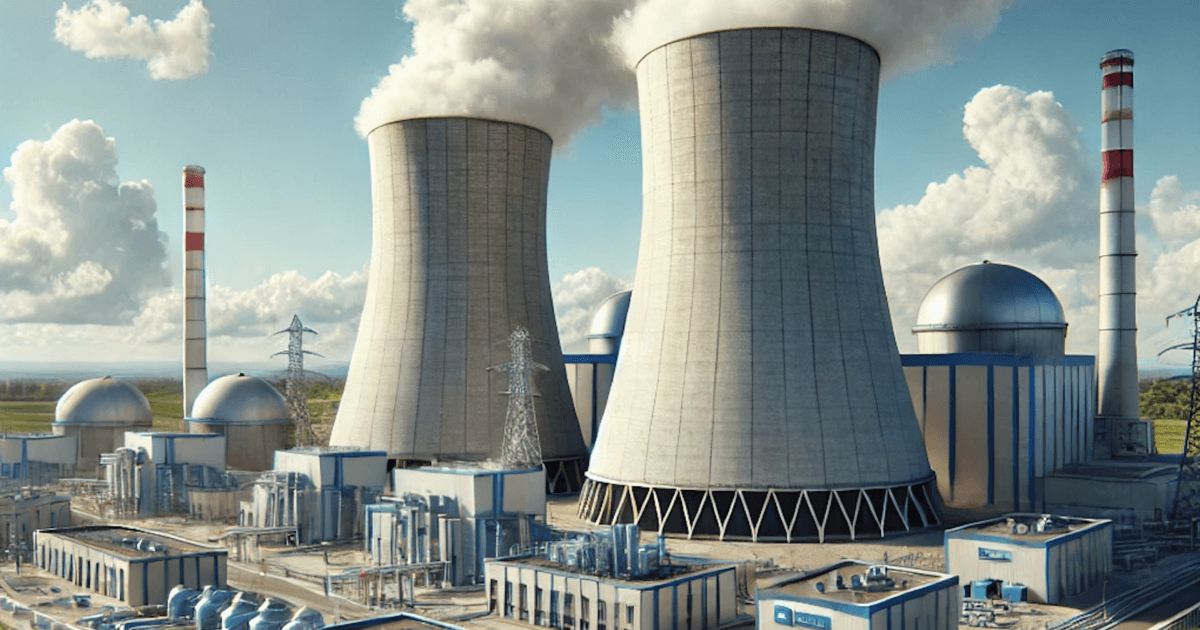

Which Nuclear Stocks Are Moving as Westinghouse Inks $80 Billion Government Deal

Nuclear power is back in the news...

Earlier this week, nuclear-reactor builder Westinghouse announced that it had agreed to an $80 billion deal with the U.S. government to build nuclear reactors. It's not just Westinghouse that's involved...

Private-equity giant Brookfield Asset Management and Uranium producer Cameco (CCJ) are both also involved in the deal (Brookfield likely for financing and Cameco likely to supply the reactors).

And it's all about fueling the boom in artificial intelligence ("AI"). As the companies said in a press release...

As a result of this historic agreement, nuclear energy deployment will be a central pillar of America's program to maintain global leadership in nuclear power development and [AI].

Yes, this is about making sure the U.S. has enough power to fuel big tech's AI investment (more on that in a bit). But this isn't just about supplying energy for the large tech firms. The U.S. government believes it's a matter of national importance. Energy Secretary Chris Wright said that it will help the U.S. "win the global AI race."

That has put nuclear stocks back in the headlines and sent shares of Cameco soaring more than 20%.

With all this heavy investment, it's clear to see we're in a "golden age of nuclear," as our colleague Steven Longenecker put it.

What does this mean for nuclear-energy stocks?

Let's dig in...

Why AI Needs Power

In short, it takes a lot more energy to run AI models than it does to run regular cloud-computing data centers. In fact, AI data centers could use more than six times as much power per rack as a conventional data center.

That means that as this AI investment continues, data centers are going to eat up even more power in the coming years...

In the U.S. alone, data centers accounted for 4.4% of total electricity usage in 2023.

But with the growth of AI, that share is going to grow significantly. The Lawrence Berkeley National Laboratory estimates that, by the end of 2028, data centers will account for 6.7% of total electricity demand – at the very least.

In their "bull" case, data centers will use as much as 12% of all electricity consumed in the U.S. So, in just five years, AI will force data centers to grow their electricity usage by 50% (at the low end) or by 170% (at the high end).

Of course, it's not just nuclear power that will fuel these data centers. With the U.S.'s leading position in the global natural gas market (and the existing infrastructure already in place), natural gas also has a huge part to play in providing power to data centers.

The Government's Nuclear Focus

Today, though, all eyes are on nuclear as a power source.

The Westinghouse deal is just the latest in a long line of nuclear investments from the U.S. government. In his first weeks in office, President Donald Trump made it clear that nuclear energy was a focus – and he signed several nuclear-focused executive orders.

Of those executive orders, one was EO 14302 – Reinvigorating the Nuclear Industrial Base. In it, the White House made clear its expectations for reviving America's nuclear-power industry:

Swift and decisive action is required to jumpstart America's nuclear energy industrial base and ensure our national and economic security by increasing fuel availability and production, securing civil nuclear supply chains, improving the efficiency with which advanced nuclear reactors are licensed, and preparing our workforce to establish America's energy dominance and accelerate our path towards a more secure and independent energy future.

Clearly, the current administration is putting an emphasis on getting American nuclear up and running... fast.

Corporations Are Buying Nuclear, Too

We've shared this list a few times in previous posts, but here are just a few of the investments that big tech companies are making to secure nuclear power...

- Microsoft (MSFT) locked in 20 years of power from Constellation Energy's (CEG) Three Mile Island nuclear plant.

And just this week, Alphabet and utility company NextEra Energy (NEE) agreed to restart Iowa's only nuclear plant by 2029 and buy power from it for 25 years to meet the Internet giant's AI-power demands.

It doesn't just end there, though. It also opens the door to building other nuclear facilities. As NextEra said in a press release...

To that end, NextEra Energy and Google have also signed an agreement to explore the development of new nuclear generation to be deployed in the U.S., which would help power America's growing electricity needs.

These deals will keep on coming as companies like Alphabet try and lock up as much energy as they can to power their AI goals.

Two Other Nuclear Stocks to Watch

Unfortunately, Westinghouse is a privately held company. So investors can't put their money to work in this deal directly. But that doesn't mean there aren't opportunities to invest in nuclear power and take advantage of this trend...

First, there's the VanEck Uranium and Nuclear Fund (NLR). NLR holds a basket of stocks that benefit from increased adoption in nuclear energy. That includes utility companies, reactor-construction firms, and even uranium miners.

If folks want broad-based exposure to nuclear energy, NLR is a great way to achieve that. Now let's take a look at two of the individual companies...

Starting with uranium miner Cameco...

Cameco is involved in the government's $80 billion deal with Westinghouse. And shares soared on the news, as we mentioned above. It's a giant in the uranium space – the largest uranium miner in the world by market cap.

So, is the stock worth keeping on your radar today? For that, we turn to our proprietary Stansberry Score...

Cameco gets an overall score of 76 out of 100, good for a grade of "B." Looking under the hood, Cameco receives an "A" for its financials and a "B" grade for its valuation. Cameco's worst grade is a "C" for its capital efficiency – but because mining is such a capital-intensive business, a slightly lower grade here doesn't surprise us.

All in all, our proprietary grading system has Cameco as a solid long-term investment. And that's hard to argue with given how much more uranium will be needed to fuel new – and restarting – reactors.

But given the huge spike in the shares today, it may be best to wait for a dip before buying.

Let's move on to small modular reactor ("SMR") company Oklo (OKLO)...

Put simply, Oklo builds smaller, more compact nuclear reactors. Instead of powering entire cities like traditional reactors, SMRs can power individual buildings – like factories and (of course) data centers.

Oklo was one of four companies that secured a contract from the U.S. government to build uranium supply lines to ensure a steady stream of the fuel to data centers. And it has a deal to build an SMR for the Air Force.

Oklo is too new to generate a full grade in the Stansberry Score, since it has only been public for about a year and is still in the early stages of securing deals.

And it's worth remembering that, as a young company, Oklo isn't generating a profit. In fact, during the most recent earnings report, the company listed negative earnings per share of $0.18.

That's not necessarily a problem for the time being. With more than $534 million in cash and equivalents, Oklo has enough capital to live on while deals take shape and it begins generating meaningful revenue. But it does mean that a stock like OKLO is on the speculative side.

Oklo has investors' attention, though. Since it went public through a special purpose acquisition company merger, the stock has soared an incredible 1,200%, giving it a market cap of more than $20 billion. And with government contracts behind it, the company likely isn't going away.

Where Nuclear Goes From Here

All of the current-generation nuclear reactors are "fission" reactors. That means these reactors split atoms to release energy and generate power. But there's a new technology on the horizon...

Nuclear "fusion" is the exact opposite.

In this case, nuclear fusion forces light hydrogen isotopes together until they merge and release heat. That heat then converts water to steam. And the steam turns turbines to generate power.

The investment in nuclear fusion is just getting started. Virginia recently approved construction of the first nuclear fusion reactor to be connected to the state's power grid.

The fusion part of the nuclear industry is still in the very early innings today. So there are sure to be some hurdles and volatility in the coming years, but today is a great time to buy in.

That's why our colleague and Stansberry's Investment Advisory editor Whitney Tilson put together a free presentation to lay out the future of nuclear fusion energy. Whitney even gives out the name and ticker symbol of a stock that's perfectly positioned to take advantage of this sweeping change.

Again, you can catch Whitney's message right here.