The Next Move for Home Prices

We all have guilty pleasures.

Mine (Jeff Havenstein) is scrolling through Zillow or Redfin to see what houses are on the market... even though I have no plans to move from my current house anytime soon.

I enjoy seeing the layouts of different homes. And I love comparing prices of homes around my area and even in other cities that I'd one day consider moving to.

I definitely spend too much time perusing the housing market. But by doing so, it helps me spot some useful economic trends.

For example, right after the COVID-19 outbreak, homes around my area were selling like hotcakes. They'd go up for sale, a bidding war would commence, and then the for-sale sign would be taken down in a matter of weeks.

However, it's a different market today...

I'm seeing many real estate agents cutting prices of homes up for sale. And walking around the neighborhood, there are for-sale signs that have been in place for a few months.

Homes just aren't selling as easily.

Of course, this is just my experience in the northern part of Baltimore and the few select cities I keep an eye on. But research shows this same dynamic is playing out around the country.

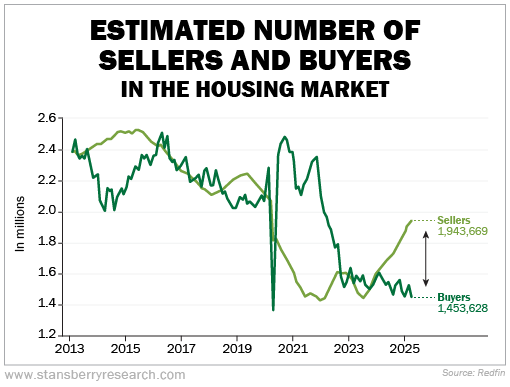

The chart below comes from Redfin. It depicts the estimated number of buyers and sellers in the housing market over the past decade-plus. As you can see, there was a huge gap between buyers and sellers in 2020 and 2021.

Back then, a big glut of buyers had to compete with one another for the few homes on the market. But today, we're seeing many more sellers than buyers – nearly 500,000 to be specific. Take a look...

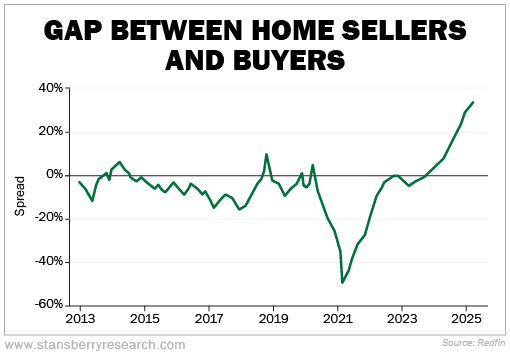

And here's the same data shown another way, just so you can see the extreme level we're at today...

According to the National Association of Realtors, the median sales price for an existing home rose 1.8% in April compared with a year earlier. The median price was $414,000, a record for April. And this was the 22nd consecutive month of annual price increases.

It's clear that fewer people are willing – or able – to buy homes at today's elevated prices.

Higher interest rates continue to weigh on buyers. Mortgage rates are hovering around 7% at the moment.

We're also seeing families become more cautious with their spending because of the high price of everyday goods and the uncertainty of President Donald Trump's trade war.

Simply put, home sellers still think we're in 2021. They're posting ambitious prices for their homes, and the fish just aren't biting.

A recent survey from Bank of America found that 75% of potential buyers are waiting for a fall in both home prices and interest rates before they make an offer.

With all this in mind, are we going to see home prices collapse like they did in 2007 through 2009?

Not likely.

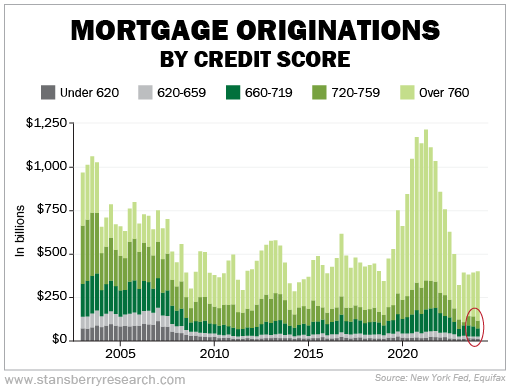

First, we haven't seen the same speculative activity. Even during the home-buying frenzy of 2021, most of the buyers had strong credit scores. You can see the share of credit scores under 720 is historically low right now...

In fact, Redfin is only projecting a modest 1% price decline by year's end.

Here's Chen Zhao, the company's head of economics research...

The reason we think home prices will fall by 1% and not something larger is because it's actually very hard for home prices to fall, unless sellers have to sell. Sellers can always decide they don't like the prices that are currently in the market and decide to stay in their home.

The percentage of mortgages that are 90-plus days delinquent remains below 1%. It was nearly 3% at the end of 2007.

So for anyone waiting for home prices to fall significantly, you might have to wait a while... Though we should see sellers come down a little on price to satisfy some buyers.

Switching gears, my good friend Porter Stansberry – founder of Stansberry Research – has a grave warning for all investors. He believes that the U.S. government is likely to default on its debt within the next four years.

Not only would this lead to a widespread economic collapse, it could threaten your Social Security and Medicare... and wipe out your retirement savings.

Tomorrow at 10 a.m. Eastern time, Porter is going on camera to explain all the warning signals, what he believes is coming next, and how you can protect yourself in the face of this imminent threat. Spoiler: The old "buy and hold" strategy won't save you this time around. Click here for all the details and to learn how to take hold of your economic future.

What We're Reading...

- The U.S. housing market has nearly 500,000 more sellers than buyers – the most on record.

- Household debt and credit report.

- Something different: Rickie Fowler makes most of sponsor exemption as he claims Open Championship spot at the Memorial Tournament.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

June 4, 2025