An important message from Porter...

An important message from Porter... Meredith Whitney is calling it quits... 'You've been warned'... The latest on the 'disappearing middle class'...

Editor's note: Before we get to today's Digest... an important message from Stansberry Research founder Porter Stansberry regarding the recent snafus at our customer service office...

As all of our longtime subscribers know, we take our mission to provide world-class customer service very seriously.

We only hire bright (college-educated), caring, talented people to represent us on the phone. These young people speak perfect English. They're well-trained on our systems. And they're used to working with our customers. These folks work at our headquarters in Baltimore – right next to my office.

We also promote a culture of serving our customers. That starts with our absolute dedication to transparency and independence in our work, and it continues through our policy of always "parting as friends." If you're not happy with us or our products, we're always willing to refund your subscription fee. That has been our policy since Day 1.

As a result of these policies, our corporate culture, and our excellent staff, our average wait times have always been one minute or less, and we normally handle all refunds within 48 hours. But that hasn't been the case recently. Hold times have been averaging 10 minutes or more... And there's a large backlog of refunds to process.

The situation is completely unacceptable to me.

I (Porter) want to let you know what caused these problems and what I'm doing right now to fix them. I also want you to know that these problems have the full attention of every executive at my company. We are dedicated to fully resolving these issues by Monday, June 22.

Beginning in April, our company experienced an unprecedented increase in new orders and a corresponding increase in demand for customer service. Our call volumes more than doubled nearly overnight. So far, we've done a poor job of staffing to meet this demand. That has resulted in longer wait times and a backlog of refunds to process. At almost the same time (in May), we began a long-planned technology migration from our legacy subscriber-database system (known as Advantage) into a far more advanced, cloud-based system that will greatly increase our online customer-service capabilities.

This combination of increasing demand and technology migration simply overwhelmed our staff. I wasn't aware of the magnitude of the problem until yesterday. Even as of this morning, I am still learning key details of what went wrong.

Here's what I've done so far to solve these important problems...

1. We've built a new website (www.stansberryaccount.com) that integrates directly with our new database system. This will enable customers to cancel orders, request refunds, and receive confirmations of refunds directly without calling customer service. All you need to use this tool is the e-mail address you provided when you placed your order and the zip code of your billing address. Please note: This tool is currently only able to cancel orders/process refunds on orders that were made in the last 60 days.

This is a major change in the way we do business. This tool could eliminate most of our call volume, greatly reducing wait times and stress on both ends of the telephone.

2. We are adding a large number of new customer service staff members. This week, we are redirecting between 15 and 20 full-time staff members from other departments into the customer service group. We need these people (temporarily) to work through our refund backlog and help reduce wait times for customer service calls. Going forward, we will be adding around 12 permanent new customer service employees, with the first of these new hires reporting to work on Monday, June 22.

3. We are completing the training process for all customer service staff on the new cloud-based subscriber-database system. All employees will be fully trained on the new system by the end of business tomorrow, Thursday, June 18. This will greatly increase our workflow. But in the short term (today and tomorrow), this could result in longer wait times.

4. We are redirecting customer service requests sent via e-mail to a satellite office in Ireland. This will further reduce the burden on our main customer service staff, allowing them to concentrate on the phones and the existing backlog.

5. We are eliminating the voicemail feature for our customer service telephone number. We've found it's nearly impossible to accurately transcribe key information from voicemail messages because of the tremendous variability of subscribers' telephone systems. Some phones are clear. Most are not. In particular, anyone using a cell phone is nearly impossible to accurately transcribe.

Meanwhile, our good-faith effort to listen to all of these messages is taking up huge amounts of staff time. Going forward, we will only provide an automated tool (www.stansberryaccount.com), the telephone (with less than one minute wait times), and e-mail (within 48 hours) as our customer service channels.

I've dedicated myself, my executive staff, and almost all of our employees in Baltimore to resolving these matters completely by the end of this week.

Please give us until Monday, June 22 to resolve any outstanding customer service issues or refund requests. If possible, please consider waiting until next week to call us about any existing customer service matter. This will give us a chance to "catch up" on the outstanding issues we face.

As always, feel free to contact me directly with any feedback you have about this matter – or any other aspect of our business – at feedback@stansberryresearch.com. And thank you very much for the opportunity to serve you.

Sincerely,

Porter Stansberry

Founder and Chairman, Stansberry Research

![]() Wall Street "star" analyst Meredith Whitney is calling it quits...

Wall Street "star" analyst Meredith Whitney is calling it quits...

Longtime Digest readers may remember that Whitney rose to fame in 2007 for her bearish call on Citigroup before the financial crisis. For years after, she could seemingly do no wrong, and was a frequent guest and quoted expert in the financial media.

In December 2010, Whitney appeared on the popular news program 60 Minutes, and that's when her fortunes began to change...

On the show, she predicted a full-blown collapse in the municipal-bond market. She warned of 50 to 100 "significant" municipal-bond defaults that would add up to "hundreds of billions of dollars." (For comparison, the previous record for defaults was just $8.2 billion in 2008.)

Whitney's prediction caused a panic. In the six months following her comments, investors pulled nearly $50 billion from the muni-bond market. Over the next few months, some of the safest municipal-bond funds fell 15%.

![]() But from the beginning, our colleague Dr. David "Doc" Eifrig disagreed. Doc went as far as to say Whitney was "dead wrong." As he told Retirement Millionaire subscribers in early 2011...

But from the beginning, our colleague Dr. David "Doc" Eifrig disagreed. Doc went as far as to say Whitney was "dead wrong." As he told Retirement Millionaire subscribers in early 2011...

|

Today, we know that Doc was right. Defaults totaled just $2.6 billion in 2011 and $1.7 billion in 2012... far less than the record-breaking $8.2 billion in 2008, and an insignificant fraction of Whitney's "doomsday" prediction.

Folks who followed her advice missed out on a 23% rally over the next two years.

Following Detroit's bankruptcy in July 2013, she returned to the headlines. In an article for the Financial Times titled "Detroit Aftershocks Will Be Staggering," she once again predicted a muni-bond disaster. From the article...

|

![]() Again, muni bonds sold off. And again, Doc said she was wrong. As he told us in the July 24, 2013 Digest...

Again, muni bonds sold off. And again, Doc said she was wrong. As he told us in the July 24, 2013 Digest...

|

Doc was right yet again. There were no "staggering aftershocks." Retirement Millionaire subscribers who followed his advice are up as much as 92%... and are still collecting big, tax-free income.

![]() Meanwhile, Whitney's latest venture hasn't gone well, either...

Meanwhile, Whitney's latest venture hasn't gone well, either...

Following her Detroit prediction, Whitney decided to try her hand as a hedge-fund manager. She opened Kenbelle Capital in November 2013. But the odds were against her from the start. As one money manager told CNBC at the time...

|

After a rocky couple years – including being sued by her top investor to get back its $46 million investment last December following months of losses – Whitney is throwing in the towel. As she told Fox Business earlier this month, "I think that chapter of my life is over. This whole experience has been highly unfortunate and I'm putting it behind me."

We wish her better luck in her next endeavor.

According to a report from Bloomberg, global central banks are quietly becoming "less market friendly." After years of record-low interest rates, quantitative easing ("QE"), and other measures, some believe central banks are changing course. From the article...

|

Count us as skeptical... While we would welcome less market manipulation from the Federal Reserve and other central banks, we'll believe it when we see it. In the meantime, we'll remain cautiously bullish on stocks, but keep our "catastrophe-prevention plan" in place, just in case.

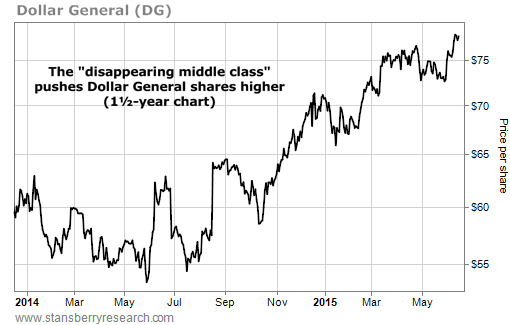

![]() One trend that has shown no signs of reversing is the "disappearing middle class." We summarized this trend in in the December 10 Digest...

One trend that has shown no signs of reversing is the "disappearing middle class." We summarized this trend in in the December 10 Digest...

|

While this trend is terrible for everyday Americans, it has been a boon to discount retailers like Dollar General (DG). Shares hit a new 52-week high yesterday.

Porter and his research team recommended Dollar General in December 2013 as one of the best ways to profit from this trend. As they noted at the time, Dollar General isn't an "everything costs $1" type of store like Dollar Tree. But it does sell everyday goods at low prices. And odds are good that the average American lives closer to one of Dollar General's 12,000 locations than to one of Wal-Mart's 5,000 U.S. stores.

![]() New 52-week highs (as of 6/16/15): American Financial Group (AFG), Allied World Assurance (AWH), AXIS Capital (AXS), CDK Global (CDK), iShares Core S&P Small-Cap Fund (IJR), and Prestige Brands Holdings (PBH).

New 52-week highs (as of 6/16/15): American Financial Group (AFG), Allied World Assurance (AWH), AXIS Capital (AXS), CDK Global (CDK), iShares Core S&P Small-Cap Fund (IJR), and Prestige Brands Holdings (PBH).

![]() In the mailbag, TradeStops founder Dr. Richard Smith answers a subscriber's question about adjusting your portfolio for volatility. If you have a question you're dying to have answered, send it to us at feedback@stansberryresearch.com. (As always, we can't offer individual investment advice.)

In the mailbag, TradeStops founder Dr. Richard Smith answers a subscriber's question about adjusting your portfolio for volatility. If you have a question you're dying to have answered, send it to us at feedback@stansberryresearch.com. (As always, we can't offer individual investment advice.)

![]() "I do not understand how you adjust the position size of each stock for its own volatility. Then you talk about leveraging this portfolio to have the same volatility as the S&P 500 which I also have no knowledge how one would do this. Is all of this through TradeStops, for which I subscribe to the basic package? Please explain. Thanks." – Paid-up subscriber Jim Lear

"I do not understand how you adjust the position size of each stock for its own volatility. Then you talk about leveraging this portfolio to have the same volatility as the S&P 500 which I also have no knowledge how one would do this. Is all of this through TradeStops, for which I subscribe to the basic package? Please explain. Thanks." – Paid-up subscriber Jim Lear

Richard Smith comment: Position sizing for volatility is available in TradeStops via the position-size calculator in the "Research" section of TradeStops.com. It is available to all TradeStops customers. We don't currently offer a service to adjust position sizes to match the S&P 500's leverage. We performed that research for Stansberry Research. But good news: We're considering making a tool like that available to TradeStops Pro subscribers later this year.

Regards,

Justin Brill

Baltimore, Maryland

June 17, 2015