Keep an Eye on the U.S. Dollar

Keep an eye on the U.S. dollar... Badiali was right... These stocks are crashing... Announcing the 2016 Stansberry Conference and Alliance Meeting...

Editor's note: The full replay of last week's TradeStops live training event won't be available much longer. If you still haven't had a chance to view it, be sure to do so here.

![]() What do the recent rallies in stocks, crude oil, emerging markets, and even junk bonds have in common?

What do the recent rallies in stocks, crude oil, emerging markets, and even junk bonds have in common?

According to analysts at Morgan Stanley, they've all been driven in large part by a falling U.S. dollar. Their research shows the correlation between a weak dollar and their own index of "risk appetite" is near its highest level in 20 years. As the Wall Street Journal reported this morning...

Morgan Stanley's Global Risk Demand Index, which measures risk appetite by analyzing moves in markets such as stocks, commodities, and emerging markets, is moving nearly in the opposite direction of dollar strength. The correlation reached negative 86% in early April.

A large negative correlation means risky assets tend to fall when the dollar gains and rise when the dollar falls.

![]() As we noted, the dollar dipped below a critical level last week, but quickly reversed. It has now closed higher for five straight days, and there are reasons to believe it could be headed even higher in the near term.

As we noted, the dollar dipped below a critical level last week, but quickly reversed. It has now closed higher for five straight days, and there are reasons to believe it could be headed even higher in the near term.

The dollar remains oversold, and speculators are more bearish than they have been since 2013. A sharp, short-term rally would relieve both of these conditions.

There's also no telling what the Federal Reserve will do next. The market believes there is virtually no chance of an additional interest-rate hike anytime soon... so even the slightest hint that Fed officials are considering another increase could send the dollar higher. More from the Journal...

The dollar is heavily dependent on perceptions of what the Federal Reserve will do with interest rates, and those perceptions could change quickly. Meanwhile, analysts warn that the fundamentals for oil, emerging-market assets and even many stocks look too weak to support the recent price gains on their own.

"Currency is the most influential factor for markets this year," said Graham Secker, head of European equity strategy at Morgan Stanley. "If the dollar starts moving higher, global risk appetite will fall."

![]() Kudos to Stansberry Resource Report editor Matt Badiali for another fantastic call...

Kudos to Stansberry Resource Report editor Matt Badiali for another fantastic call...

Back in December, Matt noted that unlike most other oil-related stocks, oil refiners were still doing well. This was because of the "spread" between oil prices in the U.S. and prices overseas. As he wrote in the December 30 edition of our free Growth Stock Wire e-letter...

Refiners take crude oil and turn it into products like gasoline, diesel, and fuel oil. If they can buy oil cheap and sell those products at high prices, they make a lot of money.

Over the past few years, they've made LOTS of money. Giant refiners Alon USA Energy (ALJ) and Phillips 66 (PSX) saw earnings before interest, taxes, depreciation, and amortization (EBITDA) rise 67% and 44%, respectively, from 2013 to September 2015. That's because for the past few years, U.S. crude oil (called West Texas Intermediate, or "WTI") has cost less than European crude oil (called Brent crude oil).

As longtime readers know, fracking technology has allowed the U.S. to tap into incredible oil reserves in areas like the Eagle Ford and Bakken shales. Annual U.S. crude oil production is up more than 70% since 2008. The glut of oil has pushed the WTI price down. It has fallen more than 70% from its 2008 peak. This caused Brent to trade at a big premium to WTI.

![]() But Matt warned readers that was all about to change. The government had recently agreed to overturn the 40-year ban on oil exports, and the spread between WTI and Brent was collapsing. Matt said it was just a matter of time before oil refiners' share prices collapsed, too. More from that essay...

But Matt warned readers that was all about to change. The government had recently agreed to overturn the 40-year ban on oil exports, and the spread between WTI and Brent was collapsing. Matt said it was just a matter of time before oil refiners' share prices collapsed, too. More from that essay...

Now, the spread has closed. The price of WTI is around the same as the price of Brent. And with the U.S. allowed to export crude oil again, the price of WTI could go higher than the price of Brent. So U.S. oil refiners will see their profits shrink. This hasn't happened yet, but it will.

As a result, shares of these companies are starting to fall. Phillips 66 is down more than 10% from its high in November. And Alon is down 33% since its peak in August. That's a trend I expect to continue. If you own U.S. refining stocks, take profits today... or at least tighten your stops.

![]() In late March, Matt doubled down on his warning. We shared his thoughts in the March 24 Digest...

In late March, Matt doubled down on his warning. We shared his thoughts in the March 24 Digest...

Because the U.S. can now export crude oil, U.S. and European refiners are on an even playing field. Without the huge price advantage, U.S. refiners will see their profit margins start to shrink. And we're already starting to see that happen...

If you still own refiners, take profits soon... because things are about to get ugly.

![]() Last week, the mainstream financial media finally confirmed what Matt has been predicting for months. From an article in the Wall Street Journal...

Last week, the mainstream financial media finally confirmed what Matt has been predicting for months. From an article in the Wall Street Journal...

U.S. refiners, which posted robust profits the last 18 months even as other parts of the oil business were racked by low crude prices, finally saw their roll come to a halt in the first quarter.

Many refining businesses reported earnings for the period that were down roughly by half from a year earlier. That decline helped sour results for oil giants such as ExxonMobil, which has counted on refining to offset profit declines in energy production, and for Valero Energy, the world's largest stand-alone refiner by output, which on Tuesday reported its lowest first-quarter profit in four years.

"The first quarter presented us with challenging markets, with gasoline and diesel margins under pressure," said Valero Chief Executive Joe Gorder.

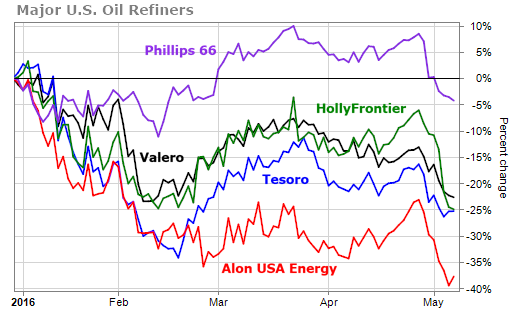

![]() As you can see in the chart below, readers who took Matt's advice have avoided losses of as much as 38% in major oil refiners...

As you can see in the chart below, readers who took Matt's advice have avoided losses of as much as 38% in major oil refiners...

![]() Finally, mark your calendars for one of our favorite events of the year...

Finally, mark your calendars for one of our favorite events of the year...

We will once again be holding the annual Stansberry Conference and Alliance Meeting at the Aria Resort & Casino in Las Vegas. This year's meeting will take place September 19-21.

Like last year, the two-day Stansberry Conference event on September 19 and 20 is open to all Stansberry subscribers, while the closed-door meeting on September 21 is for Stansberry Alliance members only.

If you enjoyed last year's event, you won't want to miss this one. This year's speakers may be the most impressive yet – including one who was once THE most hated man in the financial world.

You can get all the details – including the full list of speakers and ticket information – by clicking here. But don't delay: We are capping this year's event at just 500 attendees. If you're interested in attending, we urge you to reserve your spot soon.

![]() New 52-week highs (as of 5/6/16): Alacer Gold (ASR.TO), Franco-Nevada (FNV), Gold Standard Ventures (GSV), McDonald's (MCD), Annaly Capital Management (NLY), and Sysco (SYY).

New 52-week highs (as of 5/6/16): Alacer Gold (ASR.TO), Franco-Nevada (FNV), Gold Standard Ventures (GSV), McDonald's (MCD), Annaly Capital Management (NLY), and Sysco (SYY).

![]() In today's mailbag, one subscriber shares his thoughts on Porter's latest Friday Digest, and yet another weighs in on last week's live TradeStops training event. What's on your mind? Send your questions and comments to feedback@stansberryresearch.com.

In today's mailbag, one subscriber shares his thoughts on Porter's latest Friday Digest, and yet another weighs in on last week's live TradeStops training event. What's on your mind? Send your questions and comments to feedback@stansberryresearch.com.

![]() "All I can say is... WOW! If these allegations are true Porter (and based on just what you've said, I believe you – how important is that these days) it is a shock, although hardly and sadly at the same time, a surprise. I, like you am pretty cynical when it comes to our leaders these days no matter what kind. It seems as though at the very least, most are corrupt...

"All I can say is... WOW! If these allegations are true Porter (and based on just what you've said, I believe you – how important is that these days) it is a shock, although hardly and sadly at the same time, a surprise. I, like you am pretty cynical when it comes to our leaders these days no matter what kind. It seems as though at the very least, most are corrupt...

"But sadly, no one seems to even care anymore. They just keep voting them in, no matter at what level of office they seek, whether in government, business, education, or saddest of all, the church. Not a very good picture of the state of affairs for a nation is it? None of 'em are any better than the leaders of Enron or Bernie Madoff (how ironic is that last name)! I hope these crooks get what's coming to them in full measure, but I won't hold my breath...

"Porter, keep up the great work you do, and remind your staff that they do great work as well in support of you, and your business. I can't say enough good things about all you folks at Stansberry Research. You are all outstanding, not only for the work you do, but for the kind of people I know you are, as reflected by Porter Stansberry and the values he and his business espouse and hold dear.

"Thanks again for looking out for us ordinary folks (the little guy) as it has been described over the years. As you know we can use all the help we can get!

"And thanks to you and folks like Richard Smith at TradeStops, that help is invaluable indeed. Stansberry Research and TradeStops is without a doubt the best money I've ever spent. Continue to keep us informed... P.S. Makes me wish I worked there. You folks have such a big and positive impact on others lives." – Paid-up subscriber Mike C.

![]() "Dear Porter and Richard, that may be the best presentation you folks have done on video to date. I was unable to attend the live one as I was traveling. So I greatly appreciate your putting it up for us to read today. I am both an Alliance member and a TradeStops lifetime member, but the webinar was so well organized that it nailed down the salient points of using the TradeStops system. I went ahead and checked the overall volatility of my portfolio and discovered it was 10.7 so I must be paying attention. But I also found some deadwood and I liked the suggestion Richard made to just let extra stuff stop out and drop off by attrition... Keep up your outstanding work. I can see that I need to watch Richard's videos all over again... " – Paid-up subscriber Terry S.

"Dear Porter and Richard, that may be the best presentation you folks have done on video to date. I was unable to attend the live one as I was traveling. So I greatly appreciate your putting it up for us to read today. I am both an Alliance member and a TradeStops lifetime member, but the webinar was so well organized that it nailed down the salient points of using the TradeStops system. I went ahead and checked the overall volatility of my portfolio and discovered it was 10.7 so I must be paying attention. But I also found some deadwood and I liked the suggestion Richard made to just let extra stuff stop out and drop off by attrition... Keep up your outstanding work. I can see that I need to watch Richard's videos all over again... " – Paid-up subscriber Terry S.

![]() "Today I finally got the chance to listen to the webinar with Porter, Steve, and Dr. Smith. Somewhere near the end of the program Porter made a statement something like, 'I can almost guarantee that if you're not using TradeStops your portfolio volatility will be above the S&P 500's volatility. I'd wager that it will be around 30% or even higher.'

"Today I finally got the chance to listen to the webinar with Porter, Steve, and Dr. Smith. Somewhere near the end of the program Porter made a statement something like, 'I can almost guarantee that if you're not using TradeStops your portfolio volatility will be above the S&P 500's volatility. I'd wager that it will be around 30% or even higher.'

"I would guess that that would have been true of me a few years ago. BUT, I followed your early advice and became a subscriber to TradeStops. When it was available I upgraded my subscription to lifetime. As each new feature has become available I've incorporated it into my investing toolbox... I can't agree too strongly with your advice. Everyone should use TradeStops or they should stop investing.

"The webinar was excellent. Thank you for continuing to provide superlative educational opportunities for your subscribers. I know I'm wealthier because of it." – Paid-up subscriber Ed M.

Regards,

Justin Brill

Baltimore, Maryland

May 9, 2016

|