More volatility...

More volatility... 'Megabrew' sends beer soaring... A huge buyback at one of the world's greatest companies... An update on gold stocks...

![]() Following the "roller-coaster ride" on Thursday, U.S. stocks fell again on Friday...

Following the "roller-coaster ride" on Thursday, U.S. stocks fell again on Friday...

The benchmark S&P 500 Index fell more than 2%, giving back nearly all the gains stocks had made heading into the Federal Reserve's September meeting last week.

Today, the market opened higher and rallied more than 1%, before reversing and finishing the day up less than 0.5%.

![]() We believe further downside is possible. But even if the rally resumes from here, the market will often revisit its lows – what's known as a "test" of the bottom – before heading higher.

We believe further downside is possible. But even if the rally resumes from here, the market will often revisit its lows – what's known as a "test" of the bottom – before heading higher.

Either way, as we noted on Thursday, don't be surprised to see the volatility continue in the near term.

![]() Outside of the Federal Reserve's "non-announcement" on interest rates last week, the big news was about beer...

Outside of the Federal Reserve's "non-announcement" on interest rates last week, the big news was about beer...

On Wednesday, global beer maker Anheuser-Busch InBev (BUD) announced that it was planning an offer to acquire its rival, SABMiller (SBMRY).

The news sent BUD shares up nearly 5%, while SABMiller soared nearly 20%. Shares of other beer makers and distributors rallied as well.

The potential $275 billion merger – which the beer industry is calling "Megabrew" – would combine the world's largest and second-largest beer makers into a new industry giant.

![]() Not surprisingly, reports suggest that the deal is likely to face "intense scrutiny" from government regulators. From an article in the Wall Street Journal...

Not surprisingly, reports suggest that the deal is likely to face "intense scrutiny" from government regulators. From an article in the Wall Street Journal...

Regulators likely would press for major concessions from AB InBev, particularly in the U.S. and China, to put the brakes on two brewers that together already produce nearly a third of the world's beer and span hundreds of brands, including Budweiser, Corona, and Peroni. AB InBev and SABMiller had 20.8% and 9.7% worldwide market shares by volume last year, respectively, Euromonitor International estimates.

An intricate web of corporate alliances at AB InBev and SABMiller, including competing bottling operations for soda rivals Coca-Cola Co. and PepsiCo Inc., only heightens the complexity of negotiations. Also factoring into any potential deal: U.S. cigarette giant Altria Group Inc., which owns a 27% stake in SABMiller.

Because of the global reach of AB InBev and SABMiller, they will likely have to seek antitrust clearance from jurisdictions around the world, a process that could easily take a year, antitrust experts said. "A lot of different enforcers are going to want to look at this. You could have some surprises here and there," said Darren Tucker, an antitrust lawyer at Morgan, Lewis & Bockius LLP.

![]() The deal will likely require several "divestitures" – where one or both companies would sell off assets or entire brands to competitors – to gain approval from the various governments involved. And the Journal notes that AB InBev faces its biggest "hurdle" here in the U.S...

The deal will likely require several "divestitures" – where one or both companies would sell off assets or entire brands to competitors – to gain approval from the various governments involved. And the Journal notes that AB InBev faces its biggest "hurdle" here in the U.S...

AB InBev – with its Budweiser, Bud Light, and other brands – already controls nearly 45% of the U.S. beer market. SABMiller – through its MillerCoors joint venture with Molson Coors Brewing – controls another 25%. And the two companies also control the only two U.S.-based beer-distribution networks.

![]() The article suggests the most likely outcome would be a sale of SABMiller's stake in MillerCoors, but even that scenario is complicated. More from the Journal...

The article suggests the most likely outcome would be a sale of SABMiller's stake in MillerCoors, but even that scenario is complicated. More from the Journal...

AB InBev would have to sell SABMiller's 58% stake in MillerCoors, whose brands include Coors Light and Miller Lite. It might have to settle for a discount because Molson Coors has the right to boost its stake to 50% and name MillerCoors' chief executive if SABMiller is acquired. Molson Coors also has the right of first refusal for the remaining 50%, and the brewer's share price surged more than 10% Wednesday in anticipation of a deal.

![]() While the deal would likely be great news for BUD shareholders, history shows the deal could be even better for some of AB InBev's competitors...

While the deal would likely be great news for BUD shareholders, history shows the deal could be even better for some of AB InBev's competitors...

Following its $20 billion deal to acquire Mexican brewing giant Grupo Modelo in 2013, AB InBev was forced to sell nearly $3 billion in assets to U.S.-based Constellation Brands (STZ).

![]() Our colleague Dan Ferris, Extreme Value editor, agrees...

Our colleague Dan Ferris, Extreme Value editor, agrees...

Both BUD and STZ are open positions in Dan's advisory, and he shared his thoughts on the deal with us in a private e-mail this weekend...

There's no way the deal passes antitrust without divesting assets.

The deal could be interesting for Constellation Brands (STZ), the best-performing Extreme Value pick yet. The last time BUD needed to make a deal work, STZ picked up the 50% of Crown Imports – which markets and distributes Modelo brands in the U.S. – that it didn't already own.

Who knows what might happen this time? I bet things are very busy at STZ headquarters right now. All we can do is wait and see.

Whatever happens, we know one thing for sure: SABMiller will have as much expense cut out of it as humanly possible once the Brazilians take over. That's their game. They get rid of perks, excess staff, sports tickets, corporate aircraft, you name it...

So it's practically a guarantee that, whatever SABMiller's [earnings before interest, taxes, depreciation, and amortization] margins are today, they'll be thicker a year after the deal closes, if it closes. You never know...

![]() Another well-known stock made news recently for a different reason.

Another well-known stock made news recently for a different reason.

During the worst of last month's decline, entertainment juggernaut Disney (DIS) was buying shares...

The selloff in DIS started following the company's latest earnings report on August 4. The company reported solid earnings, but noted a slowdown in subscriber growth at its ESPN subsidiary.

Shares fell as much as 20%... and the company used the opportunity to "aggressively" buy back shares. In total, the company spent $2.4 billion buying its own stock last month, representing nearly half of the company's total share repurchases this year.

"The market [gave] us an opportunity to buy the stock at meaningfully lower prices," Thomas Staggs, Disney's chief operating officer, said at a conference last month. "So we've taken big advantage of that opportunity."

![]() Most companies buy back shares when they're expensive and popular. So it's refreshing to see a company take advantage of a selloff to scoop up shares.

Most companies buy back shares when they're expensive and popular. So it's refreshing to see a company take advantage of a selloff to scoop up shares.

Even so... we believe Disney overpaid...

![]() Disney is among a small number of companies that Porter and the Stansberry's Investment Advisory team track each month in the Stansberry Data Trophy Asset Monitor.

Disney is among a small number of companies that Porter and the Stansberry's Investment Advisory team track each month in the Stansberry Data Trophy Asset Monitor.

For those who aren't familiar, "trophy asset" companies are simply those that own or control the highest-quality assets in the world. Many of these are "tangible" assets like gold mines, railroads, or real estate. But some are more intangible... and Disney's collection of assets – like copyrights on its beloved animated movies, trademarks on characters like Mickey Mouse, and brand names like ESPN – is unsurpassed.

![]() But as we often say, even the best assets can make bad investments if you pay too much for them.

But as we often say, even the best assets can make bad investments if you pay too much for them.

The goal with "trophy asset" investing is to buy the world's best assets at historically low prices.

According to Stansberry's Investment Advisory analyst Mike DiBiase, that's definitely not the case today. Mike explained in a note this morning...

DIS was trading for around $120 a share before its last earnings release. The ESPN news sent it down 9% in one day, and it traded lower over the next 14 days... all the way down to near $95 per share.

That must have been when they began buying aggressively. Shares are now up about 8% since then to around $103. But it's still fairly expensive by most measures.

For trophy assets, we use discount/premium to asset value to measure cheapness. It's trading around a 100% premium to its asset value today. For comparison, it traded at a 55% discount to the value of its assets in March 2009, and its previous high was 135% in early August 2015.

But even by other measures, it's still somewhat high. On a price-to-earnings (P/E) basis, it's around 20. And its enterprise value (market cap plus debt minus cash) is around 13 times its EBITDA and around 29 times its free cash flow.

In other words, Disney is a great stock to keep on your "watch list," but it's still too expensive to buy today...

![]() Switching gears a bit, we have some positive news on gold stocks...

Switching gears a bit, we have some positive news on gold stocks...

We've explained the bullish case for gold stocks several times. As Porter noted in the July 24 Digest...

I believe that some combination of rising interest rates, rising defaults in the corporate bond market, and global currency/trade wars will likely cause the U.S. stock market to decline substantially. No, I don't know the exact timing of such a move. But I believe it will happen with the next few months. Downward reversion to the mean will play a role.

Likewise, I notice that the gold and precious-metals sector is in the midst of a three-year decline. I see that junior mining stocks have declined every year since 2011. Most of the best names in the space are down more than 80%.

I'm 100% certain that eventually, this downward trend will reverse. And I know that when that occurs, the resulting price increases will be dramatic. I believe average gains in excess of 250% are likely.

Investors smart enough to "hedge" their exposure to the U.S. stock market by establishing a "toehold" in the highest-quality gold and junior gold-mining stocks will likely be far more successful over the next three to five years than investors who don't.

![]() In addition to the dramatic declines in gold stocks over the past several years, investor sentiment has plummeted. Investors are as pessimistic on the sector as they were in 2006 and late 2008, just before huge rallies were about to begin.

In addition to the dramatic declines in gold stocks over the past several years, investor sentiment has plummeted. Investors are as pessimistic on the sector as they were in 2006 and late 2008, just before huge rallies were about to begin.

As regular readers know, the resource market is cyclical. Low prices and negative sentiment inevitably lead to higher prices.

Of course, prices have been low and sentiment poor for months. What's been missing is positive "price action"... a move that suggests a bottom is finally in place.

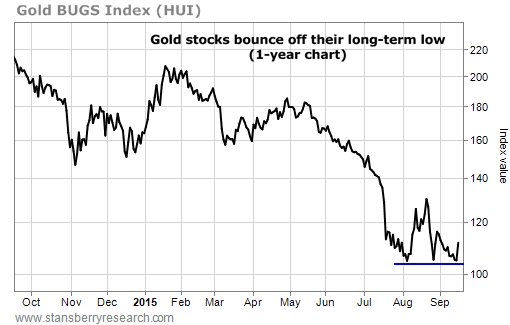

But we may now have that as well. Our colleagues Brian Hunt and Ben Morris shared the following chart with their DailyWealth Trader subscribers last Thursday morning...

![]() As you can see, gold stocks have now "tested" their August lows twice. And as Brian and Ben noted, when an asset tests a low and those lows "hold," it's often a bullish sign. And that's been the case so far...

As you can see, gold stocks have now "tested" their August lows twice. And as Brian and Ben noted, when an asset tests a low and those lows "hold," it's often a bullish sign. And that's been the case so far...

With the Federal Reserve deciding to keep interest rates unchanged... the dollar fell, and gold stocks rallied... another positive sign. Even better, gold stocks continued to rally on Friday while the broad market fell further.

![]() Again, no one can know where the market is headed next... And that includes gold stocks. But seeing the sector "hold" the recent lows and move higher while the rest of the market falls is a wonderful sign.

Again, no one can know where the market is headed next... And that includes gold stocks. But seeing the sector "hold" the recent lows and move higher while the rest of the market falls is a wonderful sign.

As Porter said, we believe investors who build small positions in the highest-quality gold stocks will do well over the next several years. Gains of hundreds of percent are likely as prices and sentiment "revert to the mean."

But according to our colleague Matt Badiali, the gains could be greater than even Porter expects...

![]() Matt, who writes the Stansberry Resource Report, says a single announcement from China could end the bear market in gold in an instant... and send prices 50% higher overnight. It sounds unbelievable... but he says it's not only possible, it could happen in the next 12 months.

Matt, who writes the Stansberry Resource Report, says a single announcement from China could end the bear market in gold in an instant... and send prices 50% higher overnight. It sounds unbelievable... but he says it's not only possible, it could happen in the next 12 months.

Matt put together a presentation explaining it all. Click here to get the details and decide for yourself.

![]() New 52-week highs (as of 9/18/15): Activision Blizzard (ATVI).

New 52-week highs (as of 9/18/15): Activision Blizzard (ATVI).

![]() In the mailbag today, a question on gold and gold stocks. Send your letters to feedback@stansberryresearch.com.

In the mailbag today, a question on gold and gold stocks. Send your letters to feedback@stansberryresearch.com.

![]() "Is it better to buy physical gold or gold mining stocks? Where do I buy physical gold?" – Paid-up subscriber N.L.

"Is it better to buy physical gold or gold mining stocks? Where do I buy physical gold?" – Paid-up subscriber N.L.

Brill comment: As always, we can't provide individual investment advice. But we think about gold and gold stocks differently...

We recommend that everyone should own a small percentage of his or her wealth in physical gold and silver. We consider this an alternative form of savings. It's not an investment. As we like to say, with these positions, we aren't looking to profit when prices rise and we aren't losing sleep when prices fall.

On the other hand, gold stocks – especially junior gold stocks – aren't for everyone. They're like leveraged bets on the price of gold. If gold rises 100%, gold stocks can soar 500%... But as we've seen over the past several years, if gold falls 30%, gold stocks can crash 80% or more. This makes them among the riskiest stocks in the market. If you're going to own them, you absolutely must keep your position sizes small. You can learn more about the difference between gold and gold stocks in the August 7 Digest here.

If you'd like to buy physical gold, we recommend contacting Van Simmons at David Hall Rare Coins and Rich Checkan at Asset Strategies International. As always, we receive no compensation for recommending their services. They simply have a long track record of taking care of our subscribers.

Regards,

Justin Brill

Baltimore, Maryland

September 21, 2015

|