The best portfolio strategy we've ever tested...

The best portfolio strategy we've ever tested... How to do what your finance professor said can't be done... The 'magic' stock of 2016...

![]() In today's Friday Digest, I (Porter) am taking a break from my recent warnings to greatly expand on an idea I first introduced last April.

In today's Friday Digest, I (Porter) am taking a break from my recent warnings to greatly expand on an idea I first introduced last April.

It's an idea I call the "magic" portfolio because it combines buying the highest-quality businesses with extremely stable stocks. When used to build whole portfolios, this combination produces market-beating results with about half the volatility of the stock market as a whole.

Financial theory suggests this combination – market-beating results and low volatility – isn't possible. However, our most recent research conclusively proves that not only does this approach work... it works in a way that's ideal for individual investors to follow.

This approach allows you to build small portfolios (not dozens of stocks) that can produce fantastic results and are vastly safer than just buying an index fund. I believe if you read today's Digest, you'll never invest the same way ever again. Going forward, you're going to buy "magic" stocks... or none at all.

![]() Now, before I continue, let me address a question you're probably thinking...

Now, before I continue, let me address a question you're probably thinking...

Porter, if you expect a bear market in stocks and bonds – the greatest legal transfer of wealth in history – why are you talking about a strategy for buying stocks today?

The answer, as I've explained before, is that no one can be certain when a bear market will begin... and, more important, if you buy the right stocks, it doesn't really matter...

![]() Of course, I don't expect you to simply take my word for it. So to prove that these ideas work, my staff has spent hundreds of hours collecting data and testing the approach. As you'll see, there's nothing magical about our research methods or these companies. Our "magic" portfolios are made up of firms with products you use every day and shares that are safe to own.

Of course, I don't expect you to simply take my word for it. So to prove that these ideas work, my staff has spent hundreds of hours collecting data and testing the approach. As you'll see, there's nothing magical about our research methods or these companies. Our "magic" portfolios are made up of firms with products you use every day and shares that are safe to own.

For investors who can't tolerate the risk of losing capital... for investors with reasonable time horizons (longer than 36 months)... and for investors who want to compound their capital at the highest possible rate, this approach holds almost unbelievable potential.

![]() How good are these "magic" portfolios?

How good are these "magic" portfolios?

We found that back-testing our highest-caliber "magic" portfolio since the year 2000 produced average annualized returns of 13%. That's a result that beat the S&P 500 by nearly six percentage points per year. This portfolio required little trading, too. Over 15 years, the maximum portfolio size was only 12 stocks, and we used a simple, mechanical, three-year holding period for all of the portfolios. We produced these results without attempting to optimize our selling strategy at all.

I promise you've never seen anything like this before. It's the perfect portfolio approach for typical individual investors who need a reliable way to compound their wealth at extraordinary rates, while minimizing risk of loss.

Assuming this portfolio was held in a tax-advantaged account like an IRA, a $100,000 investment made using this strategy in 2000 would have grown to more than $600,000. An identical investment made in an S&P 500 index fund would have only grown to $283,741.

This approach could have made investors 500% - more than double the S&P 500's return – over 15 years, while involving far less risk.

![]() When you see what kind of stocks these portfolios hold, you'll understand why it works so well.

When you see what kind of stocks these portfolios hold, you'll understand why it works so well.

Below, you'll find all the details of this approach. I'll show you the lengths we've gone to test it accurately. Best of all, there's no catch. Everyone can buy these stocks with the click of a mouse. It might look like magic, but it's all real. In fact, I'd encourage you to print a copy of this Digest and share it with your financial advisor or most financially sophisticated friends. Ask them what they think of these ideas. And let us know what they say at feedback@stansberryresearch.com.

![]() Now, let me take on the second main objection I know we'll receive...

Now, let me take on the second main objection I know we'll receive...

If this is all true and accurate... why on Earth would you ever tell anyone about this method? If you can really build simple portfolios of just a handful of stocks, using easy-to-understand criteria that can more than double the return of the stock market, why would you tell anyone how to do it? Why wouldn't you keep your mouth shut and just manage your own capital? It wouldn't take you long to become incredibly wealthy...

![]() As longtime sufferers (er, subscribers) know, I write the Digest personally every Friday with the goal of trying my best to give you the information I'd want if our roles were reversed. This strategy has worked well for me. It has led our company to become the most successful of its kind in the world. That has already made me a wealthy man. That should explain, at least in part, my motivation for continuing to serve you as best I can.

As longtime sufferers (er, subscribers) know, I write the Digest personally every Friday with the goal of trying my best to give you the information I'd want if our roles were reversed. This strategy has worked well for me. It has led our company to become the most successful of its kind in the world. That has already made me a wealthy man. That should explain, at least in part, my motivation for continuing to serve you as best I can.

There's another explanation in this particular case. This strategy incorporates value characteristics. These portfolios are built using stocks that other investors don't want to buy. That's the hidden secret to why it works so well. Most people can't successfully copy that core advantage and contrarian approach. By definition, this approach will only work for a small number of investors who have the unusual discipline and tenacity to follow it. I hope that will be you... But I know most of you will never be able to do it.

![]() This "magic" stock formula is by far the most valuable information I've ever discovered about stocks. This strategy incorporates everything I've learned about how business, investing, and the world work. It has taken me 20 years to figure this stuff out. It has taken my staff hundreds (if not thousands) of hours to test, prove, and refine these ideas so they are even more valuable. I'm proud to share these ideas with you. I hope they change your life forever. They should.

This "magic" stock formula is by far the most valuable information I've ever discovered about stocks. This strategy incorporates everything I've learned about how business, investing, and the world work. It has taken me 20 years to figure this stuff out. It has taken my staff hundreds (if not thousands) of hours to test, prove, and refine these ideas so they are even more valuable. I'm proud to share these ideas with you. I hope they change your life forever. They should.

![]() As I said, last April I introduced the idea of trying to build a "magic" portfolio. I knew from my experience recommending chocolate maker Hershey (HSY) back in December 2007 (right before the worst bear market of our lifetimes) that certain stocks can produce outstanding long-term results with shockingly little volatility.

As I said, last April I introduced the idea of trying to build a "magic" portfolio. I knew from my experience recommending chocolate maker Hershey (HSY) back in December 2007 (right before the worst bear market of our lifetimes) that certain stocks can produce outstanding long-term results with shockingly little volatility.

These "magic" stocks tend to have similar characteristics: They produce good profits (a 15%-plus operating margin). They are far less volatile than the S&P 500 (their "beta" is 20% lower than the market's, meaning their moves up and down are less severe). And they own well-known brands. To produce good investment results, it's also important to buy them at a reasonable price. We consider great companies trading for less than 12 years' worth of cash profits to be "reasonably priced."

None of these ideas is revolutionary. We've just put hard numbers behind the kinds of businesses every investor should want to buy: Highly profitable, well-known (more than $1 billion in market cap), reliable, and fairly priced.

Putting all of these particular criteria together in a single portfolio can be incredible. Last April, we showed how an investor in 2005 might have assembled a "magic" portfolio of just 10 stocks that produced annual average returns of more than 18% a year, with far less volatility than the overall market.

But as the critics reminded us, one example, picked on a rear-looking basis, is a long way away from "fact." So since late November, my team has been working with Bloomberg's database to further quantify and test these ideas. What we found was even better than I expected...

![]() Let's say that back in late November 2000, a little more than 15 years ago, you had been persuaded that these ideas were real and important. You decided to sell all of your other investments and buy only "magic" stocks, the companies with operating metrics that met our stringent standards and share prices cheap enough to qualify. Because you had no way to quantify a "well-known" brand, you bought every company with shares that qualified – strictly objectively, just by the numbers.

Let's say that back in late November 2000, a little more than 15 years ago, you had been persuaded that these ideas were real and important. You decided to sell all of your other investments and buy only "magic" stocks, the companies with operating metrics that met our stringent standards and share prices cheap enough to qualify. Because you had no way to quantify a "well-known" brand, you bought every company with shares that qualified – strictly objectively, just by the numbers.

This wouldn't have been hard. Well-known stocks are the bluest of blue-chip names: Altria (MO), Amgen (AMGN), Clorox (CLX), Coca-Cola (KO), General Mills (GIS), Johnson & Johnson (JNJ), McDonald's (MCD), and Hershey (HSY). If you had built a portfolio like this back on November 30, 2000, you would have purchased 89 different stocks. Since then, without any trading, this portfolio would have...

- Earned 9% average annual returns,

- Beaten the S&P 500 by almost four percentage points per year (400 basis points annually), and

- Had less than half the volatility of the S&P 500.

![]() Just another fluke? Perhaps. So what if you had done the same thing in November 2001 – one year later? Again, you decided you weren't capable of any qualitative judgments, you just bought all of the stocks with metrics and valuations that qualified. In 2001, that meant buying a portfolio of 90 "magic" stocks. This portfolio would have also performed incredibly well. It would have:

Just another fluke? Perhaps. So what if you had done the same thing in November 2001 – one year later? Again, you decided you weren't capable of any qualitative judgments, you just bought all of the stocks with metrics and valuations that qualified. In 2001, that meant buying a portfolio of 90 "magic" stocks. This portfolio would have also performed incredibly well. It would have:

- Earned 8% average annual returns for the last 14 years,

- Beat the S&P 500 by almost two percentage points a year (160 basis points annually), and

- Had about half the volatility of the S&P 500.

![]() Now, look... I understand nobody is actually going to buy 90 individual stocks and hold them for 15 years. Likewise, no one is actually incapable of making basic judgments about what constitutes a "major" brand. You know a major brand when you see it. This back-testing is merely an experiment to determine if, even in its most basic incarnation, these magic stocks can really beat the market with less volatility. The answer is an emphatic "yes."

Now, look... I understand nobody is actually going to buy 90 individual stocks and hold them for 15 years. Likewise, no one is actually incapable of making basic judgments about what constitutes a "major" brand. You know a major brand when you see it. This back-testing is merely an experiment to determine if, even in its most basic incarnation, these magic stocks can really beat the market with less volatility. The answer is an emphatic "yes."

![]() But what about a better, more realistic test? What if, for example, you bought all of the magic stocks (again, completely ignoring the brand component because it's not completely objective) and held these portfolios for three years, then sold? That would give you some possibility of buying low (when they are reasonably priced) and selling high (after they've had a good chance to rebound).

But what about a better, more realistic test? What if, for example, you bought all of the magic stocks (again, completely ignoring the brand component because it's not completely objective) and held these portfolios for three years, then sold? That would give you some possibility of buying low (when they are reasonably priced) and selling high (after they've had a good chance to rebound).

Of course, this test is still completely mechanical. A three-year holding period is merely a more realistic test of the strategy.

If you had done this, beginning 15 years ago:

- You would have bought and sold 13 different portfolios since November 2000;

- On average, you would have bought 72 stocks for each of these portfolios;

- They would have produced double-digit annual returns (11.6%);

- They would have crushed the S&P 500's returns by 4.4 percentage points per year (440 basis points annually);

- The magic portfolios would have beaten the S&P 500 almost 70% of the time;

- This performance would have been accomplished with low volatility (beta: 0.64).

![]() With these kinds of results, you don't need to do anything else as an investor. It might not be realistic for you as an individual to buy 72 stocks each year and hold them for three years. But employing a broker to do this for you wouldn't be difficult. (It also shouldn't be too difficult for us to interest a money manager to do this for our subscribers with small accounts.)

With these kinds of results, you don't need to do anything else as an investor. It might not be realistic for you as an individual to buy 72 stocks each year and hold them for three years. But employing a broker to do this for you wouldn't be difficult. (It also shouldn't be too difficult for us to interest a money manager to do this for our subscribers with small accounts.)

![]() Worried about losing money in stocks? Think another Great Depression is looming? It could be. But the worst of these portfolios lost less than 5% annually over three years. And remember, this period includes the 2000-2002 and 2007-2009 market bloodbaths (down 48% and 56%, respectively). Even when the "magic" portfolio loses, the amounts are small enough for the most conservative investor to withstand.

Worried about losing money in stocks? Think another Great Depression is looming? It could be. But the worst of these portfolios lost less than 5% annually over three years. And remember, this period includes the 2000-2002 and 2007-2009 market bloodbaths (down 48% and 56%, respectively). Even when the "magic" portfolio loses, the amounts are small enough for the most conservative investor to withstand.

![]() And... there's a simple way to improve these already-incredible results.

And... there's a simple way to improve these already-incredible results.

It's a way that eliminated losses altogether (in our back-testing), but still beat the S&P 500 and produced far less volatility than stocks on average. All you have to do is incorporate one of our core, original ideas for "magic"-stock investing: Buy businesses with great brands.

Why does focusing on great brands improve results so much? Because companies with good brands are far more "capital efficient." They don't have to spend as much on research and development or marketing as other firms. As a result, these companies have a lot more cash left over to spend on paying out dividends and buying back shares.

We found that eliminating stocks that didn't have a great brand from our "magic" portfolios increased the average capital efficiency of our portfolios by about 50%.

Another big advantage to focusing only on the "magic" stocks with great brands? The regular "magic" portfolios averaged 72 stocks... but sticking only to the ones with great brands meant the portfolio was just 10 stocks on average. That's a lot easier to manage.

![]() But... how can you objectively back-test for stocks that own great brands?

But... how can you objectively back-test for stocks that own great brands?

We found a market-research firm that publishes a list every year of the world's top global brands. We used this list to eliminate most of the stocks from our "magic" portfolios, keeping only those that owned one (or more) of the world's most valuable brands.

We put these smaller "magic" portfolios with great brands through the same rolling three-year evaluation, beginning at the end of 2000. Even though these portfolios had far fewer stocks, they still performed more consistently than the larger portfolios.

Again, if you had bought these portfolios every year and sold them three years later:

- You would have bought and sold 13 different portfolios since November 2000,

- On average, you would have bought 10 stocks for each of these portfolios,

- The portfolios would have produced double-digit annual returns (11.2%),

- They would have crushed the S&P 500's returns by four percentage points per year (400 basis points annually),

- The "magic" portfolios would have beaten the S&P 500 about 77% of the time,

- These investments would have had low volatility (beta: 0.64),

- And, most impressively, none of these rolling, three-year portfolios produced losing returns. Not even during the three-year period ending on November 30, 2008, following the market's devastating crash in 2008.

![]() Using our straightforward criteria – buying safe, high-quality businesses that own great brands when their shares are reasonably priced – you can effectively eliminate the risk of loss from your investing... as long as you're willing to hold for a reasonable period of time.

Using our straightforward criteria – buying safe, high-quality businesses that own great brands when their shares are reasonably priced – you can effectively eliminate the risk of loss from your investing... as long as you're willing to hold for a reasonable period of time.

That makes buying stocks safe enough for even the most conservative, risk-averse investors. Plus, for investors worried about inflation or the potential risk of hyperinflation, there is no better way to protect your purchasing power.

![]() What should you do if you want to build a "magic" portfolio of your own? It's easy: Look for stocks that have low volatility (beta less than 0.80). Look for stocks with great underlying businesses (operating margins greater than 15%). Look for stocks trading at fair prices (enterprise value to earnings before interest, taxes, depreciation, and amortization, or EV/EBITDA, of less than 12 times). Here are some of the companies that qualify...

What should you do if you want to build a "magic" portfolio of your own? It's easy: Look for stocks that have low volatility (beta less than 0.80). Look for stocks with great underlying businesses (operating margins greater than 15%). Look for stocks trading at fair prices (enterprise value to earnings before interest, taxes, depreciation, and amortization, or EV/EBITDA, of less than 12 times). Here are some of the companies that qualify...

|

A Sample of Today's "Magic" Portfolio Stocks

|

|||||

|

Ares Capital

|

CBL & Associates

|

EnerCare

|

Ritchie Bros. Auctioneers

|

TELUS

|

|

|

Atlantic Tele-Network

|

Cleco

|

MSG Networks

|

Rogers Communications

|

Buckle

|

|

|

AutoZone

|

Cogeco Cable

|

NextEra Energy

|

Shaw Communications

|

Thomson Reuters

|

|

|

Avista

|

Crown Media

|

Pinnacle West Capital

|

Smith & Wesson

|

Varian Medical Systems

|

|

|

Baxter International

|

DineEquity

|

Reynolds American

|

Surgical Care Affiliates

|

Waste Management

|

|

You can narrow down the size of the portfolio by only buying firms with great brands.

![]() I have no doubt that limiting your investing to buying only "magic" stocks (ones with or without great brands) will improve your investment results. But we also tested another factor that added considerably to overall performance and that further reduced portfolio size...

I have no doubt that limiting your investing to buying only "magic" stocks (ones with or without great brands) will improve your investment results. But we also tested another factor that added considerably to overall performance and that further reduced portfolio size...

As longtime subscribers know, we are huge fans of capital-efficient companies. I mentioned the concept above, and you can learn more about it here and here.

To summarize, being capital efficient means a company can afford to grow its earnings and invest in its own business while still having plenty of money left over for dividends and share buybacks.

One of our favorite ways to measure capital efficiency objectively is by figuring out how much of a company's revenue it is able to return to shareholders in both cash dividends and "net" share buybacks. (That only gives the company credit for the net reduction of shares outstanding.)

The regular "magic" portfolios had an average capital efficiency of 7.1%. That means, on average, these companies were able to return about $0.07 per dollar of revenue to shareholders.

But the smaller "magic" portfolio we tested – of companies only with great brands –had much higher levels of capital efficiency: 12.3% on average.

![]() Seeing this trend in our portfolio back-testing, we decided to add a third major criterion: minimum levels of capital efficiency. We started with "magic" stocks – again, companies with great businesses, low volatility, and reasonable valuations. Then we eliminated about 80% of these names, leaving only those companies that own one of the world's great brands.

Seeing this trend in our portfolio back-testing, we decided to add a third major criterion: minimum levels of capital efficiency. We started with "magic" stocks – again, companies with great businesses, low volatility, and reasonable valuations. Then we eliminated about 80% of these names, leaving only those companies that own one of the world's great brands.

As a final hurdle, we demanded that all of these firms display excellent capital efficiency of at least 10%. So to qualify for our highest-caliber portfolio, a firm had to be a "magic" stock, PLUS it had to own one of the world's greatest brands, PLUS it had to demonstrate high levels of capital efficiency.

If you had bought these capital-efficient, "magic" portfolios with great brands every year and sold them three years later:

- You would have bought and sold 13 different portfolios since November 2000,

- On average, you would have bought just five stocks for each of these portfolios,

- The portfolios would have produced the highest annual returns out of any of the magic portfolios (12.7%),

- The portfolios would have crushed the S&P 500's returns by 5.5 percentage points per year (550 basis points annually),

- The magic portfolios would have beaten the S&P 500 about 77% of the time, and

- The portfolios would have had low volatility (beta: 0.65).

![]() The capital-efficient, "magic" portfolios with companies that have great brands performed the best. They also contained the fewest stocks, on average. The largest of these portfolios consisted of only 12 stocks. And on some occasions, only one stock qualified for inclusion into this exclusive portfolio.

The capital-efficient, "magic" portfolios with companies that have great brands performed the best. They also contained the fewest stocks, on average. The largest of these portfolios consisted of only 12 stocks. And on some occasions, only one stock qualified for inclusion into this exclusive portfolio.

But despite the tiny number of stocks in these portfolios, the portfolios' average volatility was still slight – essentially the same as the larger portfolios, on average. That's amazing. Normal financial theory teaches that the only way to reduce volatility substantially is to own a large number of stocks. But by concentrating our investments into only the best "magic" stocks, we saw portfolios that beat the market by a mile, without any corresponding increase to volatility! That's financial magic.

These portfolios worked so well because their capital-efficiency scores were off the charts. These portfolios boasted annual capital efficiency in excess of 17%, on average.

![]() To get the highest possible results, you can make one additional assumption... For our experienced readers who are comfortable enduring the same amount of volatility as the overall market, you can use margin to "leverage" this portfolio in a way that increases its average volatility until it is equal to the S&P 500. Over our back-tested period, using leverage boosted average annual returns an additional 500 basis points, turning our hypothetical $100,000 investment into an incredible $1.1 million.

To get the highest possible results, you can make one additional assumption... For our experienced readers who are comfortable enduring the same amount of volatility as the overall market, you can use margin to "leverage" this portfolio in a way that increases its average volatility until it is equal to the S&P 500. Over our back-tested period, using leverage boosted average annual returns an additional 500 basis points, turning our hypothetical $100,000 investment into an incredible $1.1 million.

![]() That's a lot of fancy math. All it means is that for investors who were willing to endure the same amount of volatility as stocks on average, these portfolios would have produced amazing returns for the last 15 years.

That's a lot of fancy math. All it means is that for investors who were willing to endure the same amount of volatility as stocks on average, these portfolios would have produced amazing returns for the last 15 years.

They produced stupendous results during bull markets (a 75% annual return between November 2004 and November 2007), and they almost never lost money. The worst results came from November 2006 through November 2009, when investors would have lost less than 1% annually.

These portfolios required zero trading, would have only generated long-term capital-gains taxes, and never required the purchase of more than 12 stocks.

In short... I don't think a better strategy exists for individual investors. These results are clearly better than any newsletter that has ever been published... and better than just about any investment fund in existence.

This is truly the ultimate portfolio.

![]() Here's the most interesting fact of all. Right now, only one stock qualifies across all three criteria. In theory, you could have all of the advantages of this portfolio approach by buying just one stock.

Here's the most interesting fact of all. Right now, only one stock qualifies across all three criteria. In theory, you could have all of the advantages of this portfolio approach by buying just one stock.

![]() If you'd like to learn all of the details about our "magic" portfolio, all you have to do is read the next issue of Stansberry Data, out on Tuesday.

If you'd like to learn all of the details about our "magic" portfolio, all you have to do is read the next issue of Stansberry Data, out on Tuesday.

As you may know, Stansberry Data is available only to lifetime subscribers of my newsletter, Stansberry's Investment Advisory. (That includes members of The Porter Group, Stansberry Alliance, and the Flex Alliance who have selected Stansberry Data as one of their five subscription choices.)

We use Stansberry Data to track entire industries that we know are attractive for investors – like the Insurance Value Monitor, Capital Efficiency Monitor, Trophy Asset Monitor, and the Global Oil Value Monitor.

Published monthly, Stansberry Data includes much of the "behind-the-scenes" homework that goes into finding and researching investments for our newsletters. We are adding a Magic Stock Monitor to the other regular features in Stansberry Data. Look for the inaugural Magic Stock Monitor section in Tuesday's issue.

![]() If you still aren't convinced you should be reading Stansberry Data and following our work on "magic" stocks, let me leave you with this...

If you still aren't convinced you should be reading Stansberry Data and following our work on "magic" stocks, let me leave you with this...

As I mentioned... only one stock currently qualifies across all of our "magic" stock screens. Therefore, if you wanted to build the most selective "magic" portfolio this year, you would only have to buy one stock.

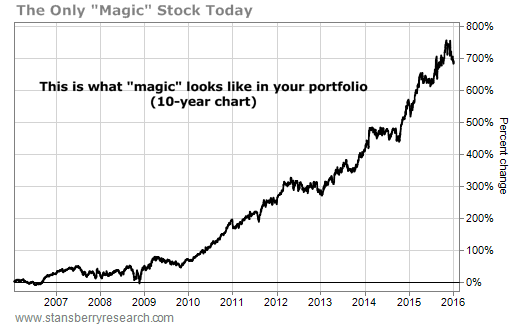

This company was built by one of the world's best investors. It serves a huge group of customers in North America. It has extraordinarily reliable results. And the stock continues to be one of the best performers in the entire world. Just look at the chart over the last 10 years...

![]() Again, to learn more, you'll have to read next Tuesday's Stansberry Data.

Again, to learn more, you'll have to read next Tuesday's Stansberry Data.

To make sure you receive your copy, sign up to become a lifetime subscriber to Stansberry's Investment Advisory. You may have received a special offer from us over Christmas. But because you might have missed it over the holidays, I've decided to extend that offer for the next 10 days.

Please don't pass up this opportunity to let us serve you in the best way possible. Just click here to learn more.

![]() New 52-week highs (as of 1/7/16): short position in Capital One Financial (COF), short position in iShares MSCI Canada Index Fund (EWC), short position in Santander Consumer USA (SC), Constellation Brands (STZ), short position in Suncor Energy (SU), and short position in SPDR S&P Oil & Gas Exploration & Production Fund (XOP).

New 52-week highs (as of 1/7/16): short position in Capital One Financial (COF), short position in iShares MSCI Canada Index Fund (EWC), short position in Santander Consumer USA (SC), Constellation Brands (STZ), short position in Suncor Energy (SU), and short position in SPDR S&P Oil & Gas Exploration & Production Fund (XOP).

![]() Another busy day in the mailbag as more praise for Porter's distressed bond service rolls in... more subscribers weigh in on this week's declines... and a novice investor asks an important question. Send your e-mails to feedback@stansberryresearch.com.

Another busy day in the mailbag as more praise for Porter's distressed bond service rolls in... more subscribers weigh in on this week's declines... and a novice investor asks an important question. Send your e-mails to feedback@stansberryresearch.com.

![]() "Hello Porter and the team, I receive your Credit Opportunities letter. After reading all the primer material, and the letters a number of times, I've just bought my very first Corporate Bonds. From a practical point, I cut and pasted the terrifying CUSIP, and placed the order online using ETrade, so it was as easy as buying a share. Thanks for all your help in getting me to try something new and outside of my comfort zone." – Paid-up subscriber Paul M.

"Hello Porter and the team, I receive your Credit Opportunities letter. After reading all the primer material, and the letters a number of times, I've just bought my very first Corporate Bonds. From a practical point, I cut and pasted the terrifying CUSIP, and placed the order online using ETrade, so it was as easy as buying a share. Thanks for all your help in getting me to try something new and outside of my comfort zone." – Paid-up subscriber Paul M.

![]() "RE: my own experience, and thankfulness for your macro and market focused analysis and commentary... I spent the better part of last year getting my feet wet in understanding basic investing, value investing, index funds, and became active in the market in November of last year. I wanted to start to test my analysis, and also see how your recommendations performed. I ended the year beating the S&P, so I was very pleased. I have benefitted from the COF short. Thank you for that on-target analysis. And with the week's decline, I have learned 4 great lessons on diversification which blew me away...

"RE: my own experience, and thankfulness for your macro and market focused analysis and commentary... I spent the better part of last year getting my feet wet in understanding basic investing, value investing, index funds, and became active in the market in November of last year. I wanted to start to test my analysis, and also see how your recommendations performed. I ended the year beating the S&P, so I was very pleased. I have benefitted from the COF short. Thank you for that on-target analysis. And with the week's decline, I have learned 4 great lessons on diversification which blew me away...

1) All my short positions have solid gains, which is nice in contrast to the declines on most long positions

2) [The gains in some long positions] is an eye opener to why diversification is seriously important.

3) I hold 25% in cash, and that helped reduce the losses in my portfolio, so while the S&P declines, my losses are about 1/2 of the S&P losses, and

4) I made a poor choice to allocate some of my cash position into 2 market indexes (VB and MGK) thinking that while I seek out other opportunities I will pick up the market's return from the index. What a bad choice. I would have been better off keeping the larger cash position, since my overall portfolio beat the S&P index when I started, and it would have beat the S&P index during this week's fall as well.

"Hindsight is 20/20 right! Thank you for your services!" – Paid-up subscriber Bryan D.

![]() "Just want to let you know that I'm sleeping very well at night. China is crashing, oil is dropping... but almost everything is on sale!! I'm not buying yet, but I have many solid investments: I'm well diversified, and I'm trying hard to mind stop losses.

"Just want to let you know that I'm sleeping very well at night. China is crashing, oil is dropping... but almost everything is on sale!! I'm not buying yet, but I have many solid investments: I'm well diversified, and I'm trying hard to mind stop losses.

"As much as I love to invest for the short term, many of my holdings are long term. The CVX, Walmart, McD, etc will be here in 5-10 years when I may retire. Meantime – I'm investing my dividends and buying more shares at a cheaper price.

"I've been a subscriber for three years now, if this would have happened 2-3 years ago, I would not be as prepared. Thanks for all your hard work – I love reading Stansberry every day!" – Paid-up subscriber Susanne P.

![]() "Dear Porter and company, For the first time in my life, I have some money to invest, on the order of 200K or so, and am interested in learning about trading bonds, stocks, and other things that you commonly write about in your newsletters. I've been reading you for about the last year, and am basically in the dark when you talk about things like puts, calls, strike prices, Level IV options accounts, etc. I don't know what these are, how they work, or how to make them happen.

"Dear Porter and company, For the first time in my life, I have some money to invest, on the order of 200K or so, and am interested in learning about trading bonds, stocks, and other things that you commonly write about in your newsletters. I've been reading you for about the last year, and am basically in the dark when you talk about things like puts, calls, strike prices, Level IV options accounts, etc. I don't know what these are, how they work, or how to make them happen.

"I realize that I'm a complete novice. Where can I go to get educated on these matters, starting at square one and building from there? (BTW, I've got a doctorate in a medical field, so I don't think that comprehension of principles will be an issue. The main issue for me will be finding the time to learn in order to remedy my ignorance in investing.) I'm a basics kind of guy, so I don't need a lot of wordiness in my instruction, but rather a more straightforward dictionary/recipe book/ABC type approach, with each lesson building on the previous ones. Thanks for your continued dialogues." – Paid-up subscriber Patrick L.

Brill comment: Our two books for novice investors – The Stansberry Research Starter's Guide for New Investors and The Stansberry Research Guide to Investment Basics – are a great place to start.

And as a "paid-up" Stansberry Research subscriber, you already have access to these books at absolutely no cost. You'll find links to these books at the bottom of the Welcome Letter that comes with each of your subscriptions. (Note: You can access them 24/7 by logging into your paid account on the Stansberry Research homepage and then clicking here.)

We also have a ton of free learning materials in the Stansberry Research Education Center, located on our website here.

When you're ready to take your education to the next level, you can find some of our favorite books on wealth, investing, and economics in our Recommended Reading list right here.

And finally, we should mention that in addition to your Welcome Letters, most of our subscription services – particularly those that use options and other advanced strategies – include educational materials and special reports explaining what you need to know to use the service. You can also access those materials anytime by logging into your paid subscription account.

Regards,

Porter Stansberry

Baltimore, Maryland

January 8, 2016

|