WSJ Capital Assets series wins Pulitzer; Strong wage growth for low-income Americans; Payrolls rising to new highs; He blew the whistle on Trump's Truth Social. Now he works at Starbucks; Weight-loss drugs

1) Kudos to the Wall Street Journal for a well-deserved Pulitzer for "Capital Assets," its investigation into stock trading by government officials – something I've been writing about for years. Here are links to each article from the seven-part series:

- Federal Officials Trade Stock in Companies Their Agencies Oversee

- The Regulators of Facebook, Google and Amazon Also Invest in the Companies' Stocks

- Wall Street Traders or Washington Officials? Sometimes It's Hard to Tell.

- As Covid Hit, Washington Officials Traded Stocks With Exquisite Timing

- The $1 Million Amazon Conflict: Washington's Ethics Czars Struggle to Enforce Stock-Trading Laws

- When Federal Officials Help Companies—and Their Own Financial Interests

- Hundreds of Energy Department Officials Hold Stocks Related to Agency's Work Despite Warnings

The corruption – or at least the appearance of it – is so blatant that the two members of Congress you'd think would be least likely to co-sponsor a bill in fact did so: AOC and Matt Gaetz introduce a bipartisan bill to ban Congress members from trading individual stocks.

2) In my April 28 e-mail, I wrote:

Given that inflation-adjusted wages of average Americans have stagnated for decades, while productivity and profits have grown strongly – meaning that corporations, not workers, have pocketed the lion's share of the gains – I think it's a wonderful development that wages are rising strongly while inflation is falling rapidly...

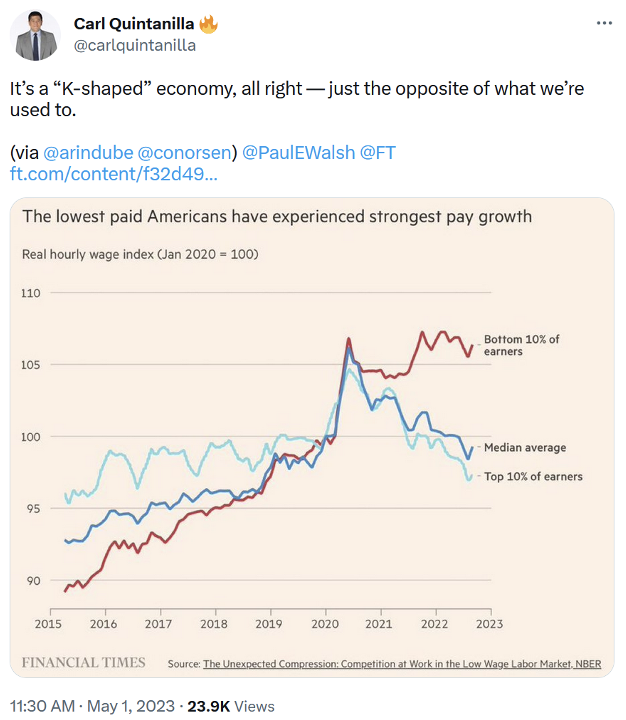

This chart, courtesy of CNBC's Carl Quintanilla, highlights that lower-income workers have seen the greatest gains in real (inflation-adjusted) hourly wages over the past eight years, which is something to celebrate:

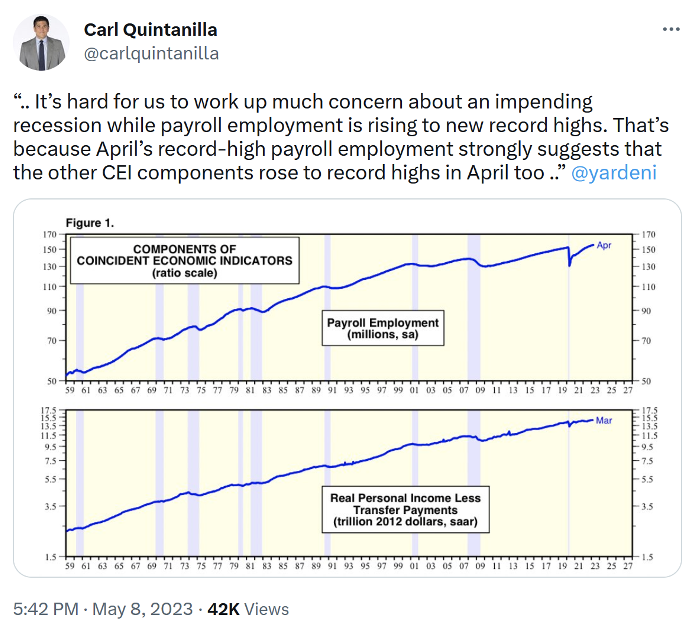

3) Quintanilla shared another tweet with more conflicting evidence about the state of the economy:

4) In my April 14 e-mail, I removed Digital World Acquisition (DWAC), the SPAC that signed a deal to acquire Trump Media and Technology Group ("TMTG"), which owns Twitter copycat Truth Social, from my "Dirty Dozen" list of stocks to avoid.

I did so solely because its price has fallen so much. As I wrote that day:

The stock closed yesterday at $13.14 per share, only slightly above DWAC's cash. Given that I think there's almost no chance the deal to acquire TMTG goes through and it's likely too late to find another deal, DWAC is almost certain to liquidate and return $10 per share to shareholders.

In this case, anyone who's short the stock at today's price will pocket a gain of $3 per share, so why not stick around?

Because "almost certain" isn't the same as "100% certain" – and, as we've seen, this stock can trade almost anywhere, totally disconnected from its fundamentals.

I'm wary of picking up pennies in front of a steamroller, which I discussed at length in my January 20 e-mail.

No matter how likely the outcome, it doesn't make sense to risk losing tens of dollars (and possibly more than $100) per share to make $3...

To understand why "I think there's almost no chance the deal to acquire TMTG goes through," read this story that ran in the Washington Post recently: He blew the whistle on Trump's Truth Social. Now he works at Starbucks. Excerpt:

Wilkerson, 38, has become one of the biggest threats to the Trump company's future: a federally protected whistleblower whose attorneys say has provided 150,000 emails, contracts and other internal documents to the Securities and Exchange Commission and investigators in Florida and New York.

Wilkerson last year publicly accused Trump Media and Technology Group of violating securities laws, telling The Washington Post he could not stay silent while the company's executives gave what he viewed as misleading information to investors, many of whom are small-time shareholders loyal to the Trump brand.

The company fired him shortly after, saying he had "concocted psychodramas" but not responding to the specifics of his claims. This month, the company's chief executive, the former Republican congressman Devin Nunes, sued Wilkerson for defamation in a Florida circuit court, claiming he had been subjected to "anxiety," "insecurity," "mental anguish" and "emotional distress" as a result of Wilkerson's comments.

Wilkerson's whistleblowing case has gained little of the attention the other legal challenges facing the Republicans' presumptive presidential nominee have gotten, including the criminal charges Trump faces related to hush money payments to the adult-film actress Stormy Daniels.

But his testimony and trove of records have challenged the main engine of Trump's post-presidential business ambitions, a venture that once commanded multibillion-dollar valuations with lofty promises to overtake the titans of American tech.

The company's attempt to merge with a financial outfit known as a special purpose acquisition company, or SPAC, has been frozen for months due to a pending SEC investigation that predates Wilkerson's public comments and has blocked the company's ability to unlock a critical source of cash.

5) I've written a number of times about the miraculous new weight-loss drugs, the best of which is Eli Lilly's (LLY) Mounjaro.

On Tuesday, I learned that a good friend has lost 90 pounds since he started taking the drug last August!

And over the weekend in Omaha, one of my readers thanked me for writing about it because it led to his wife starting on it, and she's already lost 12 pounds in the first month.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.