Two deep dives on FB; Tribute to Ned Johnson; Handwritten thank-you note from Delta

1) In addition to Twitter (TWTR), my other favorite idea that I pitched at the Legacy Research Conference on Friday was Meta Platforms (FB). You can review all 18 slides here.

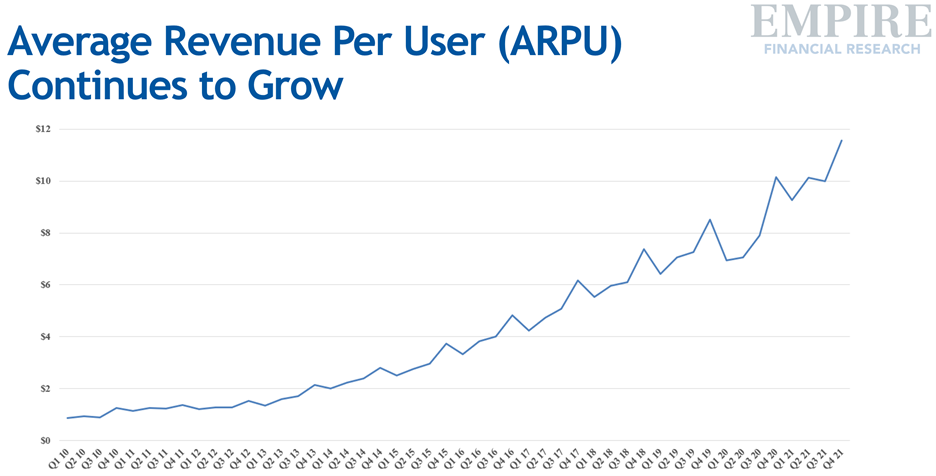

While user growth is slowing, the company continues to steadily generate more average revenue per user ("ARPU"), as this slide shows:

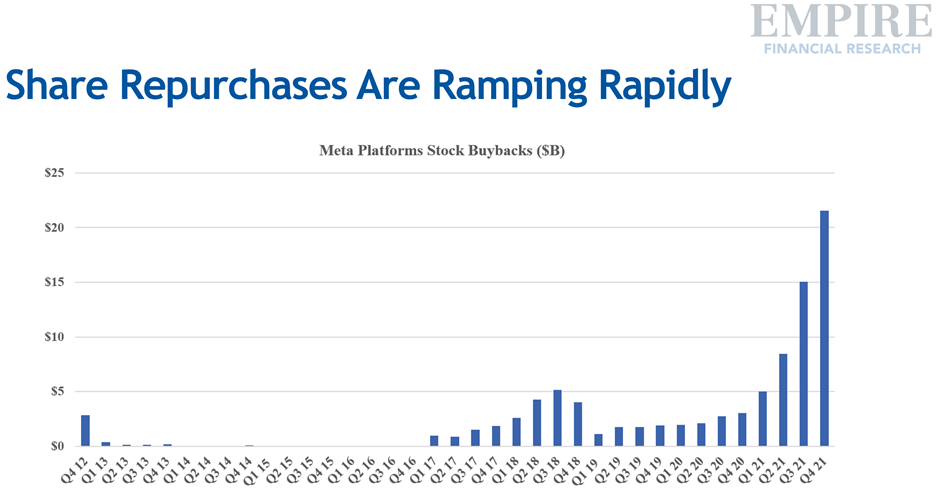

Meta has really ramped up share repurchases:

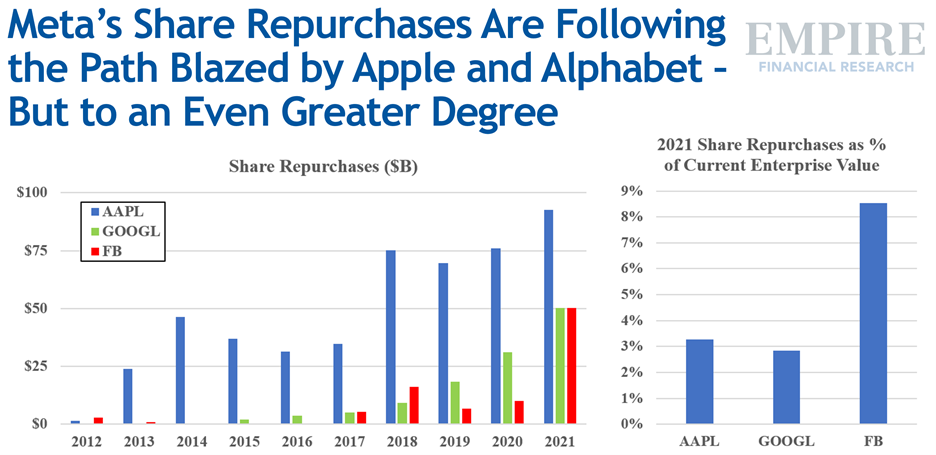

I think share repurchases will be a major driver of the stock, as they have been for both Apple (AAPL) and Alphabet (GOOGL). Note that Meta's repurchases are far greater as a percentage of its market cap.

Lastly, Meta's shares are currently trading at their lowest valuation ever:

Here was my summary:

- Buy Meta Platforms

- In the 10 years since Meta went public, it's only missed numbers four times. Given the nature of the reset after last quarter's earnings debacle, we are extremely confident that Meta will report strong Q1 numbers on April 28

- If this happens, given its cheap valuation and the heavy (top-10) weighting in the S&P 500 index, we think there could be a rapid rush back into the stock

- Hold for the long term... it might be a bumpy ride, but we expect the stock to double or even triple over the next few years

2) My colleagues Enrique Abeyta and Gabe Marshank also did a deep dive into Meta's stock with special guests Brett Williams of Unique& and Brandon Ross of LightShed Partners in their latest episode of Hard Money's Million Dollar Podcast, which you can listen to here.

3) Here's Joe Nocera with a well-deserved tribute to Ned Johnson, the longtime leader of Fidelity Investments, who passed away recently: A nation of investors. Excerpt:

Among the trailblazers who made finance more accessible to the masses starting in the 1970s – John Bogle of Vanguard with his index fund, Charles Schwab with his discount brokerage and Louis Rukeyser with his weekly interrogation of one Wall Street sage or another – Edward C. Johnson III, the longtime leader of Fidelity Investments, was the least well known yet arguably the most important.

The others were all public figures, but Mr. Johnson, who died last week at the age of 91, was a Boston patrician with a patrician's aversion to the spotlight. Despite his upper-class background, he is credited with helping to change the way the middle class thought about its money, transforming Americans from savers to investors. That's why he matters...

Mr. Johnson retired as chairman of Fidelity in 2014, turning it over to his daughter Abigail. Today, it holds over $4 trillion in assets and has more than 30 million customers. But Mr. Johnson's real legacy isn't just that he turned a small firm in Boston into a financial behemoth, but how he did it – by making investing a part of everyday middle-class life.

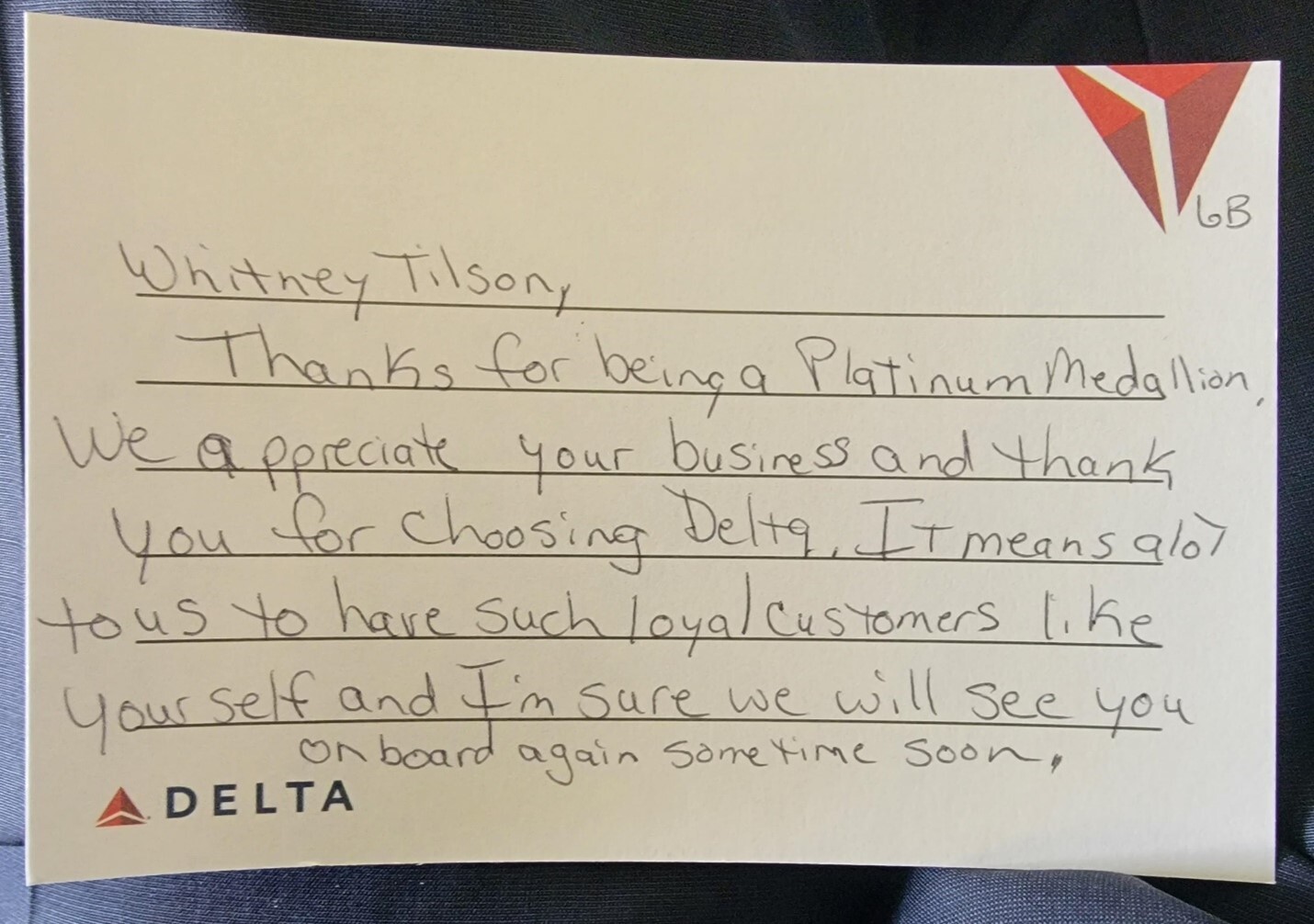

4) JetBlue Airways (JBLU) and Delta Air Lines (DAL) are my favorite domestic airlines. I've been flying so much on the latter over the past year that I was upgraded to Platinum Medallion, which has all sorts of nice perks, most notably that I'm always upgraded to Comfort Plus and occasionally to first class.

I certainly wasn't expecting this on my most recent flight: a thank-you note, handwritten by a flight attendant. Now that's a sign of a well-run airline!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.