Why it doesn't matter that I was wrong about the latest Fed rate hike; My outlook; Doug Kass is long cannabis; Google factoid and video; The highest return on investment I've ever seen

1) Yesterday the U.S. Federal Reserve hiked interest rates by another quarter point... so I was wrong when, in mid-June, when the Fed paused its rate increases, I wrote: "I think the Fed is bluffing, hoping that by signaling more rate increases later this year, it will jawbone inflation downward and not have to raise rates at all."

But I'm not too upset about getting this wrong because my overall advice to stay bullish – and the reasons for it – were exactly right.

In the six weeks since then, the S&P 500 Index is up a healthy 2.9% thanks to strong economic growth, inflation and unemployment continuing to fall, and receding fears by investors that a recession is near.

I figured, correctly, that one of two things would happen: either the economy would soften... or it wouldn't. If it did, that would be bad for stocks, but this would be offset by the Fed holding off on any further rate hikes – and eventually even cutting.

But if the economy stayed hot, this would be good for stocks, even if the Fed hiked again to cool it.

I thought the former scenario was more likely – hence my incorrect prediction about the Fed's next move – but, as I told my readers, it didn't matter because either way stocks were going to do well.

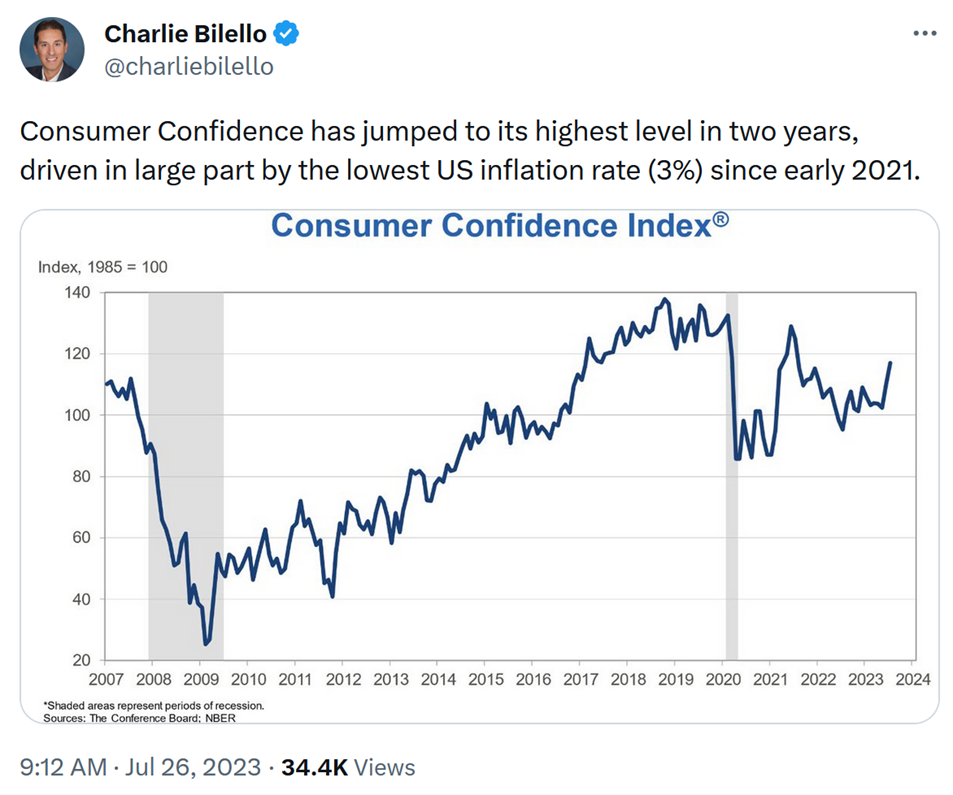

2) Looking forward, consumer confidence is high. This bodes well for the economy, as consumer spending accounts for nearly 70% of GDP:

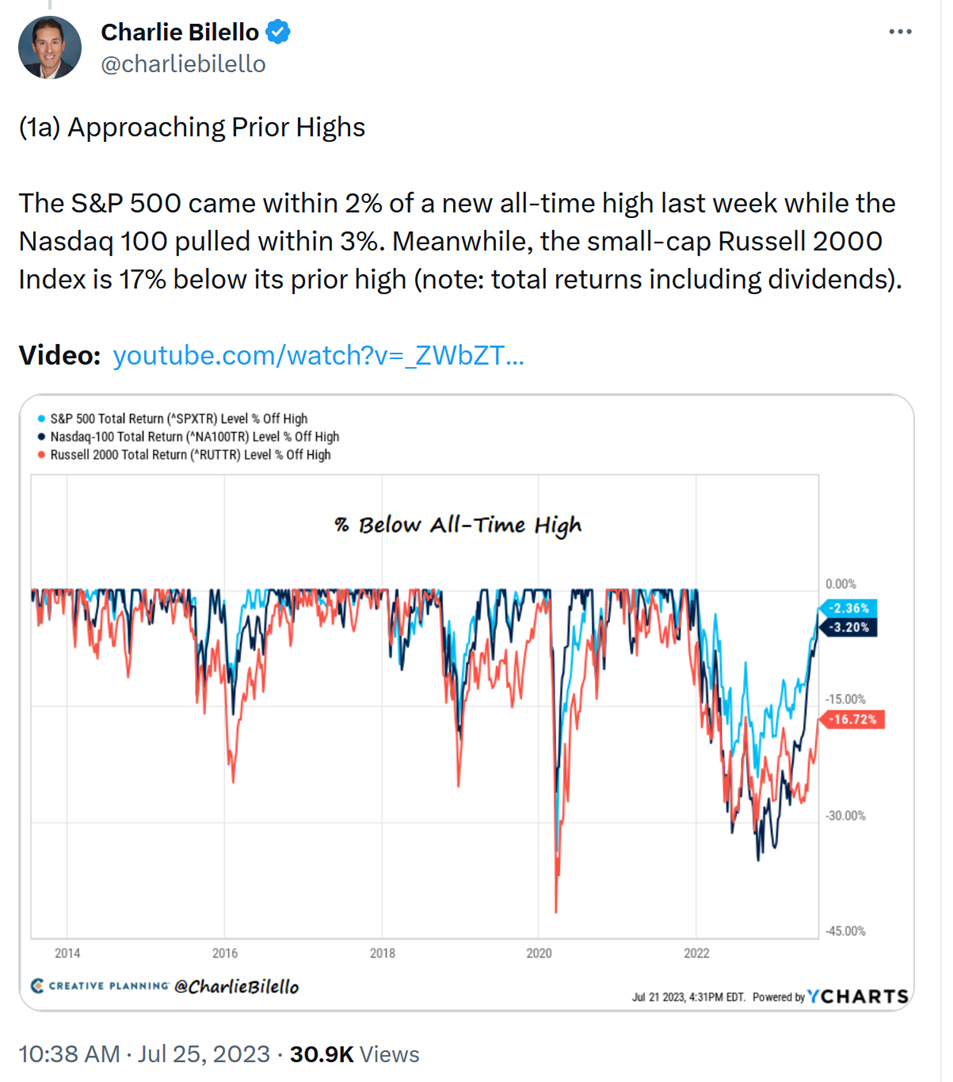

But with tech stocks having such a big run, the valuations are making me nervous:

The Nasdaq 100 Index is within a hair of its all-time high, as is the S&P 500, so I'm looking for bargains among small- and mid-cap stocks and out-of-favor sectors:

3) Speaking of out-of-favor sectors (and my wrong-headed predictions), my friend Doug Kass of Seabreeze Partners has turned bullish on the cannabis sector. Here's an excerpt from his recent missive on it:

Taking the Contrarian View on Cannabis

The market capitalization of the five largest cannabis companies is down to only about $5 billion and most individual cannabis equities are now trading at multi-year lows.

Those five cannabis entities dominate the legal cannabis market domestically and throughout much of the world.

In February 2021 the largest cannabis ETF, the AdvisorShares Pure US Cannabis ETF (MSOS), traded at $52/share compared to this morning's price of $5.40/share, a decline of about 90% in value.

The managements of most of the cannabis companies have proven that they are "not ready for prime time players" – whether judged by their inability to give investors proper earnings guidance, generally weak financial controls, and poor financial and operational management teams.

On the legislative front, attempts to pass SAFE Banking have consistently failed and will, again, this summer.

There have been multiple headwinds to owning cannabis shares, including, and importantly, custodial issues and other legal restrictions. But TerrAscend's (TSNDF) recent Toronto Stock Exchange Listing and plans by CuraLeaf (CURLF) to do the same, is changing the situation.

Meanwhile, cannabis is moving towards going national as more and more states are legalizing recreational use of cannabis.

In other words, and in my judgment, things are not likely to get worse for the industry.

Like at the time of a company cutting its dividend or at the trough of a corporation's profitability, these are exactly the sort of conditions and time one should consider buying cannabis shares. (Remember buying PacWest (PACW) and Western Alliance (WAL) several months ago – at $2 and $13, respectively – during the regional banking crisis?)

The secret to making money in extreme and uncertain times – of buying low and shorting high valuations – lies in contrarianism, not conformity.

It's been a long week, I am exhausted. And, I can't wait for 4:20 pm!

Position: Long MSOS (medium size), GTBIF (small), TCNNF (small), Short MSOS calls (small)

Thank you, Doug!

4) Following up on yesterday's e-mail about Alphabet (GOOGL), here's a tweet with a fascinating factoid and a one-minute video about Google's founders and the very smart investor who gave them $100,000 on the spot (though the video doesn't say so, it was Andy Bechtolsheim, co-founder of Sun Microsystems, in August 1998)!

5) I've seen a lot of high-return investments in my career, but this one may be the highest of all time: more than 20,000 to 1!

A Ukrainian FPV (first-person view, or suicide) drone, which cost less than $1,000, just took out a $20 million Russian Buk surface-to-air missile unit (the same type that downed Malaysia Air flight 17 in 2014, killing 298). Here are videos that Ukrainian drone units have posted publicly of that strike plus a few others, and here's a screenshot:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.