Top 30 stocks in the S&P 500 over the past 30 years; Let your winners run; Charts from Charlie Bilello; Stockholm

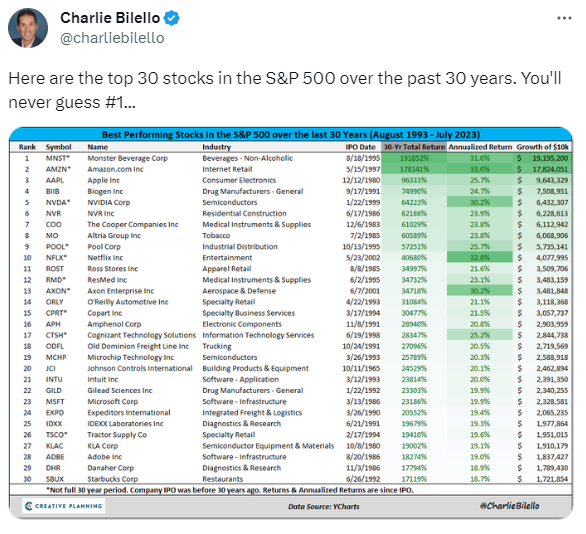

1) Here's an interesting tweet on the top 30 stocks in the S&P 500 over the past 30 years:

2) I owned a number of these stocks at various times – Amazon (AMZN), Apple (AAPL), Netflix (NFLX), Ross Stores (ROST), and Microsoft (MSFT) – but didn't make even a tiny fraction of the profits I should have because I sold them much too soon.

This underscores one of the most important elements of successful long-term investing: you must let your winners run!

Here's Chris Cerrone of Akre Capital Management with some smart thoughts on this: The Art of (Not) Selling. Excerpt:

We have learned to be very careful about the reasons we sell.

We try hard to tune out concerns about politics and the economy. We read the newspapers, and we work just down the road from Washington D.C. However, it has been our experience that we are at our worst as investors when we allow concerns about these issues, including elections, trade wars, and Fed policy, to influence our investment decisions.

In addition, we try to resist the temptation to sell (or trim, even) on the basis of valuation alone. We are unfazed when our businesses are quoted in the market at prices above what we would pay for them. It might be worth reading that last sentence again for emphasis.

Why? For three reasons...

First, when selling because of valuation, it is often with the idea that there will be an opportunity down the road to buy back in at lower prices. In our experience, it seldom works out this way.

Second, of the thousands of publicly traded companies, there are probably fewer than one hundred that meet our criteria, and opportunities to buy them at attractive prices are few and far between. Unlike average businesses that can be traded like-for-like on the basis of valuation alone, growing and competitively advantaged businesses are just too hard to replace.

Third, the very best businesses tend to exceed expectations. What may seem like a high price today may be proven to be perfectly reasonable in hindsight.

There's an old saying on Wall Street, "Pigs get fat, hogs get slaughtered," which cautions against being greedy.

I disagree.

If you're looking in the right places for high-quality businesses whose stocks are attractively priced, every once in a while you're going to invest in one that doesn't just double, but goes up five, 10, 50, or even 100 times.

To build a successful long-term track record, you must be greedy when opportunities like this arise! Investing in a moonshot stock only happens maybe once a decade – or even once in a lifetime. So it's critical that you make the maximum amount of money when you have the good fortune to have this happen to you.

Consider my experience with Netflix...

When I bought the stock in 2012, Netflix was deeply out of favor. Investors were worried about rising competition and content costs, as well as the company's plan to spin off its DVD-by-mail business into a new entity called Qwikster (a silly idea that Netflix soon abandoned).

But I saw a business with a product that customers loved that was more than 10 times bigger than its nearest competitor and was growing like a weed. Sure enough, shares soon took off. Two years later, the stock was up 600%.

As the stock took off, all I had to do was sit back and profit from correctly identifying one of the greatest stocks of all time. Instead, I sold half my shares once the stock doubled. And then, I sold some more shares when it doubled again. As the stock was doubling another time, I exited the position completely.

I thought I was being a prudent risk manager and I congratulated myself for making 7 times my money. But in reality, I shot myself in the foot. If I had simply held on to my original position in Netflix, I could have made more than 10 times what I ultimately made. It was a costly mistake.

That's not to say you shouldn't ever sell a stock that's working for you. It's important to control position sizes to manage risk, of course. And it's even more important to be attuned to fundamental changes in the story. Kodak was a great company and stock for decades... until digital photography came along. Then the stock turned into a "value trap" that lured in many smart investors, who eventually lost everything when the company went bankrupt in 2012.

When it comes to taking advantage of big opportunities, that's exactly what I'm seeing right now in one corner of the market...

Something that I've been calling "World War E" could soon trigger a mega-rally for one of the most controversial assets on Wall Street.

This type of financial event is so rare that it has happened just four other times in the past 123 years. When it takes place, it can drive the market for decades... and it can churn out a long string of massive opportunities to profit.

I share all the details in a special presentation – watch it here.

3) Regular readers will note that I often include tweets (like the one above) by Charlie Bilello...

He's the chief market strategist at Creative Planning, a wealth management firm with more than $200 billion in combined assets under management and advisement. While I've never met him, he posts a lot of great information, which is why I subscribe to his free newsletter, The Week in Charts, which you can sign up for here.

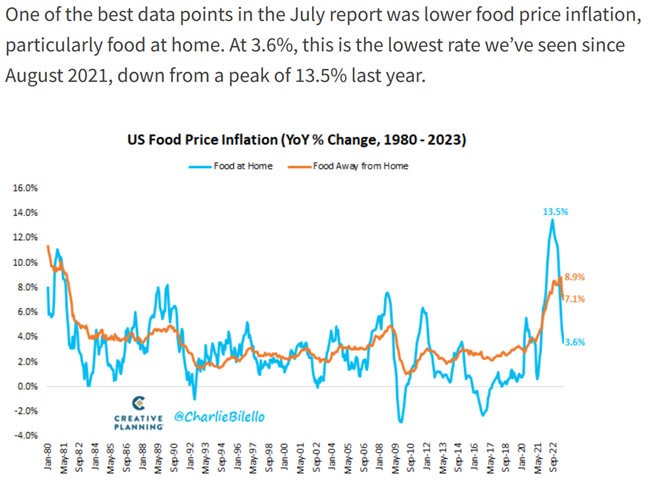

In his August 15 missive, Bilello posted a number of interesting charts, including two that underscore why I think inflation is going to remain in the 3% to 4% range. This one shows declining prices for food:

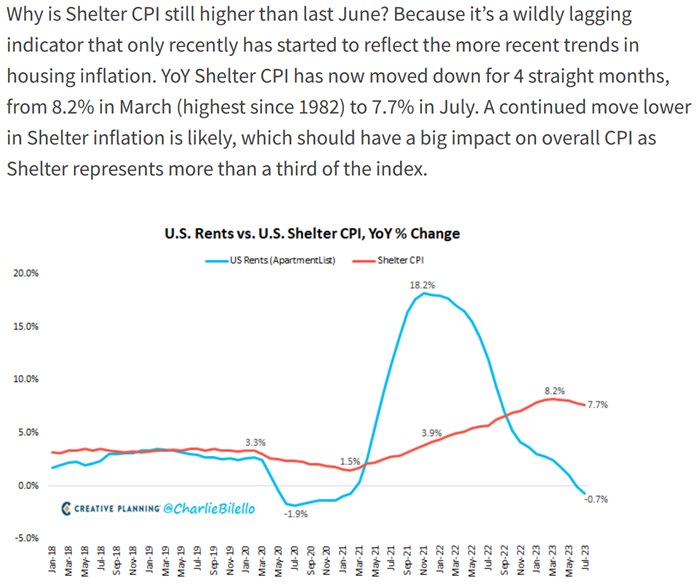

And, far more important, this one shows how shelter costs are going to keep falling because of the lag effect:

4) My friend Jesse Jonkman and I flew from Tallinn to Stockholm yesterday evening and went out to dinner in the beautiful old town.

I spent last night in an old 747 that last flew in 2005. It's parked right next to the Stockholm airport and has been converted into the Jumbo Stay Hotel. What fun!

I flew home this morning and just landed at Newark...

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.