The Band of Debunkers Busting Bad Scientists; The Harvard Professor and the Bloggers; They Studied Dishonesty. Was Their Work a Lie?; Why inflation will remain muted; My friend's bull case; Live where you want to live

1) When I first started investing more than two decades ago, I spent a great deal of time studying behavioral finance, which attempts to explain how and why emotions and cognitive errors influence investors and create stock market anomalies such as bubbles and crashes.

Understanding this area is critical to being a successful investor because, as Warren Buffett once said:

Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ... Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.

Behavioral finance is a segment of the larger field of behavioral economics that studies human behavior – and irrationality – more broadly. Research findings often influence what governments and corporations do. For example, many companies now make participating in their 401(k) retirement savings plan the default option – if you don't want to participate, you must affirmatively opt out – after studies showed that changing the default option significantly increased participation.

Well, it now appears that the entire field is infected with shoddy – and, in many cases, outright fraudulent – research, which is being exposed by a number of people, most notably three brave professors highlighted in this Wall Street Journal article: The Band of Debunkers Busting Bad Scientists. Excerpt:

Simmons and his two colleagues are among a growing number of scientists in various fields around the world who moonlight as data detectives, sifting through studies published in scholarly journals for evidence of fraud.

At least 5,500 faulty papers were retracted in 2022, compared with 119 in 2002, according to Retraction Watch, a website that keeps a tally. The jump largely reflects the investigative work of the Data Colada scientists and many other academic volunteers, said Dr. Ivan Oransky, the site's co-founder. Their discoveries have led to embarrassing retractions, upended careers, and retaliatory lawsuits.

Neuroscientist Marc Tessier-Lavigne stepped down last month as president of Stanford University, following years of criticism about data in his published studies.

Here's a New York Times article about one of the most celebrated people in the field, Francesca Gino, who was a professor at Harvard Business School before the school placed her on unpaid leave and sought to revoke her tenure, which triggered her to file a $25 million defamation lawsuit: The Harvard Professor and the Bloggers. Excerpt:

Perhaps most significant, the accusations against Dr. Gino inflamed a long-simmering crisis within the field.

Many behavioral scientists believe that, once we better understand how humans make decisions, we can find relatively simple techniques to, say, help them lose weight (by moving healthy foods closer to the front of a buffet) or become more generous (automatically enrolling people in organ donor programs).

The field enjoyed a heyday in the first decade of the 2000s, when it spawned a ream of airport best-sellers and viral blog posts, and a leading figure bagged a Nobel Prize. But it has been fending off credibility questions for almost as long as it has been spinning off TED Talks. In recent years, scholars have struggled to reproduce a number of these findings, or discovered that the impact of these techniques was smaller than advertised.

Fraud, though, is something else entirely. Dozens of Dr. Gino's co-authors are now scrambling to re-examine papers they wrote with her. Dan Ariely, one of the best-known figures in behavioral science and a frequent co-author of Dr. Gino's, also stands accused of fabrication in at least one paper.

Speaking of Ariely – who wrote one of my favorite books in this area, Predictably Irrational: The Hidden Forces That Shape Our Decisions – here's an in-depth article in The New Yorker that, in my view, clearly exposes him (and Gino) as frauds: They Studied Dishonesty. Was Their Work a Lie? Excerpt:

"I'll tell you what the research on dishonesty says, but all that came from Dan and Francesca!" the former senior researcher said. "It's like everything we know about this situation comes from the data that might have been fabricated"...

Joe Simmons has been working on a blog post, which Data Colada will probably never publish, called "The Fraud Is Not the Story." He notes, at the outset, that there is "a very large body of behavioral research that is true and important." But, he says, there is also a lot of work that is "completely divorced from reality, populated with findings about human beings that cannot be true." In the past few years, some eminent behavioral scientists have come to regret their participation in the fantasy that kitschy modifications of individual behavior will repair the world...

At the end of Simmons's unpublished post, he writes, "An influential portion of our literature is effectively a made-up story of human-like creatures who are so malleable that virtually any intervention administered at one point in time can drastically change their behavior." He adds that a "field cannot reward truth if it does not or cannot decipher it, so it rewards other things instead. Interestingness. Novelty. Speed. Impact. Fantasy. And it effectively punishes the opposite. Intuitive Findings. Incremental Progress. Care. Curiosity. Reality."

The Data Colada guys have always believed that the replication crisis might be better understood as a "credibility revolution" in which their colleagues would ultimately choose rigor. The end result might be a field that's at once more boring and more reputable.

I think the takeaway here is best captured by Daniel Kahneman, who won a Nobel Prize for his work in this area:

"When I see a surprising finding, my default is not to believe it," he said of published papers. "Twelve years ago, my default was to believe anything that was surprising."

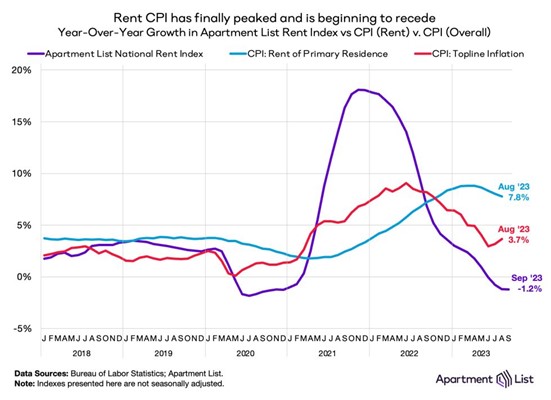

2) This chart captures a major reason why I think inflation is going to remain muted:

The shelter component of inflation, which represents about 30% to 32% of the value of the basket of goods that the Bureau of Labor Statistics evaluates to put together the Consumer Price Index (and an even greater 43% of core inflation), is comprised of a mix of rent cost (7% to 8%) and an estimate for how much a homeowner could rent their house out for (23% to 24%).

As you can see from the chart, the rise in shelter costs was a major driver of the surge in inflation from mid-2020 to mid-2022, which has reversed in the past year.

But, importantly, there's a significant lag effect: rent in particular began declining roughly six months before inflation did – and now the even larger housing component is turning down, which bodes well for inflation remaining in the 3% to 4% range going forward.

If so, I don't think the Fed will raise rates any further, which will likely provide a tailwind for stocks.

And when it comes to specific stocks I'm bullish on right now, I just released a special presentation on where I'm seeing opportunity in one corner of the market...

As I explain, it has to do with a secretive government initiative that has sweeping implications for not just our everyday lives, but U.S. national security and our country's future as a superpower.

I've identified seven stocks poised to benefit from this situation, with the potential to double or triple in value over the next several years... and potentially even more than that over the longer haul.

3) A friend of mine is even more bullish on stocks overall than I am for reasons he laid out in this post on X:

4) The same friend, who lives in a large city that gets a lot of bad press (not New York City) posted a wise comment:

He echoes my feelings about living in New York City: yes, it's the highest cost place to live in the country, but it's also the greatest city in the world, with unmatched people, culture, and dynamism, so the idea of moving away to save a bit of taxes is the dumbest idea I've ever heard...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.