One Sector Is Ready to Pop

Editor's note: The world's population is rapidly aging... and that spells opportunity for one sector that has been unfairly hated this year. In this issue, adapted from the June 11 issue of the free Health & Wealth Bulletin daily e-letter, Dr. David "Doc" Eifrig explains the growing opportunity in this corner of the market – and reveals the signal pointing to a rebound for this industry.

Japan is bathing Grandma and Grandpa with robots.

No, this isn't some scene out of a science-fiction story. It's real.

And it was born out of desperation...

You see, Japan's population is the oldest on Earth. More than 1 in 4 people there are at least 65 years old. And as its population continues to age, this will create a greater burden on the nation's health care system.

A 30-year-old might go to the doctor once or twice a year... while an 80-year-old may have seven prescriptions, three specialists, and a home nurse. This adds up fast. And Japan's health care system is still not prepared – even after a $40 billion investment in long-term care facilities that kicked off in 1989.

But a large elderly population isn't the only reason Japan is concerned...

It also has one of the lowest birth rates in the developed world. And the number of babies born in Japan has declined for nine consecutive years... reaching a record low of 720,988 last year.

Because fewer people have been getting married there since the COVID-19 pandemic, this decline will likely continue to accelerate.

Fewer babies means fewer workers. And fewer workers means fewer people to care for the swelling ranks of retirees.

This year, Japan is predicted to face a shortfall of 370,000 caregivers.

That's where the robots come in – and as we'll explain, this points to massive growth potential in the health care market...

AI Robots Are Filling Japan's Health Care Jobs

By 2018, the Japanese government had spent more than $300 million on research and development (R&D) on robots to take care of the elderly. These robots can help dress older people, lift them into bed, monitor their vitals, and even assist with bathing.

Today, nursing homes in Osaka are staffed with AI-powered robots that can track eye movements and detect early signs of stroke.

Across the country, you'll find eerily lifelike caregiving bots outfitted with silicone "skin" designed to make lonely seniors feel less alone.

And in Yokohama, robotic exoskeletons are even being used to help aging warehouse workers keep lifting boxes into their 70s.

In other words, the robots aren't replacing humans. There simply aren't enough humans left to do these jobs.

And these robots are just part of the investment Japan will need to make in its health care system.

Between 2000 and 2021, its health care spending as a percentage of gross domestic product ("GDP") increased from 7% to nearly 11%. And as its population continues to age, this spending will only increase.

Expect Growth in U.S. Health Care Investment

The U.S. is on a similar path as Japan – just a few decades behind.

Already, middle-aged adults outnumber children. But the U.S. will reach a new milestone in 2034... That's when the U.S. Census Bureau projects that the number of people aged 65 and older will roughly match America's number of children – 77 million.

This means we'll need to spend a lot more on health care.

Today, more than a third of total U.S. health care spending goes toward people over 65.

Annual U.S. health care expenditures are at a new high of $4.5 trillion. And that number is expected to rise to $8 trillion by 2035, more than 20% of projected GDP.

We're not equipping nursing homes with robotic bath assistants just yet... but we're already feeling the burden to the system.

Hospital emergency rooms are overwhelmed. Rural counties are facing doctor shortages. And long-term care facilities are so full, some families are placing loved ones on waiting lists years in advance.

Think about your own experience with the health care system... If you're like most folks, you'll have a war story or two of your own.

America's massive demographic shift creates an opportunity for the health care sector. When tens of millions of people need more care, someone has to provide it. That means more demand for medical devices, diagnostic tools, surgical robots, and even digital platforms that help doctors do more with less.

It has admittedly been a tough couple of years for health care investors... Investment in biotech has slowed since the pandemic ended. And higher interest rates make it harder for smaller biotech firms to borrow money.

But we don't expect the industry to be down for long...

You see, drug patents are finite. They expire. And when they do, that revenue has to be replaced if a company wants to keep growing. It's the nature of the industry.

Biotech R&D is central to refreshing product portfolios. And we're seeing signs of recovery...

Excluding the 2020 and 2021 highs after the pandemic, biopharma funding hit a 10-year high in 2024 at $102 billion. That's up 44% from 2023 levels.

The number of new clinical trials also rose in 2024, after seeing declines in 2022 and 2023.

And according to forecasting and analytics company Evaluate Pharma, the global pharmaceuticals industry pumped nearly $288 billion into R&D last year. That's up about 2% from 2023.

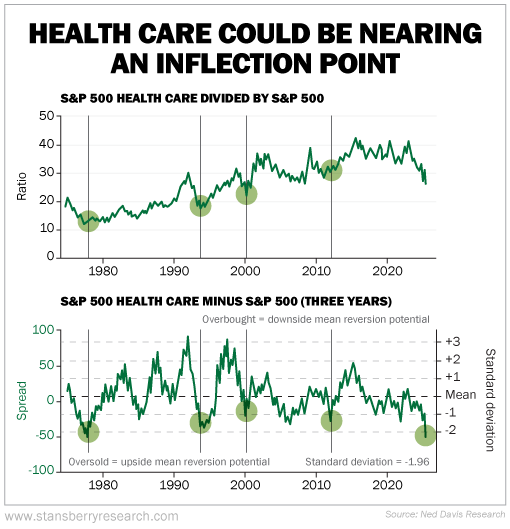

Still, the health care sector has lagged the S&P 500 Index by a staggering 72 percentage points over the past three years. When we've seen this level of extreme underperformance in the past, health care has typically rallied. Take a look...

Health care stocks have been out of favor lately. But we see things turning around. Make sure you have some exposure in your portfolio.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Editor's note: Doc says health care is the field set up for the biggest transformation – and, in fact, this shift is already underway. Today, he's predicting that one upcoming health breakthrough could change society forever... And by buying just one stock before that happens, folks could potentially double their money within two years.

Further Reading

"Investing in stocks is always risky," Doc writes. You can't predict when the next crisis will happen. But with the right investing strategy, you can keep yourself from sitting on the sidelines and missing the best opportunities during a market rally.

In order to be a pro at any skill, you must master the basics. And for investors, that means developing your own "single-plane swing" – a system to help you minimize your mistakes, improve your results, and keep you focused on what matters most.