You Should Consider Owning My 'Best Buy' in Health Care Right Now

We've humanized our pets...

They're not called "the dog" or "the cat" like they were a couple of decades ago. They're Luna, Max, and Cooper.

They're family.

And they're treated like family with better food and more attention given to their exercise, experiences, and care. Owners are shelling out for regular checkups, preventive vaccines, and – when needed – life-saving treatments and surgeries.

One survey showed that 86% of pet owners would pay whatever it takes if their pet needed extensive veterinary care.

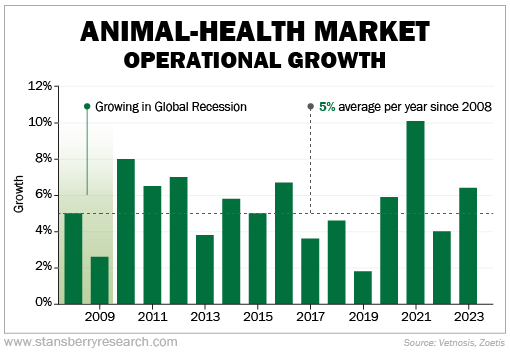

Because of this "humanization of pets," the animal-health market has proved to be very resilient through all types of economic environments. Take a look...

Today, we're seeing projections that the market will grow from $48 billion in 2023 to roughly $65 billion by 2028. And it could be worth as much as $90 billion in 2033.

I'd urge anyone to consider owning the largest animal-health business in the world – Zoetis (ZTS).

Even devoted pet owners may not recognize Zoetis' name, but their animals have probably received its medicines and vaccines. The company's sales topped $9.3 billion over the past 12 months.

Zoetis is the clear leader in most major animal-health categories and markets...

As you can see, Zoetis sells products that cater to more than just companion animals (meaning pets). About 31% of sales relate to livestock like cows and pigs.

In total, Zoetis has 17 blockbuster products – everything from medicines to vaccines to diagnostics – that each make at least $100 million in annual revenue.

Zoetis also has roughly 300 product lines. And the average market life of its brands is three decades.

Put simply, Zoetis is the dominant company in a growing industry. That should make folks want to own it...

But the market has soured on Zoetis lately.

Two of the company's biggest competitors are Merck Animal Health and Elanco Animal Health (ELAN). Merck is making headlines with a novel treatment called Numelvi. This is a similar product to Zoetis' Apoquel – a treatment that manages itching and inflammation in dogs. The European Medicines Agency's Committee for Veterinary Medicinal Products just released a positive review on Numelvi.

There's also Elanco's rival medication called Zenrelia, which is gaining traction.

As of 2024, Apoquel was the No. 1 prescribed animal-health medication. But both of these rival drugs could threaten its dominant market share.

Plus, there is some concern that growth for Zoetis' Librela – a monoclonal antibody treatment for dogs with osteoarthritis – has lost momentum. In the first quarter of 2025, sales only rose 17% year over year – less than expectations.

Zoetis noted that pet owners are often slow to adopt new treatments like Librela for chronic conditions. It takes time to educate veterinarians and consumers. But Zoetis also stated that Librela still operates in a mostly untapped market... There are 27 million dogs with osteoarthritis, and only 9 million are treated.

In the end, competition is heating up for Zoetis. And while that's a reason the company might grow more slowly in the near term, it's not reason enough to justify sending shares near a decade-low valuation.

You see, Zoetis is an innovator.

It has launched more than 2,000 new products and life-cycle innovations over the past 12 years. It has literally created new categories in animal health from scratch... And it's likely going to keep doing this because it spends more than $600 million on research and development per year – that's 7% of sales.

We believe growth concerns are more than priced into the stock. It's currently trading for a price-to-earnings multiple near a decade low...

Shares are currently trading just off a 52-week low.

We think this is a great opportunity to buy Zoetis while it's on the cheap.

The stock has returned nearly 16% a year to shareholders since 2013. We think that investors who buy at today's prices will likely see similar returns in the years ahead.

We're calling Zoetis the best buy in health care today. Consider buying shares if you don't already have this holding in your portfolio.

And for more great picks like this one, check out my Prosperity Investor newsletter. If you're not already subscribed, you can learn more here.

What We're Reading...

- For Prosperity Investor subscribers – We're Doubling Down on the Best Buy in Health Care.

- Something different: Tesla is hiring robotaxi test drivers in New York City, but the company hasn't applied for permits.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 13, 2025