We have returned to 'pre-crisis levels'...

We have returned to 'pre-crisis levels'... A World Dominator's revenue falls (again)... Why Dan Ferris isn't worried... The 'disappearing middle class' continues... How to save your retirement...

![]() Longtime readers know our colleague Steve Sjuggerud has been bullish on the housing market for several years now.

Longtime readers know our colleague Steve Sjuggerud has been bullish on the housing market for several years now.

But as we explained in the July 8 Digest, Steve recently highlighted two big reasons he's still as bullish as ever today...

![]() One, home prices are now in a solid uptrend... And two, mortgage rates are still historically cheap (despite the traditional 30-year fixed-rate mortgage rising from a low of around 3.75% in April to around 4.25% today).

One, home prices are now in a solid uptrend... And two, mortgage rates are still historically cheap (despite the traditional 30-year fixed-rate mortgage rising from a low of around 3.75% in April to around 4.25% today).

Plus, as Steve explained, based on median house prices, mortgage rates, and median income, the median U.S. home is still selling for well below "fair value"...

Today, home prices are still $52,000 away from fair value. They need to rise by 25% to get back to fair value. The move back to fair value is already underway. The good news is, house prices still have plenty of room to run higher.

![]() Steve says the historically low housing starts have led to low supply, which will inevitably push home prices higher. But that's not just his belief. Steve has also been putting his money where his mouth is...

Steve says the historically low housing starts have led to low supply, which will inevitably push home prices higher. But that's not just his belief. Steve has also been putting his money where his mouth is...

Right now, I have a greater percentage of my net worth invested in the U.S. residential property market than in any other asset class – by far. (I'm not even including my home when I say this.) The opportunity is irresistible.

And the latest data continue to suggest Steve is exactly right...

![]() According to a new report from housing data provider RealtyTrac, foreclosure starts hit a 10-year low in the first six months of the year. Foreclosures were down 4% from the first half of 2014 and 18% lower than the first six months of 2006, just before the housing market crashed.

According to a new report from housing data provider RealtyTrac, foreclosure starts hit a 10-year low in the first six months of the year. Foreclosures were down 4% from the first half of 2014 and 18% lower than the first six months of 2006, just before the housing market crashed.

An article in Investor's Business Daily also pointed out that "overall filings in the foreclosure process – default notices, scheduled auctions, and bank repossessions" were down 13% from the second half of 2014. Quoting RealtyTrac Vice President Daren Blomquist...

U.S. foreclosure starts have not only returned to pre-housing-crisis levels, they have fallen well below those pre-crisis levels and are still searching for a floor. Loans originated in the last five years continue to perform better than historic norms, with tighter lending standards and more cautious borrower behavior acting as important guardrails for the real estate boom of the past three years.

The article also noted that June data from the National Association of Realtors showed existing home sales "saw the biggest increase in nearly six years in May."

![]() Last month, we told you about two blue-chip stocks that had gone "on sale" recently.

Last month, we told you about two blue-chip stocks that had gone "on sale" recently.

This week, we have a third...

On Monday, IBM (IBM) reported its 13th consecutive quarter of declining revenues. Shares of the tech giant closed down nearly 6% on Tuesday.

![]() As Dan Ferris wrote in Tuesday's Extreme Value weekly update, "Reading the financial media's coverage of the results felt a little like reading its obituary."

As Dan Ferris wrote in Tuesday's Extreme Value weekly update, "Reading the financial media's coverage of the results felt a little like reading its obituary."

But as he explained, financial media headlines scared investors by "making a big deal out of a trend everyone covering the stock already expected."

![]() Dan noted IBM is shedding its less profitable hardware business and investing heavily in five faster-growing segments. From his update...

Dan noted IBM is shedding its less profitable hardware business and investing heavily in five faster-growing segments. From his update...

Yes, total revenues from continuing operations for the second quarter of $20.8 billion were down 13% year over year. That does sound worthy of the WSJ headline. However, when adjusting for exchange-rate fluctuations and divestitures, revenues declined just 1%. Since 60% of IBM's revenue, earnings, and cash flow are generated in foreign currencies, they translate into lower amounts when the U.S. dollar is strengthening, as it has been this year.

Revenue in "BRIC" countries (Brazil, Russia, India, and China) was particularly weak in the second quarter. Brazil and Russia are commodity-oriented economies that are heavily dependent on oil. And oil is down some 50% over the past 12 months.

Management says excluding the BRICs, revenue for the quarter would actually have increased 1%. In developed markets, total revenue growth was down slightly in the U.S. but up in two of IBM's largest countries: Germany and Japan.

![]() While Wall Street focused on IBM's declining revenues, Dan saw some positives in the company's second-quarter announcement...

While Wall Street focused on IBM's declining revenues, Dan saw some positives in the company's second-quarter announcement...

Importantly, the transition to faster-growing revenue sources appears to be on track. IBM's analytics business (think artificial intelligence learning machine "Watson") – which helps customers make sense of the huge amount of data they're now collecting – grew 20% over the first half of 2015.

That's impressive growth for a business that generated $17 billion in revenue during 2014 and is larger than Facebook, which recorded about $12.5 billion in revenue last year.

Revenue growth for cloud services was also up a strong 70% year over year. At $8.7 billion in revenue over the last 12 months, IBM's cloud unit is about 75% larger than Amazon's web services cloud platform, which CEO Jeff Bezos recently characterized as being a $5 billion business.

![]() Dan also highlighted that free cash flow rose 10% from the first half of 2014 to the first half of 2015. Meanwhile, the second-largest software company in the world today (behind Microsoft) continues to reduce its share count and pay a healthy 3.2% dividend, which it has increased every year since 2000.

Dan also highlighted that free cash flow rose 10% from the first half of 2014 to the first half of 2015. Meanwhile, the second-largest software company in the world today (behind Microsoft) continues to reduce its share count and pay a healthy 3.2% dividend, which it has increased every year since 2000.

Dan isn't worried about the quarter-to-quarter revenue numbers from "Big Blue." Instead, he says it's a great time to take advantage of the market's irrational behavior and scoop up shares of a dirt-cheap World Dominator.

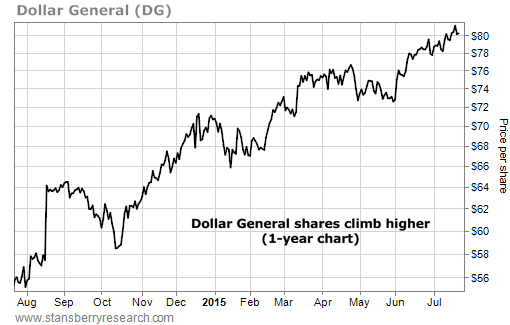

![]() Another week, another new high for discount retailer Dollar General (DG)...

Another week, another new high for discount retailer Dollar General (DG)...

As we've mentioned before, Dollar General is profiting from a trend Porter calls the "disappearing middle class."

In short, while there are strong signs the economy is improving, not everyone is benefiting. As we noted in the December 10 Digest...

The Federal Reserve's easy-money policies help the rich (those who own the assets). These people are able to borrow money cheaply and buy stocks, real estate, and other assets that will appreciate with inflation.

Meanwhile, rising prices squeeze the low-wage earners. Their costs for everything from food to rent increase as their wages stagnate (or fall).

While this trend is terrible for working middle-class Americans, it has been great for stores that sell everyday goods at low prices (like Dollar General).

Shares of Dollar General broke out to new 52-week highs in June, and have continued higher since. The stock closed at a new all-time high on Monday...

![]() But this trend isn't just making it harder for everyday Americans to make ends meet...

But this trend isn't just making it harder for everyday Americans to make ends meet...

It's also pushing the long-term dream of retirement out of reach for more and more folks. And a recent report from Government Accountability Office ("GAO") shows just how bad things are getting...

![]() According to the report titled "Most Households Approaching Retirement Have Low Savings," 50% of households with members aged 55 or older don't have a retirement savings plan (such as a 401(k) or IRA). And 29% have no savings at all.

According to the report titled "Most Households Approaching Retirement Have Low Savings," 50% of households with members aged 55 or older don't have a retirement savings plan (such as a 401(k) or IRA). And 29% have no savings at all.

Among those who do, the news isn't much better. From the report...

The median amount of those savings is about $104,000 for households age 55-64 and $148,000 for households age 65-74, equivalent to an inflation-protected annuity of $310 and $649 per month, respectively. Social Security provides most of the income for about half of households age 65 and older.

As Charles Jeszeck, the GAO's director of education, workforce, and income security told CNBC, "There hasn't been a significant increase in wages, people have student loans and other debt, and many are continuing to struggle financially. We aren't surprised that people have not saved a lot for retirement."

![]() Longtime subscribers know our No. 1 goal at Stansberry Research is to tell you what we would want to know if our roles were reversed. We do our best to help readers safely build wealth, while managing risk and avoiding common mistakes.

Longtime subscribers know our No. 1 goal at Stansberry Research is to tell you what we would want to know if our roles were reversed. We do our best to help readers safely build wealth, while managing risk and avoiding common mistakes.

But if you find yourself approaching retirement without enough savings, the truth is, smart investing alone may not be enough to get you to where you want to be. And taking on more risk with the hope of "making up for lost time" is likely to end in disaster.

![]() That's why we've teamed up with world-renowned success coach Tony Robbins (yes, that Tony Robbins) to offer you something we've never done before...

That's why we've teamed up with world-renowned success coach Tony Robbins (yes, that Tony Robbins) to offer you something we've never done before...

If you're not familiar with Tony, he's been a personal advisor and coach to some of the richest, most successful athletes, entrepreneurs, and investors in the world... And, like us, he believes millions of Americans are on the verge of a retirement crisis.

Tony spent the last four years working with one goal in mind: To help ordinary Americans become financially free... no matter how much they earn or how deep in debt they are today.

He personally interviewed 50 of the world's richest and most successful people, and asked them one thing: "If you couldn't pass on any of your financial wealth to your children, but only a set of principles, what would they be?"

He put everything he learned in an incredible new book called Money: Master the Game. We believe this book is so important, we reserved 10,000 copies exclusively for Stansberry Research subscribers.

Click here to learn more... including how you can get a real, hardback copy delivered to your door, free of charge.

![]() New 52-week highs (as of 7/21/15): Nordic American Tankers (NAT), Scorpio Tankers (STNG), short position in Suncor Energy (SUN), and short position in Viacom (VIAB).

New 52-week highs (as of 7/21/15): Nordic American Tankers (NAT), Scorpio Tankers (STNG), short position in Suncor Energy (SUN), and short position in Viacom (VIAB).

![]() In today's mailbag, subscribers ask two important questions about gold and silver. What's on your mind? Let us know at feedback@stansberryresearch.com.

In today's mailbag, subscribers ask two important questions about gold and silver. What's on your mind? Let us know at feedback@stansberryresearch.com.

![]() "Ok, Steve wrote a few days ago to have plenty of cash on hand. In fact he said whatever amount you feel is appropriate add a zero to it. Also it is suggested that we hold physical gold and/or silver. My question to you is how does one safely hide it at home? I'm open to all kinds of suggestions. Thank you." – Paid-up subscriber Doug

"Ok, Steve wrote a few days ago to have plenty of cash on hand. In fact he said whatever amount you feel is appropriate add a zero to it. Also it is suggested that we hold physical gold and/or silver. My question to you is how does one safely hide it at home? I'm open to all kinds of suggestions. Thank you." – Paid-up subscriber Doug

Brill comment: When it comes to safely storing physical gold and silver (as well as cash), you have several options. You'll probably want to avoid keeping it in a safe deposit box in a local bank, as you may not have access to it during a true crisis.

One of the simplest options is to store it in a high-quality, fireproof safe in a discreet part of your home. We also know of some folks who literally bury it on their property. (Just be sure to make note of where it is.) And as we've mentioned before, some of our editors, including Porter, have suggested using private self-storage, including overseas. Keeping some in a safe deposit box in a neighboring location outside your home country may also be a good option, depending on where you live.

![]() "Where to purchase physical gold?" – Anonymous

"Where to purchase physical gold?" – Anonymous

Brill comment: We get this question at least once a week, but it's always worth repeating. You can get our standard suggestions in the July 8 Digest.

Regards,

Justin Brill

Baltimore, Maryland

July 22, 2015

|