The Right Time to Buy Gold Stocks

Gold crosses the Rubicon... The right time to buy gold stocks... The best gold analyst in the business... 'Buffett Watch' this weekend... How to get a FREE OneBlade razor...

![]() For many subscribers, gold is suddenly interesting again.

For many subscribers, gold is suddenly interesting again.

The precious metal crossed a key "technical" barrier, according to traders. These "traders" are fine people who happen to believe that the value of an asset (gold) that has remained almost completely stable (in terms of purchasing power) since before the birth of Christ is now going to go higher.

Why, pray tell? Because both the nominal price of gold (as measured in dollars) and the 20-day moving average price (as measured in dollars) are now above the 200-day moving average. Got that?

![]() Me neither. You can call me old-fashioned, but I (Porter) perceive that essentially all of the gold that has ever been mined remains in use. (Industry doesn't consume it.) And I perceive that less than 1% of additional supplies are mined every year.

Me neither. You can call me old-fashioned, but I (Porter) perceive that essentially all of the gold that has ever been mined remains in use. (Industry doesn't consume it.) And I perceive that less than 1% of additional supplies are mined every year.

I also perceive that mining is a difficult business. It requires the rule of law, thousands of trustworthy employees willing to work for essentially slave wages, and surprisingly large numbers of both wise and patient investors. It also requires safe and stable global trade conditions, along with stable currencies for pricing production costs.

Watching the passing parade of the world's economies, I see a socialist in a tight race for the Democratic nomination for the U.S. presidency. I see both Republicans and Democrats promising, in various combinations, both more government and more trade barriers. I see labor revolts all across major gold-production areas. Perhaps most obviously, I see countries of every stripe doing their best to devalue their currencies and finance their debts on the backs of their currency holders. And... I see a complete wipeout among those who provide financing for gold miners.

![]() I shall venture a bold prediction, dear friends: Gold prices are likely to be extremely volatile. And I'd wager they'll go much higher over time. With this in mind, I have advised folks for many years (as you can hear on my radio show) to purchase gold when it has traded for less than $1,200 per ounce... when no one else wanted it.

I shall venture a bold prediction, dear friends: Gold prices are likely to be extremely volatile. And I'd wager they'll go much higher over time. With this in mind, I have advised folks for many years (as you can hear on my radio show) to purchase gold when it has traded for less than $1,200 per ounce... when no one else wanted it.

Again, you might call me old-fashioned, but with an asset that has been so remarkably stable in its intrinsic value (while fluctuating wildly in its nominal price), I would suggest your potential profits as a gold investor are largely a function of when you buy. The lower the price, the better. Ergo... "traders" – who prefer to buy gold after it has gone up considerably and after it has once again begun to attract the attention of the herd – leave me cold.

![]() Lest you think I'm unfairly exploiting the acuity of 20/20 hindsight, allow me to point out this essay... in which I practically begged subscribers not to buy a gold stock that a colleague was recommending back in March 2013.

Lest you think I'm unfairly exploiting the acuity of 20/20 hindsight, allow me to point out this essay... in which I practically begged subscribers not to buy a gold stock that a colleague was recommending back in March 2013.

Let me also point out that after gold prices fell to less than $1,200 per ounce last July and gold stocks were wiped out – but long before either had tripped over a "moving average" to the upside – I recommended an entire 10-stock portfolio of junior mining stocks. In that essay, I wrote...

I believe that some combination of rising interest rates, rising defaults in the corporate bond market, and global currency/trade wars will likely cause the U.S. stock market to decline substantially. No, I don't know the exact timing of such a move. But I believe it will happen with the next few months... Likewise, I notice that the gold and precious-metals sector is in the midst of a three-year decline. I see that junior mining stocks have declined every year since 2011. Most of the best names in the space are down more than 80%.

I'm 100% certain that eventually, this downward trend will reverse. And I know that when that occurs, the resulting price increases will be dramatic. I believe average gains in excess of 250% are likely. Investors smart enough to "hedge" their exposure to the U.S. stock market by establishing a "toehold" in the highest-quality gold and junior gold-mining stocks will likely be far more successful over the next three to five years than investors who don't.

![]() At the time, I recommended doing two things. One of them was cheap and easy. As you know because I tell you almost every week: There's no such thing as teaching, there's only learning. I recommended you buy and actually read a book. Written by my friend, the self-taught expert Meb Faber, The Ivy Portfolio is an incredible review of market extremes and trends... and the investment strategies to master them.

At the time, I recommended doing two things. One of them was cheap and easy. As you know because I tell you almost every week: There's no such thing as teaching, there's only learning. I recommended you buy and actually read a book. Written by my friend, the self-taught expert Meb Faber, The Ivy Portfolio is an incredible review of market extremes and trends... and the investment strategies to master them.

One of the reasons I knew to wait until last July to buy gold stocks is something I learned from Meb. He discovered that since 1920, any time a U.S. industry group (like mining) fell by 80% or more from its peak, the average return three years later was 170%. (No word from Meb about the average return in gold after it crosses a moving average.)

![]() The other thing I recommended that you do was difficult. It required some investment courage. It will surely also require patience... as probably just about the time that all of these newly interested buyers of gold have established their position, a correction will likely ensue. No matter. The strategy I advised was to take 10% of your portfolio and establish a 10-stock portfolio of gold- and silver-mining stocks.

The other thing I recommended that you do was difficult. It required some investment courage. It will surely also require patience... as probably just about the time that all of these newly interested buyers of gold have established their position, a correction will likely ensue. No matter. The strategy I advised was to take 10% of your portfolio and establish a 10-stock portfolio of gold- and silver-mining stocks.

At the top of my list was the venerable Franco-Nevada (FNV), the "gold standard" in mining. Since my essay last July, shares of Franco-Nevada have appreciated nearly 50%, while the Dow Jones Industrial Average is down about 6%.

![]() You might also recall that back in November 2013, during one of the first nadirs in junior gold stocks, we recommended the shares of NovaGold Resources (NG) at a little more than $2. NovaGold has the world's most attractive (but as of yet, undeveloped) gold mine, Alaska's Donlin mine. Shares closed at $4.85 yesterday.

You might also recall that back in November 2013, during one of the first nadirs in junior gold stocks, we recommended the shares of NovaGold Resources (NG) at a little more than $2. NovaGold has the world's most attractive (but as of yet, undeveloped) gold mine, Alaska's Donlin mine. Shares closed at $4.85 yesterday.

![]() Let me be clear: I don't believe any "investments" in gold and gold stocks should be considered investments at all. High-quality, conservatively managed gold producers (like Franco-Nevada) are, like the metal itself, a hedge against financial catastrophe. Most gold stocks are speculations. But they have an additional charm. They tend to rally when everything else falls (and vice versa). Thus, bought at the right time – and in the right proportion to your portfolio – they can be very useful.

Let me be clear: I don't believe any "investments" in gold and gold stocks should be considered investments at all. High-quality, conservatively managed gold producers (like Franco-Nevada) are, like the metal itself, a hedge against financial catastrophe. Most gold stocks are speculations. But they have an additional charm. They tend to rally when everything else falls (and vice versa). Thus, bought at the right time – and in the right proportion to your portfolio – they can be very useful.

The "right time" is when no one else wants gold stocks. If you haven't bought any gold or gold stocks yet, it's not too late. We are in the early stages of a long credit-default cycle. We are a long, long way from the next top in gold.

Likewise, we are a long, long way from the final bottom in financial assets. Just look at the sovereign bond markets, for Pete's sake. Would you rather own gold... or Japanese bonds that charge you interest to hold them? One day, I'll tell my kids about the time investors became so transfixed with paper money that they chose to hold paper bonds of a bankrupt government rather than gold.

![]() If you're looking for help with gold stocks, no one in the entire world is better than John Doody.

If you're looking for help with gold stocks, no one in the entire world is better than John Doody.

He has followed gold producers on a daily basis for more than 30 years. He's on a first-name basis with every CEO and major investor in the space. This knowledge and these contacts allow John to do something no one else I know in the entire sector can do – accurately tell you, based on current production and overhead costs, precisely which gold stocks offer the most value today.

John's knowledge of these stocks is encyclopedic. There's no better way to get up to speed on gold than reading John's Gold Stock Analyst newsletter. Nothing else comes close. He's a living legend. I can't make a stronger endorsement for his newsletter, which, sadly, I don't even publish.

John has been a friend to us for many years. And we strongly urge you to read his work – just don't cancel your subscription here to buy it! Besides, his newsletter will pay for itself a thousand times over in the coming months. Trust me on this one. Click here to sign up.

![]() Also... a reminder about investing legend Warren Buffett. Back in 2012, with gold trading near its all-time highs, Buffett (uncharacteristically) savaged the metal and those of us who own it. Comparing the folly of owning gold with the folly of owning tulips in the 17th century, Buffett opined about gold and its owners...

Also... a reminder about investing legend Warren Buffett. Back in 2012, with gold trading near its all-time highs, Buffett (uncharacteristically) savaged the metal and those of us who own it. Comparing the folly of owning gold with the folly of owning tulips in the 17th century, Buffett opined about gold and its owners...

Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future... gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful).

Gold, however, has two significant shortcomings, being neither of much use... and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

![]() We don't begrudge Buffett for his opinion about the price of gold at the time. We also thought it was overvalued, and we said so many times.

We don't begrudge Buffett for his opinion about the price of gold at the time. We also thought it was overvalued, and we said so many times.

But we do think Buffett is completely ignorant of gold's role in the economy. Gold is monetary ballast, not an investment. Gold is the standard against which other monetary schemes are measured. To date, all forms of human-built money have failed this test. Measured in that way, the utility of gold is immense: It provides a universal relief from the sinful wages of paper money.

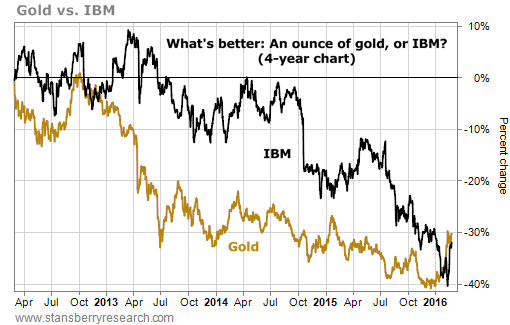

Buffett, of course, prefers to put all of his trust in corporations – mostly large, American ones. In the same letter in which he castigated gold, he lauded technology giant IBM as being one of the best investment ideas of his entire career. You surely know that both gold and IBM have declined since... but did you know that IBM is down more?

I bet Buffett won't mention that fact in his annual letter, which is due out this weekend. Meanwhile, using Buffett's logic, I wonder what you would end up with if you decided to hold IBM shares for all of eternity. Maybe not as much as Buffett paid...

![]() As you know, this month I'm urging subscribers to try my new luxury razor, the OneBlade. I used to hate shaving, and now I love it.

As you know, this month I'm urging subscribers to try my new luxury razor, the OneBlade. I used to hate shaving, and now I love it.

I spent more than $1 million building an entirely new kind of razor. It uses the fine, perfect, single, steel edge of a straight razor... but has the same kind of "floating head" that led most men to adopt the much safer cartridge razors.

By putting both kinds of technology in the same razor, I built what dozens of experts are calling the world's most "efficient" and closest shave. I urge you try it. And for the next 28 days, I'll even send you one for FREE. Get the details right here.

![]() New 52-week highs (as of 2/25/16): Franco-Nevada (FNV), Johnson & Johnson (JNJ), Coca-Cola (KO), Altria (MO), Sturm, Ruger (RGR), SEMAFO (SMF.TO), AT&T (T).

New 52-week highs (as of 2/25/16): Franco-Nevada (FNV), Johnson & Johnson (JNJ), Coca-Cola (KO), Altria (MO), Sturm, Ruger (RGR), SEMAFO (SMF.TO), AT&T (T).

![]() Have you shaved with a OneBlade yet? Has it changed the way you feel about razors? Let me know at feedback@stansberryresearch.com. I can't respond to your e-mails individually, but I read every one.

Have you shaved with a OneBlade yet? Has it changed the way you feel about razors? Let me know at feedback@stansberryresearch.com. I can't respond to your e-mails individually, but I read every one.

Regards,

Porter Stansberry

Baltimore, Maryland

February 26, 2016

|