Even the CEO of IBM Got This Wrong

Editor's note: Even the biggest innovations can appear trivial at first. In this issue, Joe Austin – a senior analyst at our corporate affiliate Chaikin Analytics – shares a mistake one industry giant made in the 1980s... and what that tells us about today's AI revolution.

We're sharing it now, adapted from yesterday's Chaikin PowerFeed free daily e-letter, because Joe's team just released a new tool that's perfect for spotting the truly disruptive players. Read on for his take on how to separate future winners from the next "Pets.com" flop...

One day, our grandchildren will reflect on what's happening in real time right now...

That's because artificial intelligence ("AI") is a generational opportunity. It's a disruptive technology that will boost almost every part of the economy.

It's a lot like Apple's (AAPL) iPhone, for example...

The first iPhone launched in June 2007. That was less than two decades ago. And yet, almost everyone walks around with a smartphone in their pocket these days.

The iPhone isn't the only tech to disrupt our daily lives, of course...

Major tech waves often follow a specific adoption pattern. And right now, AI mirrors the PC in 1985...

Back then, a lot of people believed in the potential of PCs. But the machines simply weren't practical yet.

I worked as a technology analyst at the time. I vividly remember PCs sitting idle on many senior managers' desks. In some cases, they remained unused for years.

Heck, even IBM's (IBM) CEO at the time, John Akers, looked at an early model of the PC as just a toy. He didn't believe it could ever become a critical part of our everyday lives.

In hindsight... Akers was wrong.

It Pays to Catch Tech Cycles at the Right Time

The PC changed our lives long before we all carried smartphones in our pockets. It made things easier across all sorts of industries. And it combined with another disruptive force...

In the early 1990s, companies started shifting their focus to the Internet. They saw the technology's potential, so they invested time and money into it.

Like the PC, the Internet wasn't practical at first. So the payoff didn't happen right away.

But here's the thing...

Investors who catch tech cycles at the right time can make massive returns.

After all, innovation always marches on. And the dot-com boom is proof. For example, look at what happened with Internet-related stocks – both over the short and long term...

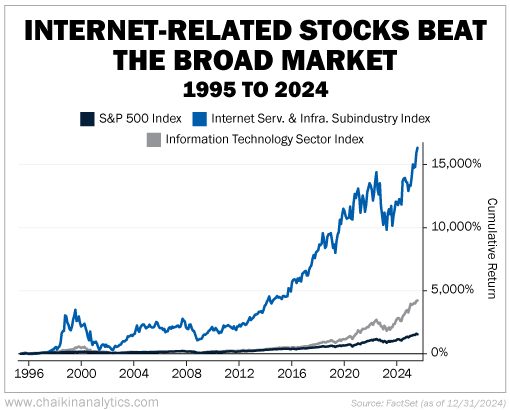

According to FactSet data, the S&P Composite 1500 Internet Services & Infrastructure Subindustry Index produced a cumulative return of nearly 4,000% from 1995 to 2000. That performance crushed the benchmark S&P 500 Index over that span.

And when we zoom out, the outperformance is even more impressive...

Even with the dot-com bust from 2000 to 2002, the S&P Composite 1500 Internet Services & Infrastructure Subindustry Index has produced a cumulative return of around 16,000% since 1995. That's more than 4 times the S&P 500's cumulative return over that period...

As you can see, buying into the broad-market indexes isn't always the right move. If that's all you do, you'll often miss the biggest gains.

Sure, in a broad-market index, you'll get some exposure to the winners. But you'll also get exposure to companies that the innovation displaces... or businesses that decline for other reasons.

Not every Internet-related stock became a big winner. We've all heard of dot-com busts like Pets.com, eToys.com, and Webvan.

Here's where the hard part comes in...

The trick to successfully investing in disruptive technology is twofold. You need to find the big winners and avoid the big losers.

Over at Chaikin Analytics, Marc Chaikin and I have put together a special presentation on this very topic. We've developed a new tool that helps us sort out the fakers from the real makers.

Yesterday morning, we explained exactly how it works. And we shared the details on exactly where we believe you should move your money for the biggest potential gains this year... with the least amount of risk.

If you missed our live presentation, it's not too late. You can find the full replay here.

Good investing,

Joe Austin

Editor's note: In the past year, around 200 AI-related stocks have doubled in value. Now, the Chaikin Analytics team has developed its most lucrative investment tool yet. It helps reveal which of these innovative stocks could be the next double or triple – showing their potential before you invest. And back tests show it could have already doubled your money 26 times. Don't miss one of the biggest breakthroughs in the history of Chaikin Analytics.

Further Reading

The rollout of AI in the economy hasn't been balanced. That's because some companies are resisting the new reality... while others are leaning into it. And those early adopters are positioning themselves to be the biggest winners as this transformation unfolds.

"Resist the urge to cherry-pick from the army of AI startups that's on the way," Sean Michael Cummings writes. These smaller-scale businesses make big promises... But in reality, without the essentials to build competitive AI models, they'll likely struggle to keep up with the best investments in the AI "gold rush."