The bull case for uranium; The Week in Charts by Charlie Bilello; My weekend in the Bay Area

1) My old friend Chris Irons recently interviewed another old friend, Harris "Kuppy" Kupperman of hedge fund Praetorian Capital, about why he's super-bullish on uranium: 100 Sigma Events? Excerpt:

Long-time readers of this site know of how enthralled I am with uranium. It is by far my largest sector exposure. Throughout the two years that I've been invested, the story has only gotten better...

... the trade is about the fact that an industry cannot function for long when deficits are running at a third of total supply. Oddly, in the uranium world, since there isn't really a liquid market for financial speculators to achieve price discovery without taking delivery, we haven't seen much more than a slow grind higher in the uranium market. This is simply the nature of an opaque and insular market with only a handful of consumers and even fewer producers.

As a result, there hasn't been the price response necessary to convince most miners to re-start mines or develop new ones – despite the universal belief that the deficits will be massive for many years into the future. When that price response does come, it will be too late as it takes years to re-start a mine and even longer to build a new one...

Throughout my career as an inflection investor, I've showed up to sleepy industries that are starved of capital. I've dreamed that 100-Sigma events could happen, and I've frequently bet big. I've always been amused as industry participants told me that I was wrong; yet couldn't explain why I was wrong. No one at WNA really disputed my deficit math. Instead, they seemed baffled that I even cared about their industry. Why were finance guys suddenly at their sleepy little conference?? Why did I care about the rapidly expanding deficits?? Didn't I understand that they could just call their fuel buyer and get more pounds??

Let me be clear, I don't think the world will run out of uranium. It's actually quite plentiful as a commodity. However, there appears to be a gap period where for a few years, the deficits will simply overwhelm the ability to ramp up production. I think that there will be a super-spike in the uranium price. Not a doubling or a tripling, but a true super-spike that will stun everyone at this conference, especially as most of these guys are functionally short.

Remember, as a utility, you're not allowed to run out of uranium. If the price goes up, you simply chase it. Just because something hasn't happened to uranium yet, doesn't mean that it cannot happen. The fact that none of them are considering that this could happen, only increases the odds of it happening.

We share Kuppy's bullishness on uranium... which is why, in the latest edition of our Energy Supercycle Investor newsletter, we shared the names of seven stocks to buy to take advantage of the setup in uranium and nuclear power.

The demand surge in nuclear power isn't just coming... It's already here. Make sure you're positioned to take advantage – learn how to gain instant access to our seven favorite stocks in the sector by clicking here.

2) Charlie Bilello, the director of research at Pension Partners, shared many fascinating charts in his latest weekly post, The Week in Charts, on the following topics:

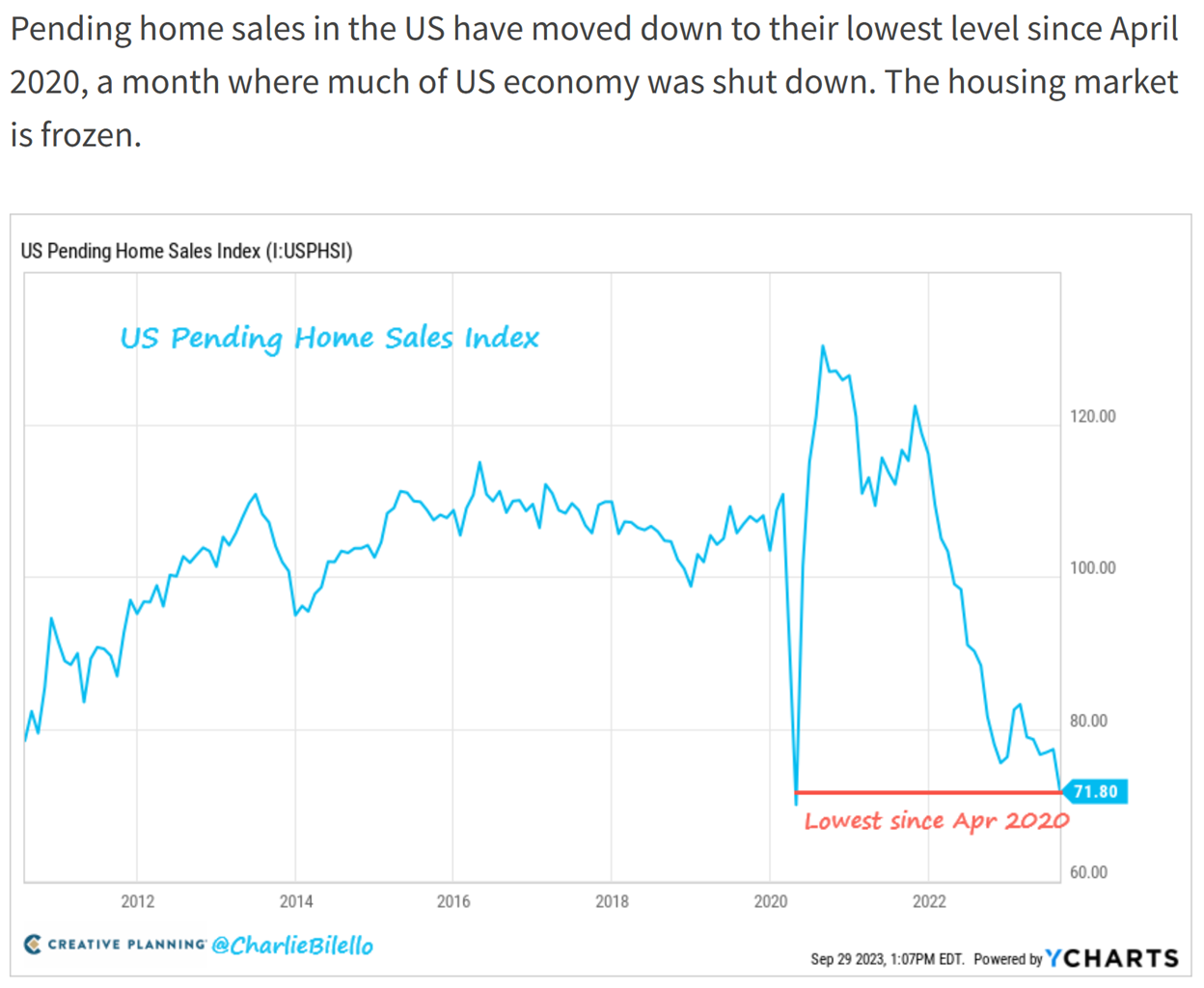

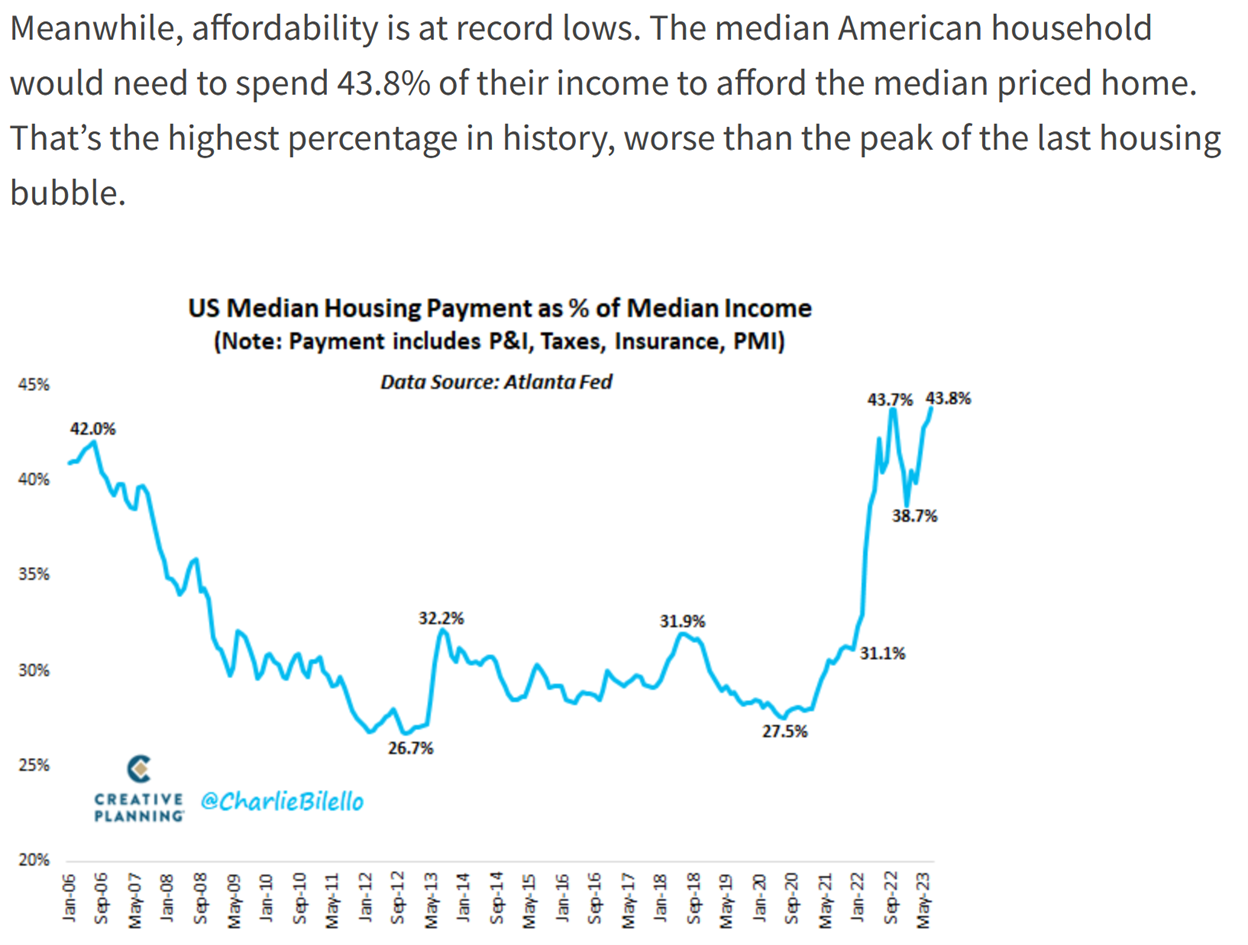

- The Frozen Housing Market

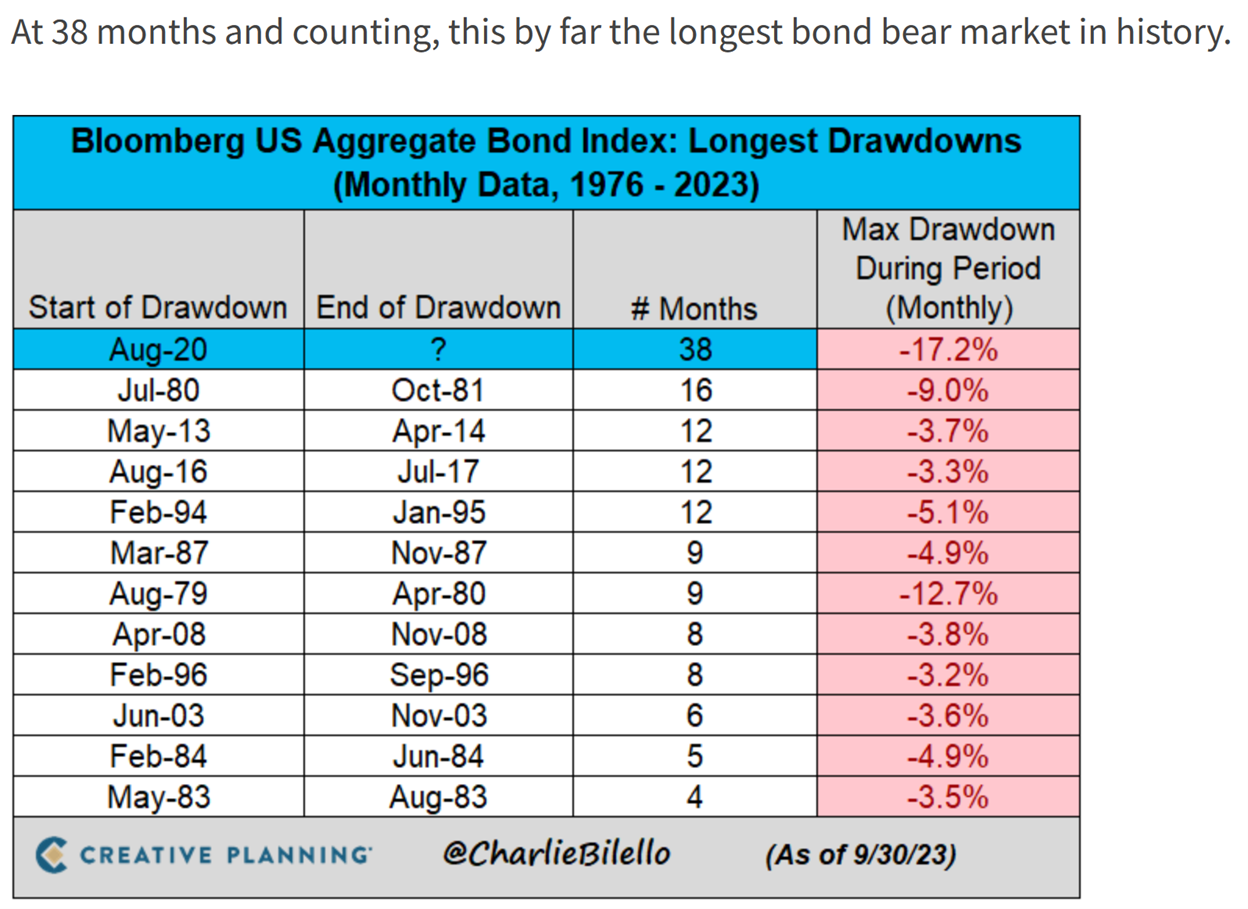

- 7 Years Gone

- Fed on Hold

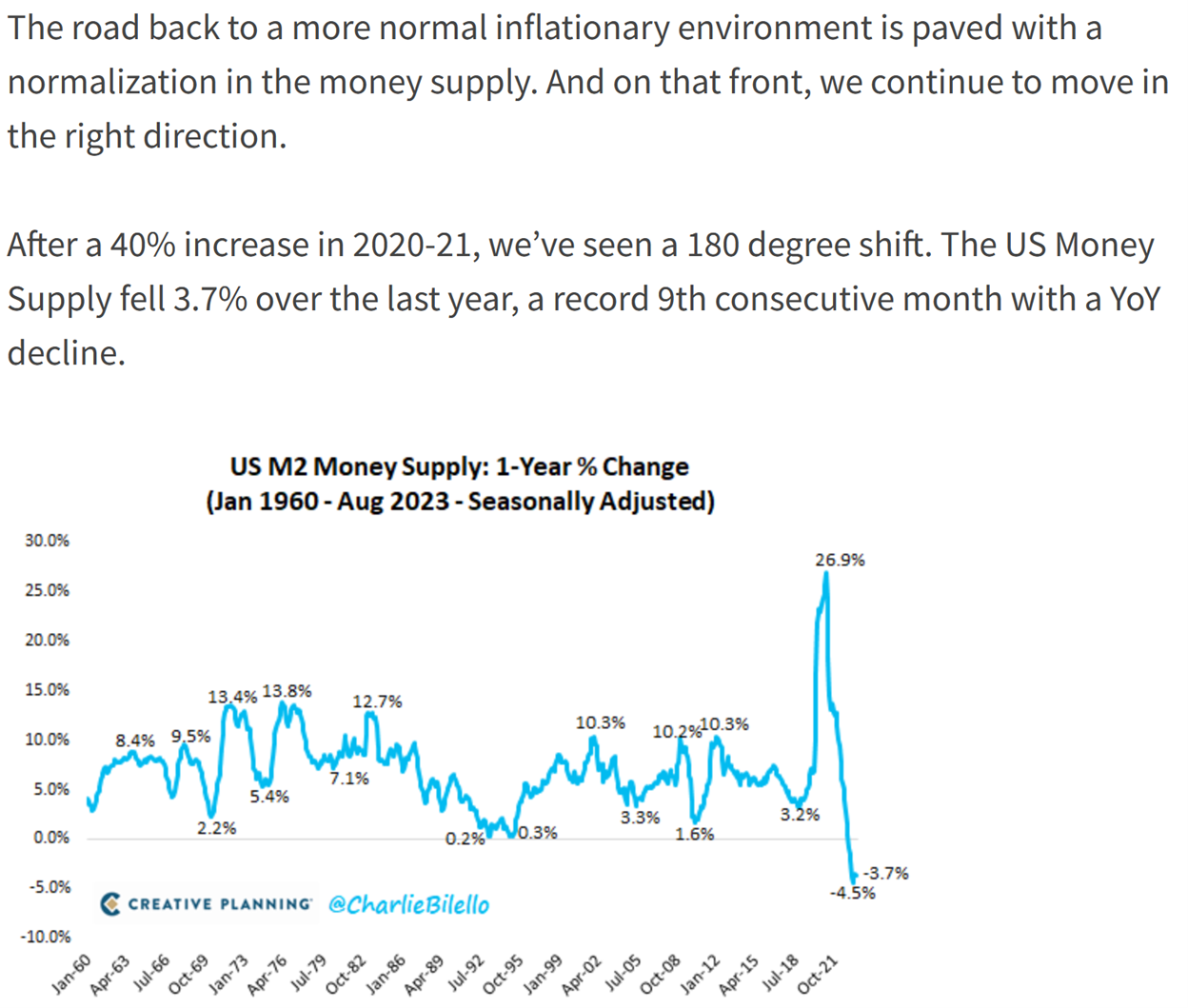

- Positive Signs for Inflation

- Unaffordable Healthcare

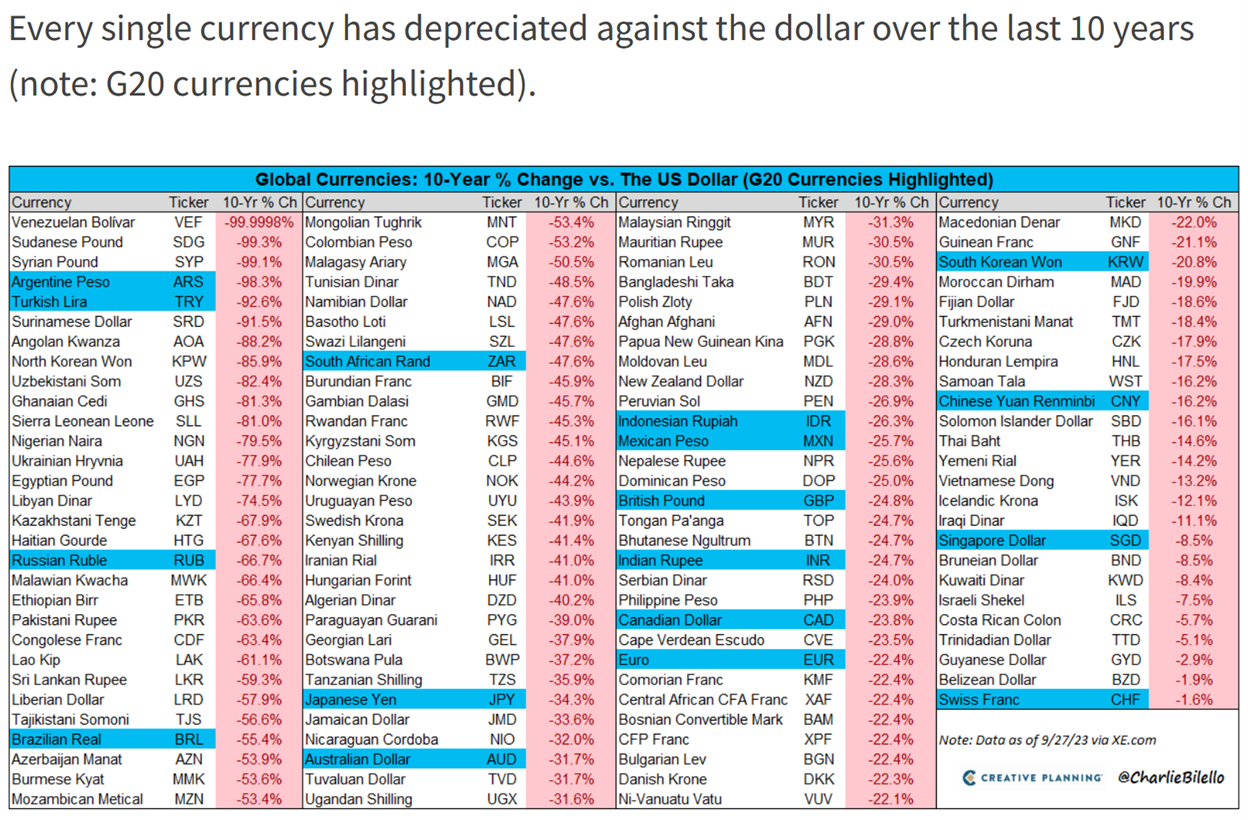

- King Dollar

- Know What You Own

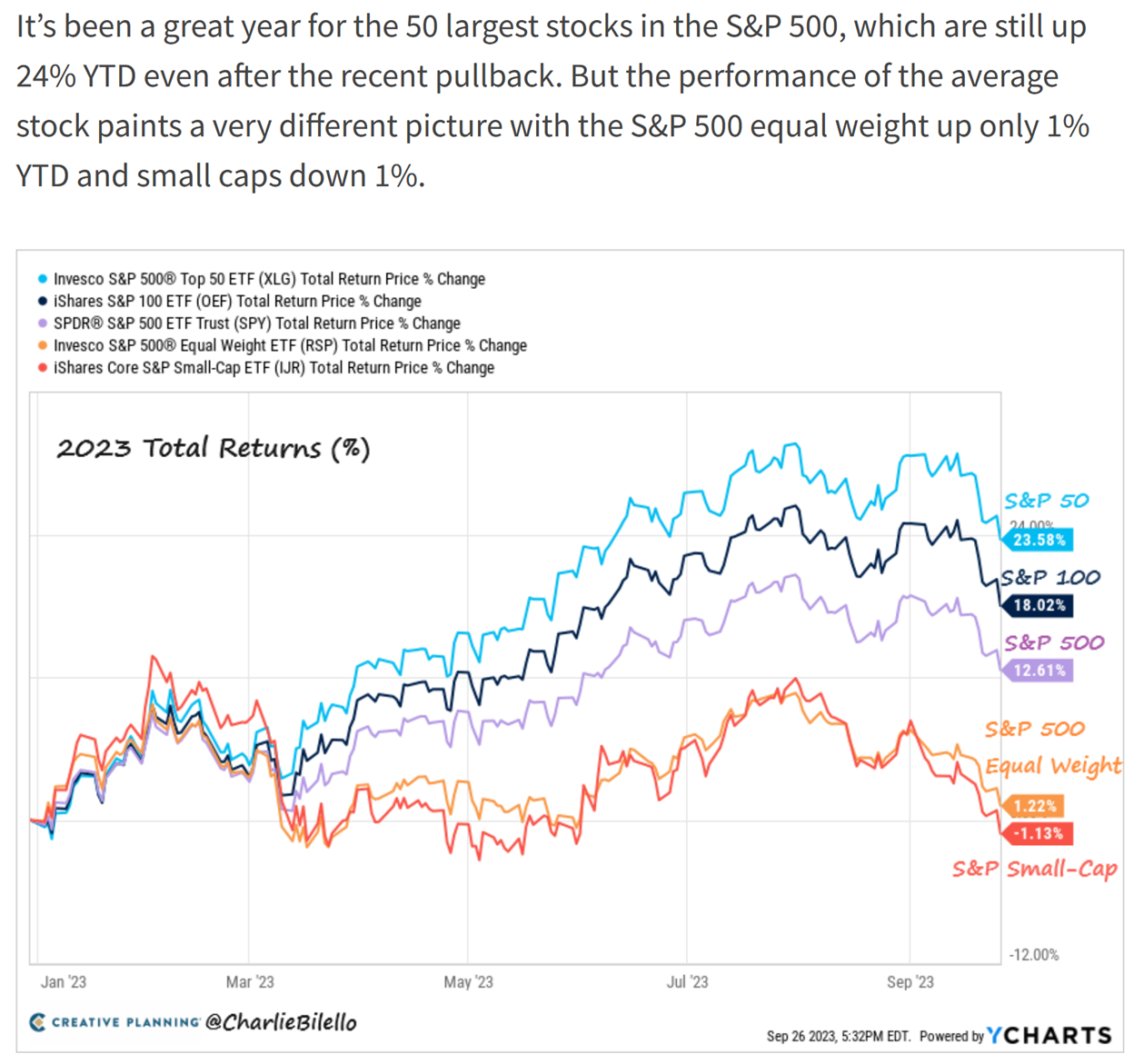

- Weakness Underneath

- The Freedom Premium

- 6% Rates?

Here are his charts that I found most interesting:

In the last chart, I saw that the Kenyan shilling has lost 41.4% of its value to the dollar in the past decade.

This has whacked my sister, who lived in Kenya for many years before recently moving back to the U.S. She bought a house outside Nairobi (about 10 minutes from my parents) eight years ago and is now selling it for roughly the price she paid for it – but in shillings, which means she's taking a loss of more than 30% in dollars... Ugh!

3) I flew to San Francisco on Friday to attend the investor day of my cousin's private medical device company, Neptune Medical, which is my single largest investment other than the S&P 500 Index. (I was pleased to see that it's going gangbusters!)

I extended the trip until today so that I could see friends and family, meet some of the world's top drone experts – whom I'm connecting with Ukrainians building drones to help win the war – and visit the two largest air taxi companies, Joby Aviation (JOBY) and Archer Aviation (ACHR) (Empire subscribers should keep an eye out for my thoughts on them)...

Below are some pictures from the weekend – visiting my aunt and uncle and cousins, the Stanford-Oregon football game, and touring around San Francisco.

Given what I've been reading about the crime and homelessness problems in the city, I was expecting the worst, but was pleasantly surprised to see that one of my favorite cities in the world was as beautiful as I remembered it.

I walked 5.5 miles yesterday morning and then went for a 6.1-mile jog in the afternoon and didn't see a single homeless person or any sign of disorder (that said, I was mostly along the waterfront and the wealthy neighborhoods overlooking the bay – my cousin said the problems are concentrated in the downtown and a few other areas)...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.