The World's Largest Economy Has Failed

The world's largest economy has failed... The most violent stage of the global currency wars starts now... Our crisis prediction proved true a month late... Soros' greatest trade repeated... Central bankers have lost control... Why we launched a new gold service... The biggest gains are yet to come...

![]() The global monetary system is collapsing...

The global monetary system is collapsing...

We have just seen the first major domino fall in the shell game of fiat currency. Yesterday, Great Britain voted to leave the European Union. And the nation's highest officeholder – Prime Minister David Cameron – has resigned.

The EU, the world's largest economy, has failed.

![]() We predicted economic panic would begin in May. We thought it would be the beginning of the end, "a period of grand financial catastrophe."

We predicted economic panic would begin in May. We thought it would be the beginning of the end, "a period of grand financial catastrophe."

But May passed without incident. Readers sent notes pointing out our "wrong" call.

It turns out, we were one month early. But make no mistake. The panic is here.

![]() Hopefully you've heeded our multiple calls for you to raise cash and buy gold. If so, you've made a fortune in the past two months. If not, we will urge you once again. It's not too late... At least, not yet.

Hopefully you've heeded our multiple calls for you to raise cash and buy gold. If so, you've made a fortune in the past two months. If not, we will urge you once again. It's not too late... At least, not yet.

In one of our many writings about the coming economic collapse, we highlighted the recent moves by billionaire hedge-fund manager George Soros.

The 85-year-old came out of retirement this January to direct his firm's investments. According to the Wall Street Journal, he was "lured" back to the helm of Soros Fund Management "by opportunities to profit from what he sees as coming economic troubles."

Soros bought hundreds of millions of dollars' worth of gold and made a massive short bet on the S&P 500. Think about that for a moment...

One of the world's wealthiest investors (who is famous for his understanding of financial markets) came out of retirement at 85 to go massively long gold and massively short stocks. Perhaps he thought the coming crash would be the "Big One."

![]() Ironically, Soros made a name for himself when he made $1 billion shorting the pound – and "breaking the Bank of England" – in a single day in 1992. Soros borrowed $10 billion to bet against the pound, which pushed down the value of the currency. And despite the Bank of England's best effort, it couldn't stop the bloodshed. It unpegged the pound from the German Deutsche mark (a fixed-currency arrangement called the European Exchange Rate Mechanism).

Ironically, Soros made a name for himself when he made $1 billion shorting the pound – and "breaking the Bank of England" – in a single day in 1992. Soros borrowed $10 billion to bet against the pound, which pushed down the value of the currency. And despite the Bank of England's best effort, it couldn't stop the bloodshed. It unpegged the pound from the German Deutsche mark (a fixed-currency arrangement called the European Exchange Rate Mechanism).

Soros' fund made $7 billion in profit. He personally pocketed $1 billion.

![]() That "Black Wednesday" experience soured a generation of the British on the idea of joining a single European currency and contributed to the current anti-European Union sentiment in the country.

That "Black Wednesday" experience soured a generation of the British on the idea of joining a single European currency and contributed to the current anti-European Union sentiment in the country.

But Soros didn't just predict a coming financial catastrophe. On Monday, he warned once again about a plunging pound...

In a piece for the British newspaper The Guardian, Soros said if the Brexit referendum passed, "the value of the pound would decline precipitously." The drop would be bigger and more devastating than the 15% fall that happened in the wake of 1992's Black Wednesday.

In that piece, Soros predicted that leaving the European Union would make the pound worth about one euro... meaning by leaving the EU, Britain was effectively joining the euro – via a method "that nobody in Britain would want."

He also said a Brexit would "have an immediate and dramatic impact on financial markets, investment, prices, and jobs."

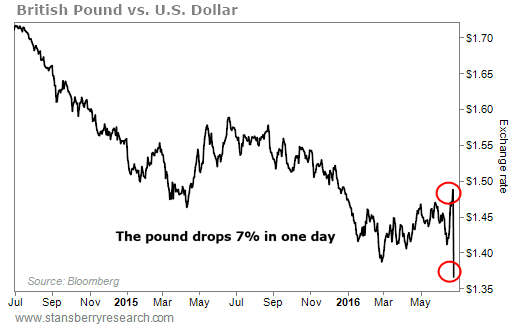

![]() On its worst day in September 1992, the pound fell 4.05%.

On its worst day in September 1992, the pound fell 4.05%.

Today, the pound plunged as much as 13% to its lowest level in 30 years. (It finished the day down roughly 7%.)

Not only is it the pound's largest one-day fall in history... It's one of the largest drops for a major global currency in history.

![]() Soros was right again. And who knows how much money he'll make this time. But according to his prediction, the pound has far from bottomed.

Soros was right again. And who knows how much money he'll make this time. But according to his prediction, the pound has far from bottomed.

One final thing on Soros... Another trader responsible for breaking the bank in 1992 was a guy named Stanley Druckenmiller.

Last month, Druckenmiller, now a billionaire fund manager himself, also warned the world to get out of stocks and buy gold. And like Soros, he invested hundreds of millions of dollars in gold and gold stocks.

![]() Two of the richest and smartest investors on the planet – along with our humble newsletter shop – warned you. We hope you listened.

Two of the richest and smartest investors on the planet – along with our humble newsletter shop – warned you. We hope you listened.

![]() But this is just the beginning. The U.K. has cleared the path for others to follow...

But this is just the beginning. The U.K. has cleared the path for others to follow...

The Brexit vote, like the popularity of Donald Trump and Bernie Sanders, shows that the masses are reaching a breaking point. And, in the case of the U.K., there's a majority that's so fed up with the status quo that they're willing to risk chaos for change.

As Matthew d'Ancona wrote for The Guardian: "[British voters] heard the warnings, listened to experts of every kind tell them that Brexit meant disaster, watched the prime minister as he urged them not to take a terrible risk. And their answer was: get stuffed."

France's right-wing Front National leader Marine Le Pen (a presidential hopeful) is urging France to leave the EU. Le Pen's Dutch equivalent, Geert Wilders, also wants a referendum so the Netherlands can split.

How do you unwind the euro? Your editor doesn't know the answer. Unfortunately, neither do the central banks. We do, however, know one thing... It will involve economic pain. And it will expose the global monetary experiment of the last decade for what it is – a dangerous sham.

Noncreditworthy people, businesses, and governments have borrowed far too much money. The chain reaction of defaults is starting. The scary thing is nobody knows exactly how this will play out, because the world has never seen so much bad debt before. It seems the students, consumers, and countries borrowing these mind-boggling sums never stopped to consider – one day, their debts would need to be paid.

![]() Today's economy is being propped up by the easy-money policies of central banks, who believe they can simply paper over any problem. And somehow, magically, print growth.

Today's economy is being propped up by the easy-money policies of central banks, who believe they can simply paper over any problem. And somehow, magically, print growth.

But the central banks have officially lost control. And they'll soon start flailing even more wildly... Printing money to buy every asset in sight (regardless of quality) and cutting interest rates lower into negative territory.

![]() The Federal Reserve, Bank of Japan, and European Central Bank all issued nearly identical statements saying they were willing to provide markets with more liquidity... And they're all working together to fight this crisis.

The Federal Reserve, Bank of Japan, and European Central Bank all issued nearly identical statements saying they were willing to provide markets with more liquidity... And they're all working together to fight this crisis.

![]() Central bankers are hamstrung. So, they'll do the only things they know how to do... Print money and cut rates. Perhaps it will boost the markets temporarily.

Central bankers are hamstrung. So, they'll do the only things they know how to do... Print money and cut rates. Perhaps it will boost the markets temporarily.

But ask yourself... How will currencies be valued when they offer no yield and are backed purely by highly leveraged and very expensive equities?

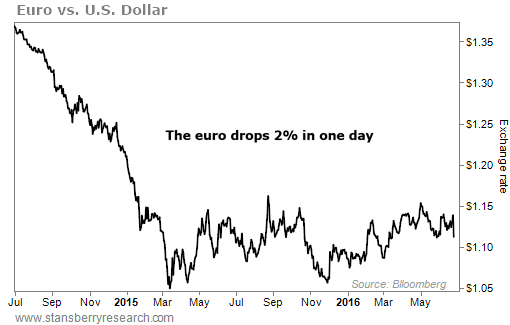

We're about to begin the most violent stage of the ongoing currency wars. The U.K. will devalue. The euro will follow. Then Japan... And China.

Take a look at these currencies today:

![]() Also, look at shares of Europe's largest banks today...

Also, look at shares of Europe's largest banks today...

London-based Barclays is down 18%. Banco Santander of Spain is down 20%, Deutsche Bank in Germany is down 17%, and Royal Bank of Scotland plunged 18%.

European financial markets are in freefall. Several European banks are trading below their 2008 lows. They're pricing in a huge crisis.

![]() Financial markets are crumbling... Currencies are plunging... Investors are losing faith in paper money and central bankers' abilities to control it. So where does this all end?

Financial markets are crumbling... Currencies are plunging... Investors are losing faith in paper money and central bankers' abilities to control it. So where does this all end?

It all ends with gold. The precious metal soared 4.5% today to $1,320 an ounce.

![]() You'll remember the warning we shared from our "Metropolitan Man" on April 1. If you haven't read that Digest, you can do so here. If you've already read it, go back and reread it.

You'll remember the warning we shared from our "Metropolitan Man" on April 1. If you haven't read that Digest, you can do so here. If you've already read it, go back and reread it.

Earlier this year, Porter was invited to dinner in New York City with one of the most powerful men in a world... During his 40-year career, this man has worked in the highest levels of government and finance. For the last dozen years, he has served as an adviser to some of the wealthiest institutions and families in the world.

And he told Porter about a shocking plan being discussed in the upper echelons of government today... A plan to stop a run on the dollar when negative interest rates come to the U.S.

![]() The plan is as follows (from the April 1 Digest):

The plan is as follows (from the April 1 Digest):

The only way to re-establish credibility and regain control of the financial system in the event of a global run on paper currencies would be to re-establish the U.S. dollar's convertibility into gold. Our host described the means for accomplishing this goal. The Fed, he said, could offer to swap all of the Treasury bonds it holds (about $2.4 trillion) for all of the gold owned by the U.S. Treasury. When you do the math, you come up with a new dollar-to-gold ratio of $9,677. Roughly $10,000 an ounce.

![]() To take advantage of what we saw as the largest gold bull market in history – perhaps, even, the last bull market in gold – we launched an advisory called Stansberry Gold Investor.

To take advantage of what we saw as the largest gold bull market in history – perhaps, even, the last bull market in gold – we launched an advisory called Stansberry Gold Investor.

We did not launch a gold-focused investment advisory because we are convinced of a sustained increase in mining productivity or vast new discoveries. We are buying mining firms and physical gold as a hedge against what we see is the imminent (and inevitable) collapse of the current global monetary system.

And the results in Stansberry Gold Investor so far have exceeded even our expectations.

![]() Since we launched the service – less than three months ago – gold has rallied about 7%. But Stansberry Gold Investor subscribers are doing much, much better...

Since we launched the service – less than three months ago – gold has rallied about 7%. But Stansberry Gold Investor subscribers are doing much, much better...

As of midday trading today, they're holding double-digit gains on every single recommendation, including gains of 81.8%... 97.1%... and even 104.8% so far.

![]() All told, Stansberry Gold Investor subscribers are up an average of 31% across the entire portfolio (including positions in the metal itself). That's more than four times the return of gold over the same period.

All told, Stansberry Gold Investor subscribers are up an average of 31% across the entire portfolio (including positions in the metal itself). That's more than four times the return of gold over the same period.

![]() The financial crisis we've been warning you about is happening right now. The U.K. voting to leave the European Union is just the first leg. We expect to see other, major European nations leave the EU. After all, with the U.K. gone, that leaves Germany, France, and the few other healthy member nations shouldering more of the cost to float countries like Greece, Italy, and Spain.

The financial crisis we've been warning you about is happening right now. The U.K. voting to leave the European Union is just the first leg. We expect to see other, major European nations leave the EU. After all, with the U.K. gone, that leaves Germany, France, and the few other healthy member nations shouldering more of the cost to float countries like Greece, Italy, and Spain.

Again, watch for the U.K., the EU, Japan, and China to start devaluing their currencies. That money will flow into the dollar and gold.

The Fed will eventually start easing again. Negative interest rates are coming to the U.S.

The world's monetary system is coming unraveled. And you have to be prepared.

Don't be frozen by fear. You don't have to be a victim.

Investors who buy gold and gold stocks today will see tremendous gains over the coming years. It's the single best way to protect your finances and hedge against calamity.

If you're not reading Stansberry Gold Investor, you're making the biggest mistake of your life. To learn more about a subscription (without watching a long video)... click here.

![]() On a separate note... Many of you have heard Porter mention Stansberry Asset Management ("SAM"), a new registered investment-advisory firm led by world-class investment manager Erez Kalir. SAM officially launched in April and is now managing accounts for a growing group of investors with portfolios of $500,000 or more.

On a separate note... Many of you have heard Porter mention Stansberry Asset Management ("SAM"), a new registered investment-advisory firm led by world-class investment manager Erez Kalir. SAM officially launched in April and is now managing accounts for a growing group of investors with portfolios of $500,000 or more.

Erez and the SAM team take Stansberry Research's investment ideas and combine them with asset-allocation, portfolio-construction, and risk-management tools typically reserved for institutional investors. At the same time, they work hard to avoid many of Wall Street's money-management pitfalls – like hidden fees and simplistic asset allocation based on criteria such as your age.

I think this is a great opportunity for people who appreciate the work produced by Stansberry Research but don't have enough time to read all of the content and manage their own investments... or people who struggle each year to get the results they want.

It also may be a good diversification option for people who enjoy managing one area of their investments – like options or commodities – but who prefer to have a professional money manager, who shares our philosophy, handle other parts of their portfolio. In fact, Porter is currently in the process of moving all of his stock investments – outside of a small Fidelity 401(k) – over to SAM and will be one of its early clients. SAM will manage his children's trusts, too.

![]() If you are interested in learning more about SAM, you should know the firm is offering a significant fee reduction for founding investors who join in the first three months as a way to thank those who help it get started. This discount is only available to investors who initiate accounts prior to July 15, 2016.

If you are interested in learning more about SAM, you should know the firm is offering a significant fee reduction for founding investors who join in the first three months as a way to thank those who help it get started. This discount is only available to investors who initiate accounts prior to July 15, 2016.

SAM will be hosting a webinar on Wednesday, June 29 at 8 p.m. Eastern time (5 p.m. Pacific) for investors who would like to learn more. CEO Erez Kalir will share the firm's market outlook, give a high-level overview of how SAM is positioning portfolios, and also discuss how it uses Stansberry Research. At the end, he'll host an open Q&A session for any questions about SAM.

Space is limited, so if you're interested in attending the webinar, please register using this link. (Also, please see the bottom of today's Digest for an important note about SAM.)

![]() New 52-week highs (as of 6/23/16): Aflac (AFL), Becton Dickinson (BDX), Johnson & Johnson (JNJ), Nuveen Preferred Securities Income Fund (JPS), 3M (MMM), Altria (MO), Procter & Gamble (PG), Spectra Energy (SE), Sysco (SYY), AT&T (T), and ExxonMobil (XOM).

New 52-week highs (as of 6/23/16): Aflac (AFL), Becton Dickinson (BDX), Johnson & Johnson (JNJ), Nuveen Preferred Securities Income Fund (JPS), 3M (MMM), Altria (MO), Procter & Gamble (PG), Spectra Energy (SE), Sysco (SYY), AT&T (T), and ExxonMobil (XOM).

![]() Today's Brexit panic has at least one subscriber firing off angry e-mails... Have we failed you, too? Let us know at feedback@stansberryresearch.com.

Today's Brexit panic has at least one subscriber firing off angry e-mails... Have we failed you, too? Let us know at feedback@stansberryresearch.com.

![]() "Come on. What is wrong with you? Wake up. I am a paid up subscriber of Stansberry Gold, True Wealth System and some more reports from you.. Now it has gone quite sometime since the world markets have gone bananas due to Brexit. Your services have not commented anything. All my other professional investment letters have sent alerts, but it is astonishing that you keep on sending various crap news without any link to the present market situation. That is not professional!" – Paid-up subscriber Magnus Westenson

"Come on. What is wrong with you? Wake up. I am a paid up subscriber of Stansberry Gold, True Wealth System and some more reports from you.. Now it has gone quite sometime since the world markets have gone bananas due to Brexit. Your services have not commented anything. All my other professional investment letters have sent alerts, but it is astonishing that you keep on sending various crap news without any link to the present market situation. That is not professional!" – Paid-up subscriber Magnus Westenson

Goldsmith comment: I appreciate your frustration, Magnus. It's a brutal day today. And while we didn't specifically warn about the Brexit risk (we can't divine how British voters think), we have certainly been pounding the table on the many, many risks in today's market.

We also warned readers we believed a crisis was coming in May. So, if you've lightened up, as we suggested, you're in good shape.

Likewise, if you've acted on any of the recommendations from Stansberry Gold Investor, you've made large profits today and for the past two months. As you saw above, the entire portfolio has produced huge gains for our readers. We hope it has for you, as well.

Regards,

Sean Goldsmith

June 24, 2016

Important note about SAM: Stansberry Research LLC ("Stansberry Research") is a subscription-based publisher of financial information. Stansberry Research is not regulated by the Securities and Exchange Commission ("SEC") because it is a publisher. Stansberry Research and Stansberry Asset Management ("SAM") are separately operated and are overseen by different boards.

Although SAM will utilize investment research published by Stansberry Research, SAM has no special or early access to such research. It receives information from Stansberry Research just like any other subscriber does – after the issues are published.

This disclosure is being provided to you by Stansberry Research, a subscription-based publisher of financial information, in accordance with Rule 206(4)-3 under the Investment Advisers Act of 1940, as amended ("Advisers Act"). The disclosure is intended to inform you of an agreement ("Agreement") between Stansberry Research and SAM, an investment adviser registered with the Securities and Exchange Commission ("SEC"), relating to advisory client solicitation services.

You should receive, separately, a copy of SAM's client brochure (Form ADV Part 2).

Name of Solicitor: Stansberry & Associates Investment Research, LLC (referred to herein as "Stansberry Research")

Name of Investment Adviser: Stansberry Asset Management, LLC (referred to herein as "SAM")

Nature of Relationship between Solicitor and Adviser: An arrangement exists permitting Stansberry Research to be compensated by SAM to use the "Stansberry" name, for advertisements in Stansberry Research publications, and for advisory client solicitation services by Stansberry Research on behalf of SAM.

Stansberry Research and SAM are and will remain separate corporate entities that are separately operated and are overseen by different boards and different management teams. SAM's management team is responsible for the investment decisions of SAM. No member of SAM's management team nor any other officer or employee of SAM is an officer, editor, writer, or other employee at Stansberry Research. Similarly, neither Porter Stansberry nor any other officer, editor, writer, or other employee at Stansberry Research is an officer or employee of SAM.

Stansberry Research officers, editors, writers, and other employees are prohibited from controlling SAM by any means, including through ownership, contract, or otherwise. Certain Stansberry Research personnel may have certain limited rights with respect to the governing body of one or more parent entities of SAM. Certain Stansberry Research personnel may also have economic interests (including noncontrolling ownership or profits interests, but excluding any form of compensation) with respect to one or more parent entities of SAM. Members of SAM's management team and SAM officers and employees are prohibited from controlling Stansberry Research by any means, including through ownership, contract or otherwise.

Solicitor Compensation: Stansberry Research will be compensated for its solicitation services by SAM.

Solicitor Compensation Arrangement Terms: For its solicitation services, Stansberry Research will be compensated by SAM as set forth in the Agreement. This compensation is initially a flat annual dollar amount and may be amended in the future by mutual agreement of Stansberry Research and SAM.

Additional Disclosure: On April 10, 2003, the SEC filed a civil complaint against Pirate Investor LLC (the predecessor of Stansberry Research), its founder, Porter Stansberry (together with Pirate Investor LLC, the "Stansberry Parties"), and others, and amended its complaint on November 14, 2003. In its amended complaint, the SEC alleged that the Stansberry Parties violated the antifraud provisions of the federal securities laws by offering to sell information obtained from a senior executive of an unnamed company listed on the New York Stock Exchange. The complaint also alleged that the information was false. The SEC alleged that by engaging in such conduct, the Stansberry Parties violated Section 10(b) of the Securities Exchange Act of 1934, as amended ("Exchange Act"), and Rule 10b-5 thereunder. On October 2, 2007, the United States District Court for the District of Maryland entered a permanent injunction (the "Injunction") permanently enjoining and restraining the Stansberry Parties from future violations of Exchange Act Section 10(b) and Rule 10b-5 thereunder, and imposed civil penalties including disgorgement and fines.

As a result of the Injunction, among other things, Advisers Act Rule 206(4)-3 generally precludes Mr. Stansberry and Stansberry Research from receiving cash solicitation fees for the solicitation of advisory clients from investment advisers registered or required to be registered under the Advisers Act. However, on September 30, 2015, the SEC staff issued a "No Action Letter" providing relief to Mr. Stansberry and Stansberry Research that, subject to certain undertakings, enables Mr. Stansberry and Stansberry Research to receive cash solicitation fees from registered investment advisers without the threat of regulatory enforcement action.

|