Stocks that work even when you're dead wrong...

Stocks that work even when you're dead wrong... A secret to finding capital-efficient companies...

![]() In today's Friday Digest... a powerful investment secret that took me two decades of reading and thinking to figure out.

In today's Friday Digest... a powerful investment secret that took me two decades of reading and thinking to figure out.

This investment secret will show you how to build a portfolio that I believe will make you money in almost any market condition. The ideas in today's essay will allow you to make money in the stock market even when you're bearish or afraid of stocks in general. And here's the best part: These secrets will also show you how to outperform in bull markets. In short, these are the most valuable ideas anyone could give you about investing in stocks...

![]() Trust me, you won't learn these things in school. And while a few great investors could teach you these things, almost no one would. You see, great financial strategies are only valuable if they're relatively unknown. That, of course, raises two important questions we should answer first...

Trust me, you won't learn these things in school. And while a few great investors could teach you these things, almost no one would. You see, great financial strategies are only valuable if they're relatively unknown. That, of course, raises two important questions we should answer first...

![]() Question No. 1: "Porter, if these strategies really are valuable... why on Earth are you telling anyone about them?"

Question No. 1: "Porter, if these strategies really are valuable... why on Earth are you telling anyone about them?"

That's easy. You and I have a fair deal that has made me a wealthy man. I work my hardest to give you the information I would want if our roles were reversed. And you pay me a fair price for the ideas I deliver. Unless I give you valuable ideas that work to deliver profits for you, you won't continue to pay me for my ideas.

If you've followed my work for any length of time, you realize financial research is both my job and my passion. Since the day I left college 20 years ago, this is the only professional work I've done. I have huge incentives to do my best to make sure that our ideas are the best you can find anywhere. What follows below are some of the best ideas I've found about how to safely make a lot of money in the stock market. Put these ideas to work and I have no doubt you will die wealthy.

![]() Question No. 2: "Porter, once you've published these ideas, how do you know they will continue to work? If everyone knows how to use these strategies, won't the markets simply adjust prices in a way that makes it too expensive to follow? Why won't these ideas be 'priced out' of the market?"

Question No. 2: "Porter, once you've published these ideas, how do you know they will continue to work? If everyone knows how to use these strategies, won't the markets simply adjust prices in a way that makes it too expensive to follow? Why won't these ideas be 'priced out' of the market?"

This one is a lot less certain. The truth is, if I was doing a great job as a publisher, the value of these ideas would quickly evaporate. That's because more and more investors would begin to favor investments with these qualities, pushing their prices up to levels that would discount their value appropriately. Much like the odds on a horse race, knowing the "favorite" is only an advantage if other investors aren't wise to the advantages I'll describe below. But... I'm not concerned about losing our "edge" anytime soon. As you'll see below, these ideas aren't likely to become popular with the "herd."

![]() First, these strategies require a fair amount of thinking. We can do most of the homework for you, but nobody can make you think. As philosopher Bertrand Russell once said, "Most men would rather die than think; in fact, most do." These ideas also require discipline to implement. Smarts and discipline? Almost no human being can bring those assets to bear when it comes to his money.

First, these strategies require a fair amount of thinking. We can do most of the homework for you, but nobody can make you think. As philosopher Bertrand Russell once said, "Most men would rather die than think; in fact, most do." These ideas also require discipline to implement. Smarts and discipline? Almost no human being can bring those assets to bear when it comes to his money.

So I'm not worried. These ideas should never be popular. The truth is, even after reading this essay and seeing our results over the last decade of using these ideas... almost all of you will continue to invest as you have always invested. In my experience, people will not change their core investment strategies until after they've suffered a disaster. (By the way, if that has been true for you, I'd love to hear your story. Please e-mail me at feedback@stansberryresearch.com.)

![]() Two weeks ago, I promised to share three things with you. First, I told you I'd give you the secrets to finding and quantifying great businesses, plus I'd give you the tools you needed to evaluate whether or not the shares of those businesses were cheap or expensive. You should always know several core metrics for every business you buy. If you know those metrics, there's no excuse for buying a business that isn't great.

Two weeks ago, I promised to share three things with you. First, I told you I'd give you the secrets to finding and quantifying great businesses, plus I'd give you the tools you needed to evaluate whether or not the shares of those businesses were cheap or expensive. You should always know several core metrics for every business you buy. If you know those metrics, there's no excuse for buying a business that isn't great.

Likewise, there's no reason to ever buy a great business if it isn't trading at a fair price. This isn't baseball. You aren't going to strike out. You get to look at "pitches" all day, every day. You only have to act when you see a pitch that's perfect for you. And the truth is, the longer you wait, the better your results are likely to be.

![]() Next, I told you I'd give you the secret to doing well in stocks, even when you're completely wrong about the market or the sector overall. That's what we're covering in today's Friday Digest: How to make money even when you're dead wrong about the market as a whole or the sector you're buying.

Next, I told you I'd give you the secret to doing well in stocks, even when you're completely wrong about the market or the sector overall. That's what we're covering in today's Friday Digest: How to make money even when you're dead wrong about the market as a whole or the sector you're buying.

![]() Two weeks ago, I introduced this idea by showing you the example of homebuilder NVR (NVR).

Two weeks ago, I introduced this idea by showing you the example of homebuilder NVR (NVR).

I pointed out that even if you had bought

No, I'm not a rear-facing guru. I wrote an entire issue of my newsletter, Stansberry's Investment Advisory, primarily about why

This is an extreme example of how you could have made money even if you had bought into the worst sector at the worst time imaginable. And by the way, if you really didn't know that real estate and homebuilders were in a bubble by 2005, you must have been living in a cave... or a drug-induced state of euphoria. Even mainstream financial magazines were warning people about the madness in residential real estate.

![]() So what's the secret? How did I know that

So what's the secret? How did I know that

As regular Digest readers know, a capital-efficient business is able to generate outsized returns without investing heavily in expensive machinery, research and development, or factory maintenance. One of the main symptoms of capital efficiency is the ability to pay large sums of money back to shareholders.

Just consider this: In the last three years,

This incredible capital efficiency means that if you own

Even if you had bought this stock at the worst time to buy a housing stock in your entire life, you would have still done OK because of this company's highly capital-efficient business model.

![]() Now... here's the secret. A few types of companies are always capital efficient because of their structures.

Now... here's the secret. A few types of companies are always capital efficient because of their structures.

Some, which we've written about extensively, are certain kinds of insurance companies. We prefer property and casualty (P&C) insurance companies over life insurance companies for one reason: Everyone dies. It's difficult for life insurance companies to produce excellent underwriting results because they are all working off the same mortality charts.

On the other hand, P&C companies can (and do) have different underwriting strategies. For high-quality underwriters, capital is not merely cheap, it's "less" than free. As you know if you've ever paid for homeowners insurance and never made a claim, it's the insurance company's customers that provide all of the capital – and more – that's required to operate it.

![]()

![]() Obviously, most investors want some diversification. And we don't recommend only investing in insurance companies. But we do want to note that in 1947, Shelby Davis invested $50,000 in just 12 high-quality P&C companies. He never sold them or traded them. By the 1980s, he was on the Forbes 400 as one of the wealthiest people in the world.

Obviously, most investors want some diversification. And we don't recommend only investing in insurance companies. But we do want to note that in 1947, Shelby Davis invested $50,000 in just 12 high-quality P&C companies. He never sold them or traded them. By the 1980s, he was on the Forbes 400 as one of the wealthiest people in the world.

Davis is the only person we know of who became a billionaire simply through passive common-stock investments. Likewise, we know investing legends Ben Graham (perhaps the most famous investor of the last 100 years) and Warren Buffett earned most of their common-stock investment returns through insurance companies. We are certain that sticking with insurance would lead to vastly better investment results for most individual investors.

![]() There's another kind of business that's almost as capital efficient as insurance and that can operate in just about any sector. These firms are the absolute best way to invest in almost any industry or trend. I'm talking about royalty companies. These firms raise capital and then invest in operating businesses. But rather than buying stock or lending on credit, these companies buy a small percentage of the company's future revenue. Royalty rates vary, but they're typically between 5% and 10% of all future revenue. That adds up.

There's another kind of business that's almost as capital efficient as insurance and that can operate in just about any sector. These firms are the absolute best way to invest in almost any industry or trend. I'm talking about royalty companies. These firms raise capital and then invest in operating businesses. But rather than buying stock or lending on credit, these companies buy a small percentage of the company's future revenue. Royalty rates vary, but they're typically between 5% and 10% of all future revenue. That adds up.

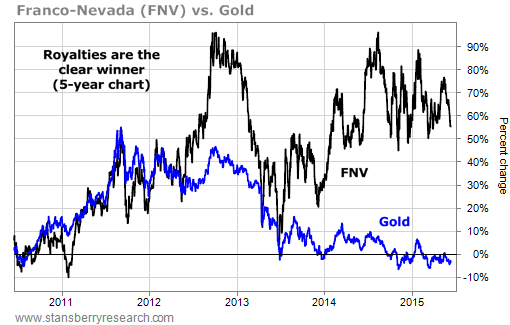

![]() Lots of investors know about resource-focused royalty companies. The most famous (and one of the best) is Franco-Nevada (FNV). Most investors know that owning gold over the last five years hasn't been a great bet. (It's down around 3%.) But even if you bought gold at just about the worst possible time in the last 20 years, if you bought gold via exposure to Franco-Nevada's royalty streams – its stock – you've done well. You're up nearly 60%...

Lots of investors know about resource-focused royalty companies. The most famous (and one of the best) is Franco-Nevada (FNV). Most investors know that owning gold over the last five years hasn't been a great bet. (It's down around 3%.) But even if you bought gold at just about the worst possible time in the last 20 years, if you bought gold via exposure to Franco-Nevada's royalty streams – its stock – you've done well. You're up nearly 60%...

![]() Here's the secret: Royalty companies aren't limited to resources. In fact, most of the best companies we cover in terms of capital efficiency and quality are actually "hidden" royalty companies.

Here's the secret: Royalty companies aren't limited to resources. In fact, most of the best companies we cover in terms of capital efficiency and quality are actually "hidden" royalty companies.

Take fast-food giant McDonald's (

![]() Here's another example. Did you know that soft-drink icon Coca-Cola (KO) doesn't generate most of its revenue from the sale of beverages? Nope, most of its revenue comes from the sale of syrup used by bottlers around the world to make canned or bottled soft drinks.

Here's another example. Did you know that soft-drink icon Coca-Cola (KO) doesn't generate most of its revenue from the sale of beverages? Nope, most of its revenue comes from the sale of syrup used by bottlers around the world to make canned or bottled soft drinks.

Coke sells syrup for the same reason that McDonald's sells franchises. It's a way of putting most of the capital costs associated with the business on the back of a local partner. It's the bottlers who have to pay for almost all of Coke's capital costs by building the local bottling plants and supplying all of the trucks needed for distribution.

![]() If you think about this idea for a minute, it's simple to grasp. Take two stocks in the same industry. One has zero capital costs. It's a royalty firm, in one form or another. The other is a typical corporation that continues to reinvest its profits in capital projects. After all, almost all companies require capital to grow.

If you think about this idea for a minute, it's simple to grasp. Take two stocks in the same industry. One has zero capital costs. It's a royalty firm, in one form or another. The other is a typical corporation that continues to reinvest its profits in capital projects. After all, almost all companies require capital to grow.

Over time, which business do you think is most likely to have rewarded its shareholders better? The company that has zero (or nearly zero) capital costs or the company that must reinvest 40% to 60% of its profits back into its business to help generate more growth? The answer, of course, is the company that doesn't have capital costs.

![]() One final secret... Why aren't the massive differences in financial performance between capital-efficient companies like

One final secret... Why aren't the massive differences in financial performance between capital-efficient companies like

This kind of accounting is not useful when determining the value of an insurance company's revenues... or a royalty company... or a company like McDonald's, which receives so much of its revenues from capital-free franchise contracts. And yet... Wall Street continues to value all stocks by their reported earnings, which are generated using "railroad accounting" that has remained largely unchanged for more than 100 years. Understanding where there are huge differences between reporting earnings and cash results for shareholders gives us a big advantage over most investors – even most professional investors. I hope it lasts...

![]() Now... what if everything – or mostly everything – that I've written today goes straight over your head? Or what if you understand the concepts but have no desire to figure out which insurance companies are good underwriters... or which operating businesses are capital efficient... or even which stocks in a given sector are royalty collectors?

Now... what if everything – or mostly everything – that I've written today goes straight over your head? Or what if you understand the concepts but have no desire to figure out which insurance companies are good underwriters... or which operating businesses are capital efficient... or even which stocks in a given sector are royalty collectors?

Well, that's why we're here. In my Investment Advisory, we've been focusing on capital-efficient strategies for a decade. These are companies we believe will do well no matter what happens to the stock market as a whole.

![]() Regular Digest readers will recall my annual effort to measure our good intentions against actual results. These "Report Cards" (which you can read here and here) show our subscribers how well (or poorly) our investment recommendations have performed over certain periods – usually against the last several quarters.

Regular Digest readers will recall my annual effort to measure our good intentions against actual results. These "Report Cards" (which you can read here and here) show our subscribers how well (or poorly) our investment recommendations have performed over certain periods – usually against the last several quarters.

I asked our friend Dr. Richard Smith to measure my newsletter's capital-efficient recommendations. Richard's Ph.D. is in mathematics and he built the portfolio-management software TradeStops that we've written about many times. And he has performed many insightful analyses of our recommendations over the years.

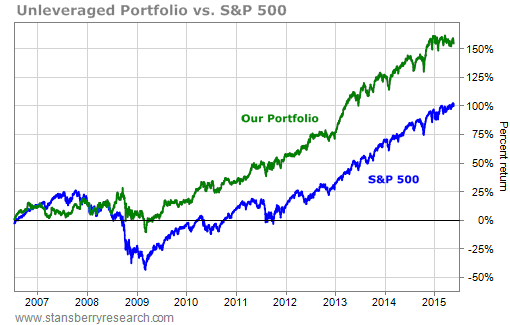

This time, I asked him to see how our capital-efficient recommendations, combined with our insurance recommendations, and our super-safe "forever" recommendations like pharmaceutical behemoth Johnson & Johnson have performed against the stock market over the last decade. These are the recommendations I believe will succeed no matter what happens to the rest of the stock market. Richard's conclusions are displayed in the chart below...

![]() In the chart above, Richard represents the Stansberry's Investment Advisory portfolio against the returns of the benchmark S&P 500 stock index. As you can see, the portfolio beat the S&P 500 over the last 10 years by a wide margin. I believe this advantage is extremely likely to continue. Because of the low volatility of these stocks, I have more good news...

In the chart above, Richard represents the Stansberry's Investment Advisory portfolio against the returns of the benchmark S&P 500 stock index. As you can see, the portfolio beat the S&P 500 over the last 10 years by a wide margin. I believe this advantage is extremely likely to continue. Because of the low volatility of these stocks, I have more good news...

A portfolio of super-safe stocks like these allows you to apply leverage safely. Please listen carefully to what I'm saying: I do not support using leverage in a way that will make your portfolio more volatile than the stock market as a whole. I do support maximizing the total return potential of low-risk, low-volatility stocks by adding leverage to equalize your portfolio's volatility to that of the stock market as a whole.

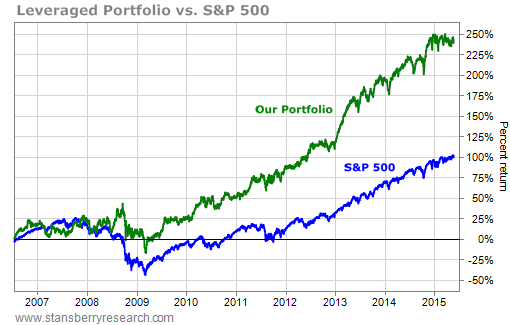

To do so safely and effectively, you first want to equalize the risk of each of your portfolio positions. That is, each position size is adjusted to reflect the volatility of the individual stock. The more volatile the stock, the smaller the position. The less volatile the stock, the larger the position. All of the stocks in this particular conservative portfolio are low-volatility stocks. Richard shows you what that looks like in terms of total returns with the green line. Now... here's the fun part. What would your total returns have been if you had taken our capital-efficient recommendations over the past 10 years (which includes our insurance picks and our super-safe companies) and applied leverage to the portfolio in an amount that increased your portfolio's volatility to match that of the S&P 500?

The "risk parity" portfolio is displayed below. By taking high-quality, low-risk investments and adding leverage to equal (but not exceed) the volatility of stocks on average, we were able to increase our total returns dramatically...

![]() Please note that these are rear-looking, simulated results. We are not claiming that anyone could have actually achieved these particular results exactly or that we advised adding leverage to our recommendations at the time we made them. We didn't. This simulation only explores whether that approach might be beneficial in the future. That certainly appears to be the case. These kinds of businesses offer investors tremendous amounts of what finance geeks call "alpha." That is, they offer higher returns per unit of risk. They generate this alpha because of an obvious advantage – a lack of capital costs.

Please note that these are rear-looking, simulated results. We are not claiming that anyone could have actually achieved these particular results exactly or that we advised adding leverage to our recommendations at the time we made them. We didn't. This simulation only explores whether that approach might be beneficial in the future. That certainly appears to be the case. These kinds of businesses offer investors tremendous amounts of what finance geeks call "alpha." That is, they offer higher returns per unit of risk. They generate this alpha because of an obvious advantage – a lack of capital costs.

![]() I believe these ideas can make anyone a vastly more successful investor. I hope they do so for you. And I hope today's Digest was helpful to you and helps you understand why we focus on capital-efficient companies. I'd love to hear what you think about these ideas or how I might make these concepts easier for you and others to understand. Please send me your thoughts to feedback@stansberryresearch.com.

I believe these ideas can make anyone a vastly more successful investor. I hope they do so for you. And I hope today's Digest was helpful to you and helps you understand why we focus on capital-efficient companies. I'd love to hear what you think about these ideas or how I might make these concepts easier for you and others to understand. Please send me your thoughts to feedback@stansberryresearch.com.

![]() New 52-week highs (as of 6/11/15): Dollar General (DG), Euronav (EURN), iShares U.S. Insurance Fund (IAK), Prestige Brands Holdings (PBH), and ProShares Ultra Health Care Fund (RXL).

New 52-week highs (as of 6/11/15): Dollar General (DG), Euronav (EURN), iShares U.S. Insurance Fund (IAK), Prestige Brands Holdings (PBH), and ProShares Ultra Health Care Fund (RXL).

![]() In the mailbag, Stansberry's Investment Advisory analyst Mike DiBiase answers some of your questions from Porter's recent Friday Digests. Send your questions to feedback@stansberryresearch.com.

In the mailbag, Stansberry's Investment Advisory analyst Mike DiBiase answers some of your questions from Porter's recent Friday Digests. Send your questions to feedback@stansberryresearch.com.

![]() "Hi, I called in to ask that these two very specific questions be clarified. The operator said that she would escalate to the editor, and the clarifications would likely be published in a week or less. I would appreciate that, not just for me, but also for other readers, as I suspect I am not the only one with doubts. I am a little confused because the terminology on this email does not exactly match the terminology on Yahoo finance. Most I can figure out on my own. But there is one that I am having trouble with: Test 3, The third part of our four-part litmus test for great businesses is 'return on invested capital.'

"Hi, I called in to ask that these two very specific questions be clarified. The operator said that she would escalate to the editor, and the clarifications would likely be published in a week or less. I would appreciate that, not just for me, but also for other readers, as I suspect I am not the only one with doubts. I am a little confused because the terminology on this email does not exactly match the terminology on Yahoo finance. Most I can figure out on my own. But there is one that I am having trouble with: Test 3, The third part of our four-part litmus test for great businesses is 'return on invested capital.'

"You say: Coke has $30 billion worth of equity capital and $42 billion worth of debt (adding the current position of long-term debt to long-term debt). On Yahoo Finance, KO bal sheet, I see Total Stockholder Equity=30,320,000, so I assume this is aka 'equity capital' (30b). Please confirm. However, Long Term Debt =19,063,000 so... I am not clear how you are determining KO has 42b worth of debt. Sorry if I need my hand held, but I won't give up till I understand this." – Paid-up subscriber Dave Leflang

Mike DiBiase comment: You are correct. For total equity capital, use the "Total Stockholder Equity" from Yahoo Finance's balance sheet. Getting total debt is easy, too. In the return on invested capital calculation, we're only interested in the total debt that has been invested in the company, including all bonds and bank loans.

Companies are required to split this debt into two lines on their balance sheet – one line for the portion of their debt that has to be repaid within the next year, and the other for the remaining longer-term portion.

The portion that has to be repaid within the next year is usually called "current portion of long-term debt" on the balance sheet, or something along those lines. "Current" just means it's due within the next 12 months. For total debt, using Yahoo Finance's balance sheet, you have to add the two lines – one called "Short/Current Long Term Debt" (which was $23 billon for KO) and one called "Long Term Debt" (which was $19 billion) – which totals $42 billion.

![]() "Hello, I am trying to figure out what formula you used to get 12.9. [You said] 'Looking at enterprise value and cash flow also gives us a more accurate way to value Markel's business. On this basis, the shares are only trading at 12.9 times cash earnings – a multiple that's cheaper than the market as a whole.' I understand the formula used to figure out the 7.7% but I don't get the 12.9. I need to know this so I can calculate if the company is trading less than 10 times their cash flow. Thanks!" – Paid-up subscriber Erica Mac

"Hello, I am trying to figure out what formula you used to get 12.9. [You said] 'Looking at enterprise value and cash flow also gives us a more accurate way to value Markel's business. On this basis, the shares are only trading at 12.9 times cash earnings – a multiple that's cheaper than the market as a whole.' I understand the formula used to figure out the 7.7% but I don't get the 12.9. I need to know this so I can calculate if the company is trading less than 10 times their cash flow. Thanks!" – Paid-up subscriber Erica Mac

Mike DiBiase comment: At the time, Markel's enterprise value was around $9.25 billion. When I say "cash earnings," I mean operating cash flows. You can find this amount in the Key Statistics section under "Operating Cash Flow (ttm)," which tells you the operating cash flows over the last 12 months. For Markel, it's $717 million. Dividing the enterprise value ($9.25B) by this number gives you a ratio of 12.9. Today, Markel's enterprise value is around $9.55 billion, so the company is currently trading at 13.3 times cash earnings.

Regards,

Porter Stansberry

Hawk's Nest Marina, Cat Island, Bahamas

June 12, 2015