The Most Important Gold Chart in the World Today?

Two-year highs for gold and silver... A new 'bull run' has started... The most important gold chart in the world today?... What to do if you already own gold... A new negative-interest-rate record... Your last chance to get a free year of Doc's service... P.J. O'Rourke: Five lessons from the digital generation...

![]() Silver hit a fresh two-year high of more than $21 per ounce on Tuesday, following its biggest two-day rally in five years.

Silver hit a fresh two-year high of more than $21 per ounce on Tuesday, following its biggest two-day rally in five years.

Gold joined in this morning, hitting a new two-year high of its own above $1,375 per ounce.

But far bigger gains could be ahead...

![]() Financial-services firm UBS says gold has entered the early stages of a new "bull run."

Financial-services firm UBS says gold has entered the early stages of a new "bull run."

In a note published this morning, analyst Joni Teves flagged three key drivers pushing gold prices higher today: negative real interest rates, a faltering U.S. dollar rally, and "lingering" risks for the global economy.

More important, the firm believes these drivers are unlikely to end anytime soon. "This trend should now deepen, attracting more participants and encouraging those who have been hesitating to get more involved," said Teves.

In short, the reasons for owning gold are "more compelling than ever."

![]() Regular readers know we agree...

Regular readers know we agree...

We believe gold and silver prices could absolutely soar over the next few years... and select precious metals stocks could rally 10... 20... even 50 times more.

![]() Today, we have another big sign these moves have already started...

Today, we have another big sign these moves have already started...

In a blog post this morning, technical analyst Chris Kimble shared what could be the most important gold chart in the world today.

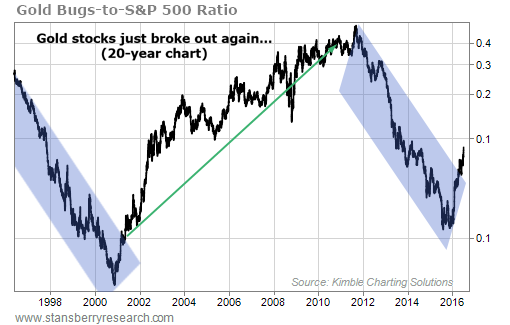

The chart shows the relative performance between gold stocks – as tracked by the NYSE Arca Gold BUGS Index ("HUI") – and U.S. stocks in general – as represented by the S&P 500 Index. When the ratio is falling, stocks in general are outperforming gold stocks. And when the ratio is rising, gold stocks are outperforming the overall market.

![]() As you can see below, stocks outperformed gold stocks from the mid-1990s until about 2001, while gold stocks beat the broader market from 2001 through late 2011.

As you can see below, stocks outperformed gold stocks from the mid-1990s until about 2001, while gold stocks beat the broader market from 2001 through late 2011.

As you might recall, these dates line up almost perfectly with the end of the big bear market in gold in late 2000... and the end of gold's 10-year bull market in 2011...

![]() Over most of the past five years, stocks in general were beating gold stocks again. But that changed early this year. Gold stocks have been beating the overall market again...

Over most of the past five years, stocks in general were beating gold stocks again. But that changed early this year. Gold stocks have been beating the overall market again...

More important, as you can see in the chart, the ratio just broke out of a multiyear "channel" like it did in 2001.

Why is this important?

It suggests the recent move in gold and gold stocks isn't merely a big bear market rally, but the start of a new bull market. History says gold stocks could now beat the stock market as a whole for years to come.

![]() Of course, there will be pullbacks and corrections along the way. But more and more evidence suggests the five-year bear market in gold and silver is over... and much higher prices are ahead.

Of course, there will be pullbacks and corrections along the way. But more and more evidence suggests the five-year bear market in gold and silver is over... and much higher prices are ahead.

If you still haven't taken positions in gold, silver, and the world's best precious metals stocks, you could soon miss your chance.

Click here to join our best gold and silver research service. You'll get instant access to everything you need to know to profit from what could be the biggest gold bull market in history.

![]() Our colleague Ben Morris agrees...

Our colleague Ben Morris agrees...

As he told his DailyWealth Trader subscribers this spring, the biggest risk in precious metals today isn't that you buy before a sharp correction... it's that you don't own enough (or worse, any at all).

On the other hand, if you already own close to your ideal amount of gold and silver, you can be more patient.

You can wait for a pullback to add to your positions... or you can take advantage of some simple options trades to lock in discount prices today and collect some extra income in the meantime.

This is what Ben has recommended to his subscribers... He suggested selling put options on a handful of gold and silver stocks. The results have been terrific.

![]() In simple terms, when you sell a put, you're agreeing to buy a stock you want to own if it falls below a predetermined price. In return, you collect a cash "premium" upfront. If the stock falls to that lower price, you'll be required to buy it at the agreed-upon "strike" price. If not, you simply keep the money you received.

In simple terms, when you sell a put, you're agreeing to buy a stock you want to own if it falls below a predetermined price. In return, you collect a cash "premium" upfront. If the stock falls to that lower price, you'll be required to buy it at the agreed-upon "strike" price. If not, you simply keep the money you received.

Ben walked through one of his latest winning trades in yesterday's issue of DailyWealth Trader...

On June 20, shares of the VanEck Vectors Gold Miners Fund (GDX) were trading at around $25. I suggested selling the July 15, $24 put options for $0.90. We got paid 3.8% for agreeing to buy shares at a 4% discount...

On Friday, the fund closed at $29.05. That's up more than 16% from when I recommended the trade.

![]() As Ben explained, the continued rally in gold stocks means the value of the put option he recommended subscribers sell has plummeted in value. (Remember, when you sell a put option, you hope its value declines so much that it expires worthless.) More from Ben...

As Ben explained, the continued rally in gold stocks means the value of the put option he recommended subscribers sell has plummeted in value. (Remember, when you sell a put option, you hope its value declines so much that it expires worthless.) More from Ben...

Our July $24 puts have lost almost all of their value... Right now, the July $24 puts on GDX are trading for just $0.03. If you close the trade today, you'll earn a $0.87-per-share profit. That's a 3.6% return on the trade... And it's 97% of the potential profit.

We've held this position for just three weeks. That comes out to an 88.3% annualized return...

We'll likely continue to sell puts on stocks we'd like to own... And at some point, when there is a sizeable correction, we'll likely end up buying them. In the meantime, we'll keep collecting big cash payouts...

![]() Another day, another new negative-interest-rate record...

Another day, another new negative-interest-rate record...

Yesterday, Swiss government debt became the first to sport negative yields across all maturities, when 50-year Swiss bond yields hit an all-time low of negative 0.0119%.

That's right, all Swiss government bonds – from two-year bonds all the way out to 50-year bonds – now charge rather than pay interest.

This morning, 10-year Japanese government bond ("JGB") yields hit another record of negative 0.275%. The yield on 20-year JGBs went negative for the first time, too.

That leaves just 30-year JGB yields – currently at just 0.015% – and 40-year JGB yields in positive territory.

![]() Regular Digest readers know these record-low rates have coincided with unprecedented quantitative easing ("QE") by Japan's central bank.

Regular Digest readers know these record-low rates have coincided with unprecedented quantitative easing ("QE") by Japan's central bank.

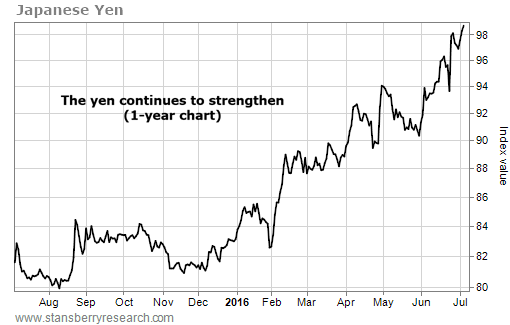

Yet, despite these efforts, the value of Japan's currency, the yen, has been soaring versus other major currencies...

![]() The Bank of Japan ("BoJ") already owns the majority of the Japanese government bond market, and it's a top-10 shareholder in 90% of Japanese blue-chip stocks.

The Bank of Japan ("BoJ") already owns the majority of the Japanese government bond market, and it's a top-10 shareholder in 90% of Japanese blue-chip stocks.

What's next?

Don't be surprised if the BoJ steps up its easing efforts in a big way, and directs its QE program outside its own borders. The U.S. Treasury bond market – where yields are still (relatively) big – could be a prime target.

![]() In fact, recent action suggests the market may already be anticipating this move...

In fact, recent action suggests the market may already be anticipating this move...

This morning, both 10-year and 30-year U.S. Treasury yields hit new all-time lows. Ten-year yields fell to less than 1.32% for the first time on record, while the 30-year yields plunged to less than 2.1%.

Bloomberg reports 30-year U.S. Treasury yields are now lower than the gross annual dividend yield of the S&P 500 Index. This has only happened one other time in U.S. history: during the peak of the 2008-2009 financial crisis.

![]() All told, since the "Brexit" vote two weeks ago, an additional $1.2 trillion worth of debt has plunged into negative territory. According to analysts at financial-services giant Citigroup, there is now $7.5 trillion worth of this debt around the world... and 10 countries now have more than half of their outstanding debt trading with negative yields.

All told, since the "Brexit" vote two weeks ago, an additional $1.2 trillion worth of debt has plunged into negative territory. According to analysts at financial-services giant Citigroup, there is now $7.5 trillion worth of this debt around the world... and 10 countries now have more than half of their outstanding debt trading with negative yields.

![]() As we mentioned yesterday, this plunge in yields has hurt anyone who needs income in retirement.

As we mentioned yesterday, this plunge in yields has hurt anyone who needs income in retirement.

But there is a strategy that can help you retire with the income stream of a millionaire... even if you've only saved $100,000 to $200,000. We've already detailed this strategy in the Digest over the past several days – you can read more here and here – so we won't do so again today.

But we do want to remind you that this presentation from our colleague Dr. David "Doc" Eifrig is being taken offline tonight at midnight. Find out how to get a FREE year of his trading service by clicking right here.

![]() New 52-week highs (as of 7/5/16): Automatic Data Processing (ADP), Central Fund of Canada (CEF), Deutsche Bank Gold Double Long Fund (DGP), VanEck Vectors Junior Gold Miners Fund (GDXJ), SPDR Gold Shares Trust (GLD), Gold Standard Ventures (GSV), Welltower (HCN), Johnson & Johnson (JNJ), Mid-America Apartment Communities (MAA), Medtronic (MDT), 3M (MMM), Altria (MO), Nuveen AMT-Free Municipal Income Fund (NEA), Newmont Mining (NEM), NovaGold Resources (NG), New Gold (NGD), Nuveen Municipal Value Fund (NUV), OceanaGold (OGC.TO), Procter & Gamble (PG), Regions Financial – Series B (RF-PB), SEMAFO (SMF.TO), Silver Standard Resources (SSRI), Constellation Brands (STZ), Sysco (SYY), Vanguard Inflation-Protected Securities Fund (VIPSX), Vanguard REIT Fund (VNQ), Wells Fargo – Series W (WFC-PW), and PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund (ZROZ).

New 52-week highs (as of 7/5/16): Automatic Data Processing (ADP), Central Fund of Canada (CEF), Deutsche Bank Gold Double Long Fund (DGP), VanEck Vectors Junior Gold Miners Fund (GDXJ), SPDR Gold Shares Trust (GLD), Gold Standard Ventures (GSV), Welltower (HCN), Johnson & Johnson (JNJ), Mid-America Apartment Communities (MAA), Medtronic (MDT), 3M (MMM), Altria (MO), Nuveen AMT-Free Municipal Income Fund (NEA), Newmont Mining (NEM), NovaGold Resources (NG), New Gold (NGD), Nuveen Municipal Value Fund (NUV), OceanaGold (OGC.TO), Procter & Gamble (PG), Regions Financial – Series B (RF-PB), SEMAFO (SMF.TO), Silver Standard Resources (SSRI), Constellation Brands (STZ), Sysco (SYY), Vanguard Inflation-Protected Securities Fund (VIPSX), Vanguard REIT Fund (VNQ), Wells Fargo – Series W (WFC-PW), and PIMCO 25+ Year Zero Coupon U.S. Treasury Index Fund (ZROZ).

![]() Not much more than a few moths in today's mailbag. Send your questions, comments, and diatribes to feedback@stansberryresearch.com.

Not much more than a few moths in today's mailbag. Send your questions, comments, and diatribes to feedback@stansberryresearch.com.

Regards,

Justin Brill

Baltimore, Maryland

July 6, 2016

Five Lessons from the Digital Generation

By P.J. O'Rourke

I haven't seen my teenage daughter face-to-face in years...

No, her mother and I aren't divorced. I didn't lose custody. My daughter and I aren't estranged.

It's just that her nose is buried in her iPhone. All I ever see is the top of her head.

Which gave me an idea...

Like many people my age, I'm puzzled by the "digital economy." What parts of it will succeed? What parts will fail?

A "digital generation" is coming of age, raised in a digital world. This generation's tastes, preferences, and opinions will determine the fate of the digital economy. They've already made some corporations, investors, and key players rich – and others broke. And that's just the beginning.

The digital generation's peak earning years are yet to come. We'd all like to know what will happen when today's kids run tomorrow's economy.

And here I was with a one-girl focus group sitting right across the breakfast table, so deeply involved in the digital economy that her hair was dragging in her nut-butter-and-chia-seed toast.

All I had to do was get her attention. "Honey," I said, "I've hidden your car keys."

"WHERE?!" she screamed.

"Inside a $20 bill," I said. "And I'm sure I can find them if you'll spend a few minutes letting me interview you about the digital economy."

"The what economy?" she said. I tried to explain. She got an A in her high school economics class... but she looked at me like I was talking crazy talk... which was my first lesson...

Lesson No. 1: When analyzing the digital economy, delete the word "digital."

People under 20 take the digital world so much for granted that "digital" isn't even a thing. This is because the Digital Revolution is over, and digital won. Everything we mean by "digital economy" has already been integrated into the economy itself.

Lesson No. 2: Put not your faith (nor your money) in high-tech devices.

Me: "What are the various devices that you use to listen to music, watch movies, TV, and videos, do your schoolwork, communicate with your friends, and stay in touch with current events and the outside world?"

Daughter: "My phone and my laptop."

Me: "Just your phone and your laptop? Are there any other devices that you'd like to have?"

Daughter: "No."

Me: "What about a smartwatch?"

Daughter: "They're stupid."

Me: "Google Glass?"

Daughter: "My friends would throw up laughing."

Me: "Fitbit?"

Daughter: "Why?"

As well she might ask. She plays three sports and eats nut-butter-and-chia-seed toast. At least she had the good manners not to suggest that I get a Fitbit.

Me: "iPad?"

Daughter: "It's a giant version of a phone that can't make phone calls."

Me: "iPod?"

Daughter: [rolls eyes] "Totally obsolete. The iPhone is the iPod with a phone and Internet."

The digital generation isn't impressed because something is high-tech. In their world, everything is high-tech and always has been. So much so that when my daughter was 5 and watched my wife try to find the cordless phone, she suggested, "Mommy, why don't you tie a string to this part of the phone and then tie the other end of the string to that part of the phone?"

Lesson No. 3: You're better off trying to win at three-card Monte than you are trying to predict which social-media platform is the best investment bet.

Me: "Twitter is big, right?"

Daughter: "If I'm really bored."

Me: "The appeal of Twitter is supposed to be that it's immediate."

Daughter: "I haven't checked Twitter in two weeks."

[She checks Twitter.]

Daughter: "Twitter is stagnant. No one new is getting on it."

Me: "How about Facebook?"

Daughter: "Overwhelming as a whole. Cluttered. Too much oversharing. A lot of old people are on it."

Me: "Therefore, I gather, Facebook is doomed."

Daughter: "No. It's the only social media where you can really get a message out, to adults and peers alike. The memorial service at church for the victims of the shooting in Orlando, for instance. It's a big public bulletin board."

Me: "What do you use most?"

Daughter: "There's an order to it, kind of a ranking. E-mail is formal. I send e-mails to my teachers and people like that. Texting is impersonal, for checking in with parents. Also for appointments and making plans. Calling is personal. I always call my boyfriend.

"I use Instagram for photos, it's less messy than Facebook, just pictures and captions. Snapchat is another way to send pics. They disappear within 10 seconds of being opened. It can be used to send nudes...

[Shocked look on my face]

"...but it's more permanent than people think, because you can take screenshots of the nude photos and send them all over the Internet."

Me: "OK, that's more than I needed to know. What about advertising?"

Lesson No. 4: Internet advertising is like no advertising you've ever seen. In fact, it's like no advertising at all, possibly worse.

Daughter: "I never look at it."

My daughter buys things on the Internet. So does her younger sister. So does my wife. We know the UPS man so well he comes for Thanksgiving dinner.

Daughter: "Internet ads are annoying. They're not effective. No one pays any attention to them. And I'm creeped out by the way the ads track what I've been looking at. If I'm looking at some sneakers on Amazon, all of a sudden sneaker ads start popping up. I hate them. I wouldn't buy what they're advertising."

Lesson No. 5: The digital generation isn't in love with the digital world.

Factor this in whenever you hear a "brilliant idea" about using "metadata from the Internet" to "change everything."

Daughter: "Everything we do on the Internet is tracked, which is creepy. I'd ban that."

And the digital generation doesn't necessarily want to be "more connected" than it already is.

Me: "What do you wish was on the Internet that isn't?"

Daughter: "There's already too much. I really don't want to know how much time I spend on the Internet, and I really wish I didn't do it. When it's in your hand, it's like automatic to go to, which I think is really bad. I hope I'll use it less in the future. I honestly have anxiety about picking up my phone."

Me: "You do?"

Daughter: "But it's mostly because of all the calls from you and Mom about where I am and what I'm doing."

Regards,

P.J. O'Rourke

|