Tweets on WeWork and inflation; Facebook says Susan and I have been friends for 13 years

My analyst Kevin DeCamp continues to find and send me interesting tweets...

1) WeWork's (WE) stock crashed 39% yesterday to $0.13 per share after the company reported yet another quarter of hideous losses and admitted what every sensible person has long known: "substantial doubt exists about the Company's ability to continue as a going concern."

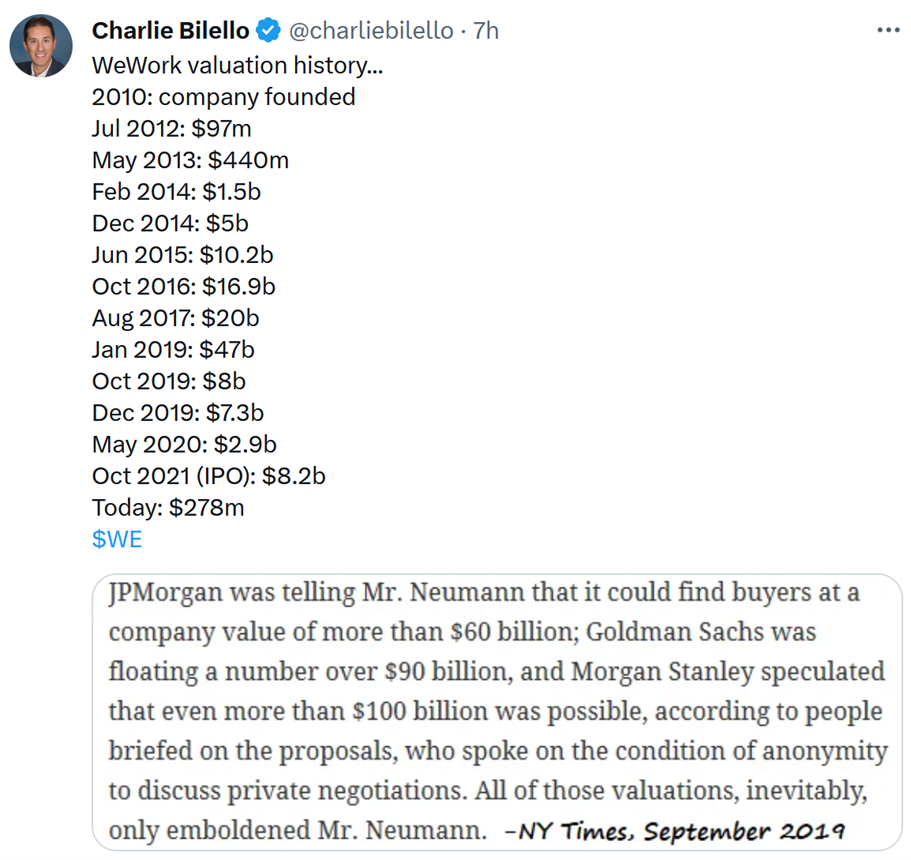

Here are two tweets by Charlie Bilello documenting WeWork's history of losses and absurd valuation (note that the company's market cap is now down to $102 million):

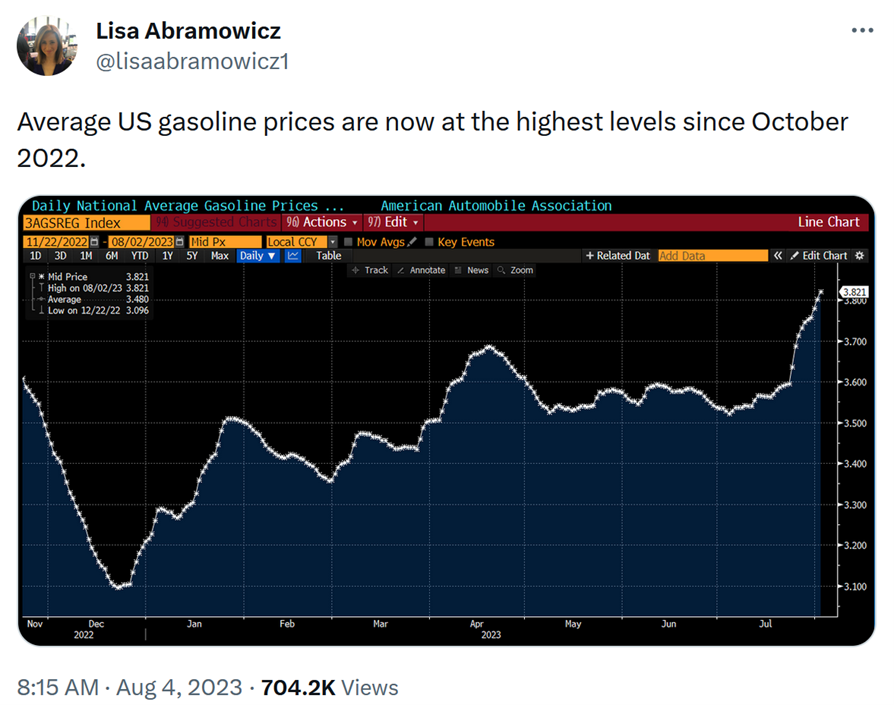

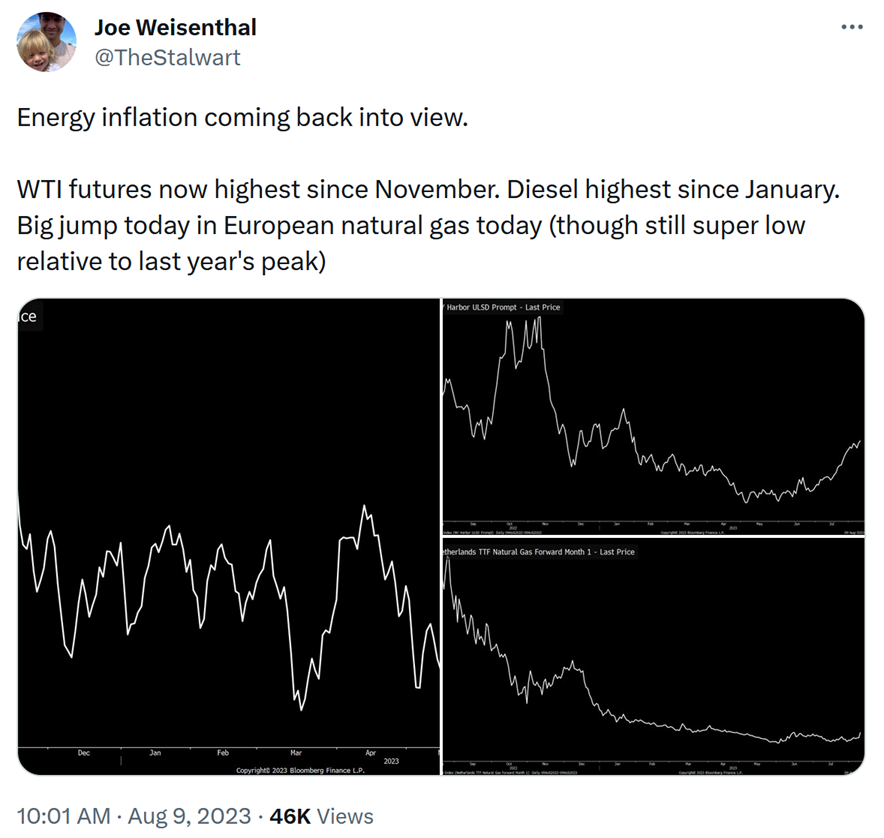

2) Energy prices have moved up quite a bit recently:

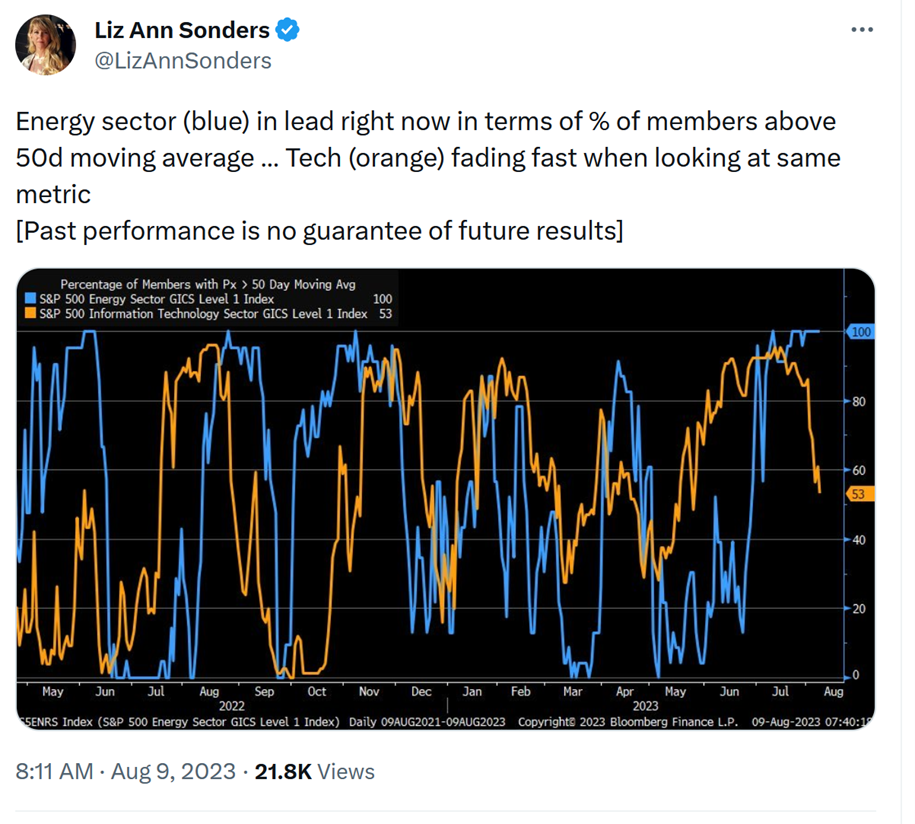

3) As a result, energy stocks (which we are very bullish on) have been rising while tech stocks have pulled back. Here's an interesting way of showing this:

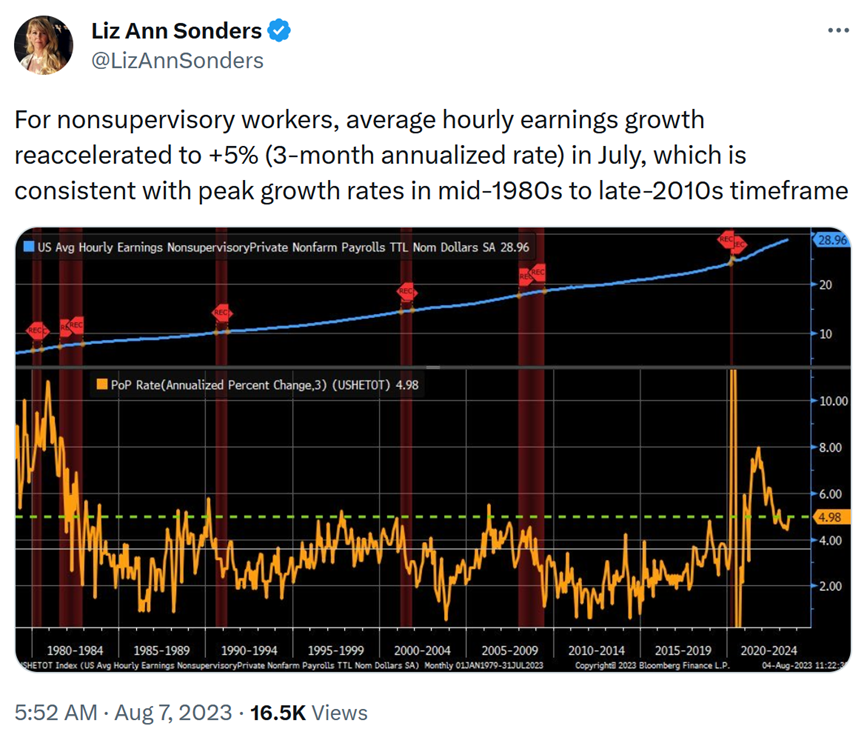

4) This is also somewhat inflationary – though I think it's good news for the U.S. that wages for average workers are rising at a healthy rate:

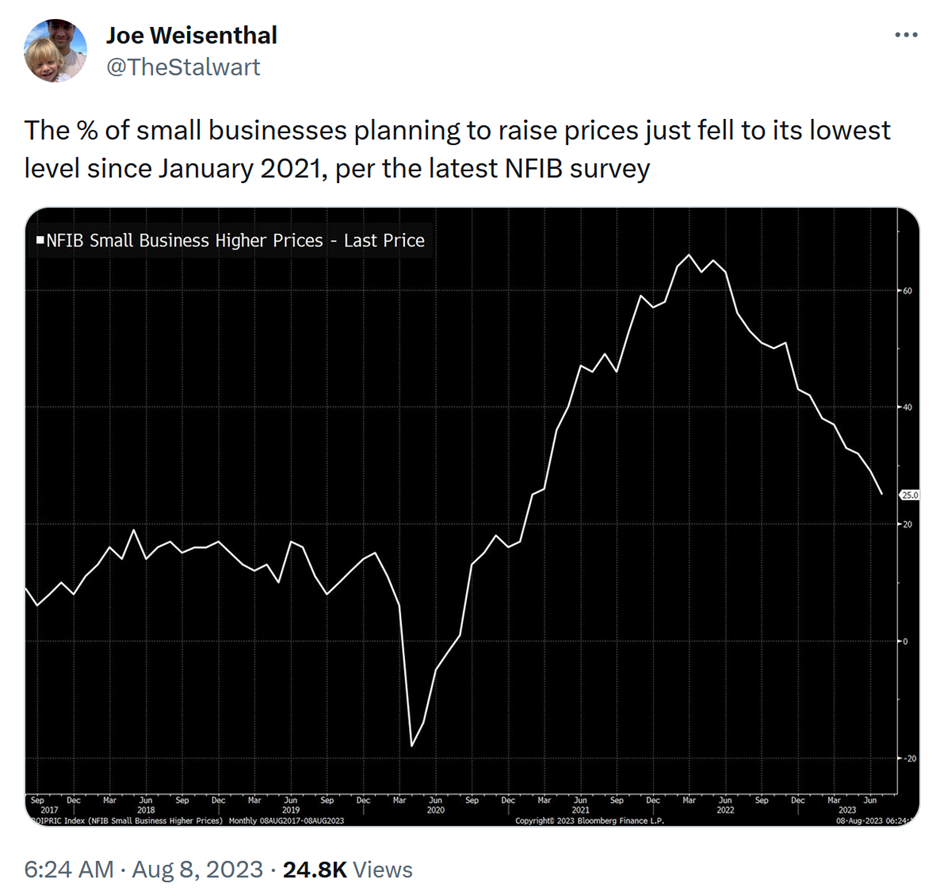

5) Offsetting these inflationary pressures, however, are many factors – including this:

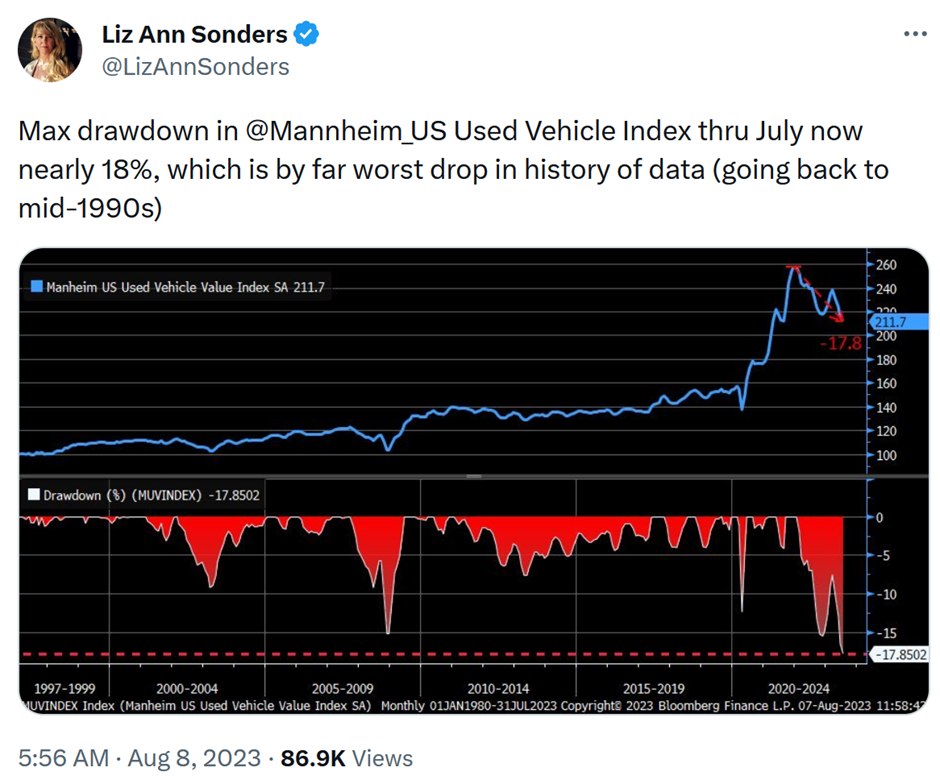

6) This should help as well:

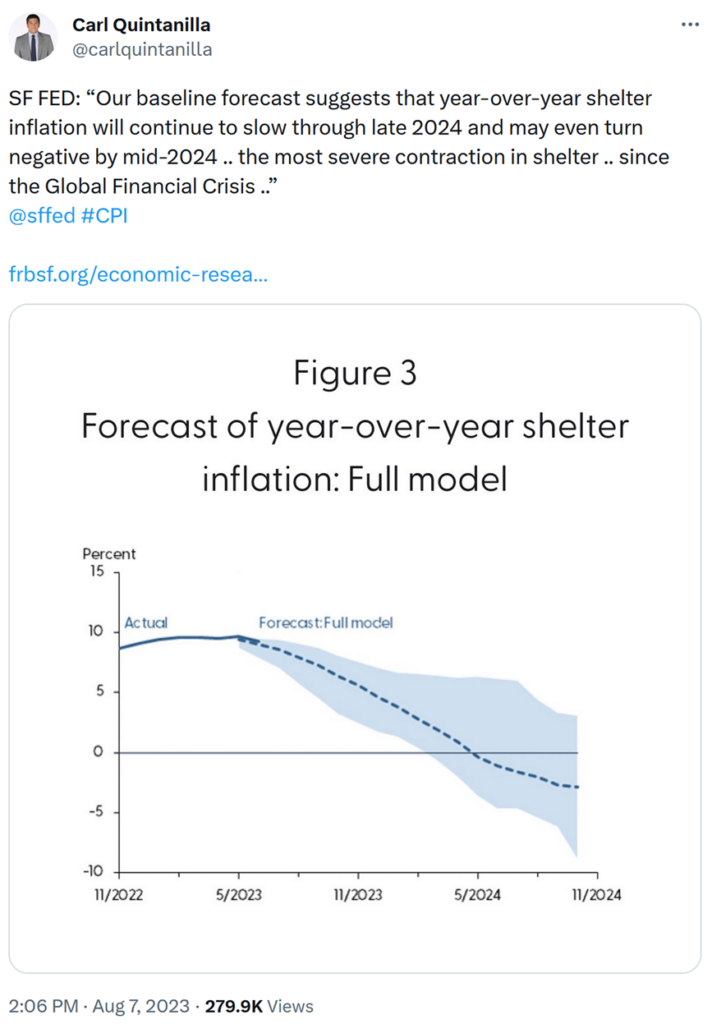

7) And this:

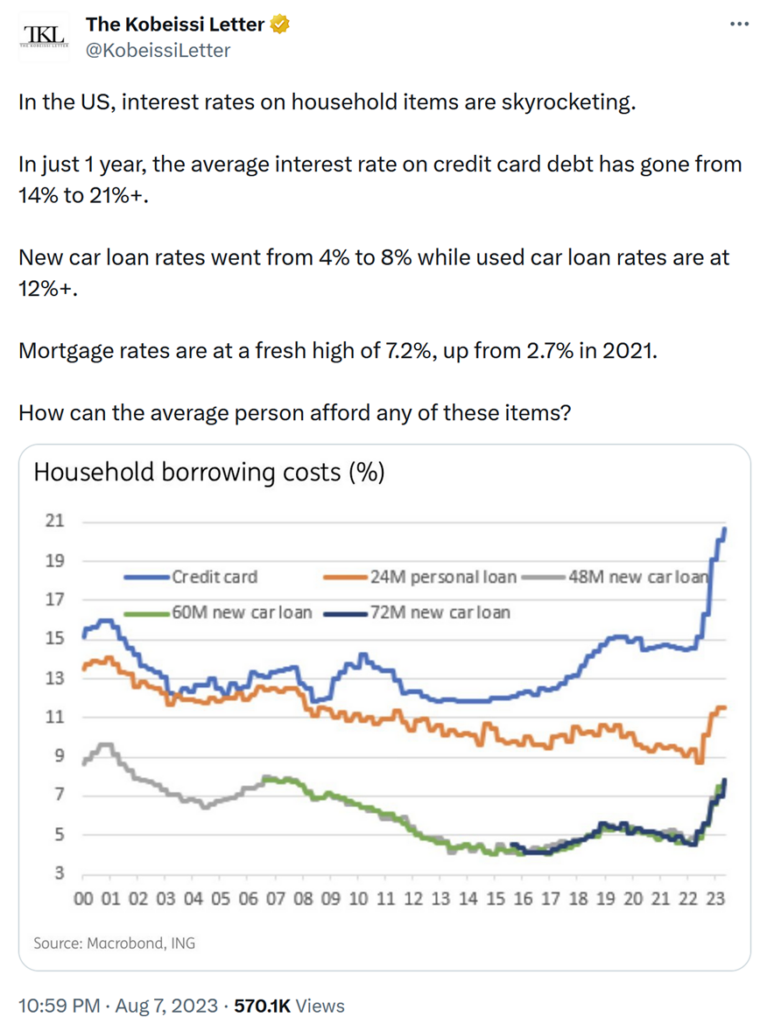

8) Lastly, the impact of rising rates will surely help dampen inflation:

9) However, as I've been saying for a while, I don't think inflation is going to 2% anytime soon – a view reinforced by this morning's latest figures for July. I think the new normal is around 3%, which investors are starting to realize:

10) This made me laugh...

Isn't it nice that, with our 30th anniversary two months away, Facebook says Susan and I have been friends for 13 years?😜🤣👍🙏🤞🎉❤️❤️❤️

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.