The 'Debt Jubilee' Is Getting Mainstream Attention

The Weekend Edition is pulled from the daily Stansberry Digest. The Digest comes free with a subscription to any of our premium products.

.jpg)

Another quarter, another new high for debt...

Earlier this month, the Federal Reserve Bank of New York released its latest quarterly report on household debt and credit. And in short, Americans continue to borrow like mad...

Total household debt climbed another $193 billion in the fourth quarter of 2017 to a record $13.15 trillion. It has now risen for 14 consecutive quarters and five straight years... It now sits just shy of $500 billion more than the previous peak in the third quarter of 2008.

Credit-card debt once again led the way... It rose 3.2% in the quarter to $834 billion. Student and auto loans increased 1.5% and 0.7%, respectively, to a record $1.38 trillion and $1.22 trillion. And even mortgage debt climbed substantially for the first time in several quarters, up 1.6% to $8.88 trillion.

On the bright side, the New York Fed did note that "serious delinquencies" – defined as loans that are 90 days or more delinquent – didn't get worse for most categories last quarter. In fact, the overall delinquency rate ticked down from 2.4% to 2.3%, thanks largely to an improvement in mortgage debt. But it was up significantly year over year.

This trend is unsustainable...

Sooner or later, it will end... and one of the largest credit-default cycles in history will begin. But like the "Melt Up" in stocks, we suspect it could continue a little longer.

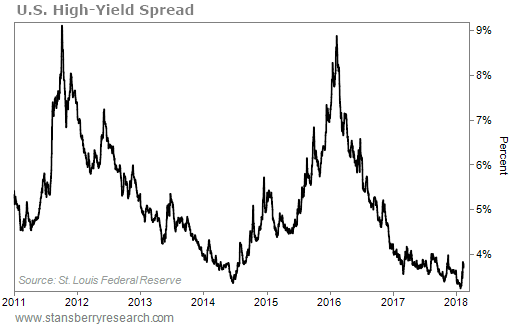

The following chart shows the U.S. high-yield corporate "spread." This is the difference in yield between U.S. Treasury bonds and high-yield (or "junk") corporate bonds.

In simple terms, this spread tells you what, on average, investors are demanding in extra yield in order to hold the riskiest corporate debt instead of government bonds. This makes it a good "early warning" indicator of broad credit-market trouble.

As you can see, the junk-bond spread has begun to move higher this year. But it remains below 4% today. This is near its "tightest" level in history, and well below levels that would indicate stress in the credit markets...

In short, the junk-bond market – the "canary in the coal mine" for the credit market – is healthy... for now.

Again, we can't know exactly when this boom will end...

But we can guarantee it won't end well.

Regular DailyWealth readers know Stansberry Research founder Porter Stansberry believes the most likely outcome is a "debt jubilee"... a financial "reset" that wipes out trillions of dollars of this debt through a massive devaluation of your hard-earned savings. As he explained in the October 28 DailyWealth...

|

If you're like most folks, you're probably skeptical...

You might even assume that this was just a provocative story Porter dreamed up to sell more newsletter subscriptions. After all, nothing like this could actually happen in America today... right?

Think again.

Not only is a jubilee possible... it's already being discussed in "mainstream" circles. As CBS News reported last week...

|

Expect to hear even more about these ideas as debts continue to rise and more Americans fall hopelessly behind. In the meantime, if you still haven't seen Porter's detailed presentation on this situation, be sure to check it out right here.

Regards,

Justin Brill

Editor's note: We've never seen what's going to happen next... Porter says the U.S. financial system is about to be "reset." And the markets will react violently. Fortunately, you don't have to be a victim...

To help you prepare for what's ahead, Porter published a brand-new book – The American Jubilee. In it, you'll learn America's 50 most dangerous companies... a critical move you must make in your bank account... and much more. Get your copy for just $19 right here.