Seritage to be an attractive short for two main reasons:

1) The majority of Seritage's assets are one-off mall anchor boxes, which are very challenged from a liquidity perspective.

As Seritage has sold assets, the portfolio concentration has shifted from ~48%/52% mall/freestanding at spinoff to 60%/40% today due to the lack of buyers for the mall boxes. B and C malls themselves went no bid even before COVID, and there have been minimal recent trades of even A-malls.

Additionally, because Seritage's boxes are fractions of malls and not malls themselves, I think the majority of Seritage's assets have only one possible buyer – the owner of the adjacent mall (data on Seritage's previous property sales strongly support this).

If Seritage were forced to sell these mall boxes, either today or at debt maturity, they would likely only clear at a deeply distressed price, far below the already-low prices where a few similar mall boxes have previously traded.

2) The three Premier mixed use developments that Seritage is close to completing – Santa Monica, Westfield UTC, and Aventura – have been flops, sitting mostly vacant today.

Before Seritage, nobody I know of had ever attempted to redevelop and try to lease a fraction of a high-end mall when the rest of the mall is owned by a top mall operator. The two Premier projects already open to tenants have revealed that this concept was poorly conceived, and all indications point to the three such project struggling as well.

I think all three of the close-to-complete Premier properties will fail to stabilize at much above 50% occupancy, and the only possible buyer for these properties is the owner of the rest of the mall, who is fully aware they're the only buyer. Any trades of these assets should also be at a deeply distressed price.

Estimating distressed prices is difficult, so I value Seritage's assets based on what I call an "appraisal" valuation. The assumptions in this appraisal valuation are 1) valuing every mall box based on the very limited transaction comps available (in reality, there's massive adverse selection in that the few mall boxes have already traded are the highest quality); and 2) valuing the three mostly complete Premier mixed use developments as if they're fully stabilized and cash-flowing.

Even in this generous appraisal value scenario, I'm shaking out to a gross asset value slightly below SRG's current enterprise value, suggesting all the upside is already priced into the stock.

Needless to say, owning illiquid, hard-to-value, negative cash-flowing assets with maturing secured debt usually doesn't lead to great outcomes for equity holders. The mall boxes and three Premier projects are a majority of Seritage's assets, so it doesn't take very aggressive discounts to their appraised value to cause the equity to be a full wipeout.

I haven't done the work to have an opinion here, but my friend and former partner Glenn Tongue thinks the short thesis is out of date and wrong, which is why he shares Peterson's bullishness of SRG...

4) Longtime readers have no doubt noticed that I often combine business and leisure travel...

For example, a month ago I flew to Las Vegas for the Consumer Electronics Show on Thursday and Friday (reports here, here, and here) and needed to be in Orlando on Monday and Tuesday for the ICR Conference (reports here, here, and here), so rather than flying home in between, I hopped over to Salt Lake City and squeezed in two days of skiing at Snowbird.

Similarly, I took advantage of being in Switzerland last week for the VALUEx conference, invited Susan to fly in Friday morning to join me (she says yes more often since we became empty nesters last June!), and that evening we took the train an hour to St. Moritz, where we spent the weekend with friends I met at the last VALUEx I attended five years ago.

We stumbled upon the bobsled world championships (and spent an hour getting an insider's view on the sport from Aron McGuire, the CEO of USA Bobsled and Skeleton), saw a new sport we'd never heard of, Cresta, and skied a bit. Here are some pictures:

I posted more pictures and descriptions of what we did, including what we learned from Aron, on Facebook here and here.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.