The AI Layoffs Will Continue Until Morale Improves

There will be millions... and perhaps tens of millions... of jobs cut in America in the years ahead thanks to artificial intelligence ("AI").

The latest news from Amazon (AMZN) credited AI efficiencies for their plans to fire up to 30,000 white-collar office workers.

Amazon's corporate layoff is an early sign of what's coming to other large tech companies. Back in 2022, Amazon was also the first mover – laying off 27,000 over several months. It was quickly followed by dozens of other well-known tech companies, shedding tens of thousands of their own employees.

Expect to see plenty more folks purged in the months ahead as tech companies refocus their spending from salaries to AI compute.

Of course, there will also be hundreds of billions... and perhaps trillions... of dollars incinerated as those same companies build out AI in the years ahead.

AI is almost certainly a speculative bubble. But it can grow far more manic. And it likely will.

As my colleague Alan Gula wrote last month, the AI boom isn't even in dot-com territory yet...

The bad news is that there probably will be a bust after such unrestrained investment.

The good news, if you could call it that, is that the comparisons between the peak of "irrational exuberance" in the late 1990s and the current AI boom are misguided.

Still, there is no current business model justifying the massive amounts of money sloshing around the AI sector. Worse, it is unknown whether there will ever be one that justifies the trillions of dollars spent, beyond the hope of an artificial general intelligence ("AGI") that can do everything a human can, both better and far cheaper.

In fact, OpenAI CEO Sam Altman admits exactly that:

Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes.

And yet, if a company does not embrace AI, that company may well be doomed. As Altman went on to add:

Is AI the most important thing to happen in a very long time? My opinion is also yes.

If you are an investor today, you must hold on to both of these contradictory ideas.

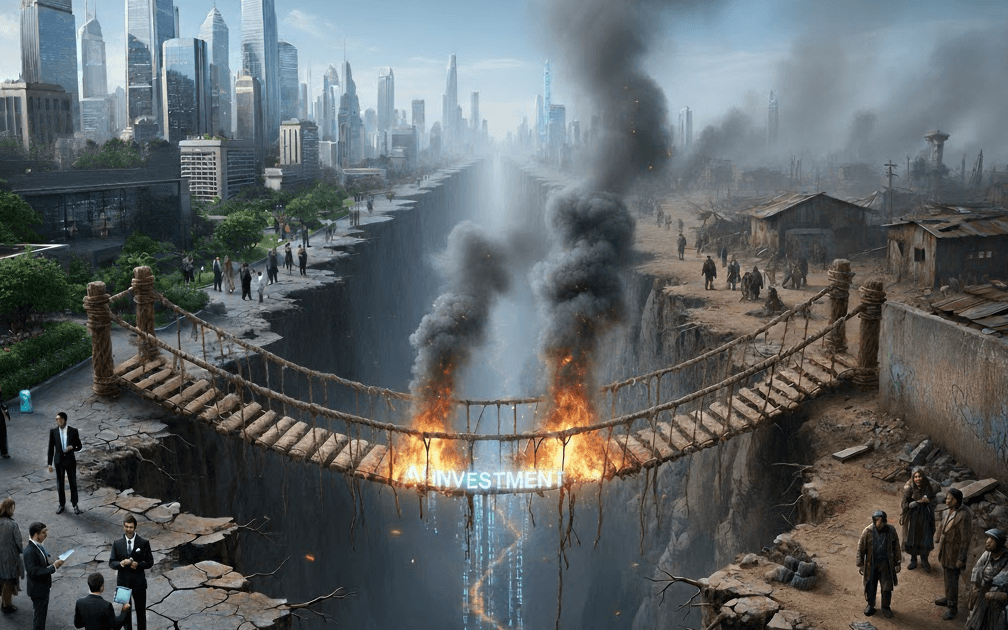

Frankly, this market right now – overheated or not – may be your last chance to cross the looming chasm between the "haves" and the "have nots" before its rickety bridge goes up in flames.

It's already smoldering. And you do not want to get left behind...

The Amazon Job Cuts Are Only the Beginning

According to insiders, few corners of Amazon's corporate empire were spared. The cuts came from multiple divisions, from human resources and retail operations to devices, cloud computing (Amazon Web Services), and more. As Reuters reported when it broke the news:

"This latest move signals that Amazon is likely realizing enough AI-driven productivity gains within corporate teams to support a substantial reduction in force," said Sky Canaves, an eMarketer analyst. "Amazon has also been under pressure in the short-term to offset the long-term investments in building out its AI infrastructure."

And looking ahead to next year, the company was blunt – it will be looking for "additional places [to] remove layers, increase ownership, and realize efficiency gains."

This means tough times ahead if you're one of those "layers" to be removed at Amazon or another corporate giant.

As we noted earlier, Amazon led the charge laying off folks in 2022. And the biggest tech companies quickly followed – shedding more than 250,000 jobs in total...

- Meta Platforms (META), best known for its Facebook and Instagram social networks, cut roughly 21,000 workers in two waves as Mark Zuckerberg declared 2023 the company's "year of efficiency."

- Google owner Alphabet (GOOGL) eliminated about 12,000 jobs in early 2023, its largest-ever downsizing.

- Microsoft (MSFT) announced more than 10,000 job cuts, or about 5% of its workforce, as growth in its cloud and software business slowed.

- And dozens of other household names – from Oracle (ORCL) and Salesforce (CRM) to Zoom Communications (ZM), Spotify Technology (SPOT), IBM (IBM), and Netflix (NFLX) – each shed thousands of employees.

We suspect we'll hear more this week as a flood of earnings reports come in from the biggest tech companies in the world.

How many folks will find themselves without a job in 2026, thanks at least in part to AI?

Millions of Americans May Soon Be Out of Work

Goldman Sachs says that AI can already replace 2.5% of the American workforce – that's more than 4 million employees. And looking ahead, it expects as much as 14% of the current U.S. workforce could ultimately be at risk within the next five years.

That would be roughly 22 million Americans, suddenly out of work...

Meanwhile, Goldman has told its employees to expect another round of job cuts by year-end... as OpenAI has hired about 100 former financiers to train AI to replace entry-level tasks at investment banks – like building Excel valuation models and PowerPoint pitch decks. As Bloomberg notes:

The project underscores the urgency at Sam Altman's OpenAI to make its powerful AI technology more useful to businesses across a wide swath of industries, from consulting to finance to legal to technology. Despite reaching a $500 billion valuation earlier this month, the world's largest startup has yet to turn a profit.

The AI-driven layoffs are coming... and they're part of a much broader trend.

The Wall Street Journal reported this summer that 1 in 5 S&P 500 Index companies has shrunk their workforces over the past decade. As the Journal notes:

All of the shrinking turns on its head the usual cycle of hiring and firing. Companies often let go of workers in recessions, then staff up when the economy picks up. Yet the workforce cuts in recent years coincide with a surge in sales and profits, heralding a more fundamental shift in the way leaders evaluate their workforces. U.S. corporate profits rose to a record high at the end of last year, according to the Federal Reserve Bank of St. Louis.

This is how the chasm in America widens between the "haves," folks who have saved, invested in the market and seen their capital grow... and the "have-nots," who are living paycheck to paycheck without saving for a future rainy day.

The Widening Chasm in America

We make no judgment here on how folks find themselves in the "have-not" category...

We've met plenty of unlucky people. And we've read the many papers on inequality from self-described democratic socialists like Senator Bernie Sanders, who earlier this month wrote an op-ed for Fox News predicting the same job-loss disaster that we're predicting, albeit at an even greater scale...

AI, automation and robotics could replace nearly 100 million jobs in America over the next decade, including 40% of registered nurses, 47% of truck drivers, 64% of accountants, 65% of teaching assistants and 89% of fast food workers, among many other occupations. And as bad as that may seem, I am afraid it may be an underestimate.

We simply disagree with his so-called solutions.

There is no socialist government coming to "save you" from AI – whether that means seizing corporate assets and redistributing them to the favored few or creating new robot taxes.

You can't stop the hundreds of billions of dollars going into AI, whether they're ultimately profitable or not... If anything, those capital flows are still gathering speed.

And you can't stop corporations from focusing on efficiencies, even at the cost of millions of American jobs... America's embrace of innovation is why it has been the world's wealthiest economy for so long.

But you can keep yourself from ending up on the wrong side of this widening chasm in America by relying on yourself, not the government.

Our advice is simple: Pay off debt. Save rather than spend. And invest in strong businesses and assets that can survive a crisis.

This boom will ultimately end. You must invest now, before it does. And you must focus on owning the companies that will still be around after the bust.

My colleague and Wall Street legend Whitney Tilson has built a team of coders, developers, and research staff... They've spent the past few years in search of a better way of investing, using AI. Here's how he puts it in his recent documentary explaining their discovery:

I can tell you that a massive, unstoppable wave of change is ripping through America right now.

You go to college… or you send your kid or grandkid off to college, and they graduate with more debt than a young person should ever carry.

Then you land a job only to realize you're making far less than you were told to expect.

You try to buy a house, and the prices are completely detached from reality.

Childcare, health care, and food costs more than even the rent…

And just when you think you figured it out… you now have to worry that a robot or an AI system could take your job. Or that the money you were promised in retirement won't be there.

This is what we and the next generation are up against.

And if we don't act now – if we don't find a way to get on the right side of this shift – we're going to watch that drawbridge rise, and we'll be stuck on the wrong side.

One Wall Street CEO recently said we're facing a "violent reset." He says it'll bring social unrest. This could mean mass protests and more riots in cities all over America.

In the process, hundreds of thousands of people are going to ascend to a totally new level of wealth, out of reach to the rest of us.

You still have time to save yourself. But you don't have long.

It doesn't seem fair. But it is happening. The only thing you can do is prepare.